By Alex Tarrant

Prime Minister John Key said he understood today's move by ratings agency Standard and Poor's to put New Zealand's credit rating on negative outlook was due to New Zealand's high private indebtedness and S&P's reassessment of risks following the Irish banking crisis.

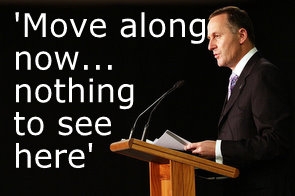

"My understanding there is no new information – in other words nothing new has changed in New Zealand," Key told journalists in Wellington.

"In fact the Finance Minister (Bill English) met with Standard and Poor’s two weeks ago, (and) there were no specific issues raised at that point," he said.

"But what is true is that they are reflecting on our total overall indebtedness, particularly the issue that the government has been talking for some time about, which is our level of private sector indebtedness, and the fact that we rely so heavily on foreign borrowings for that.

"And the recent changes to the Irish situation, and uncertainty in the international financial markets, have, I think, forced Standard and Poor’s to reassess the risks."

'Nothing's changed in NZ, actually we think it's better'

Nothing had changed from the conversation Finance Minister Bill English had with S&P two weeks ago, where the rating agency did not express "any great concern", Key said.

"We can draw no other conclusion than the international environment has changed," he said.

"With the position in Ireland, that has had an impact on their (S&P’s) assessment of countries that have an over-reliance on debt.

"What I will say though is the way it’s been positioned by S&P and other rating agencies to us is, if you’re [public] gross debt to GDP or net debt to GDP is less than 30%, then you are in a small group of countries for which the rating agencies have no concerns in that regard.

That was "absolutely" where New Zealand was positioned, with a very small group of other countries – Korea, Australia and one or two others, Key said.

"If you’re under 60% of GDP then their assessment is it will have some impact on growth, but you’re certainly not their biggest problem children, and if you’re at 100% of GDP, like a number of economies, and some more, then that’s of much greater interest to them," he said

"Nothing that we’ve seen has changed from our point of view, in fact if anything, our position looks stronger from our point of view.

"We accept that we’ve had to take the earthquake on the balance sheet, accept tax revenues have been a little bit weaker this year than we had anticipated, but we expecting it to be stronger in future years," Key said.

Don't know yet what will or won't be in Budget 2011

Asked how austere the 2011 Budget would have to be, given comments from Finance Minister Bill English last week that the government's deficit would be lower than forecast, Key said the government had not yet started the process "of even really trying to formulate what will or won’t be in the budget".

"We’re totally committed to the NZ$1.1 billion new budget spending increase plus or minus the 2% that we have," he said.

"Quite clearly it is important that the government does whatever it can do to restore surpluses as rapidly as practically possible.

"Now that’s always a balancing act between slowing the economy down, but also making sure that we have those surpluses.

"We are not going to be going into election 2011 campaigning on a lolly scramble. If Labour want to do that, they’re welcome to do that. But we won’t be doing that, because we’re committed to a NZ$1.1 billion spend," he said.

Wouldn't it be nice if the word was surplus

Key was questioned about Treasury Secretary John Whitehead’s comments last week that Treasury would like a faster return to government surplus than the 2016 target government had set.

Key said he would like the books to get back to surplus as soon as possible.

"Fundamentally we had, I’ll put it in these terms, a ‘strong balance sheet’ when we went into the global financial crisis, and that put us in good stead. Because from a private sector point of view, we know not only the debt levels were too high, but they were largely offshore financed," Key said.

"So I think when you look at it, we’ve been very committed to making sure that our [government] debt levels stay under 30% of GDP at their highest point, and that as soon as we can start building assets on the balance sheet, we’ll do that,” he said.

"Just looking at the numbers last week that the Finance Minister put out, [the forecast for] slightly lower growth this year [is] probably a reflection of what has been a very weak international position and stickiness for everybody, but equally Treasury are upgrading their growth forecast for 2011 I think to 3.5%.

"Net on net it took us to roughly the same place in about three years," he said.

Sent a message?

Asked whether Whitehead's comments had sent the government a message, Key said government would continue to work on the issue as fast as it could.

"The deficit is always the difference between two very, very large numbers," Key said. "Sometimes they’re a little bit out of your control, like tax revenue when things are going badly, it all compounds on itself, and when it’s going well it does the opposite the other way.

