Reinsurance giant SwissRe is in the business of insurance on a grand scale. It is a reinsurance company, an insurer of insurers, providing backstop cover for front-tine general insurers.

Not only is it essential they understand current risks so that they can price them, it is also essential they look ahead to future risks, emerging or changed risks so they can be "better informed about their business strategies".

SwissRe publishes its SONAR report (Systematic Observation of Notions Associated with Risk), an internal crowd-sourced compilation of what their analysts expect. They have tools for early identification of emerging risks.

They report on these annually, and the latest report only includes risks identified in earlier reports if they are growing in significance.

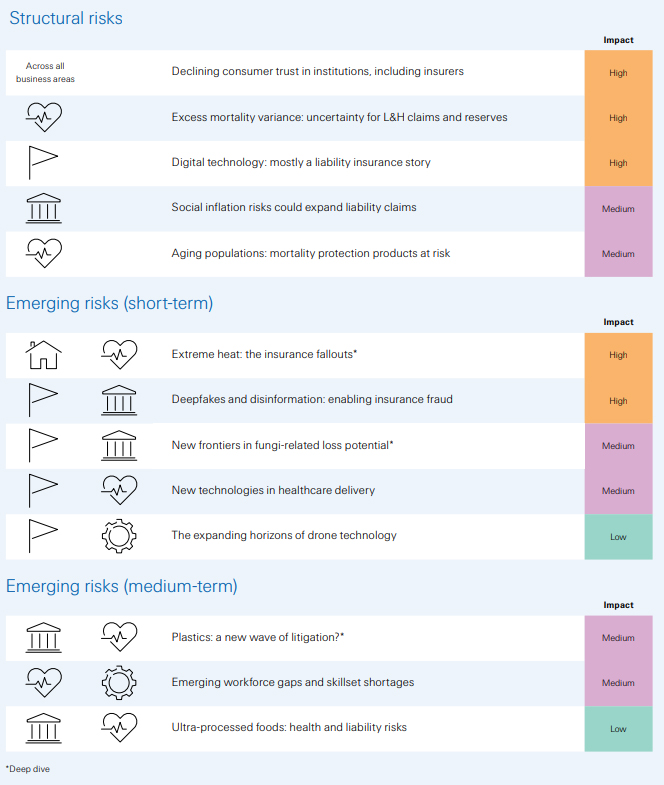

This year’s SONAR highlights five structural risks, including a lack of consumer trust in the industry, a challenge to the core value proposition of insurance.

Another real-time structural risk is social inflation, a drag on profitability in casualty business, particularly in the US.

Demand for liability insurance has been growing rapidly, a main driver being changes in the legal landscape exemplified by large verdicts. Insurers facing big increases in legal defence costs will likely pass this on to consumers through higher premiums.

They also highlight the insurance significance of current elevated levels of excess mortality, ageing populations and digitalisation.

With respect to emerging risks, this SONAR includes deep-dive assessments of three exposures and potential implications for insurers.

Rising temperatures and their impacts are widely recognised as a threat to communities around the world. They note extreme heat events specifically, given the expectation that these will occur more frequently in the coming years. The claims implications are many, stemming from more accidents, illness, chronic diseases and even death. Extreme heat can also stress healthcare systems, in turn raising the costs of medical insurance.

Still on the theme of warmer conditions, they note that fungi are adapting to higher temperatures. Among others, this could see claims in property insurance rise on account of mold infestation.

Meanwhile in agriculture, the overuse of fungicides and development of multi-drug resistant strains of fungal infection could drastically cut crop yields.

Another emerging risk assessed is the harm caused by plastics. Plastic and plastic particles have already generated litigation cases on account of environmental pollution and the harm they can cause to human health. Advances in attribution science indicating causal links could fuel litigation across many sectors, hitting liability insurers most.

They are also watching for generic risks that will build in the longer term. For example the rapidly rising consumption of ultra-processed foods. They say these could spark rising claims in liability and health, as evidence of associated negative health outcomes like obesity and diabetes mounts.

They also flag the potential insurance ramifications of digital innovation such as the deployment of deepfakes and the dissemination of disinformation through social media, and the growing role of digital technology in healthcare delivery, all of which will likely impact Life and Health (L&H) and casualty lines of business.

Other technology emerging risks are the use of drones for strategic purposes, and how artificial intelligence (AI) will likely influence workplace skill set needs in the future.

In addition to more claims in L&H and casualty, the latter could also increase the cost of providing insurance in situations where automation leaves a lack of sufficient job-specific human talent and where this, in turn, leads to an increase in operational errors.

You can read the full SONAR report here.

While they don't deal with Australian or New Zealand risks specifically, our insurers need reinsurance and this is the lens those backstop providers assess risks arising in this part of the world.

They summarise the 2025 review like this.

1 Comments

Both the report and the reporting fail to address the elephant in the room.

Insurance relies, as does the rest of the capitalism/neoliberalism system we've very recently set up, on GROWTH. The percentage of extra activity tomorrow, inflates away a portion of the underwrite. As it does debt generally.

We have reached the peak of global GROWTH, as was inevitable (and insurance appears as blind to the physics as the economics profession is - perhaps because the former are trained in the latter) and obviously insurance become ever-more risky on the de-growth trajectory. More things go wrong; more operations get smaller or fail; cascading risks compound.

As noted - but what is noted is the effect, not the cause - people are insuring less. That trend will continue, with implications for spread. We have already been through one event where AIG had to be bailed out (by unrepayable debt, in the US instance) - nobody is going to believably bail our Munich Re.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.