New research by Motu Economics and Public Policy Research shows just how much more susceptible properties in coastal parts of New Zealand are to storm damage.

Researchers, David Fleming, Ilan Noy, Jacob Pástor-Paz and Sally Owen, have found that while the average property in New Zealand is located about 11km away from the coast, the average property involved in an Earthquake Commission (EQC) claim after a weather-related event is only 6km from the coast.

They’ve drawn this conclusion having looked at the more than 26,000 weather-related claims lodged with the EQC between 2000 and 2017.

The EQC provides natural disaster insurance for residential property. Its Natural Disaster Fund is funded by levies added to residential home and contents insurance premiums. It is also backed by reinsurance and a Crown guarantee.

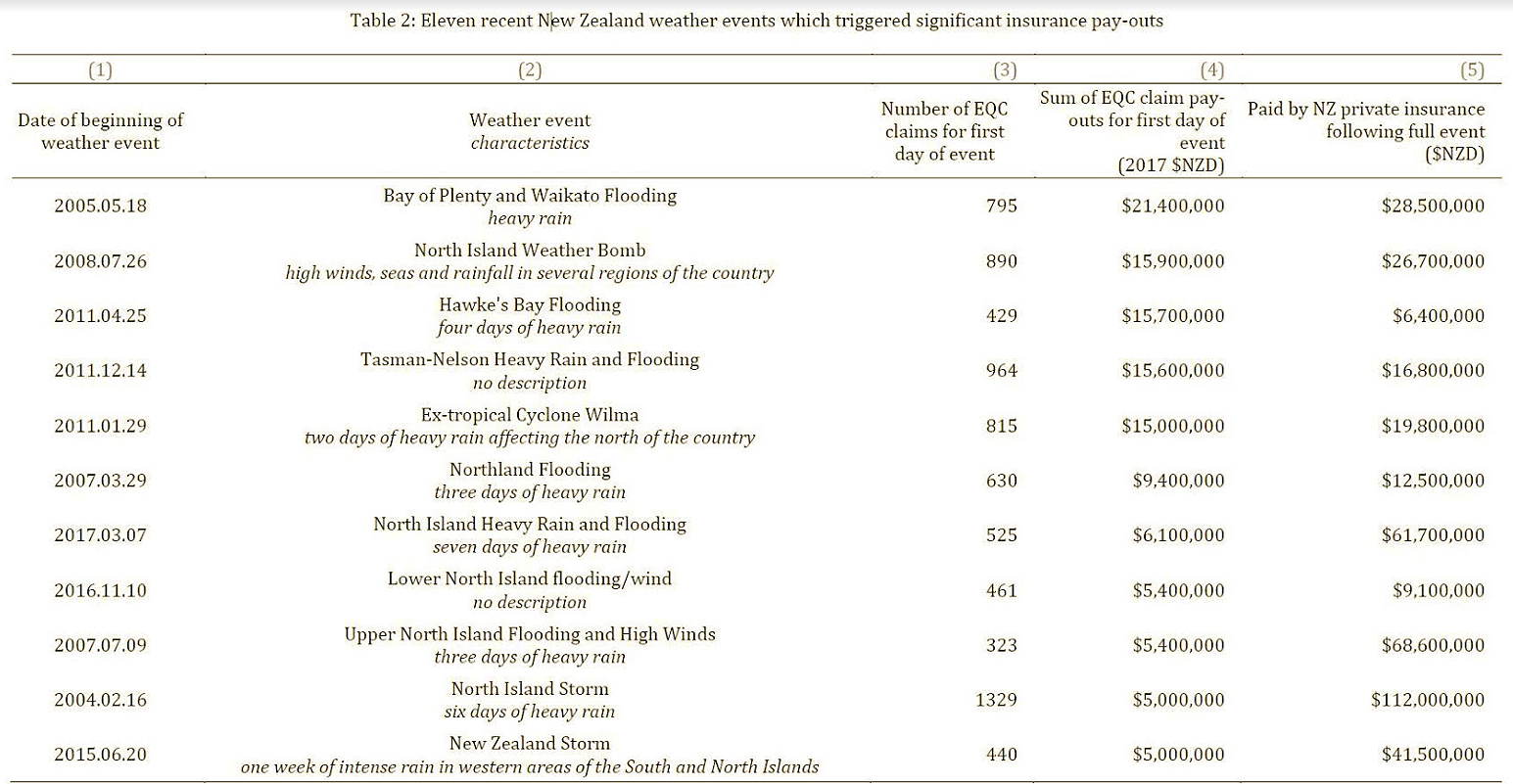

The researchers found that five major events accounted for a third of all pay-outs made by the EQC between 2000 and 2017.

Four of these occurred in Northland, the Bay of Plenty, Nelson and Tasman - the regions (along with Wellington) with the highest proportions of people and properties negatively affected by weather events.

