Each KiwiSaver scheme has its own particular way of charging for its services, and it can be confusing comparing and navigating your way though these fees.

Almost all schemes charge a fixed membership fee, plus an investment management fee which pays for the 'expertise' of the investment manager. The more volatile the asset class invested in, or the more active the investment management, the higher the investment management fee. In a number of cases additional performance-based fees are also be charged if performance exceeds some specified benchmark.

Other types of common fees include trustee fees and administration fees. You can find a full breakdown of fees in each fund's profile. And all funds also charge for expenses specific to the fund - things like the audit fee. These can vary significantly.

In other countries, investment vehicles are required to publish a 'management expense ratio' (usually known as the MER) which captures the total fee and expense burden on the fund. There is no such requirement currently in New Zealand for KiwiSaver funds to publish their MER.

However, we are calculating something very similar, an overall Expense Ratio using the fees and charges listed in the investment statement and the expenses from the scheme's latest annual report. Using the Expense Ratio and knowing what is included in the fund-reported returns enables us to re-calculate the fund-reported returns so they are on a consistent, comparable basis. Click here for how we calculate performance.

Our Expense Ratio includes the fixed dollar 'membership' fee that almost all funds charges. Although only averaging around $35 a year, that is equivalent to a fee of more than 0.5% for an average KiwiSaver balance of $6,600 - and this was the actual average as at September 2010. We have included this fee on the basis of a $10,000 balance.

Future investment performance is never certain, so it makes sense to take a close look at fees. You can get a feel for how much fees can eat away at investment returns by playing with this calculator.

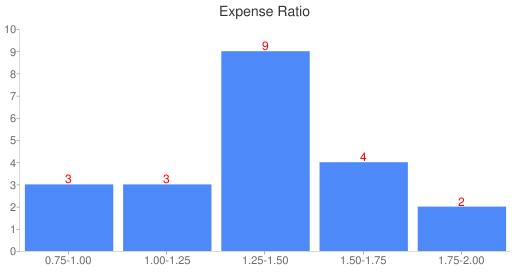

To see how a fund stacks up in comparison to others of the same type (see here for some words on fund types), we have provided a chart at the top of each fund type table. Here is the one for moderate funds.

So you can see that the Expense Ratio varies from between 0.75%-1% per annum to 1.75%-2.00% with the bulk in the 1.25%-1.50% range.

1 Comments

Try out slope unblocked if you like fast-paced platform games. Control the ball as it smashes through the 3D course, collecting diamonds along the way and staying out of the deep.