Here's my blogroll for the week. Starting off with a tax cut stoush. Who gained the most from the tax cuts over the last three years? Lots of charts in today's blogroll (some funny ones).

Have a good weekend all.

The Standard vs Farrar on who benefited most from the tax cuts

A stoush between Kiwiblog's David Farrar and The Standard has led to some colourful charts on who benefited most from the income tax cuts stemming from Labour before the 2008 election and the ones from National after the election.

The way Labour go on, you would think the only people who got tax cuts in the last three years were the despised “rich pricks”. Now of course when you cut taxes, those who pay more tax get a larger tax cut. Just like how a bank which pays 5% interest on your investment pays mroe money to someone with $10,000 invested than $2,000 invested.

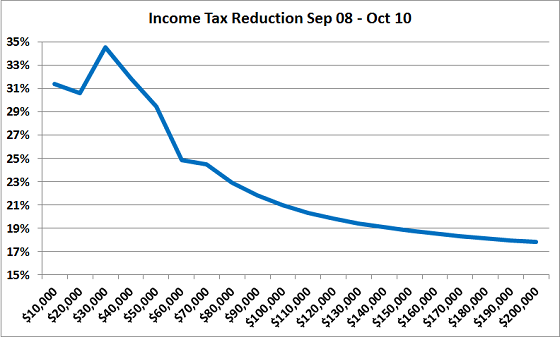

Anyway you can see how those earning up to $50,000 had had a massive 30% reduction in the income tax they pay thanks to Labour’s last minute grudging October 2008 tax cut and National’s 2009 and 2010 tax cuts.

And you’ll also see the filthy rich pricks earning over $100,000 have had percentage tax cuts of less than 20%.

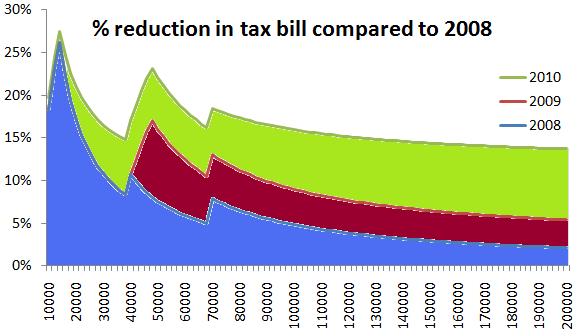

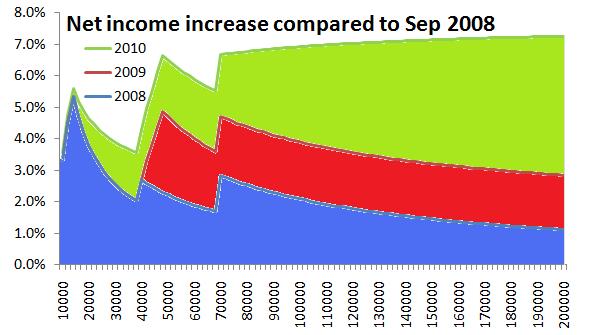

2. But Bright Red at The Standard took exception to Farrar's chart, and published a series of much more colourful graphs showing what reductions came from which tax cuts. They say for most people the biggest benefit came from Labour, but for the rich, the biggest benefit came from National.

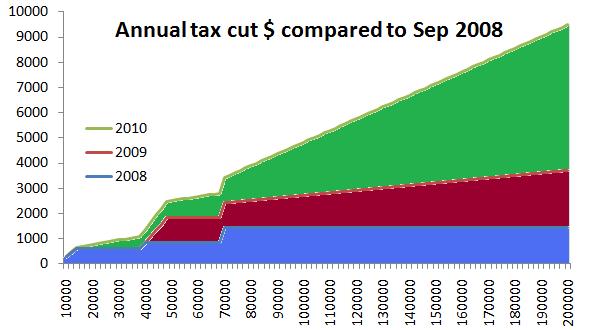

It’s kind of misleading to talk in terms of percentage reduction in your tax bill in the first place. A person on $10,000 a year has had a 20% reduction in tax but that’s only $300 a year. A person on $200,000 has had a tax reduction of 14% but that’s $9,500 – 32 times more.

Seeing as 50% of people have incomes under $28,000, most of the % reduction in tax for most people came from Labour. For the rich though, the big reduction came from National.

Labour made it so that the tax cuts topped out at $1460 a year. National made it open ended. The bigger your income, the bigger your tax cut.