"At the end of the day if we stick at a very modest new budget spending component, and I describe NZ$1.1 billion as that, then over time government spending as a percentage of GDP falls, and we will return to surplus," he said.

'It's the debt,' English says

Meanwhile Finance Minister Bill English released a statement saying the credit rating move highlighted the need to reduce New Zealand’s heavy reliance on foreign debt:

Standard and Poor’s decision to put New Zealand’s foreign currency rating on negative outlook highlights the need to reduce our heavy reliance on foreign debt, Finance Minister Bill English says.

“This is a long-standing problem for New Zealand and has left us vulnerable as a country,” he says. “The Government is taking steps to reduce this external vulnerability and to move the economy towards savings and exports.

“They include the tax changes in the Budget this year and work currently underway with the Savings Working Group. From here, it’s important that our economic programme continues.

“Standard and Poor’s praised the New Zealand Government’s commitment to get back to budget surplus by 2016, and it noted that New Zealand had outperformed most other advanced economies in the past two years.

“However, it said the negative outlook on New Zealand’s AA+ foreign currency rating reflected risks stemming from its widening external imbalances and relatively low levels of national savings.

“As Standard and Poor’s notes, New Zealand’s household liabilities - at about 156 per cent of disposable income - are 50 per cent higher than 10 years ago.

“Banks and the Government, which are borrowing in volatile international financial markets, face higher interest costs on their increasing debt. In the past 10 years alone, New Zealand’s net foreign liabilities have jumped from about $90 billion to more than $160 billion.”

Mr English noted that, despite the negative outlook on its AA+ rating with Standard and Poor’s, New Zealand still enjoys the highest possible Aaa (stable) rating with Moody’s.

(Updates with Key comments on returning to surplus, comments on Budget 2011, Bill English comments).

39 Comments

Bill English comments in

More comments from Key. He thinks NZ is actually in a stronger position than when Bill English met with S&P two weeks ago

"Nothing has changed and we think it is better" - can I get some of what they are taking, nothing will change but i will feel better....

Considering one of the alternatives is the Greatest Depression in 100 years....nothing has changed IS better IMHO.

Notice that the comment is on PRIVATE debt, debt taken on by companies and individuals....who now with the downturn and high exchange rate are struggling....

Over the last decade companies have taken on a silly amount of debt that shows little sign of having been of benefit, stop blaming the Govn for your poor position and fix your own house.

regards

Oh yes the emperor has new clothes as well...

So basically it seems Key is blaming this on Standard and Poors' reassessment of private sector risk following the Irish banking crisis. ie it's got nothing to do with the government's finances....

'Nothing's changed in NZ, actually we think it's better'

In the US they call that a Bushism.

"My understanding there is no new information – in other words nothing new has changed in New Zealand,".....haaarrrhahahaa...a feck what a joke.....wasn't it just hours ago English let it be known the upcoming Treasury report would not be good....something of a fiscal fart.

Mind you Key is being honest...no honest he is...."nothing new has changed in New Zealand"...quite correct....and also the fundamental 'fly in the soup'....even Bollard is on record as saying this fix is going to take longer...a whole friggin lot longer than govt has so far said!

So S and p try to do us a favour and John boy starts popping off at the mouth.

Here's a tip for ya John Boy ...learn to shut your shitmixer once in a while for the benefit of all.

Ok, final update there with Key comments on returning to surplus.

Here's the quote on how the government is expecting its spending as a % of GDP to 'fall':

"At the end of the day if we stick at a very modest new budget spending component, and I describe NZ$1.1 billion as that, then over time government spending as a percentage of GDP falls, and we will return to surplus," he said.

Only works if GDP goes up, but hey.

I'm off for a drink. Evening all.

Cheers

Alex

denninger has some interesting clips, first one Ireland second China

http://market-ticker.org/akcs-www?post=172928

http://market-ticker.org/akcs-www?post=172943 and Mish on Ireland http://globaleconomicanalysis.blogspot.com/2010/11/irish-citizens-sold-… are we going the same way, or will we embrace austerity in Govt spending and return to our export competitiveness, its going to one or the other.Austerity in Gov't spending isn't going to save us - we haven't got the capacity in our police and defence forces, nor in our prisons/courts to maintain order if through austerity you mean pull back on benefits in a time of high unemployment. The police have already all but "given up" on investigating burglery, for example.

