Insurance

[updated]

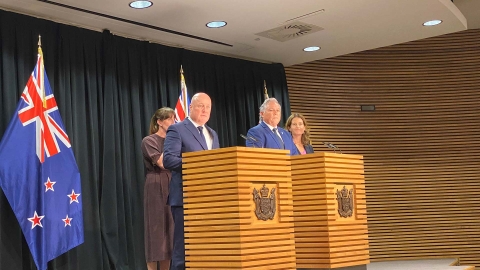

Prime Minister Christopher Luxon announces $1.2 million to support regions impacted by extreme weather events through mayoral relief funds, says there is a strong case for an independent government inquiry

27th Jan 26, 11:35am

1

Prime Minister Christopher Luxon announces $1.2 million to support regions impacted by extreme weather events through mayoral relief funds, says there is a strong case for an independent government inquiry

Patrick Watson points out the housing market is the US economy’s thousand-pound gorilla. Bad things happen when it gets angry

19th Dec 25, 11:06am

1

Patrick Watson points out the housing market is the US economy’s thousand-pound gorilla. Bad things happen when it gets angry

Tower Insurance to pay $7 million penalty after the FMA says it used advertised multi-policy discounts to attract and keep customers but did not have ‘systems that could reliably deliver on the promised discount’

9th Dec 25, 3:31pm

1

Tower Insurance to pay $7 million penalty after the FMA says it used advertised multi-policy discounts to attract and keep customers but did not have ‘systems that could reliably deliver on the promised discount’

Government pushes out decision on whether to increase the Natural Hazards Insurance Levy as Finance Minister Nicola Willis says insurance is a major cost-of-living pressure on New Zealanders

19th Nov 25, 7:02pm

5

Government pushes out decision on whether to increase the Natural Hazards Insurance Levy as Finance Minister Nicola Willis says insurance is a major cost-of-living pressure on New Zealanders

Auckland Councillor says if politicians don’t take the lead on climate change adaptation, ‘it’s going to be done in a pretty blunt way because reinsurers are not going to back it up’

15th Nov 25, 9:00am

1

Auckland Councillor says if politicians don’t take the lead on climate change adaptation, ‘it’s going to be done in a pretty blunt way because reinsurers are not going to back it up’

Amanda Whiting, CEO of New Zealand’s largest insurer, moving back to Australia, will continue to lead IAG NZ until successor appointed

4th Nov 25, 10:50am

Amanda Whiting, CEO of New Zealand’s largest insurer, moving back to Australia, will continue to lead IAG NZ until successor appointed

Reserve Bank says Cabinet has agreed to recommendations to progress an amendment bill to change the Insurance (Prudential Supervision) Act

24th Oct 25, 11:22am

Reserve Bank says Cabinet has agreed to recommendations to progress an amendment bill to change the Insurance (Prudential Supervision) Act

Climate Change Minister Simon Watts says the topic of who pays for climate adaptations is a ‘tough’ conversation, plans to work with coalition partners and also opposition to figure out principles around this

21st Oct 25, 3:40pm

12

Climate Change Minister Simon Watts says the topic of who pays for climate adaptations is a ‘tough’ conversation, plans to work with coalition partners and also opposition to figure out principles around this

Climate Change Minister Simon Watts says government objective is to mitigate genuine hardship not distort risk signals for homeowners hit by extreme weather

18th Oct 25, 9:15am

15

Climate Change Minister Simon Watts says government objective is to mitigate genuine hardship not distort risk signals for homeowners hit by extreme weather

[updated]

Climate Change Minister Simon Watts to introduce legislation clarifying the responsibility of local government by requiring adaptation plans in the highest priority areas

16th Oct 25, 10:52am

4

Climate Change Minister Simon Watts to introduce legislation clarifying the responsibility of local government by requiring adaptation plans in the highest priority areas

People's homes, jobs plus the fisheries and aquaculture sectors are at growing risk as climate change and human activity puts pressure on New Zealand's oceans and coasts, report says

8th Oct 25, 1:39pm

8

People's homes, jobs plus the fisheries and aquaculture sectors are at growing risk as climate change and human activity puts pressure on New Zealand's oceans and coasts, report says

IAG NZ paying $19.5 million penalty after self reporting Financial Markets Conduct Act breaches the FMA says are the worst in any fair dealing case it has taken to court to date

6th Oct 25, 1:11pm

7

IAG NZ paying $19.5 million penalty after self reporting Financial Markets Conduct Act breaches the FMA says are the worst in any fair dealing case it has taken to court to date

Suncorp New Zealand's annual net profit after tax for general insurance hits $398 million due to lower reinsurance costs, 'benign' weather and 'earn-through impact of previous year's pricing changes'

14th Aug 25, 2:05pm

Suncorp New Zealand's annual net profit after tax for general insurance hits $398 million due to lower reinsurance costs, 'benign' weather and 'earn-through impact of previous year's pricing changes'

IAG NZ's annual insurance profit climbs above A$600 million as insurance margin rises

13th Aug 25, 5:15pm

IAG NZ's annual insurance profit climbs above A$600 million as insurance margin rises

Natural Hazards Commission says land cover is ‘a contribution payment, not full cover’ as just over half of NZ homeowners say they expect full insurance compensation for natural hazard damage

12th Aug 25, 4:05pm

3

Natural Hazards Commission says land cover is ‘a contribution payment, not full cover’ as just over half of NZ homeowners say they expect full insurance compensation for natural hazard damage