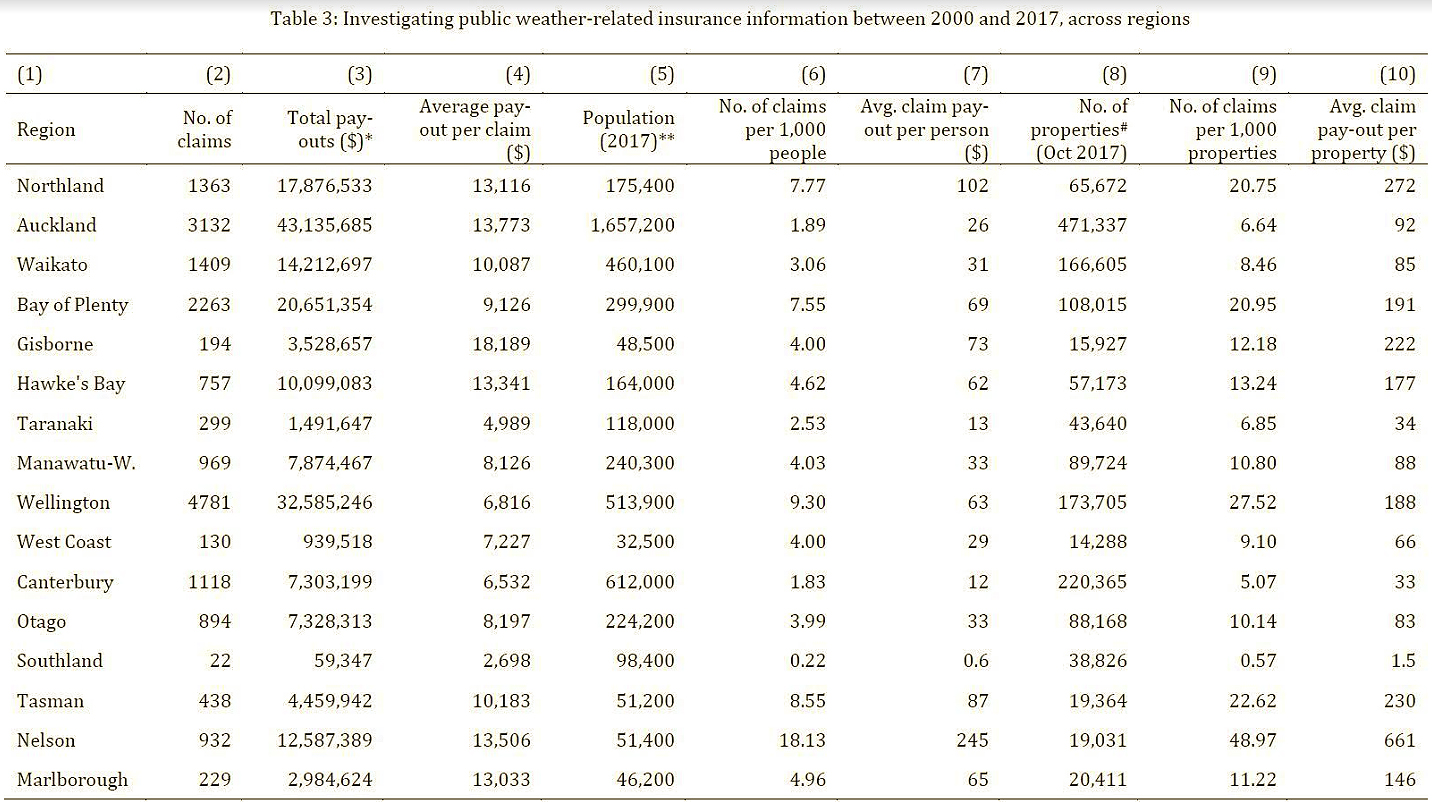

The number of claims lodged with the EQC per 1000 properties was 48.97 in Nelson, 27.52 in Wellington, 22.62 in Tasman, 20.95 in the Bay of Plenty and 20.75 in Northland.

Looking at the value of claims paid out by the EQC, after Auckland and Wellington, the Bay of Plenty and Northland were the regions that received the highest pay-outs, followed by Nelson.

Gisborne was the region with the highest average value of pay-out per claim of $18,189.

“With climate change it’s vital to know how weather-related events translate into financial liabilities for the Crown,” Noy says.

“This is the first in-depth analysis of EQC claims for weather-related events and is the beginning of understanding what we may face in the future.”

Motu researchers also found there was no relationship between regions with higher population growth and regions that lodged the most claims.

This suggests people aren’t necessarily moving to high risk areas.

Looking further at the socio-economic side of the data, Motu researchers found weather-related EQC claims tended to come from areas where households had higher median incomes.

Locations with a median income in the top 40% of incomes reported more than half of the total claims and pay-outs made.

The researchers didn’t dig into the reasons behind this, but say it could be due to these households having better access to the system, their damaged assets being worth more, or them having more land exposed.

“We are only just beginning to provide insights about the increasing risk that current and future residential areas might face, given the possibility of increasing frequency of extreme weather events,” Noy says.

“This paper is the first part of research which we hope will ultimately project the financial liability from climate change for EQC, and through it, the Crown”

The researchers say their findings should be considered in the context of discussions initiated by the Parliamentary Commissioner for the Environment, Simon Upton, who is proposing to institute an EQC-like scheme for dealing specifically with sea-level rise and flooding.

It could also be useful as the Government revises the EQC Act and the Insurance Law Reform Act.

33 Comments