We could however get rid of a bunch of quangos.

Where welfare is concerned, we need to immediately switch to a benefit payment system which delivers food via electronic food "cash cards" which cannot be used to purchase alcohol, drugs, tobacco etc - and where rent payments are made directly from Government to the landlord. I can only imagine the reason we have not implemented food "cash cards" has to do with the liquor/tobacco industry being against it - they have far too much influence. But, enough is enough. Crime will only get worse during a period of high commodity inflation... time to act is now to reduce violent crime fuelled by alcohol and drugs.

Exporters are in trouble, just watch farm receipts collapse this summer.

I was thinking ,DOC slash %50, Foreign affairs %50,get rid of Animal health board, Osh, woman's affairs,civil servants and MPs pensions,force councils to cut expenditure, get rid of regional councils etc.. Takes courage but what are the options - Borrow more. How do we pay it back?

I agree with you regards welfare.

Yep, exporters are in trouble but that's a completely different issue to austerity measures. Civil servants don't have a government super/pension plan anymore - the GSF (Government Super Fund) stopped taking new memberships many, many years ago. Further restructuring of local government always carries a signficant upfront cost - witness Auckland - and we've yet to see whether this results in lower expenditure and lower local government taxes. Only way to make any dent there is to legislate for mandatory expenditure reductions - but the question then is what activites would central government relieve them of?

Sure there is plenty in central government that we could cut back on - but one of the biggest ticket items is superannuation - means testing it would be a place to start. Also, they have to close the tax loopholes (e.g. ring fence losses) as a means to replace the revenue they're losing fast on poorer export returns.

And health.... big reform needed there. Just read Gareth Morgan's "Health Cheque" - heaps of opportunity to rationalise healthcare - provincial hospitals are sucking funds out of the main centres ... it's ridiculous. Time we stopped politicising healthcare. A Pharmac model for purchasing/delivering services would be a good start - get rid of the DHBs.

There is so much this Government could be doing. They're too slow and frankly, they look like they haven't a clue.

Increase tax.....it will come, it has to....

regards

steven... the key is whether that's increase regressive taxation (e.g. GST - that's already been done) or progressive taxation (e.g. capital, transaction etc.). I reckon it's highly unlikely the latter will be done because this Government is following the neoliberal prescription to the tee.

The neolib way would suggest the next thing we'll see is reduced benefits, as opposed to increased progressive taxation.

Right on Kate , we should issue foods stamps or electronic food cards not give them money .

We know for example that among the biggest beneficiaries of the benefit payments are KFC , McDonalds and tobacco and liquour companies .

Also, step into the Pokey machine Pub at Clendon Shopping centre at 9.00 am on any weekday and look at all the people who should be at work , are instead on the pokey machines.

It should be exposed, its a national disgrace

You know, it's funny how the "urban growth restrictions: housing bubble" bugaboo crops up AGAIN in the case of Ireland. There was a lot MORE about their policy settings to admire (low tax rates etc) but their policy on land use has still tanked their economy.

Even Aussie is starting to show signs:

http://www.thirdwavegroup.com.au/tidal-report/tidal-report-the-elephant…

I used to admire the RBA because they "got it" about urban planning and housing bubbles.

Now I am disgusted to find that they are just another bunch of hubristic central bankers.

http://www.theaustralian.com.au/business/property/rba-intervened-to-ave…

They STILL THINK THEIR BLOOMING BASE BANK LENDING INTEREST RATE IS "GOD". Keep the supply restrictions on so that new home building doesn't pop the bubble, and leave it to US to micromanage the crisis through OUR omnipotent interest rate tool.

Boy, do I want to write something on this for the "Austrian Economics" sites......!

From the article:

"The bank feared the release of land would cause traffic gridlock, environmental problems and potentially a US-style housing slump."

What right has a bank to be concerned about "traffic gridlock, environmental problems" - obviously just excuses to keep the supply of land down and keep the ponzi scheme afloat!!!!!

And "Melbourne Jumps Its Boundary"

http://www.theage.com.au/business/property/melbourne-jumps-its-boundary…

That's great for commuting distances eh?

