The Australian financial year ends on 30 June. Perhaps surprisingly given the geopolitical turmoil, the year to 30 June 2025 proved another rewarding one for Australian share market investors.

The S&P/ASX 200 is the index most often used as the benchmark for the Australian equity market. It is made up of the 200 largest stocks listed on the Australian stock exchange.

In the latest financial year, the ASX 200 climbed 10%. That compares with rises of 7.8% in the 2024 financial year and 9.6% in the 2023 financial year. The last time the index had an annual decline was in the 2022 financial year.

As well as a rise in value of 10% in the latest year, the ASX 200 produced a dividend yield in excess of 3%. Add to that the ‘franking’ (or imputation) credits attached to many dividends, and 2025 represents an above-average year for investors.

A 13% plus return also looks good at a time when the inflation rate sits below 2.5%.

The wider All Ordinaries index comprising the largest 500 listed Australian companies achieved a similar result. It now has a market capitalisation well over A$3 trillion.

The benefit of high returns from the domestic Australian share market are widely enjoyed thanks to the country’s compulsory superannuation system. Most adult Australians have an indirect interest in the market via their super fund. Australian listed shares represent at least 25%, and often more, of the investments of most ‘balanced’ super funds.

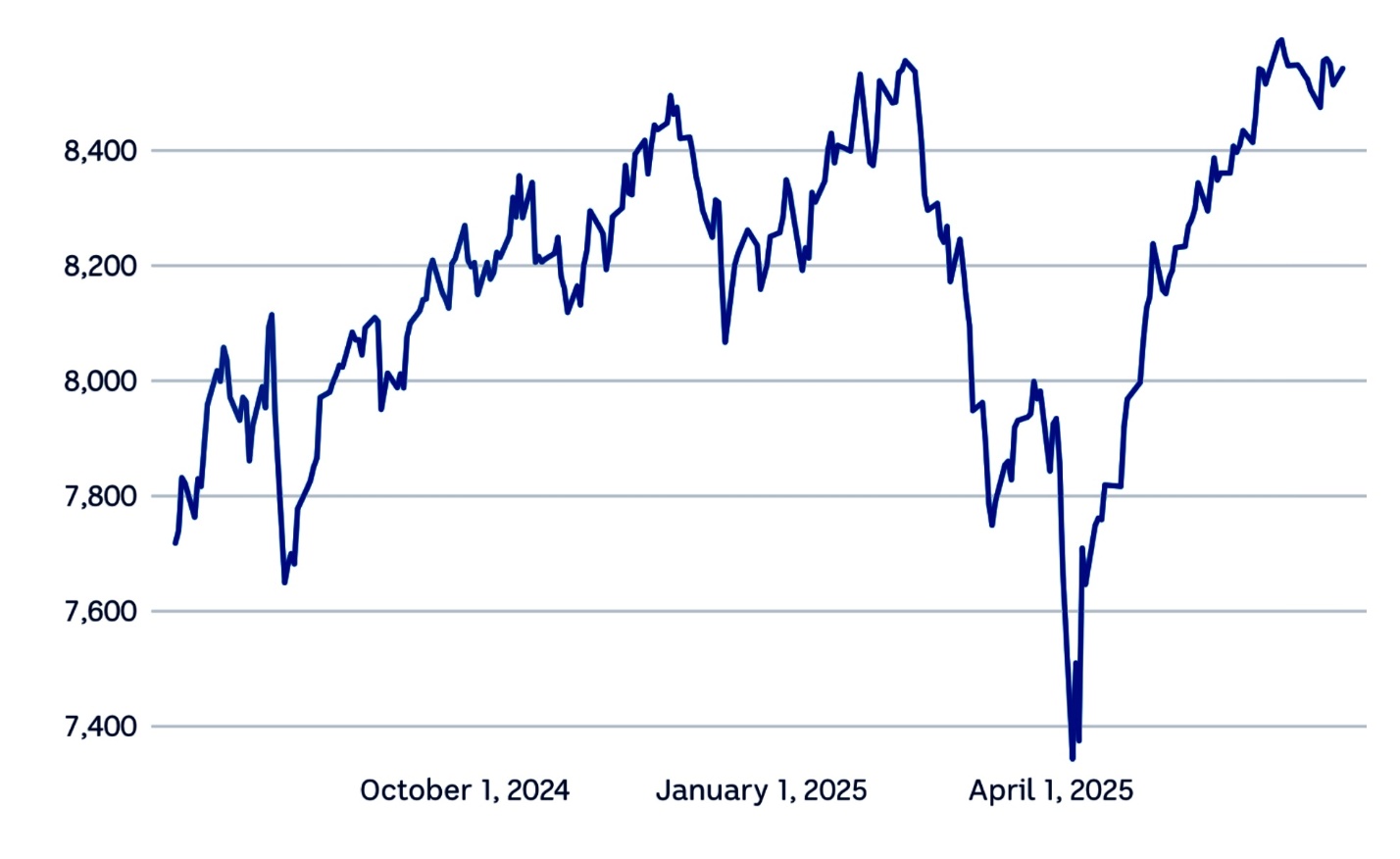

The path to this year’s share market gains was far from smooth as illustrated by the following graph.

