The word ‘volatility’ has been mentioned a lot over the last couple of years. If you were chatting to friends or family about financial markets recently, the conversation probably included plenty of talk of ‘volatility’. One term that probably wasn't mentioned was sequencing risk. Combining volatility and sequencing risk can lead to unfavourable outcomes for investors.

Sequencing risk, or "sequence of returns risk", refers to the potential impact of the order in which returns are received on the overall performance of an investment portfolio. When markets fluctuate more widely, the timing and order of returns are of more concern, particularly for investors that have liquidity needs from their portfolios.

Since the GFC, where the compression of interest rates persisted and asset prices rocketed upwards, sequencing risk was less of a concern because investment portfolios kept growing. However, the market environment at present is a very different story. When markets fluctuate both positively and negatively, sequencing risk is higher.

Investors need to consider the likelihood of drawdowns and what their risk tolerance is. Market movements are exacerbated by higher interest rates as there is more pressure on valuations, especially those businesses with higher levels of debt and longer-dated revenue streams.

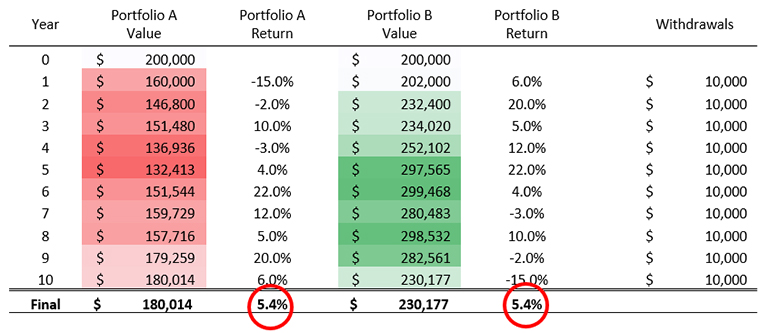

For investment portfolios the mathematics is straightforward. Take the example in the table below where two portfolios start with $200,000 and withdraw $10,000 at the end of each successive year, over a period of 10 years. Portfolio A incurs two negative years of returns early on, whilst Portfolio B has a string of positive years before the returns sour towards the end of the 10-year time horizon. Both portfolios have an overall compound return of 5.4% per annum.

A portfolio that fluctuates in value more widely means the specific timing of withdrawals is critical. It makes it harder to buy and sell investments. The timing of redemptions to meet client goals can cause significant differences in the final value of the investment portfolio.

There are several ways to help mitigate sequencing risk when constructing portfolios. A portfolio that smooths the return and takes a lower risk approach is supreme. Diversification is key, though this is easier said than done. A well-diversified portfolio going forward will not be the same as it has been in the past, tighter liquidity conditions will cause asset prices to deviate. Asset return expectations need to be scrutinised carefully. A portfolio that focuses on managing risk, rather than avoiding risk, will be important in building and preserving capital, especially if market sell offs are larger and more frequent.

Secondly, different rebalancing strategies should be considered. Investors need to consider the performance consequences of how different strategies will behave in various markets i.e. up, down, and flat markets. Maintaining a client’s portfolio against their goals requires ongoing vigilance.

Thirdly, effective governance will be critical. Regular reviews should be undertaken to ensure the portfolio aligns with the investor’s risk tolerance and objectives. Re-assess the appropriate investment time horizon, focus on known cash flows but also consider unknown cash flows. An awareness of behavioural biases is important to ensure poor investment decisions aren’t made.

Any decisions now will have an impact on the portfolio in 10, 20, or 30 years from now. Each investor is unique. The investment portfolio should be constructed to suit the investor as much as possible. The robustness of investor portfolios should be evaluated with the change in the market paradigm.

Access to the RIPPL Effect reports is here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.