They obviously haven't discovered totalitarian "regional" planning yet, eh?

heres goes Portugal

Yes, Portugal’s public debt is manageable at 86pc of GDP - although even that figure is in question. Opposition leader Peder Passos Coelho said over the weekend that the real figure is 122pc, accusing the government of "fictitious" accounting. Be that as it, public debt is not the core problem. Private debt is one of the highest in the world at 239pc (Deutsche Bank data), and the events of the last two years have taught us that private excess lands on the taxpayer one way or another in a crisis. A chunk of this is owed to foreigners, and must be rolled over.

Portuguese banks have been well-behaved. There is no property bubble. But as the IMF points out in its Article IV report, the banks have a "heavy reliance" on external funding, equal to 40pc of total assets. It was a funding crisis that killed Northern Rock, not bad loans.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/81499…

Ireland is in a whole different league from NZ. Both countries have around the same population but NZ (going by the CIA fact book of Debt -External 'total public and private debt owed to nonresidents repayable in internationally accepted currencies) has USD62.5 billion but Ireland has USD2,287 billion.

What did they spend it on? We could have been a 'Pacific Tiger' if we had borrowed and spent that much!

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2…

Alot of it was spent on "sweeteners" to attract overseas industry - stuff of the recent Warner Bros ilk here - tax credits, government handouts etc..

2.2 trillion is a lot of sugar!

The CIA fact book is has lots of interesting stuff.

The next Piig off the rank is Portgual with 11 million people has half a trillion of external debt.

Exporters are in trouble, just watch farm receipts collapse this summer.

Andrew - NZ is currently experiencing record commodity prices (and in NZD terms), and below average interest rates ? NZ exporters on average aren't in trouble, and some are doing very well.

Thanks Grant, I was going to make exactly the same point to Andrew. He is prone to abit of pessimistic hyperbole. Lets try to keep some perspective here.

SS, I had a bad day yesterday, spent it with a couple or R/E agents. Costs, especially rates are out of hand around here. There is a stand off between buyers and sellers most buyers want to see some profits and sellers are thinking of the high prices of the past. Huge numbers of farms 'for sale at a price'

Still think we are in it up to our eye balls. A lot of hill country around here couldn't service a livestock mortgage, let alone pay for fertiliser. I want to see the $ back and costs back and and I dont see that happening together as so many of our inputs are imported.

I am getting record prices but I dont think they are sustainable, also Im back %40 on my stocking so will have to borrow this year at record prices to re-stock. My accountant tells me a lot of his clients with small businesses want to sell as they are finding their profitability dwindling.

I think sheep farming is small fry compared to the elephant in the room, which is dairy farming, its debt and its profitability. Im happy to wait it out but I dont see an answer to our free spending Govt and the high costs of producing here. Maybe Im wrong and we are about to enter a new nirvana but I doubt it. I admit some dairy farmers with low debts and costs are doing well at present making $1000 a cow before drawings, tax and interest but I think the world is becoming awash with milk. Only a 1/3 of the buyers left at Fonterra's auction is a warning.

I look at NZ's debt and I dont see a big enough productive base to support it.

Hi AJ, I suspect a buying opportunity similar to that of the mid/late 80s possible here. I see a sustained lift in product prices, certainly in the short to medium term. All the info im getting from a meat and wool perspective is extremely bullish. Dairy im not as informed on.

That said I agree that there looks to be an increase in people looking to sell and a decrease in buyers that have the ability to raise finance. I was talking to a finance guy last night and he said Westpac and ASB were pulling back hard at the moment. That suggesst your senario of a further correction could be possible. Many will just hold on and ride it out but once an older guy has made the decision to go the motivation to get out becomes quite strong i suspect. So those that have to opportunity to capitalise on a weak market and enjoy the benifits of higher product prices should do well. That combination doesnt occur very often at all.

As for the macro economic stuff I couldnt agree more. The Govt has to start faceing reality and pull its fiscal head in. Bill English is my local MP and he has an annual meeting in the local town before xmas. I am prepareing my questions already!

Hmmmm how did that Irish story go again? http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10626240 Now for plan B?

He doesn't have the mind, and he never had it. He is not under his own steam, because anything which might help his own country will impact his masters.

Time to wake up!!!

I think the point is that NZ like Ireland, like the UK, like the USA, like almost every country in the world, can't read, (it is impossible) to repay public debt. It is never going to happen. Add in private debt and we are all very screwed. It is actually that simple. Talking about austerity, and exports is simply going to make no difference what so ever, other than perhaps mean the interst on the debt can be paid a few months longer. Awesome!

