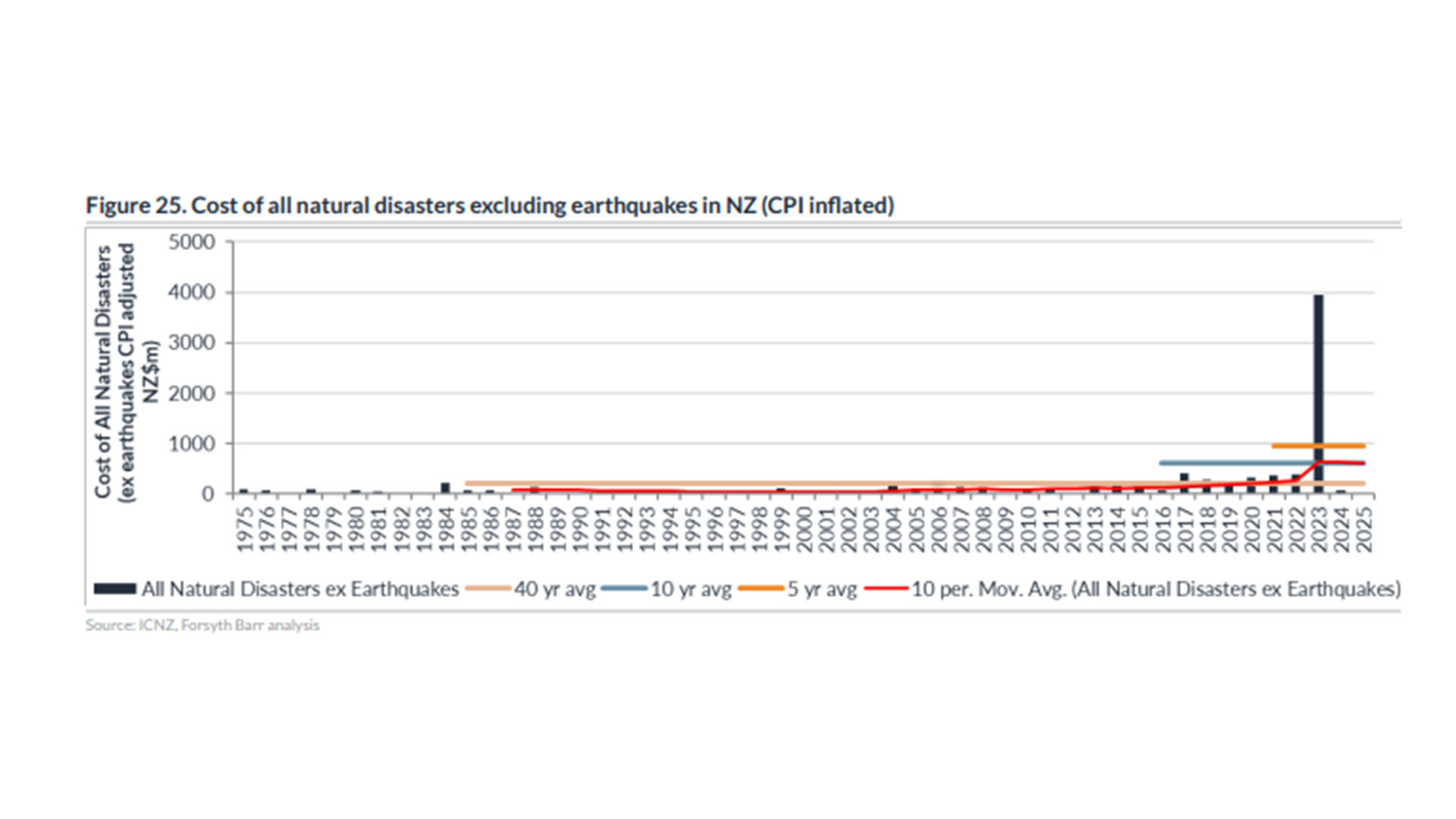

Over the past 40 years, the average cost of all natural disasters - excluding earthquakes - in New Zealand across all insurers is $203 million.