The NZHerald is running this story also, including comments from the Insurance Council and IAG.

Can't help but feeling that this is a general softening up of the public to accept the increases the insurance companies are pushing through for higher risk properties.

Research that states the obvious is official confirmation of facts long known.

That a house in a high risk area is facing increased premium costs seems fair to all and it gives incentives to build in lower risk areas.

Perhaps we should hold councils responsible for allowing subdivisions on land not suitable for building on, other than that it increases council revenue through building consents and rates for ever after.

But the irony of that will be that the councils will take out insurance for that and guess who ends up paying the premium.

As we all know an elected council is "only" doing what the electorate "wants" which is another way of saying "nobody can hold me responsible".

We need common sense in a huge dose.

No I dont think we should be holding councils responsible. In effect if you do then that is socialising the losses.

Bear in mind when Kapiti? council tried to do it they ended up in court against home owners and lost. So they are hung either way, that isnt reasonable IMHO. ie I really dont think its the council's willingness to let the building happen for profit, its their inability to say no without losing costly court cases.

I dont think you are displaying common sense, but there you go. One man's common sense is another stupidity it seems.

For insurance there are a number of factors that need to be considered and i struggle to understand why the insurance industry has not already been all over this. Proximity to coastal and waterway areas, height above them, proximity to unstable cliffs/hill sides and so on. Thinking about it - these are likely the highest value properties as they will be built on the prime coastal areas that command the best prices in most areas. The evidence of global warming's impact on weather events has been reasonably clear for a year or so now, unless you're implacably in denial and totally resistant to change. So those people who own those properties should be paying increased risk premiums rather than expecting them to be subsidised by every one else.

