Table 1: Gold posted solid gains across all major currencies in August

Analysis by the World Gold Council.

A strong rally into month-end saw gold reach US$3,429/oz (+4%), and as of the end of August, gold was up 31% for the year. Gold gained in all major currencies, despite a much weaker US dollar (Table 1). And the positive momentum has carried on in early September.

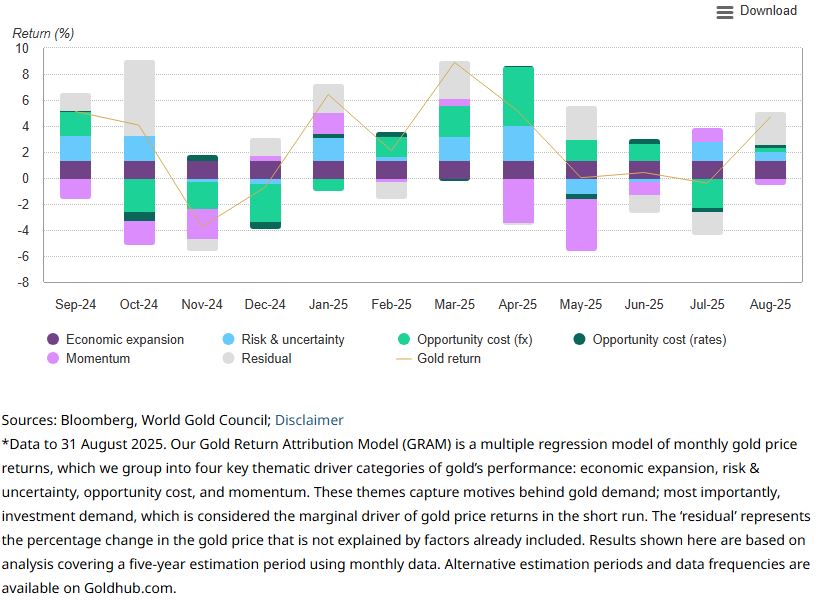

Our Gold Return Attribution Model (GRAM) suggests major contributors to August price performance were a drop in the US dollar early in the month, continued geopolitical tensions, and strong global gold ETF flows (Chart 1). More recently, a higher chance of a September rate cut has also played a role.

Gold ETF flows provided plenty of support, especially late in the month, posting US$5.5bn (53t) of inflows, dominated by North America (US$4.1bn) and Europe (US$1.9bn), while Asia and other regions saw outflows. COMEX managed money net longs saw more restrained inflows of US$2bn (+16t).

Chart 1: A US dollar reversal, broad gold ETF gains and Trump-Fed tensions helped drive gold close to ATH in August

Gold price and performance in key currencies*

| USD (oz) |

EUR (oz) |

JPY (g) |

CAD (oz) |

INR (10g) |

RMB (g) |

AUD (oz) |

|

| August price* | 3,429 | 2,934 | 16,212 | 4,712 | 101,967 | 782 | 5,234 |

| August return* | 3.9% | 1.6% | 1.4% | 3.1% | 4.0% | 2.0% | 2.2% |

| Y-t-d return* | 31.4% | 16.4% | 22.8% | 25.5% | 34.3% | 26.9% | 24.3% |

| Record high price* | 3,435 | 3,006 | 16,079 | 4,743 | 100,130 | 830 | 5,393 |

| Record high date* | 13-Jun-25 | 22-Apr-25 | 23-Jul-25 | 22-Apr-25 | 23-Jul-25 | 22-Apr-25 | 22-Apr-25 |

*As of 31 August 2025. Based on the LBMA Gold Price PM in USD, expressed in local currencies, except for India and China where the MCX Gold Price PM and Shanghai Gold Benchmark PM are used, respectively.

Source: Bloomberg, World Gold Council

Stubborn stagflation

- US real rates may become more influential for gold in the near term as US investors grab the baton from emerging markets, and that influence could increase if rates were to fall

- So far rates have been sticky, but that is more reflective of a growing unease about stagflation

