By John Walley

By John Walley

Reserve Bank Governor Dr. Alan Bollard this week stated that he is essentially powerless to stop the rise of the New Zealand dollar. This makes one wonder how other small countries have manged to exercise more control over their exchange rate, rather than being battered by the choices of policy makers elsewhere and carry trade arbitrage.

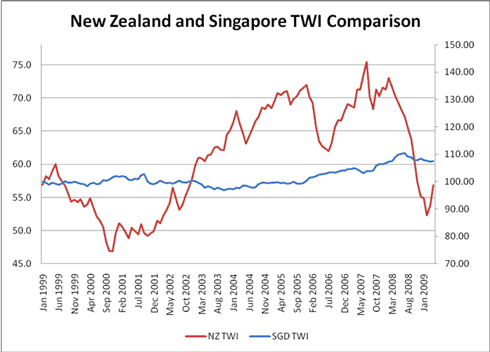

Bollard is indeed powerless under our current monetary policy framework, but this stems from the choices inherent in that framework and it need not be the case. Singapore is a classic case where the Government has decided that a stable currency is a key forerunner to economic growth and have acted accordingly:

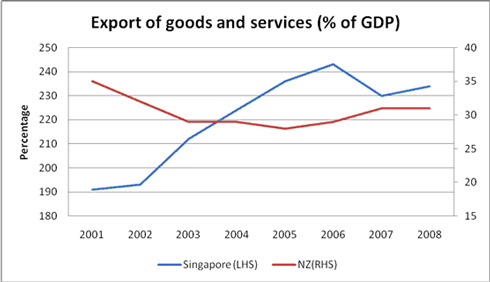

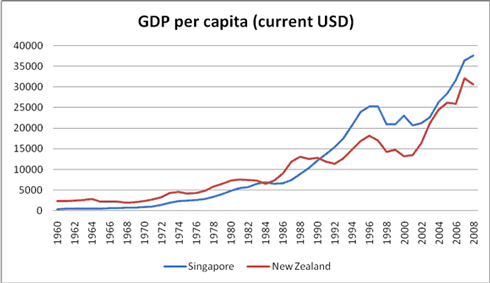

Having decided that the Singaporean export sector is critical to real growth in Singapore, their policy alignment has delivered external stability. The impact on the growth of the Singaporean economy has been significant:

Having decided that the Singaporean export sector is critical to real growth in Singapore, their policy alignment has delivered external stability. The impact on the growth of the Singaporean economy has been significant:

One obvious flaw in the "˜do what Singapore does' argument is that New Zealand does not have the foreign reserves needed to carry out such a policy "“ neither did Singapore when they started; vision and leadership come first.

One obvious flaw in the "˜do what Singapore does' argument is that New Zealand does not have the foreign reserves needed to carry out such a policy "“ neither did Singapore when they started; vision and leadership come first.

There are other policy options, such as a variable compulsory saving scheme, that New Zealand could implement. Also, printing and then selling New Zealand dollars as the United States and the United Kingdom have done is one way to build up reserves. An overvalued currency and a repeat of the political inaction we saw in the last currency cycle will push any hope of a sustainable recovery further away.

____________

* John Walley is the CEO of the New Zealand Manufacturers and Exporters Association.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.