Timber .....

S&P and the other rating agencies have over the past 2 years been proven conclusively to be liars and charlatans. This is a provable fact. They are incapable of assessing risk and have been shown to be in the pay of banks and will say anything required of them in return for moneymuch in the same way as the big four accounting firms have failed in there duty. I understand why we have to keep them on side but we should all acknowledge at the outset that they are crooks . Yet most comments have been attacking other New Zealanders rather than point out what these ratings people really are. They may well have been paid to make this statement about New Zealand, they have been paid in the past to say that subprime morgages were tripple A rated. It maybe in someones interest to pretend to believe them but people actually make there own assessments.

Debt has become a very strange beast. Most people have a very old fashioned view about debt. Don't take on too much . pay it off quickly etc. If you take on debt that means you are spending someone else's money and you have a moral obligation to pay it back. These ideas are completely out of step with the modern notions of debt. Debt today is about perpetual ever increasing debt. Debt that can never be fully paid off, debt that will never go away.

If you loaned someone money at a personal level your first concern would be getting your money back because you lent real money, money that you had and decided to lend to someone. Your second consideration may be interest. For banks the only consideration is interest, or the servicing of the loan. If you pay the loan off then they no longer have the asset. Banks create money when they write the loan and then charge interest on the money they have created.

Debt Today

1. A massive rise in private debt on housing in New Zealand has been used to impoverish the country as a whole , as well as a massive wealth transfer from young to old, poor to rich.

2. Student loan debt. How did we ever get convinced that this was a good idea. Once again it is a wealth transfer from young to old. From New Zealand to foreign interests.

3. Very little debt available to productive enterprises- ignoring debt on farm land

The kind of debt we are talking about today was created at the times the loans were taken out - an asset is created at the banks. they have the money to pay the loan amount only because we have agreed to continue making the payments.

We are beating ourselves up for being sucked into taking on this massive debt, but most countries like us did the same thing. It was a con trick. We are all marks. The gambling joke is something like 'If you don't know which one is the mark at the table then it is probably you'

Ireland is not being bailed out so much as the German and British banks that loaned to Ireland are being bailed out.

Giles S&P may have been proven liars as you put it over the last considerable period but they as a rating agency are not alone in that are they......the ratings industry as a whole over the last ten years has become more of a blend of selected statistics and spin doctorism,while acting more as a mouth-piece for global vehicle drivers, as messenger boys with ever changing battle plans until faced with the big push.....In short you can't put too much stock...faith...reliance...in ratings that are as a routinely sullied to suit agendas of ...Other vested interests.

Having said that ...........the NZD is still well over-valued and in need of correction and in that I'll even take a foul ball.

Christ-stove...you're right!

there was/is plenty of anecdotal evidence which came out after the GFC that showed that the ratings system of all the major players from S&P, Fitch etc were all suspect and essentially in cahoots with the likes of Lehmans ( RIP), Goldmans etc...i actually think if some global entity was to come up with a new, highly- controlled and provable ratings system based on the " new normal" that they would be a useful asset to the fin.mkts.

APN are currently issuing un-rated notes here in NZ ( which i owuldn't touch)...if they were rated would that make any difference under what we're saying..or is the habit so ingrained that we only buy rated bonds because they're supposedly "more secure"?...and ,of course, get a lower rate because ...gee shucks..they're rated ?

Well highlighted Robo..N......I am always amused when the "Market" and banky boy like the message and shout it from the rooftops and equally amused when they don't and quickly go into damage control.....................the absurdity ..?victims of their own spin a workplace accident ..if you will.

Well look at this on the bright side.....at least we can expect a better quality of spin and BS from the overpaid pointy heads in wgtn.

Definitely not time to borrow when rising rates can only be avoided if the govt stops borrowing like now......it just will not happen.

Hopefully if we emerge from this shite, somebody will make bloody sure the banks are no longer able to worm their way so deeply into the economy, that govt worries more about them than the people.

The best thing the peasants can do at this stage is to avoid borrowing...give the banks the bums rush...that will speed up the process of pulling down the stack of cards.....force the govt to act with much needed urgency.

FYI have put up "S&P's negative outlook for NZ shows its rejection of National government's lack of action on savings and foreign debt, Labour's Cunliffe says. Your view?"

http://www.interest.co.nz/news/sps-negative-outlook-nz-shows-its-reject…

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.