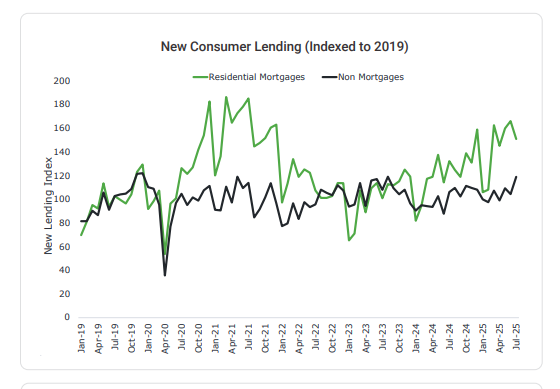

New mortgage lending was 24.4% higher in the July quarter than a year ago, says credit bureau Centrix.

The bureau says that reflects increased market activity and borrowers increasingly looking to refinance for lower rates.

The data is for mortgages approved, not loans actually drawn down, an important distinction.

New non-mortgage lending was up 11.5% year-on-year, driven by greater market activity in credit cards, vehicle and personal loans, and buy now pay later (BNPL).

Centrix's August report says that, while some indicators are improving, many households and businesses continue to struggle.

On the plus side, mortgage arrears improved for the month, from 1.58% to 1.38%, with 21,200 home loans past due, down 400 from June.

Specific consumer areas - vehicles, credit cards, personal loans, telco/broadband, BNPL - all improved. Only in energy did accounts in arrears deteriorate, to 4.2%, reflecting high winter payments.

In consumer loans, 90-day plus arrears eased, to 81,000.

On the negative side the number of people in shorter-term arrears rose by 2000 during July to 480,000, 12.4% of the the "credit-active population."

Business credit defaults rose by 8% year-on-year, but the growth rate is easing.

"The manufacturing industry is the worst hit, with credit defaults up 19% year-on-year, followed by the property/rental sector with credit defaults up 13% compared to the same period last year," Centrix says.

Company liquidations have surged, up 26% year-on-year, partly reflecting stronger IRD enforcement activity.

Centrix says there had been 765 liquidations over the last year in the construction industry, up 46%, and 297 in hospitality, up 49%.

"As we head into spring, there is no doubt that while some indicators are improving, many Kiwi households and businesses continue to face financial challenges," says Centrix chief operating officer Monika Lacey.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.