S&P/ASX 200 index for the 12 months ended 30 June 2025

Source: ABC

In just seven weeks, from mid-February till the first week in April, the ASX 200 slumped around 14%. Two and a half months later it had completely recovered. No doubt fortunes were made and lost during that remarkable market convulsion.

Like so many things these days, the presidency of Donald Trump was the major factor in the market’s volatility. His tariff wars in particular create the type of uncertainty markets hate. Many of his prime targets are some of the biggest importers of Australia’s minerals and mining is the second largest sector in the ASX 200. It includes giants like BHP and Rio Tinto.

Much of the share market’s recovery from its April lows was attributable to the so-called TACO factor – ‘Trump always chickens out’. The view was quickly formed that many of his early, seemingly disastrous, announcements on trade were just part of Trump’s negotiating tactics and might never come to pass. Time will tell.

A significant driver of the share market’s success in the 2025 financial year was the decline in inflation and its impact on the Reserve Bank of Australia’s interest rate policy. After keeping the cash rate at 4.35% since November 2023, the RBA finally cut the rate in February, and then again in May. Market expectations are for three more rate cuts this year.

One Australian company was a standout in FY2025 – the Commonwealth Bank of Australia. Its gain of more than 45% over the year was a major contributor to the 10% rise in the ASX 200. The next two biggest contributors were Westpac Bank and Wesfarmers (a diversified conglomerate that includes Bunnings and the Kmart group).

The single largest drag on the index was CSL, the global biotechnology company. It dropped over 12% during the year.

As of 30 June, the ten listed Australian companies with the highest market capitalisations were as follows:

| AU$ bln | ||

| 1. Commonwealth Bank of Australia | 309 | |

| 2. BHP Group | 187 | |

| 3. National Australia Bank | 120 | |

| 4. CSL | 116 | |

| 5. Westpac Bank | 116 | |

| 6. Wesfarmers | 96 | |

| 7. ANZ Group | 87 | |

| 8. Macquarie Group | 87 | |

| 9. Goodman Group | 70 | |

| 10. Telstra | 66 | |

It’s interesting that five of the most valuable eight companies are banks. That dominance is not seen in most share markets. The Australian market is very light on industrial and manufacturing groups compared to many other developed countries.

Among the most significant events in FY25 was the effective backdoor listing of the Chemist Warehouse. Its merger with Sigma Healthcare created a $32 bln pharmacy behemoth that is currently the 18th most valuable company in the market.

Another notable transaction was the reappearance of Virgin Australia. The airline went into administration in 2020 and was acquired by Bain Capital. It was re-listed last month via an IPO that raised $685m. Its current market capitalisation is around $2.4 bln.

The 2025 financial year ended with the emergence of a potential takeover of Santos, one of Australia’s largest oil and gas companies. A consortium of the Abu Dhabi National Oil Company and the Carlyle group, a US private equity player, has launched a $36 bln bid for Santos. However, volatility in the price of oil combined with a host of regulatory hurdles mean that the bid’s success is far from certain.

Going forward, volatility is likely to be a key feature of the Australian share market generally. As always, movements in exchange rates, commodity prices, interest rates, and international equity markets will play a role in determining the direction of the market in the current financial year.

But war in the Middle East and Ukraine, Trump’s ongoing tariff negotiations with both Australia and its key trading partners, and other events yet to be revealed – the ‘unknown unknowns’ – will add further uncertainty.

One thing is certain. Few investors will be disappointed if the Australian market repeats its FY25 performance.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

2 Comments

The S&P/ASX 200 index is highly concentrated in its largest companies with the top 10 stocks making up approx 47-49% of the entire index by market cap. For comparison, the top 10 stocks in the US S&P 500 index account for about 35%.

In terms of performance, you'd be far better better off just owning CBA given its relevance to the Ponzi and the Aussie ruling elite's commitment to ensuring its vitality.

CBA - P12M- +40%; P5Y - +149%

We saw the top few hold the majority of gains in the S&P500 before things started southward, and with Oz being 2-3 years behind NZ on the housing market boom and downturn, they have some challenging times ahead. It'll be interesting to see how this impacts their share market.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.