The criteria for KiwiSaver Default provider selection in 2021 was seriously imbalanced. What do the new Default funds look like and how do they compare to the fund managers’ equivalent non-default balanced fund? What criteria can you use to make an assessment of the funds on a forward-looking basis? Are the Default funds loss leaders for the providers, hoping to pick up more members? If so, who pays? Were the selection criteria too skewed towards fees, as opposed to best-in-class investment capabilities?

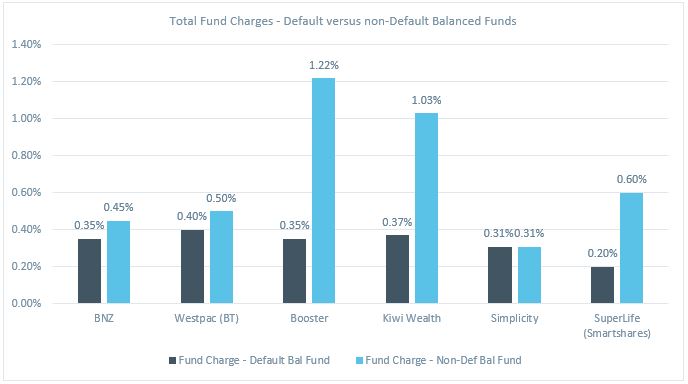

The graph below shows the total fund charges for each of the six default providers, comparing their Default fund to their non-default balanced fund. The difference in fund charges range from 0% to 0.87% per annum, where the Default fund is the same or less than the equivalent non-default balanced fund.

Why are the fees different if the risk profile settings and investment objectives are supposedly both ‘balanced’?

Source Research IP, fund manager disclosures, May 2022

One reason for the difference in fees is the school of thought that a Default fund is a ‘loss leader’ within a fund manager’s KiwiSaver offering, especially given the competition for FUM in the growing KiwiSaver space. The Ministry of Business, Innovation & Employment referred to ‘reputational benefits’ in their August 2019 discussion paper

“While we accept that fees are only one component of a value‐for‐money service, we want to see reductions in fees for default funds as a result of this review and subsequent procurement process. Default providers get a steady stream of new customers and reputational benefits as a result of being a default provider. Given these benefits, the government expects that providers will offer more competitive fees in order to enhance outcomes for members.”

Active fund managers in the market looking to apply for ‘default status’ were always going to be challenged.

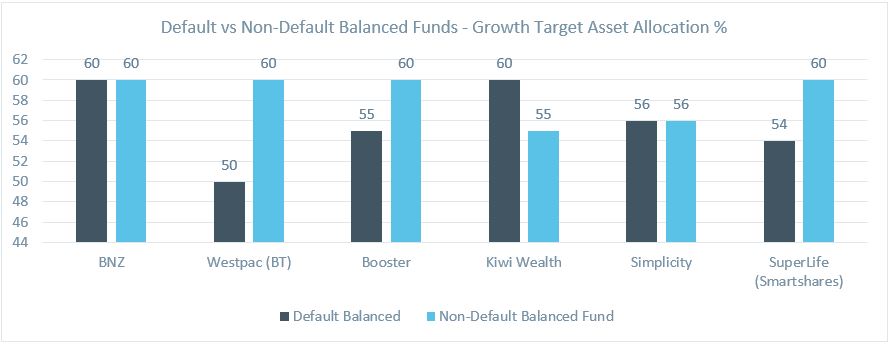

So what assets do these fees give you access to? The graph below shows the difference in growth target asset allocations between the Default and non-default balanced funds.

Source Research IP, fund manager disclosures, May 2022

A key observation is that the Default funds have the same or less growth assets than the non-default balanced funds. The exception being Kiwi Wealth which makes use of allowable asset allocation ranges in the non-Default fund to invest into ‘Other’ assets explained below. ‘Growth’ assets are typically more expensive than ‘defensive’ assets, so this is one way to bring down the price point of the Default funds. The management of growth assets can be more time intensive and harder to access, so this could be another reason why the fees for Default funds are comparatively lower than the non-default funds.