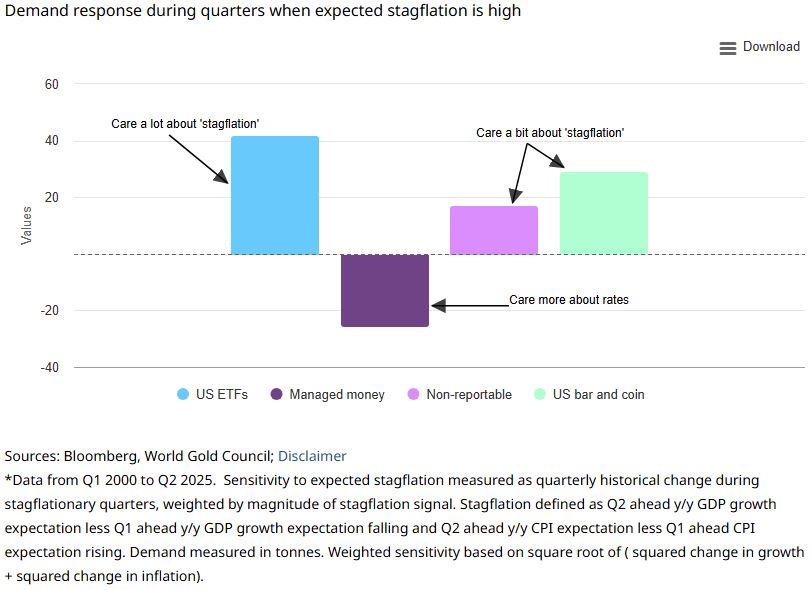

- Our quantitative analysis of various US investor types suggests that stagflation is of greatest concern to ETF investors, followed by retail bar and coin buyers. Fast money futures investors are more concerned with rate trajectory.

Chart 2: US investors grabbing the baton

Passing the baton

The relationship between the price of gold and its core drivers shifts over time, sometimes reflecting who is most active in the market.

For example, US real interest rates (opportunity cost) were tightly linked to movements in gold between 2007 and 2022. Last month we suggested that one reason for gold’s decoupling from rates post 2022 was the preponderance of emerging market demand from central banks and other investors, rather than a breakdown in US investor relationship with rates.

Now that central banks and Asian investors have stepped back a bit, as indicated by our Gold Demand Trends data, local premia and intraday session returns (Chart 2), a tighter gold-rates relationship could re-establish itself and Western investors (particularly the US) could become more dominant in driving short-term returns.

Should rates across the curve start to drop, a ramp up in gold buying could be triggered in the US. But we’re not seeing that quite yet. In fact, the curve is steepening as the short end drops on Fed cut hopes, but the long end remains high on risk premia and future inflation concerns (Chart 3).

Chart 3: Between a rock and a hard place

The sticky long end might hinder some rates-driven interest in gold. However, a rise in inflation that is concurrent with a slowdown in economic activity1 and weakening labour markets, signals we are increasingly flirting with a stagflationary environment. And this tends to favour gold. But which investors are most sensitive to such an environment?

What’s your flavour?

Our analysis suggests that ETF investors are the most sensitive to expectations of stagflation – statistically, significantly so (Chart 4). Bar and coin investors are next, although the average response is not statistically significant. On COMEX, non-reportable investors – who are said to be more representative of retail flows – have also responded positively, on average. But ‘fast money’ investors, many of whom are Commodity Trading Advisors (CTAs) appear less enamoured by stagflationary fears.

This is possibly because they are more focused on interest rates – as we surmised last month. And, for CTAs, technical factors arguably play a role too. In other words, stagflation threatens higher rates, not lower as we are seeing at the moment, and fast money investors are perhaps less willing to participate until those start to soften.

Chart 4: What’s your flavour? Investors’ estimated sensitivity to stagflationary pressure

In summary

Gold’s sensitivity to US real interest rates may increase as Western investors, particularly in the US, take a more active role amid softer demand from emerging markets.

While rates in the long end remain sticky, this reflects growing stagflation concerns – an environment that has historically supported gold. Among US investor segments, ETF holders show the strongest response to stagflation risks and have picked up their pace of investment over the last few weeks, not just in the US but in Europe too – where real rates are still rising – suggesting risk drivers are offsetting rates-based drivers.

Futures traders appear more focused on rate dynamics. As the yield curve steepens (driven by lower front-end rates) and inflation fears persist, the interplay between macroeconomic signals and investor behaviour will be key in shaping gold’s next move.

Footnotes

1US goods trade deficit widens sharply in July | Reuters

This article is a re-post from here.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here.

Comparative pricing

You can find our independent comparative pricing for bullion and coins in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

1 Comments

Linked below is a revealing interview from the former head of 'The Silver Institute' (a somewhat similar organisation to The World Gold Council who wrote the above article). The Silver Institute doesn't normally make rash statements. In $US the silver price has increased 41% since the start of the year. Get the kids/grand-kids some silver?

A silver price shock is coming. In this exclusive interview, former Chairman of The Silver Institute Phil Baker warns Kitco's Jeremy Szafron that "insatiable" physical demand is creating a historic supply deficit that could lead to a violent repricing of the metal. The former CEO of Hecla Mining reveals why the current silver rally is fundamentally different from the "fake-outs" that frustrated investors in 2011 and 2020. Baker provides an on-the-ground report from his recent trip to the Perth Mint, where he was told physical demand has "exploded". He also reveals a fascinating sociological shift: heirs are no longer selling their inherited silver, creating a "long-term generational sort of asset" that is permanently tightening the market. Why does he believe the silver price will go "significantly higher than $50" and that an "$80 silver" price is "certainly possible"? Watch now to find out.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.