Individuals and business owners, with insurance covering their properties, cars and contents for fire damage, will next year start paying more towards funding the revamped fire service.

The New Zealand Fire Service, National Rural Fire Authority, and 38 other rural fire authorities will merge to become one organisation known as ‘Fire and Emergency New Zealand’ (FENZ) from July 2017.

The issue being consulted on now, is by how much the levy insurance policyholders pay, should be increased by to keep the new organisation afloat in the 2017/2018 financial year.

The New Zealand Fire Service Commission, in a consultation document released today, suggests the levy should increase by 39%.

Its Board believes this will equate to an increase of about $36 per year, or 70 cents per week, for the average home owner.

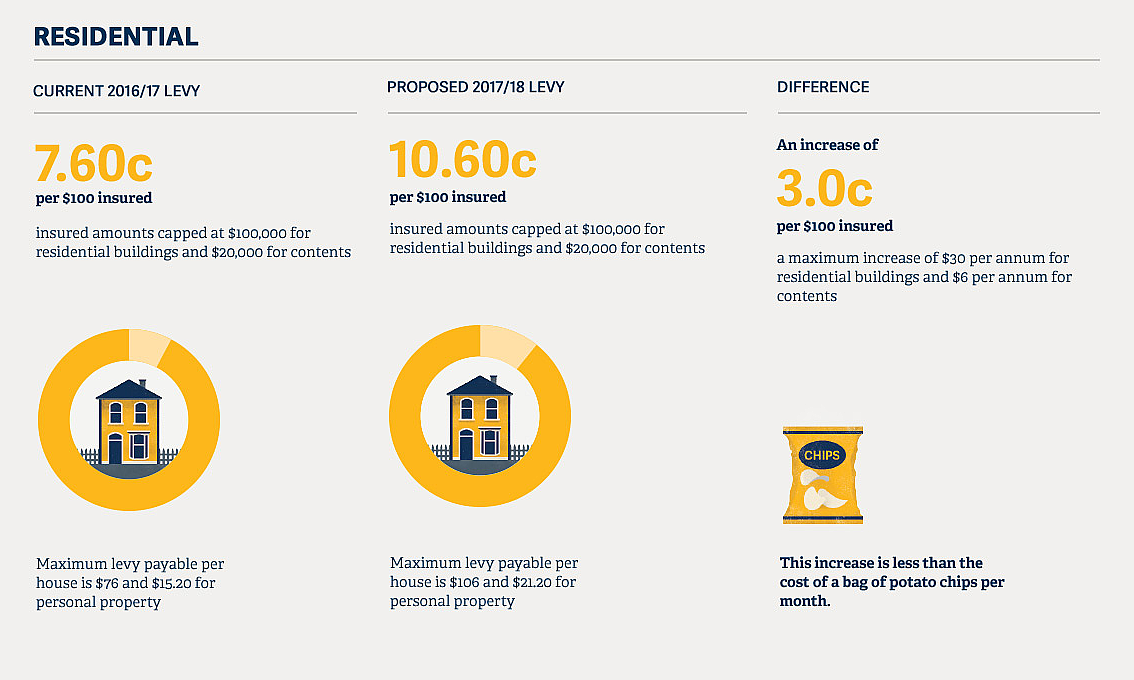

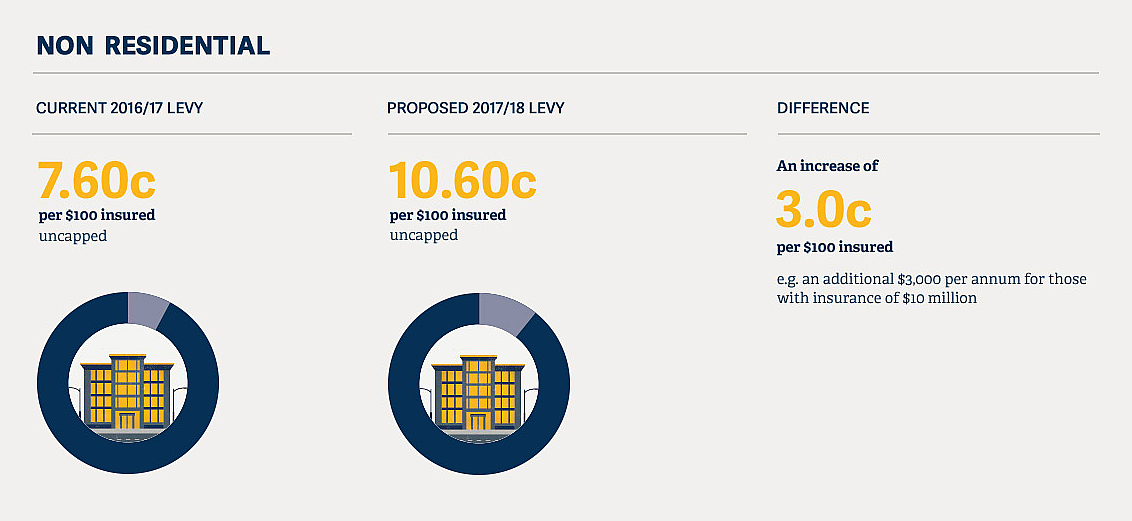

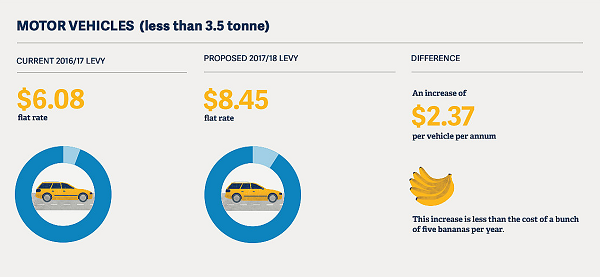

This is what the proposed levy changes look like in dollar terms:

Why the levy increase?

Currently 95% of the Fire Service’s operations are funded by the levy.

Yet the rate of the levy hasn’t increased in eight years.

The Commission says this is putting our fire services under increasing pressure, as the level of funding doesn’t reflect increases in inflation or the wider range of services undertaken by our fire services.

For example, the proportion of non-fire incidents the Fire Service responded to made up 38% of the total number of incidents it responded to in 2014/15 - up from 31% the previous year.

The Commission, in the consultation document, says: “The levy rate proposed will generate revenue to fund fire services to perform the increasing range and volume of activities expected by the public.

“In addition, the levy rates will fund the ongoing support activities expected of the new organisation, FENZ. These activities include such things as investment in rural fire services, and better support for volunteers.”

Nearly 40% more in levies needed in 2017/18

The Commission says it will cost $535 million to operate FENZ in the year starting July 2017. After allowing for “other sources of funding”, the Board must generate $483 million in levies.

Put in perspective, $350 million of levies were collected last year. So 38%, or $138 million, more is needed for 2017/18.

As a part of Budget 2016, released in April, the Government announced it would make a $112 million capital injection for the transition to the new organisation, to be repaid over 10 years.