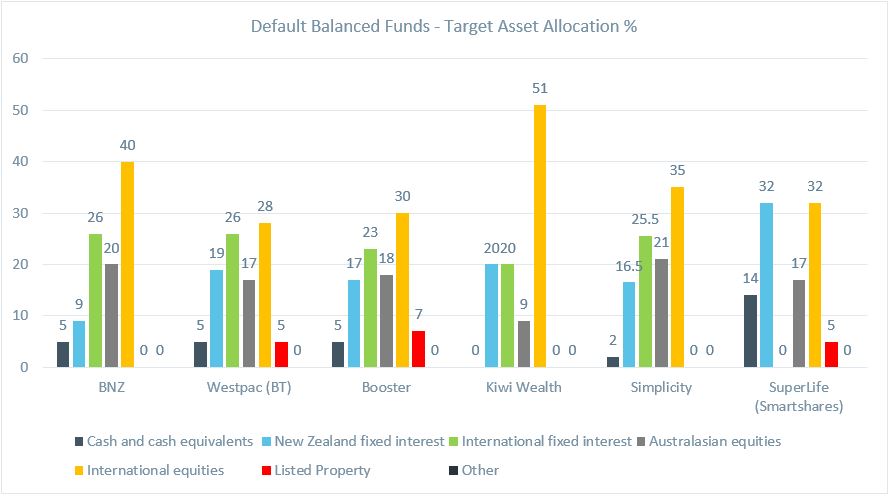

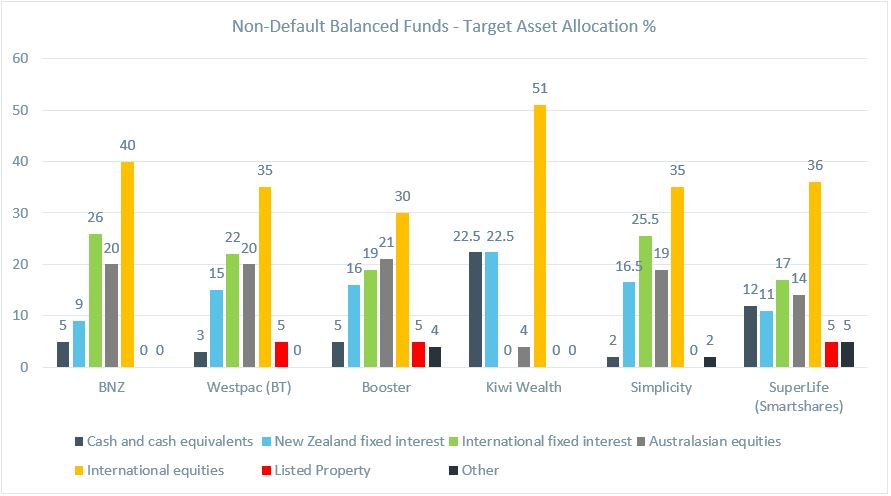

So what are the non-default funds investing in that the Default funds aren’t? The following graphs show the types of income and growth assets that the fund managers target.

Source Research IP, fund manager disclosures, May 2022

Source Research IP, fund manager disclosures, May 2022. Note: Kiwi Wealth don't specify targets, so the benchmark index weightings have been used

A couple of key observations are that the non-Default balanced funds invest the same or more into (a) international equities, and (b) ‘other’ assets. What does ‘other’ mean? These assets can be broadly categorised as ‘alternative’ assets, which in this case means unlisted property (Booster, Simplicity), core infrastructure (Smartshares) or absolute return funds and commodities (Kiwi Wealth). Again, alternatives are typically more expensive asset classes to access. Alternative assets offer a different risk/return profile compared to traditional asset classes such as cash/bonds/equities, i.e. alternatives are typically used to provide diversification benefits to an investment portfolio.

Diversification is the only free lunch in investing…in theory. In practice:

TINSTAAFL – “there is no such thing as a free lunch”

Diversification is often presented as an oversimplified concept. A snapshot of assets may seem diversified but taking a deeper dive at the “risk factor” level may find overlapping factor exposures that are themselves correlated. Correlations can be heightened in periods of extreme stress or uncertainty. It pays to look further than a simple asset allocation overview of a fund. Make sure any alternatives in the fund are more lowly correlated to the rest of the portfolio, ideally in times of extreme stress. This should be conducted from a whole of portfolio perspective, that is all investments, be they KiwiSaver or retail investment holdings. At Research IP we often identify inconsistencies when a whole of portfolio review is completed. Understanding the purpose of the components of your total investment holdings is important and can help guide future decisions and investments.

Gaining access to different types of assets evidently costs more, or providers are choosing to charge more. Time will tell how these funds perform, but what criteria can you use in the meantime to make an assessment of the funds on a forward-looking basis?

How were the Default providers chosen?

There are a number of notable omissions in the new list of Default providers. Some declined to participate, others chose to hold their ground on what they believed was a fair price. There is also a notable bias to passive managers and passive investment approaches for the Default funds. We have been quoted previously that they might be cheap but you need to be careful what you wish for - in simple terms passive equity funds are just cap weighted momentum strategies and passive bond strategies just allocate more capital to the larger issuers of debt.