From the right

3. The SFO can't lose on Hubbard approach. Cactus Kate has penned her thoughts on the Hubbard saga.

Quite simply the SFO HAD to charge him. Remember there is a difference between being charged and convicted but with this breadth of capture, my bet is Hubbard is 6 foot under before the case is ever near a Court.

The SFO can't lose with this approach. They aren't playing to win on 50 charges here they are playing not to lose. And if the case doesn't actually make it through the Courts due to Hubbard's health then they win.

They win because most "average" people think that 50 charges equals guilt. Those of us with IQ's over 110 and a business or legal background know that this isn't necessarily true. I still give Hubbard the benefit of the doubt on the criminality issue.

I sincerely hope Hubbard didn't commit fraud and any indiscretions were simply that of a man too stubborn to realise he was past it and his business was too large for one man to control effectively without external advisors of better quality than flea audit and accounting firms.

We export food and those exports are one of the few bright spots in the economy at the moment.

When demand and prices are high on international markets the price increases on the domestic market.

That doesn’t make it easy for people struggling on tight budgets but the problem isn’t high export prices it’s low incomes.

She then goes on to quote from the National Bank's Agrifocus, which has some good charts in it.

The other factor which impacts on the milk price is the cost of production.

Dairy farm total input prices have increased by nearly 34 percent, 3 percent more than aggregate consumer prices, and 2 percent less than the price increase for fresh milk. This would, on the face of it, seem to explain nearly all the observed milk price increase over the past 10 years. Ultimately, a complete examination would include other parts of the supply chain, notably the dairy processing sector, the two New Zealand supermarket chains and local dairies. This analysis would include margin and cost movements, but because of commercial sensitivity, it is difficult for us to obtain a complete dataset that would allow a full assessment for fresh milk.

Eleven of the 17 farm working expenditure categories have increased more than the price of milk.

The main culprits are fuel and electricity, which have increased a whopping 92 and 87 percent respectively over the last 10 years, or 9.2 and 8.7 percent respectively year-on-year.

One of the reasons fuel and electricity prices have increased is the imposition of the ETS. If Labour acts on its threat to force farmers to pay additional ETS levies it will impact on the price of milk.

5. How Key's promise to stop the exodus to Australia has been broken. Not PC shares his thoughts on the highest net exodus of people from NZ to Aus for a May month since Muldoon. Didn't Key say he would fix this problem?

Um, didn’t this government promise to “fix” this problem? Didn’t John Boy stand in the middle of Eden Park at some point before he was elected saying he’d arrest the departure of one football-stadium of NZers per year who were leaving to follow a better dream. I seem to recall there was even a rather mediocre billboard campaign along those lines.

Turns out it was a lie.

Turns out that that even the “real tax cuts” were a lie—especially since the tax cuts promised were vaporised, and GST and borrowing went up to fund the derisory “cuts” finally acceded to.

Turns out then that while a smile and wave might do wonders for your poll ratings, it does nothing at all to fix the problems John Boy was elected to address.

From the left

6. Who won the Auckland train contract. Trevor Mallard blogs on RedAlert on who's won the contract to build 20 trains for Auckland. It's certainly not KiwiRail and they're not being built in Dunedin.

Very interesting that the leader of the national party and Steven Joyce have left it to a Chinese website to announce that they have on our behalf purchased another 20 locomotives that should have been built at Hillside and Woburn. No tender. And the first 20 over a year late from the same Chinese source.

Maybe it was because Kiwirail were at the same time firing staff in Dunedin and the Hutt Valley.

Because it is Kiwirail not Chinarail it is time the economic benefits of these purchases (jobs created, skills developed, tax paid, benefits avoided) rather than just the accounting costs are taken into account.

7. Tower Insurance found a loophole. This is today's must read from David Haywood at Public Address. He purchased a 100 year-old house in Christchurch and purchased insurance for total replacement cover. But Tower is weaning its way out of it, it seems.

Indeed it was one of the things that has consoled us through three massive earthquakes; through the times we lived without sewerage, water, and electricity; through the six weeks when we were evacuated from the city with a young baby and a three-year-old. At least, we thought, we had total replacement insurance – if the worst came to the worst we would be able to rebuild a house of the same quality and size as we had before.

And yesterday, of course, the worst (as regards to the house) happened. A man called Liam phoned us to say that we had nine months to leave the property. Although our house was repairable and the land comparatively undamaged, the state of the surrounding houses meant that we had to go. Fair enough – and, of course, at least we had total replacement insurance.

