Here's my top 10 links from around the Internet for the last couple of days at 10 am. I welcome your thoughts and suggestions for other links in the comments below.

1. Here's yet more evidence to say long term interest rates are rising globally. Despite the heavy buying of US Treasury bonds by the US Federal Reserve, long term bond yields are rising because bond investors expect all this money printing to be inflationary, says John M Mason over at Seeking Alpha. Here's our charts of US Treasury yields.

2. The stress test results are becoming a tad stressful. Citigroup is disputing the results, which apparently suggest that Citigroup needs to raise US$10 billion in fresh capital, the WSJ.com reports

3. Tyler Durden at ZeroHedge has an excellently sceptical view of how the banks are trying to delay the release of the results and renegotiate the way the stress tests were done. Sheesh.

4. And lo and behold, the release of the stress tests was delayed until later this week, Bloomberg reported.

5. Three more US banks closed over the weekend and now the US Deposit Insurance Fund has just US$19 billion of assets backing US$6.4 trillion of assets, Rolfe Winkler at Option Armageddon points out.

6. The bankruptcy of Chrysler looks like it's turning septic. Parts suppliers have stopped sending parts to the factories, forcing them to close. Dealers are in shock and contesting the idea of General Motors' financing arm (GMAC) providing cheap loans, the WSJ.com reports.

7. And here's an interesting unintended consequence. Moody's is saying the Chrysler bankruptcy could damage the market for repackaged car loans known as asset backed securities because of a slump in used and new car prices, Research Recap reports.

8. Remember Fortress Credit Corp? It was the vulture fund that lent money to Capital and Merchant, MFS Pacific, Bridgecorp and then Hanover Finance in their dying days, often taking senior positions to debenture holders and extracting their money first. The ultimate parent of Fortress was a US based hedge fund behemoth called Fortress Investment Group that was at the centre of a grotesquely overblown world of ever larger and wealthier fund managers. This in-depth piece from Bethany McLean at Vanity Fair is worth reading, if only to get a sense of how arrogant and corpulent these hedge funds had become. The photo-shopped photos are fabulous. HT Daniel Gross at Slate.

9. Here are some of the latest facts on Chuck Norris, which were spotted by Felix Salmon at Reuters. Here's my favorite. "Only Chuck Norris can issue secured debt. The rest is at his mercy."

10. Here is a cool piece on New Scientist that shows a forecast for the number of Swine Flu cases globally that uses plane tracking software and a dollar bill tracking website (wheresgeorge.com) to predict how widely it will spread. Worth watching. HT CreditWritedowns.

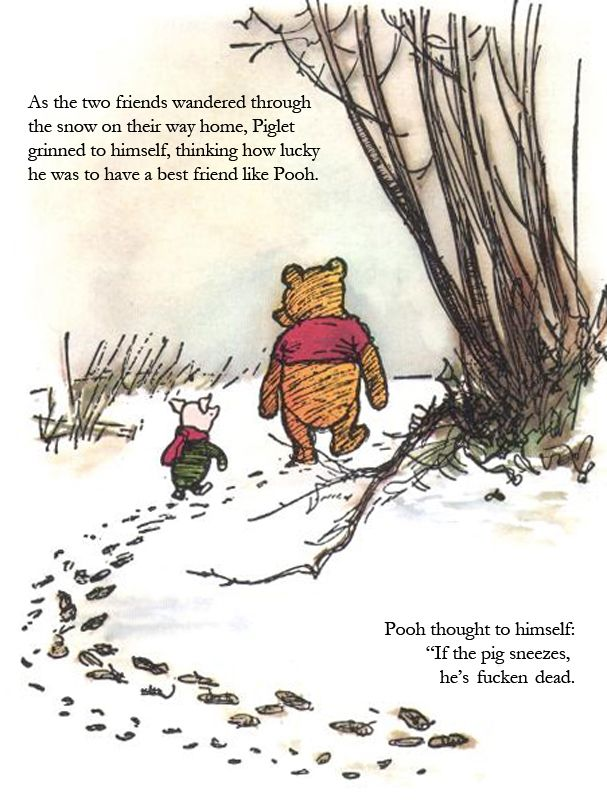

Finally, I'm not sure I'll be able to read Winnie the Pooh to my 7 year old daughter again with a straight face.

HT

HT Barry Ritholz at The Big Picture

HT

HT Barry Ritholz at The Big Picture

Top 10 at 10: Chrysler bankruptcy going septic; Stress tests delayed; Good swine flu news; Behind the Fortress

Top 10 at 10: Chrysler bankruptcy going septic; Stress tests delayed; Good swine flu news; Behind the Fortress

4th May 09, 10:00am

by

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.