This press release has been received from Equifax.

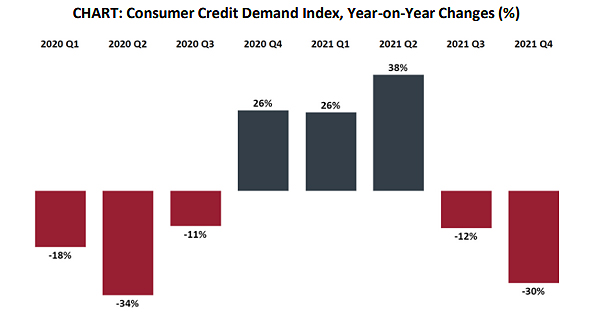

A drop off in demand for home loans during the December 2021 quarter was predominantly fuelled by lockdowns, according to Equifax New Zealand Managing Director, Angus Luffman. The latest data from Equifax New Zealand shows a 35.2% reduction in overall consumer enquiries when compared to the same quarter in 2020. “Extended lockdowns in Auckland have impacted demand leading to big declines across all major retail credit products. The percentage falls are exacerbated by the huge volume of home loan enquiries recorded in the December 2020 quarter. Demand reached fever pitch during this period, so it’s important to factor into the equation,” says Luffman.

Overall credit demand for the December 2021 quarter dropped by 30.2% on the December 2020 quarter with Canterbury recording the smallest reduction in consumer enquiries of 21%, and a 4% reduction on quarter three of 2021. Despite recording a 23% year-on-year decrease in home lending demand, Canterbury out-performed the Auckland and Wellington markets, which had downward year-on-year December quarter movements of 35% and 36% respectively.

“What we could be seeing is more people looking to relocate to a region where property prices are more accessible, but job opportunities are still strong,” says Luffman. “The significant changes in the way we work over the past two years may also have opened up opportunities in regional areas. Based on housing demand, Canterbury is leading the charge. and in some cases, allowing people to retain their jobs in cities like Auckland and Wellington, whilst living in Canterbury.”

Consumer discretionary spending has been heavily impacted following the August 2021 lockdown in comparison to lockdowns in 2020, with a significant reduction in demand for unsecured credit, says Luffman. Marlborough was the most affected region with a 46% year-on-year drop in credit card enquiries. Personal loan demand in the December 2021 quarter also took a hit with the largest decreases recorded in Taranaki (- 40%) and Waikato (-38%). “Although it’s not yet evident what’s causing these decreases in the regions, what we borrow for and how we spend it is changing. When the pandemic first hit in 2020, many people were forced to cancel holidays and that money was being spent elsewhere – whether on domestic travel or home renovations. What we’re seeing now is that Kiwis are becoming more circumspect, paying down debt, being more guarded and focusing on purchases that increase quality of life at home, whether that’s a renovation, swimming pool, boat, or a new car. The demand for auto loans has also increased as the supply chain tightens up and vehicles appreciate.”

With the threat of an Omicron outbreak in New Zealand, Kiwis are expected to remain cautious around their discretionary purchases in 2022. It’s also expected that CCCFA and LVR requirements will have an impact on the availability of home loans and unsecured credit demand. “Credit enquiries are a lead indicator of housing turnover and price movement,” says Luffman, “and despite the increase in house prices across New Zealand in the December quarter, the recent reduction in mortgage demand may indicate cooling prices in the coming quarters.”

111 Comments

Buying a house now would be like buying a new car from a showroom.

The moment you take the keys you have lost 25% of the value.

Completely different.

If you're a speculator, sure, if you're an investor it's irrelevant.

Genuine investors went extinct a long time ago. The yields don't make any sense for residential property investment.

Even more so now interest rates and term deposit rates are increasing.

Why would an investor tolerate a yield of 2-3%?

Because you can do it with leverage rather than cash. 2 -3 % is a bit silly, but if you can get 4-5 % then it makes sense.

Even if you have to put a bit in every week this is far less than your mortgage gets paid down.