It also agreed to contribute $30 million of funding over three years towards the “cost of public good non-fire activities, such as responding to medical emergencies, floods or other natural emergencies”.

Changes proposed for 2017/18 part of larger shake-up

So where to after the 2017/18 year?

The funding changes being consulted on for 2017/18 are a part of a transition to broader changes outlined in the Fire and Emergency New Zealand Bill, introduced to Parliament in June.

The Minister of Internal Affairs Peter Dunne in April announced that from July 2018 the fire levy would be broadened to include insurance on material damage. The levy on motor vehicle insurance would also be extended to include third party insurance.

So at some stage in 2017, consultation will begin on what the 2018/19 levy will look like.

The Commission says it will consider implementing differential rates for residential and non-residential policies, revised caps for residential and personal property, and new exemptions from the levy.

Dunne says the government has “listened to submitters during the recent Select Committee process” and some of these proposed measures will “address any affordability or fairness concerns”.

In the 2019/20 financial year, and the two financial years that follow, three-year rates will be applied with full implementation of the levy provisions contained in the new legislation.

Every time new rates are set, the public will be consulted.

Insurance Council: levy 'unfair'

The Insurance Council of New Zealand has long opposed the levy, saying it is unfair those with insurance pay for a service those without insurance benefit from.

Its chief executive Tim Grafton confirms an increased levy won't affect insurance premiums.

"The tax is passed directly to the insured and GST applies on top," Grafton says.

"Under the Bill that is before Parliament, the tax applies to the amount the property is insured for. There is no connection to premium, but an increase in the tax or levy.”

Grafton adds that while there's been no levy rate increase in eight year, the total amount the Fire Service has received in levies may have increased.

"This is because over that time commercial property values have increased and with that the sum insured has increased.

"So while the rate may have stayed the same on a building, if the value has gone up $10 million and the building is now insured for $10 million more, then the levy take by the NZFS will have increased. Ditto if there are more vehicles on the roads."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.