The number of residential properties available to rent is increasing while the average asking rent is decreasing, according to the latest data from property website Realestate.co.nz.

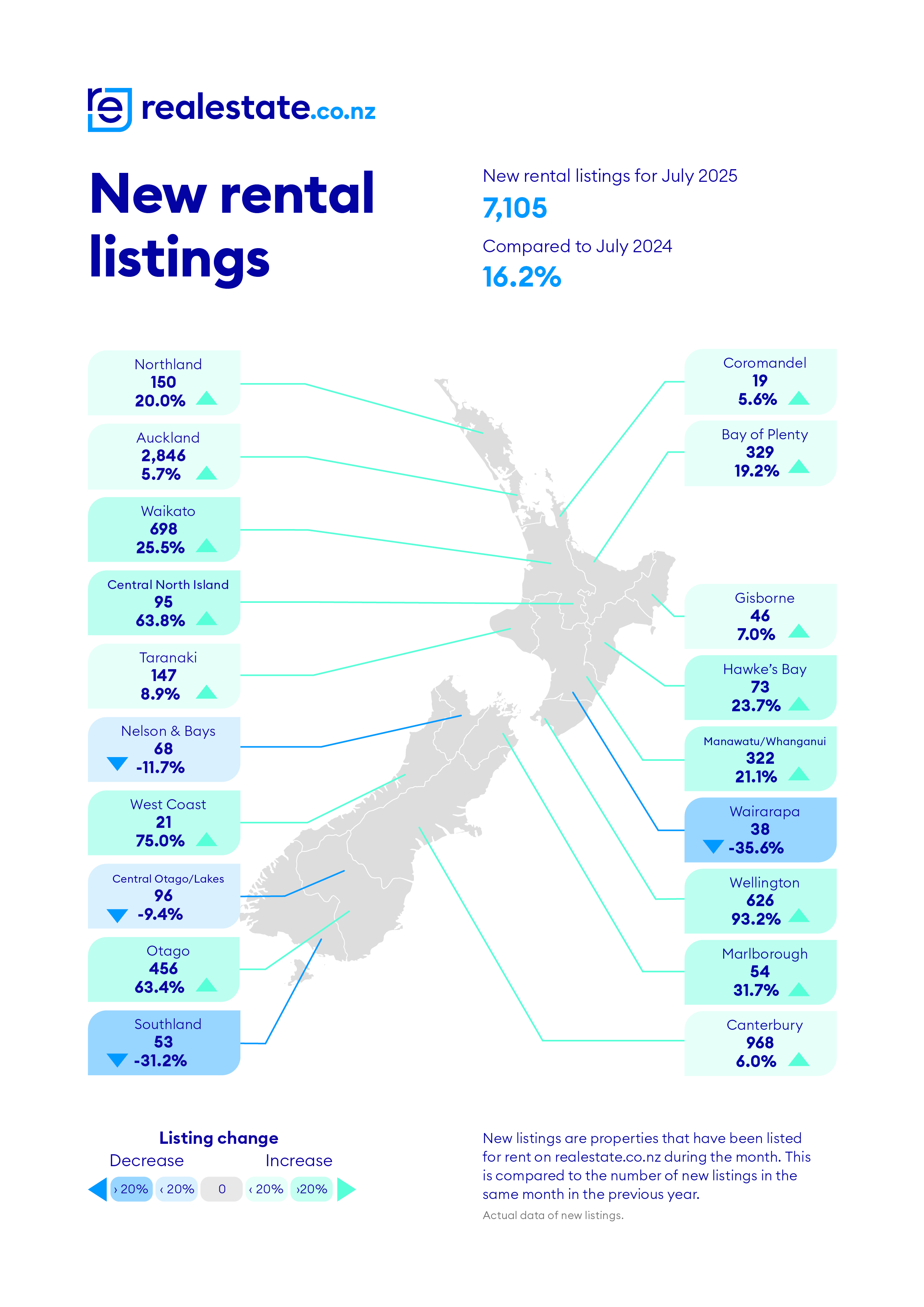

The website received 7108 new rental listings across the entire country in July, which was up 16.2% compared to July last year.

Around the regions, the biggest increases in properties for rent compared to a year ago were in Wellington, where they almost doubled (up 93%), followed by the West Coast up 75% and Otago up 63%.

In Auckland, the country's largest rental market, new listings were up 5.7% compared to July last year.

The first chart below shows the regional listing figures and their annual change in all regions.