Also inflation excelerates this as your debt gets inflated away over time.

Anyone ever wondering why someone would invest in property over a different higher returning asset somewhere else.

Answer: leverage!

One reason - In 5 to 10 years time that 3% on money originally planted becomes 5% to 7%.

We can only but evaluate these things according to our own strategy and tolerances.

Underrated comment Brock. Anyone getting in now is gambling, pure and simple. The genuine investors brought years ago and cashed out in the last year with huge gains. The crowd is always late to the party...

*Speculators

Not exactly, the real investors are aiming for long term returns, got in the market when the price is not doing well and cashed out when price is still going up. It's extremely hard to time exactly peak and bottom of the market. They normally cash out before everyone starts selling.

mixed definitions.

Especially when there is no peak!

Indeed. Commenters above write such nonsense. Real investors cashed up to enjoy watching their money inflate away...I don't think so!

Personally speaking I don't plan on selling any of my rental portfolio. I have acquired mainly based on yeild potential and the ability to take this for re investment. I factor in capital gains in terms of retirement planning (how much is needed to sustain a type of lifestyle) but the actual property prices could go up or down by 50% and I would not care.

Its like everyone assumes that rental property investment has to be all about capital gains.

Be careful of all those boomers dropping off in the next 20 years and the largest demographic ever to be in existence not being there to buy them up in vast amounts...

Part of the large pressure on pricing is because millennials, the 2nd largest demographic, are now entering their prime house buying years.

RBNZ C32 December 2020 to November 2021:

FHB -> # of Borrowers = 36,428 with total lending = $19,617m (average $538k @ 80% LVR = $672k purchase price average)

Investor -> # of Borrowers = 45,313 with total lending = $22,138m (average $488k @ 60% LVR = $813k purchase price average)

I plan to be around for at least another 40... But even if they sank and never recovered and the world of fiat collapses. I'd still be able to rent them out at whatever the going currency is. And my kids can just take them and do the same. My point is that much of the conversation here assumes all investors are only in it for the capital gains, rather than a more long term/yield view.

Are you talking about Bitcoin or housing VTHO ? You should have bailed at $67K it looks like it may never get back there. You could argue it may stabilize now which will make it suitable for a currency but while its going all over the place its hopeless.

I get your point but the irony is now if you snag a new car and drive it out of the lot, you could sell it for the same value or more that day, such are the ~4-6 month waiting periods.

I bought a new car last June and was offered $10k to trade it in, which was fair value but I hung on as we needed to retain it at the time. Just sold it today for $15k.

Well done! Lucky you didn't make a gain with RE, you would be called all sorts of nasty names on this site!

Case and point sir. Well played!

Start of the house price correction, possibly crash.

And watch housing construction drop away later this year wilth the crash in demand.

It's going to be an interesting year for the economy.

The last things NZ needs in 2022 are a property crash and a slowdown in construction activity. The economy would be on its knees.

Yep. But I think it will happen.

You?

I don't know. I'm a probability guy and all I could say is that it "could" happen. I don't know how any of the modeling of the banks, RBNZ, and govt would have prepared for the scenarios we're not facing (based on inflation expectations and need for the sheeple to start servicing inflation / debt through higher interest rates). Like many of my peer group, I believe that the they want to let inflation rip as far as possible to devalue nominal debt obligations before lifting interest rates in any meaningful sense.

If there is anything positive to say, most people don't have much cash savings to deflate away anyway. 50% of bank accounts have <1K in savings and 70%<10K. ASB defines living paycheck to paycheck as those spending more than they earn. Personally, I think $10K in cash savings is still paycheck to paycheck living.

I don't think it will happen in 22. Its too early. As I've posted before, I think there are plenty more resources yet to fall within the event horizon of the housing bubble.

But I have to believe it - I'm long on popcorn.

My advice buy Knee pads wear a wet suit with flippers and a snorkel the deluge is coming,

Property prices should be lower, no question. They are stupidly high thanks to poor policy.

The economy should not have been placed in the position where it's dependent on them staying up.