But when I phoned Tower Insurance this morning to initiate a claim – guess what? They found a loophole.

Tower Insurance maintain that the house is not a write-off. They maintain that they are only obliged to repair the house – not to honour our insurance policy for total replacement. They say that just because we won’t be allowed to live on the land, and that the house will be bulldozed, doesn’t mean that the house is an insurance write-off. Sorry, they say, but what the government mandates with regard to land is nothing to do with them.

Tower say that they will only pay the book value on the property – the very thing that we have been paying insurance for years to avoid. And by Tower’s own numbers this leaves us nearly $200,000 short of the money required to replace our house.

And what about the land? The news isn’t great there either. Gerry Brownlee has done an outstanding job of upgrading the standard EQC payout – and I sincerely thank him for that. But unfortunately the area-by-area system used to determine rateable value means that land on the river bank is underestimated in comparison to market price. In our case, the rateable value of the land is $80,000 less than that assessed by a registered valuer when we purchased the property.

8. Christchurch payout money will just cross the Tasman. Tim Selwyn at Tumeke picks up on a comment made by Danyl at DimPost on the quake payout money:

Danyl of Dim Post: "Most of that $635 Million will pay off mortgages owed to Australian banks. I suspect much of the remaining equity will also cross the Tasman"

9. And Danyl has an idea for keeping those insurance companies on their toes. Good idea methinks.

Here’s an idea, a little service that a media organisation or just a keen web developer could provide: a Rate my Insurer site where Christchurch residents affected by the quake could score the quality of the coverage their insurer provided, and then the rest of the country – almost all of whom also live in potential disaster zones – could make decisions to re-insure based on the aggregate results.

Economics blogs

10. Why can't politicians think 'these job losses are good news'? Paul Walker at Anti-Dismal doesn't seem a supporter of 'bail-out nation' policies. He's got a point. Weak companies fail. We don't want the weak. If they fail that means those workers hogged by the weak should shift into more productive sectors.

To increase out productivity and growth we have to ask and answer harder questions. We have to look at how we deal with things like creative destruction, innovation, human capital, investment and competition, along with interactions between them.

By creative destruction I mean the exit of firms from industries, and the associated job losses, along with the development of new firms and markets. Entrepreneurs identify and realise new market opportunities, create investment opportunities and drive innovation. Maintaining free entry and exit to and from markets is an important issue if we wish to increase productivity. Accepting the exit of underperforming firms and, especially, the associated temporary loss in employment, is important to improvements in productivity. Trying to prevent such exit and loses will only prolong weak productivity growth. When considering the reasons for poor European productivity growth, the economic historian Nicholas Crafts has gone so far as to write,“Politicians find it attractive to wax lyrical in support of the “knowledge economy” and rush to adopt targets for R&D spending and participation in tertiary education. This “happy-clappy” approach to addressing Europe's productivity growth shortfall keeps them in the comfort zone. More progress would be made if the dark side of productivity improvement implied by creative destruction – exit of established producers and re-deployment of labour – were accepted and facilitated. If only ministers could bring themselves to think (better still occasionally to say) “these job losses are good news”.”How many ministers in New Zealand want to think such things, let alone say them?!

6 Comments

#7 Sorry, they say, but what the government mandates with regard to land is nothing to do with them.

Unbelievable - surely the Government knew this would be the case in this type of circumstance? "Full replacement" policy ends up becoming RV.

Perhaps to achieve full replacement, the owner could insist the insurance company pay for its removal to another site?

Well Kate,

If the government had 'forced' people into buying shoddy land yes, you may have a point. The fact is this land was always known to be substandard and much like when you decide to buy a house or car or anything it's still a case of "buyer beware".

The 2007 GV/RV for land is a good deal. The government is NOT responsible for property or land price inflation past that point so anyone demanding "like for like" is just being quite frankly ridiculous.

You can not hold the government to ransom over a natural event like this! People have to realize that some will come out of this event with a loss of equity. But that is surely better than a government like here in the States making it quite clear that in such an event, you on your own for everything!

I'm getting a little piss-off (and i'm not the only one) with what I see as a self righteous "homeowner syndrome" out of many in CHCH where ANY loss in their equity due to ones OWN bad decisions either in buying land in bad areas or former wetlands is everyone else's problem (namely other taxpayers) and not their own responsibility & their insurance company.