Ocean Beach drive, at the foot of Mt Maunganui comes to mind ...

Mission Bay, Kohimarama etc.

Already getting flooded on occasion. Potential to get much worse over coming decades.

From what I can read the insurance companies are indeed heading in this direction. I think part of their reticence has been the competitiveness of the industry, but with 1:1000 year events happening as frequently as 1:10 something has to give.

Then there are all the other impacts, food,

"After years of bumper harvests, global output could drop this year for the first time since the 2012 to 2013 growing season. This could have political and social ramifications. Egypt, which relies on subsidized bread to feed its almost 100 million people, is already paying the highest price for its imports in more than three years."

examples abound,

https://www.investors.com/research/futures/wheat-crop/

and energy for instance,

"The hot weather also has forced a German coal-fired plant to curb operations and reduced the availability of some plants in Britain fired by natural gas."

https://www.bloomberg.com/news/features/2018-07-25/heatwave-hits-commod…

Funny thing of course is that the poo pooers on solar try to claim that renewables are not reliable, unlike coal, gas and nuclear, LOL.

What really worries me however is if the [Labour] Govn decides to offer "state" insurance if no one else does, OMG that will be a bad day in the making.

"The evidence of global warming's impact on weather events has been reasonably clear for a year or so now, unless you're implacably in denial and totally resistant to change." Actually it has been clear for at least two decades. One could perhaps add the word "reasonably" to maybe three or so decades ago.

Rather goes to prove the point doesn't it. The insurance industry has been too busy counting it's profits to actually provide a comprehensive, robust and well balanced product to it's customers that stands up to scrutiny.

actually not the case.

Cui bono? The insurance premium elevation crew, assuredly.

And one cannot help chuckling at the article's use of this 'statistic': "the average property in New Zealand is located about 11km away from the coast"

That's certainly not true for (let's enumerate 'em):

- Dunedin (probably 80% within that 11km line)

- Christchurch ditto, where even the airport is only 15k from our beach

- Wellington ditto

- Napier - 11km out and yer in the Vineyards...

- New Plymouth

- Tauranga

- Auckland maybe 80% within that line

With such sloppy use of 'statistics', the credibility of the entire report is, shall we say, negligible.

But we can certainly all look forward to premium increases on the strength of it.

Yeah, thought the same thing when I read that.

Risk factors are associated with most insurance, for example in car insurance past claims history, driving offences, and age of driver in relation are considered risk factors.

Equally there is some rationale to looking at high risk areas for property; however, the reality is that the situation is a lot more complex than a analysis as has been carried out using simple and very short term data.

An example of this is that prior to 2010 Christchurch would have been considered a very low risk earthquake zone compared to say Wellington, Hawkes Bay and West Coast which are are all very close to significant faultlines.

Equally, simply being on coast front is not necessarily present the same risk factor for all. Clearly the topography - location on active cliff front, sheltered beach, open beach, inlet - all present different risk factors. Here in the Hawkes Bay, as with most other coastal areas, some beach front properties are located on beaches prone to long term erosion whist other accretion.

If we are after properties carrying their true risk factor, then rather than bland "coastal high, inland cheap" there needs to be individual risk assessment. After all, while that property in Te Kuiti may not be prone to tsunami risk, landslip is significant; equally while Auckland is lowish earthquake risk, it is at higher volcanic and tropical cyclone risk than the South Island.

Climate modelers are now openly reporting the possibility of world sea levels rising 2.5 meters by 2100 which is within the lifetime of current infants. Within only the last five years there has been a rtaher sudden increase in ice melt in Antarctica. So such extreme scenarios are becoming ever more probable. That dangerous word exponentials is becoming ever more present. Rising seas must also raise rivers thus coastlines are not our only concerns. We WILL be increasingly protecting our flood plains at tax/ratepayer expense. The easiest and cheapest source of access to expert advice is Youtube, Professor Jennifer Francis provides a good start.