HM, but you made it quite clear you're expecting house prices to fall 5-10% this year, hardly a correction and definitely not a crash

Even 30% only takes us back 2-3 years. Who cares?

The banks know they have now "tapped" the market for one of the highest price housing markets in the world vs. incomes .....they know these current prices are just too high for FHB's ....but they still have to make a profit for their shareholders.... they don't want to let the 'great property party' fade away .....can't put up interest rates too soon as that makes it that much harder for FHB's and existing mortgage holders......but what happens when all this current unfinished property comes on the market with developers and builders facing increased costs and delays .... they kinda have killed the goose that laid the golden egg by letting prices get to this level ...... I truly do not know where this market is going....???

Good post. I know I am a broken record on development, but it's the massive elephant in the room that hardly anyone is talking about.

Imagine if you a developer that sold off the plans 12-18 months ago, and your development is nearing completion. You sold 2 bedroom townhouses for 675k, but due to soaring costs that's not even break even now.

What do you do, just count your losses? (and possibly go out of business, you don't have your anticipated profit to reinvest in the next project).

Or do you try and delay the project and invoke the sunset clause? Hope that the buyers can or are able to pay another 150k? If not, will there be people out there willing / able to buy to replace those buyers?

VERY precarious times.

Good post. I know I am a broken record on development, but it's the massive elephant in the room that hardly anyone is talking about.

Worse case scenario. The landscaped is dotted with half-finished property developments as everything is abandoned.

This happened a lot in the mid to late 70s.

This happened a lot in the mid to late 70s.

It's happening right now across Asia, particularly China and SEA.

What happens to them? Banks foreclose. Conned investors if not funded by bank loans loose out.

Development then gets sold for a song to pay off creditors. The business cycle goes on. Someone takes over and makes a go of it.

I thought about this today too. Developers might try and game the off-the-plans buyers, even without sunset clauses (and whose lawyer would in their right mind recommend to a purchaser to agree to a sunset clause at the option of the developer?) but if the generic purchasers can't afford to pay the difference, i.e the bank won't pony up more debt, then the whole thing falls over. Developers are therefore relying on another type of buyer coming along, which only works in a rising market with easy credit.

HM, it seems like you're not too familiar with developments, only a very inexperienced developer wouldn't have an "escalation clause" included in his contract. FYI, an escalation clause is a clause allowing the developer to pass on increasing build costs after the original fixed contract

The banks are not too happy about lending on such contracts.

I see many builders and developers learning to live without a shirt but still wearing a full face mask for fear of being recognised rather than against covid.

Ohhh the nastiness and schadenfreude is strong today!

Perhaps they'll decide it's time to start offering young people 35 year mortgage terms so they can afford to pay higher prices?

Now there is a lot of new buyers out there that know what it feels like for the fly peering out of the Venus fly trap.

Low demand or potential borrowers have just given up hope and walked away?

Combined with 2 years of fear-based messaging from the government and a sense of limited freedom to act or make decisions for the future.

The strict 20% deposit combined with the increase in prices has put the prospect of buying my first house out of reach for now. After talking with the bank late last year, they want me to come back in 3 years time once I have saved up a further 30 to 70k plus have 3 more years of KiwiSaver to add to it.

There's still room in upward valuation for residential real estate.

I am calling you out again as a troll. A similar comment I made yesterday got edited out. I don't know why, so this one probably will be too. Calling people out as trolls is justified, at least in my opinion.

I was in a good mood yesterday and that's the only reason I wasn't replying to your failure to understand a simple table from RBNZ.

It appears to me that everyone who has a different view from you is defined and called a troll by you.

Perhaps with some introspection, you may just find the contrary.

Enjoy your weekend.

Nope.

Very open to different views. But you just put out provocative statements, without justification, to rile people up. Don't you?

That's the definition of trolling.

As you know I have acknowledged that there's a chance that prices *might* slightly increase. I made that very clear in my scenarios late last year.