Particularly those who own rentals and "allegedly" think they run a REAL business yet they now expect the NZ taxpayer to pick up the tab for such properties and land values!

Justice, the above post relates to the building - and the fact that the owner who has a "full replacement" policy isn't going to get "full replacement" value in his/her insurance payout.

But in terms of land - if the land in some of those suburbs was indeed "substandard" as you say, then it should never have been consented for residential subdivision. Or (as is the case for many beachfront land/properties in New Zealand), if the land is known to be prone to natural hazard (see section 72) then the consenting council must caveat the title under section 73(1)(c) of the Building Act (previously section 36(2) under the 1991 Act) which identifies on the land title that the dwelling has been built on land subject to a natural hazard.

So, any house built on this, as you call it "substandard" land, post 1991 should have had its title caveated - unless (which seems to be the case here), the Council deemed that the land was not prone to natural hazard.

http://www.legislation.govt.nz/act/public/2004/0072/latest/DLM306820.html

Why, you might ask, did not the Christchurch City Council caveat the titles to these properties? All over New Zealand I suspect, council's choose NOT to use this legitimate mechanism because they want to encourage development on marginal land (i.e. often peat/wetlands where a great deal of excavation and infill goes on to make it development ready). If in granting subdivision of this marginal land, the council indicated to the developer that all the land titles would be caveated as subject to natural hazard under the Building Act - how saleable do you think ANY of this land would have been?

People buying on this type of marginal land have been right royally screwed. They paid more for this wasteland than it was ever worth. They were NOT made aware of known risks. It's been the case ALL OVER NEW ZEALAND.

But is 'that notation' in their contracts, Kate? I was looking at units on the corner of Bealey and Park Street, the newly developed old hospital site, a few years back when they were in mortgagee status, and lo and behold, something I'd not taken notice of before in the Contract of Sale - a Liquifaction Clause ,and all sorts of other 'little' notations re flooding...and earthquake !. So that land, on the Avon, may not have been on its own?

What might subsequently have been put into a contract of sale would only be the present vendor and/or vendors agent trying to limit their liability for what was initial negligence by the council who chose not to caveat the title on granting building consent. The important issue is that title caveat. If the regulator does not use that section (72 and 73 in the 2004 Act; section 36 in the 1991 Act) at the time of granting bulding consent - then what they are saying is that the building IS NOT being constructed on land prone to a natural hazard.

Council's all over NZ have been negligent in this regard - (as I say because they were complicit in promoting the development of substandard/marginal land) - and as a result we have what I imagine will be hundreds and hundreds of thousands of homes built on peat/wetland which will likely suffer severe liquefaction given the smae circumstances that Chch has just been through.

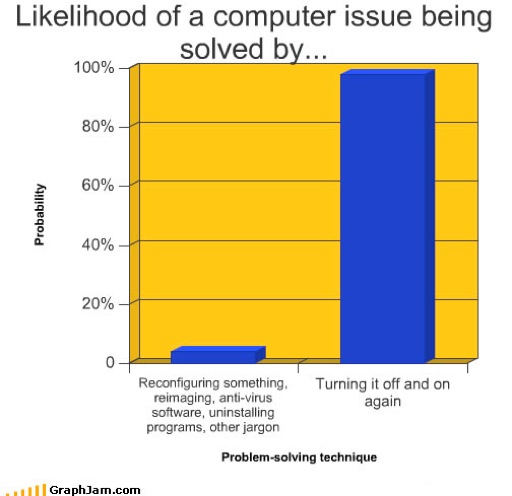

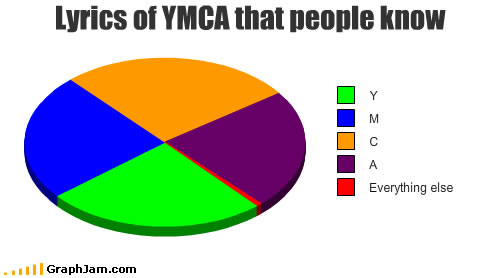

Great selection Alex. Love those graphs, quite accurate eh.

Only thing with the computer repairs is I am sure that applied to windows, piece of junk that it is. I have a cousin that has been using Linux since the 80's, he can run his computers for six months without switching them off.

Intersting comment here http://www.trademe.co.nz/Community/MessageBoard/Messages.aspx?id=738496&topic=3

Sadly some of the applications I use are not available for Linux. Interest.co has a bit of trouble with Ubuntu, but at least it does work.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.