Sea level change is a major issue facing all of us.

You refer to "climate modelers" now report possibility of sea levels rising by 2.5m by 2100.

Not sure which modelers you refer to but this seems a bit on the high side estimate; UN inter government panel on climate change currently predict a change by 2100 of up 0.8 metres. Still of very significant concern.

Three years ago I visited Kiribati, a country of atolls most at risk from seal level changes where issues of inundation currently exist.

So called climate modellers may be reporting such tripe....but that has no bearing on likely reality....Fact...the world is on a very long term slight warming path, barring the occasional cooling path, and sea levels are rising ever so slowly....the long term pattern thats been happening for god knows how long....anything we do will not be changing these patterns markedly, though the patterns could change tomorrow, if the sun changes, or there are changes in the earths inner core, or other reasons we don't understand, but increase of CO2 in the atmosphere is not one of the major players....this is all about stealing your money....by all means put efforts into mitigating the effects for affected populaces, such as low lying atolls, but stop buying into the ridiculous idea that mankind can have more than a negligible effect on earths climate....the stupidity on this subject beggars belief.

I will try and duck the likely tirade of uninformed commentary lol.

Yes, truthout; I totally agree and support you.

. . . and don't also forget to mention that the tooth fairy is going to visit me tonight, restore my hair, make me 20 years younger, leave a Porsche in the garage, and deposit $3 million in my bank account.

Ahh, it is so much better living in a world of fake news and belief.

Well this is going to increase the coast of living...

Very punny!

I sea what you did there

printer8. CHCH was never considered a 'very low EQ risk'. Its proximity to the alpine fault combined with the significant value at risk in the city, made it a key exposure for insurers before the latest EQ sequence.

Premium rates have not historically been directly correlated to actual risk for a variety of reasons, including that a significant chunk of the end premium is a pass through of the cost of reinsurance. The process to allocate that cost at a granular policy level is influenced by commercial expediency and is not an exact science. Insurers are moving towards individual risk based pricing but cross subsidisation on a location basis will continue.

Agreed on both points.

The Christchurch seismicity was well known and a 1991 EQC-funded report hit the nail on the head (so to speak), in the light of subsequent occurrences. So no excuse for ignorance of history, please, p8.

Insurers are retailers. The wholesalers are the Re-insurers who actually pay out upon claims. This leaves the locals to take the heat as they are free to choose exactly how they spread the risk and thus the premiums.....

Hi waymad

I refer you to the Executive Summary of your report:

For Christchurch;

- catastrophic property damage and major life loss of life expectancy average return period is 6,000 years (which occurred)

- extensive property damage with some loss of life 300 years.

It concludes that while the risk of an earthquake is same as Wellington, for catastrophic events it is lower.

Printer8. It depends on which fault systems are being talked about. The 2010 sequence was not the alpine fault which moves every 300 years or so +/- 60 odd years. Last significant rupture 1717. When the Alpine fault next slips it'll generate accelerations in CHCH city similar to the Darfield 9/2010 event, so damage there will be moderate.

Darfield was was an unknown fault system that rendered pre 2010 EQ return period calculations for CHCH city partly obsolete, including those in this EQC report (but not Ian McCahon's work on liquefaction which proved to be presciently accurate).

My point was that Christchurch was assumed to be at relatively lower risk of earthquakes prior to 2010. Yes, the Darfield faultline was unknown prior to that time (although the existence of other similar faultlines in the Christchurch locality were well known) and this affected earlier assumptions .

Yes, McCahon was very much right regarding liquefaction and until 2011 it was term and its consequences most of us (including planners) didn't really appreciate.