Not even provocative statements. Just the same statement at all times. Doesn't matter what the news is: CWBW says house prices will rise.

Doesn't matter what the news is: CWBW says house prices will rise.

Sounds like Granny Herald and Ashley Church. Granny Herald is not really news though.

But he's provoking isn't he.

He's clearly a troll in my books. And for some reason that's ok but calling it out isn't.

A troll living in a oil drum..sticky!

Perhaps being right all the time is an act beyond provocation to you?

That'll make things simple for me; the next time I'm having doubts on whether I'm right, I'll only need to refer to how provoked you are.

CWBW says house prices will rise.

Then he's been right for the last 30 years !

Just as long as you ignore the bits where they didn't.

Provocation is subjective. Some are offended by LGBT some embrace them. Do I need to consider how you feel when making a statement?

This country is ruin by snowflakes.

I am calling you out again as a troll.

Public forums on property and crypto are crawling with trolls. Particularly on the latter, the anti-crypto movement is really growing and uses troll tactics like drawing associations between Bitcoin and the far right. I call them the peanut gallery. Trolls don't bother me personally and I think they can serve a good role in exchange of ideas. Clever and entertaining trolls are rare though.

I'm happy to say why I think crypto is a terrible idea... I'm not sure this makes me a troll.

Isn't that when you deliberately set out to annoy people?

People suggesting something you don't want /like is just that?

Whislt I'd hate to see it. And think it unlikely, For all we know we'll keep pumping these prices to the stratosphere.

Sadly your correct. People claimed prices maxed out 12 months ago and looked what happened. We will be lucky if house price gains remain in single digits over the course of 2022.

Imagine if you had kids Carlos. They could educate you on the difference between "your" and "you're".

Imagine if you had a wife Brock. She could educate you on how to be kind.

Yvil,

Ouch! It's a bad habit of mine to make similar remarks when I see apostrophes being used wrongly, but I am trying to break the habit. However, I will never understand why people use it at all when they clearly don't understand it.

I was one of those tragics who rushed to buy the book Eats, Shoot and Leaves by Lynn Truss and have a book, The Times Guide to English Style and Usage beside my computer. A sad case indeed.

Hi Yves,

There is something fishy about your remark. Are you confusing me with Clarke Gayford?

Aroha.

Clarke Gayford, New Zealands version of the UK's Ronnie Pickering. "Do you know who I am?"

"Do you know who I am" is already firmly taken by Aaron Gilmore. Who?

People on here make me laugh when all they can fault me on is spelling. Far bigger things in life to worry about people. English was my worst ever subject in school, technically I failed it so badly I was not allowed to progress from the 5th form to the 6th form however as I was the top student in science and math they gave me a pass.

CWBW .....can I just ask you a simple question please ...have you personally ever experienced a housing market crash ?

Obviously. However, in the business of making money, no one is required to be right all the time; you only need to be right a few to make more than enough money.

Thank you for your answer CWBW .....so basically you have quite a bit of "skin in the game" and you are hoping for the "status quo" of the last 10 or so years - fair enough.

If Omicron is the last gasp of Corona, then may be in the second half of 2022, more migrants/students may be allowed in, increasing the demand for houses to rent/buy. The scene is still not clear how it will go, but there is some cautious optimism there.

I think many more will leave where life stack up better.

Yep. It's hard to see net migration into a country with a 12x house price to income ratio. The Londoners etc. who returned over the past two years will be ready to bail again. NZ's gonna start seeming pretty dull coming into another winter as the world reopens.

I sincerely believe that we need a "crash" back to levels that would see wage/salary earning Kiwis able to afford a home (DTI~3-4?), as devastating as that would be for the current 'economy'.

With an Election due end 2023 though, I fully expect the Govt to desperately pull every conceivable lever to avoid a lowering of property prices.

Jacinda Ardern Dec 2020: “What we’ve simply expressed here is that the growth that we’ve seen is unsustainable. So, if anything, it is much more sustainable to have those much smaller increases. I think people expect that you see that in the market.....What we also accept is that for most New Zealanders, their house is their most significant asset… A significant crash in the housing market - that impacts people’s most significant asset.”