But more recently, the 10-year average annual industry cost is $606 million. And the five-year average is $952 million per annum, according to Forsyth Barr analysis and Insurance Council New Zealand. This comes from a chart featured in investment firm Forsyth Barr's latest general insurance digest released last Thursday.

Natural disasters and climate change remain on people's minds as residents in the Nelson Tasman region have been battling heavy rainfall, flooding and slips. Conversations have also arisen over how the country will manage - and pay for - climate change and natural hazards in the future.

What else is happening with New Zealand's general insurance sector, according to Forsyth Barr?

In its latest general insurance digest, Forsyth Barr analysts James Lindsay and Will Twiss say the pace of growth for insurance premiums has slowed down as the country’s general insurance sector is in the softening phase of its pricing cycle.

The analysts say the pace of growth for premiums was decelerating with modelling suggesting it would bottom out in the third quarter of 2026. This “implies roughly one more year of softening remains”.

This echoes recent comments from insurers Suncorp and IAG which expect “modest” or “low” growth when it comes to gross written premiums (GWP), including in New Zealand, the analysts say in the report.

GWP is the total amount customers pay for insurance coverage on policies issued by the insurer.

The report notes how IAG, in its FY24 update, said rate momentum moderated over the second half of 2024 particularly in personal lines (this is insurance that covers people from things like loss of property, death or injury), while Suncorp said premium growth was now more volume-led, especially across New Zealand.

Both companies expect lower reinsurance costs going forward. This comes as “global reinsurers are reinforcing this shift toward more selective underwriting”.

Insurance company Tower has also seen similar conditions arise, the report’s analysts say, with its GWP growth in the first half of 2025 at 4% on the prior comparable period (pcp), “primarily reflecting customer volume recovery following deliberate pruning of high-risk segments in FY23 and FY24”.

“Our research suggests this market-wide shift in tone is unlikely to reverse quickly.”

Strong stock performance

Stock performance has been strong over the past three months, the analysts say.

Tower has gone up 19%, QBE Insurance is up 15% while IAG and Suncorp rose by 13%.

Strong gains were delivered and over 12 months, these companies delivered strong performance, according to the report.

‘Competitive behaviour now becomes key’

In the report, Lindsay and Twiss say: “While the cycle has clearly turned, execution and competitive discipline - not timing - will now differentiate the sector’s forward-year stock performance.”

“So far in 2025, conduct has remained rational. Insurers are embedding more differentiated pricing, while the reinsurance market is signalling some benefit flow-through.”

With about 81% of New Zealand’s personal lines market held by IAG, Suncorp and Tower, “pricing behaviour among these three will set the tone for industry margins”.

Forecasting reinsurance costs to fall for Tower

The analysts say they retain their 5% GWP growth estimates for Tower over FY25, FY26 and FY27.

“For FY25, this aligns with management expectations, while our estimates for FY26 and FY27 are well below Tower’s guidance of medium-term GWP growth targets of 10% to 15% per annum.”

The report says Tower continues to target “peril-specific” customers through “granular risk-based pricing” with 92% of its book now with “low” or “very low” flood-risk bands.

Referring to a 2024 report on reinsurers from consultancy group EY on price softening and how this will “be uneven and favour carriers with loss-modelling clarity and demonstrated retention discipline”, the analysts say “we view Tower as a beneficiary in that context” with its “elevated reinsurance costs of 15.2% of GWP in FY24 (and we estimate falling to 13.3% in FY25) and $50 million large-event allowance, set at the 90th percentile".

The analysts are forecasting that FY25 reinsurance costs will fall about 180 basis points as a percentage of GWP and they also think it will stay low in FY26, “supporting earnings resilience even with a conservative $50 million large-event provision”.

1 Comments

Humans have entered the degrowth era. Not surprising, after an exponentially-increasing growth phase on a finite planet.

Insuring therefore gets exponentially fraught, from here on in (sorry economists; physics trumps your blind construct).

And reinsuring is the averaging of insuring globally - so it becomes exponentially fraught too; heading towards impossible. Expect a cascading abandonment of insuring, due to inability to pay, compounding the problem.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.