Local knowledge transcends vague generalisations. Alan Watson (now deceased, I worked with him at Malvern County in the '80's) and others warned about precisely the sorts of effects even moderate quakes would have in susceptible areas in Christchurch. And the long history of quakes throughout the period since 1840 which affected Christchurch is well traversed in the original reference. What did happen, of course, is that humans became complacent. They forgot that previous results do not guarantee future performance....

The other point which needs to be made is that the Christchurch earthquakes sequence (plural because we are around a 16000 count of the sods, last one a 4, just off the beach, coupla weeks ago) was not 'catastrophic' by any reasonable measure.

Most of the deaths were in two buildings: one shockingly designed (shear tower outside floor plates, poorly linked in), the other had cantilevered vertical supports from first floor plate above grade. The first building pancaked when the floor plates decoupled from the shear tower, the second building partly pancaked after the first floor, which had exhibited prior cracks, failed near the cantilever.

The rest of the city had perhaps 5% houses red-zoned (8000 from 160K properties), 10% cracks in floor slabs and other non-destructive failures, rest had Gib cracks and path/drives kinked. Some has fairly much zero of any of this. The bulk of the destruction (e.g. in the Old CBD) was the direct result of a rush-to-demolition by the 'authorities'.

But lives carried right on: no shortages of food, fuel, shelter and the other necessities, with a little ingenuity. For catastrophes, ye haveta look at Lisbon 1755, San Fran 1906, and similar.

Re that list of catastrophes - more recently 2004 (Indian Ocean, rank #2) and 2010 (Haiti, rank #11) are right up there;

https://en.wikipedia.org/wiki/List_of_natural_disasters_by_death_toll

And of course, who knows what will eventuate at Fukushima in the long(er) run.

printer8. Re your obviously correct comment about the South Island being less exposed to tropical weather systems; Canterbury is however still subject to these systems and with weather patterns changing will be more so in future. Christchurch particularly, with wide areas of flood vulnerable land in the eastern suburbs having sunk in the EQ. The devastating flood of 1883 is now thought to have been a cyclone and Cyclone Giselle, otherwise known as the Wahine storm, did significant damage down south.

The bottom line to all this debate is that is that all regions of New Zealand are subject to risks associated with natural hazards.

However, the issue for insurance purposes is that compared to car or fire insurance is that damage from most natural hazard events tends to be far more wide spread, but significant events are less frequent and the return expectancy is longer, and exact timing unpredictable.

A classic example of this would be an eruption of Taupo; a return period is something like 20,000 years but the consequences would be decimation of much of the central North Island making the region inhabitable for a considerable period.

It looks as tho this is a system designed for middle- and low-income Kiwis buying safe houses to subsidise high income Kiwis buying risky property.

Tell me it isn't so. Please.

It looks as tho this is a system designed for middle- and low-income Kiwis buying safe houses to subsidise high income Kiwis buying risky property.

Tell me it isn't so. Please.

Answer is that no, it's not a system 'designed' to do that, it is however a partly unavoidable outcome, which is gradually changing as insurers move more to location based risk pricing but which, in the opinion of this humble scribbler, will to some extent remain the case for some time to come.

Try to think about it in a positive way. Next time you are at Pauanui look on a canal mcmansion and feel joy that you are through paying your insurance premiums, helping to maintain such an impressive symbol of capitalism.

This research does not appear credible: In the context of weather events like flooding and wind only the distance from the coast appears to have been taken into account. For example, properties situated higher than neighbouring sea, lake or river levels however are not flood prone. If insurance premiums are to reflect all actual risks accurately, then ALL factors must be taken into account to include AND exclude risks. For example, how many insurance premiums in Wellington's hilly suburbs contain a flood risk portion, when many can never get flooded? If getting into detailed risk assessment, then DO the details right!

The problem will be scale, ie trying to look at properties on an almost individual basis is close to impossible. So I would think insurance companies will take a zone/blanket effect, if you dont like it well move to another company (good luck with that).

You raise an excellent point. Elevated sections with sea views aren't prone to flooding. And being in NZ they would never be at risk from slipping. Oh no.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.