Jacinda Ardern is a great political leader and thinker.....for a student association.

John Key 2.0 on houses and productivity.

So we'll elect John Key 3.0 who also talks the talk on productivity but himself chose to invest in...housing.

The above is the most disappointing thing that she said for voters like me that were hoping for more affordable house prices. Still I think they are doing more on this front than National would have. It's mostly RBNZ to blame for the situation we are in.

I think you need to understand that the idea of govt and central banks as independent entities is a fraud. It is not a conspiracy theory. It is based on the idea that both share the same dogma and ideologies.

Jacinda Ardern December 2021...

Speaking to RNZ for an extended end-of-year interview, Ardern said she hoped 2022 would halt the recent "runaway increases in house price growth [inflation]".

Asked directly whether she wanted prices to come back, Ardern said: "Yes".

"We need [the market] to stop heading in the direction it is," she said. "Even if you saw [prices] come away, in many cases it would be bringing [them] back to levels that we were at only a year or two ago."

What a courageous statement, acknowledging that prices can and must decrease.

too bad she didn't act on this when covid happened and freaked out instead.

What does Clarke think... sure he's got alot of opinions on the matter. Probably lining up another house moving tv series as we speak...

What a courageous statement, acknowledging that prices can and must decrease.

too bad she didn't act on this when covid happened and freaked out instead.

Well you just contradicted yourself by calling her courageous yet failing to act and freaking out.

You are right, she was courageous 2 years late

I sincerely believe that we need a "crash" back to levels that would see wage/salary earning Kiwis able to afford a home (DTI~3-4?

Slapheid, annual average NZ wage is $56'000, if we assume a DTI of 4 that means servicing a mortgage of no more than $224'000, at a typical 80% borrowing it means average house prices would come back to $280'000. Good luck with that!

Average household income in New Zealand is $107,196 (2020).

Entirely reasonable.

Lies, damned lies and statistics. Out of that average, you've got to pay tax, loans, feed, clothe, insure and transport yourself plus your dependents. Then you've got to cover the cost of the shelter you already have, which for most means rent. So after all of those exploding living costs, plus income tax that taxes any wage adjustments you might get in nominal terms as if it's in real income, that's the bit that's actually left over.

How reasonable is that? Far less than the misleading gross income figure for a household makes it out to be.

Notice what isn't in here? Discretionary anything. Think internet, phone, TV, movies, non-essential food such as eating out, socialising, holidays, school trips, pets... you get the idea. So in other words, live on the bones of your arse, forever.

And that's assuming you have a job that would survive in the event spending dropped, which it would in the event house prices walked back. The old saying of "A recession is where your neighbour loses their job, a depression is when you lose yours" springs to mind.

I was suggesting that limiting borrowing to 4x that amount was reasonable.

The problem is that amount is a fantasy. It has no relevance to what households can actually save, and they can't save what they aren't getting and what's not left over after the essentials are covered.

Absolutely. A debt to income limit is just a blunt upper bound for responsible lending.

Further examination of expenses may reduce the lending amount further.

Interest rates going up inflation going up house price coming down this is only way the market is going. The banks have pulled in so many people , a huge amount of them over leverage. The banks don’t care as they have your deposit and will sit on houses maybe renting them out to old owners. The next year is going to be tuff for people with million mortgages this will happen quickly and hopefully fall to a place where average wage earners can afford a house and still be able to live. The people on here who think it’s still going up or even staying stable are clowns 🤡

DTI~3-4 - made sense 60 years ago. Now the stay at home wife is rare so household income is a better guide. Consider your 'tax, loans, feed, clothe, insure and transport' - feeding and clothing was a battle for a family 60 years ago but now they comprise a small fraction of a typical income. In real terms loans, food and clothing are far cheaper than in the past. Therefore there is more disposable income which is being used for second cars, foreign holidays, takeaway and restaurant food and of course houses. The other big difference to 60 years ago is having kids - when my mother had her third and fourth child the household budget hardly changed (I wore my brother's outgrown clothes) but today children can only be afforded by beneficiaries, the really wealthy and the prime minister (and will she have four?).