The review of default KiwiSaver providers in 2014 and 2021 used the following weighted criteria to decide which fund managers should ‘enhance the financial well-being of default members’:

| Weighted Criteria in 2014 | Weighted Criteria in 2021 | ||

| 30% | Fees | 60% | Fees |

| 15% | Investment capability | 14% | Provision of default investment product |

| 15% | Organisation background | 14% | Member experience |

| 15% | Organisational capability | 6% | Transition |

| 15% | Administration capability | 6% | Organisational structure and financial standing |

| 10% | Member education | ||

Two key observations, (1) less focus on capability in 2021 compared to 2014, and (2) the major increase in weighting to fees between 2014 and 2021. Research IP believes the weighted criteria in 2021 was seriously imbalanced. What other criteria can you use to make an assessment of the funds?

When choosing a KiwiSaver fund, you certainly want a forward-looking assessment. You want independent information, not simply a fund manager’s spin. For most people, unfortunately the easiest, and often the only, way to assess a fund manager is to look at fees and past performance. This is relevant but absolutely not the whole picture.

The Research IP rating is a forward-looking tool that shows the degree of confidence Research IP has that a manager can achieve the fund’s stated objective. The overall weighted average score in the table below translates to the “IP” rating, with “5 IP’s” being the top rating. The higher the score, the greater confidence Research IP has in the manager’s ability to achieve the Fund’s stated objective over a full market cycle (i.e. seven plus years). An investor should not view this score as being reflective of short term, i.e. less than three year performance. Research IP does not warrant a manager’s or fund’s performance.

The qualitative rating of a fund is a function of the Research IP Factor Weighting process, which is built around the six qualitative research categories outlined in the table and explained further below:

| Research Process Category | Model Factor Weight | Analyst Average Score | Maximum Factor Score |

| Corporate & Investment Governance | 15% | x.xx | / 5 |

| Investment Philosophy & Process | 20% | x.xx | / 5 |

| People | 25% | x.xx | / 5 |

| Portfolio Construction & Implementation | 15% | x.xx | / 5 |

| Risk Management | 15% | x.xx | / 5 |

| Investment Fees | 10% | x.xx | / 5 |

| Overall Average Score | x.xx | / 5 |

1. Corporate & Investment Governance – for example, alignment with parent company (if applicable), tax structures, strength of finance structure and capital funding, management and portfolio manager performance incentives and fee structures, competitors, and resourcing support.

2. Investment Philosophy & Process – for example, investment beliefs, consideration of environmental, social and governance (ESG) factors, research methods and tools, targets and goals within portfolio management, tactical and strategic asset allocation, and external manager selection, monitoring and engagement.

3. People – for example, capability and stability of the team, experience of portfolio managers, what they are responsible for and who makes the decisions, composition of independent directors, trustee reports, level of disclosure, mandates, frequency of compliance meetings and details relating to the Investment Committee.

4. Portfolio Construction & Implementation – for example, consistency with the philosophy, underlying factors, construction process, asset allocation, ESG, appropriateness of benchmark, tracking errors and transaction costs.

5. Risk Management – for example, tools and resources, systems and controls, quality and consistency of decision-making framework, capacity constraints, and portfolio risk controls.

6. Investment Fees – these are assessed on a relative basis in line with the relevant peer group of the fund. Research IP consider the fees holistically at the product level.

To see the output of the Research IP Factor Weighting process, the latest qualitative research reports are available here.

Keen to see more research on KiwiSaver Funds? Request research here.

Price is what you pay, value is what you get

Ultimately, an investor needs to be aware of what they are investing in, caveat emptor – ‘let the buyer beware’. Like any consumer product, the consumer should undertake the appropriate due diligence to decide which KiwiSaver fund is most suitable for them. The fund manager has more information about the quality of the investment product than the consumer. Research IP aims to help lessen this difference in favour of the consumer, and help financial advisers provide a valuable service to their clients over the long term.

Is this more about marketing for FUM and flow, where managers have found ways to structure cheaper product i.e. less growth assets, less alternatives, more passive investment approaches, less diversity?

We recommend having a closer look at what each manager is choosing to do in their (non-Default) Balanced Fund, why do they have their other option?

5 Comments

Tl;dr - look to post-fees returns by fund over time as guidance / how the investment entities are staffed and governed (i.e. reputation of fund managers and the board) before deciding where to chuck your ducats, rather than sweating fees.

Discuss.

Easier said than done of course! 'Reputation' shouldn't be relied on too much though. Slightly off topic example, but investors in Theranos could attest to this with the Board consisting of several notable figures from the worlds of government and business e.g. George Schultz, Henry Kissinger...

Those creatures were also notorious carpet-baggers and grifters who took the lazy money.

I wouldn't trust anything Kissiger shilled for!

Great argument, clearly articulated and well presented. I appreciate the time taken to write this. Well done!

I have been puzzling for sometime why the same provider charges higher fees for the “ same” non default version i.e. the flip side of your question. I need to read your article again as it is complex but very interesting.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.