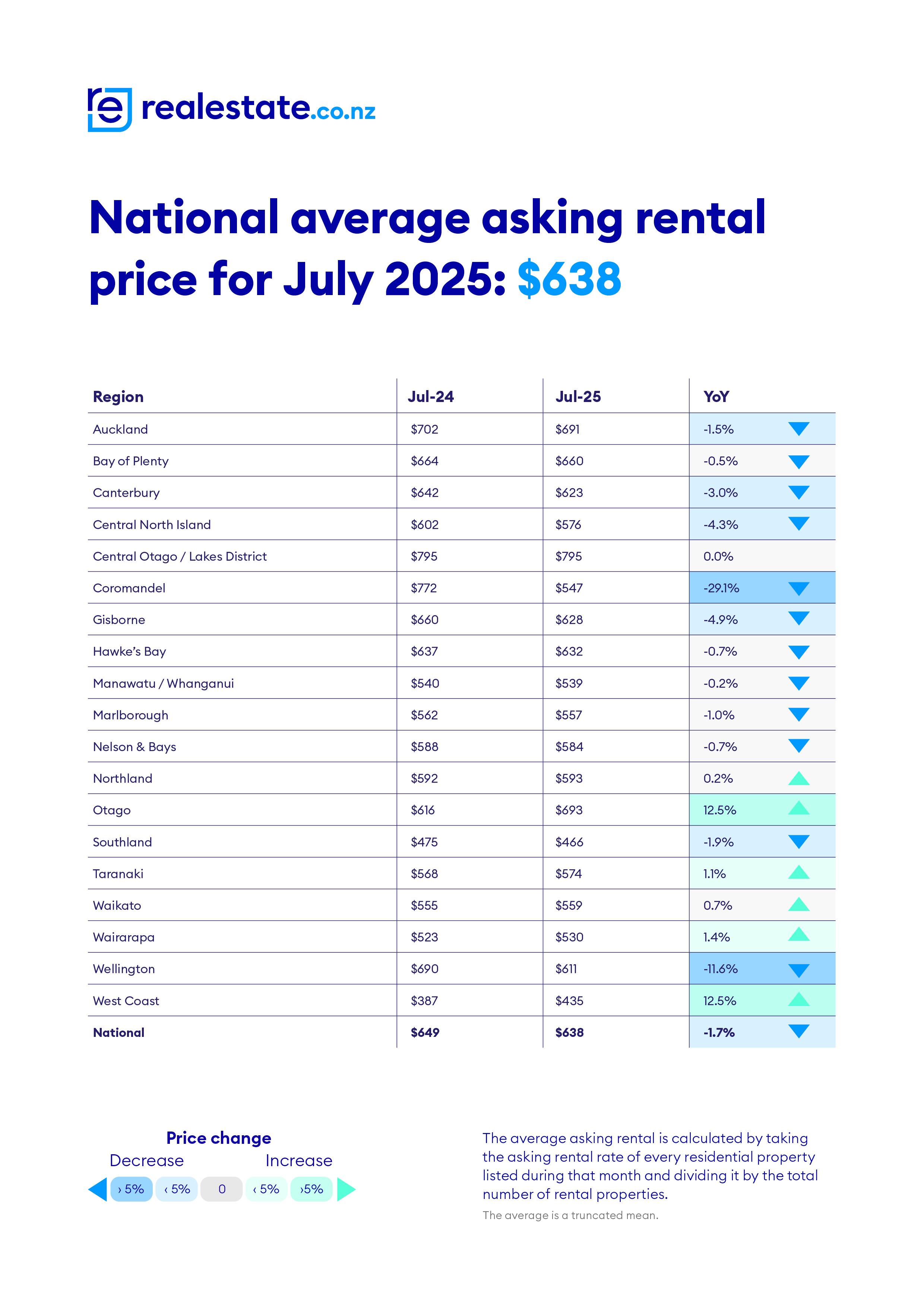

Perhaps not surprisingly, while the number of properties available to rent was up compared to a year earlier, their average asking rent declined.

The national average asking rent on Realestate.co.nz declined from $649 a week in July last year to $638 in July this year (-1.7%).

The biggest decline was on the Coromandel, where the average asking rent declined from $772 a week in July last year to $547 in July this year (-29%), followed by the Wellington region where the average asking rent declined from $690 a week in July last year to $611 in July this year (-11.6%) - the second table below shows the annual movement in asking rents by region.

The comment stream on this article is now closed.

8 Comments

Great to see declining rents nationwide, hope it goes further down over the coming years!

The ones at the bottom of the rung, are getting a much-needed breather, from leveraged blood suckers.

The ones at the bottom of the rung have moved back in with their parents, or sleeping on a couch.

While they save for a flight west. Rent seeking above all else is causing the export of our educated workforce.

Couldn't be more directly related to the TradeMe article really.

With higher rates, insurance, upkeep, repairs etc and without the assumption of appreciation of the house which won't happen unless we get mortgage rates closer to the Covid era the landlord model doesn't work, more money in that out annually without the "mark to market" revaluation of the property. So prices are just re setting hopefully to a more sustainable level for everyone, owners, landlords and renters. After all, everyone needs a roof over their heads.

Landlords don't set the price of properties.

In the 2010s, we used the same argument about foreign buyers. Banned them, and what do you know, prices still went up.

The Salem Witch Trial approach to resolving housing.

We didnt really ban them...we just gave them a couple more hoops to jump through.

We were very careful not to impact demand too much

Disagree. The never ending rent increases and over use of leverage creates the spiral upwards.

Precisely. The market can only charge what people can afford and as jobs are more scarce, people will move out if they cannot afford high rents, of which we are seeing in aggregate now, coupled with the ongoing numbers leaving for abroad, both leaving their rentals and trying to rent their OO's adding supply.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.