I like giving our 2nd the clothes from our 1st. Its nostalgic, oooohhh the blue bear jumper! my favorite!

I know what you mean. We have a circle of friends all having kids at the same time, and our kids clothes keep turning up on kids in the other families. I think the record is a shirt passing to a sixth kid, somewhat faded. Nostalgia.

I don't see how DTI can get down anything close to historic levels when build costs are pushing $3,000 per m2 and median household income is around $86,000.

You know what's probably going to happen right...

Just when sh*t looks like it's going to hit the fan & should, covid pops up and provides the perfect excuse to get the money printer going & back track on laws to keep the party going... We don't even have Omicron in the community yet. Once that hits we'll be back in the same position as last year.

Except that international rates are going up this time.

Will they though? Or is it all talk...

Not sure about this. What major democratic economies have increased stimulus due to the advent of Omicron? Governments, like markets, appear to be looking past this variant and continuing with planned monetary and fiscal tightening, not easing.

It's early days...and for many countries the real difficulty is stopping the stimulus

I agree. Full retard stimulus is going to be slightly eased back to try to take the edge off inflation, but the first sign of asset price deflation will produce plenty of jutifications to amp up the juice again.

This will end in currency collapse - it always does.

Seems to be 3 factors.

1) FHB's who might have had a 20% deposit for early 2021 prices now find it's only a 10% deposit for current prices, and banks are cutting back on high LVR loans.

2) Investors who have already leveraged the capital gains of their existing stock to buy more in 2021 while interest rates were low are not so keen to take on more debt, especially as the interest payments will eventually no longer be tax deductible.

3) Interest rates are already almost double what they were in early 2021 and are only going to climb higher, given the talk on what the RB is expected to be doing with the OCR.

Your first point happened to me; after talking with the bank late last year, because of the now strict 20% deposit rule and the increase in prices over the last couple of years, I now need to save double what I am at the moment each month for the next 3 years to be in with a chance. A couple of years ago buying a house was looking very close - now the dream seems to be getting further away.

You and your partner need jobs with Auckland council - 25% of their employees earn over $100,000.

Move to Oz and get better pay, cheaper houses, better weather, nicer more positive outlook on life

Yeah, cause if there were ever a nation of people with a positive easygoing disposition, it's Australia.

It's bigger, so lands cheaper and there's economies of scale to be had. But of the dozens of people I've known over the last 10-15 years to set sail for the lucky country, only few have cracked it, the rest have realised changing location won't necessarily have you sorting your act out.

If someone can remote work, move somewhere seriously cheaper, like Mexico or South East Asia.

Dont panic just yet. I think what you will see is that the CCCFA has just given the housing market a giant big smack out the head.

These stats are still looking backwards (if only just) but they're interesting. The problem with humanity is that it thinks it can solve its own problems. It can tweak things, alter things, re-arrange things, move countries, change families etc. but it can never seem to solve it's own problems. It used to go to work to make money, but these days it just spends created money (and associated debt) to create the illusion that things are alright, but, sigh, they aren't. As the article eludes to.

In fact, the people do not trust their govt, or their lackies in the mainstream media. The same people have grave concerns about the poor state of their education systems & the generally gross negligence of the govt's state services at an obscene cost. Politicians do not look after the people. The people look after the people. The politicians look after the politicians. We have created a huge gap of missing integrity, containing mis-trust & deliberate misapprehension, to be followed this year by missed mortgage payments & more misdeeds from our mis-politicians.

I think we might need a military coup.

You can tell the policy is working a treat.

All the skin-in-the-gamers coming out to protest. Usual suspects, the likes of mortgage broker, property spruiker John Bolton.

John, here's a novel idea - how about property prices correcting, back to fundamentals. Then you'll be back in business. This is the drum you should be beating.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.