Debt

Institute of International Finance debt monitor flags growing leverage in the AI sector, sees momentum for private credit

11th Dec 25, 5:00am

4

Institute of International Finance debt monitor flags growing leverage in the AI sector, sees momentum for private credit

Brian Easton says we should follow the Golden Rule of Fiscal Management and not borrow for consumption in the medium run

10th Nov 25, 8:32am

Brian Easton says we should follow the Golden Rule of Fiscal Management and not borrow for consumption in the medium run

Murray Grimwood says we are headed for a global one-off readjustment of life as we know it that will be of epic proportions - unless we respect basic physical laws

27th Sep 25, 9:00am

81

Murray Grimwood says we are headed for a global one-off readjustment of life as we know it that will be of epic proportions - unless we respect basic physical laws

Brian Easton looks at the options for a Government that's hit its borrowing limit but would still like to spend

8th Jul 25, 8:20am

2

Brian Easton looks at the options for a Government that's hit its borrowing limit but would still like to spend

Brian Easton on why Government borrowing is limited

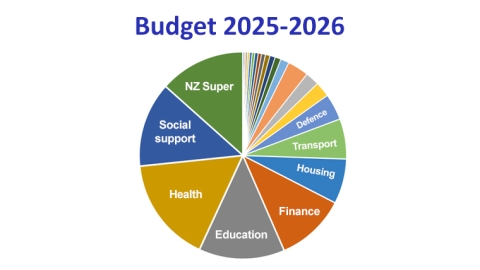

Budget 2025/26 - Summary of all spending plans

24th May 25, 10:56am

Budget 2025/26 - Summary of all spending plans

Institute of International Finance highlights solid growth of ESG-related debt

26th Feb 25, 11:19am

Institute of International Finance highlights solid growth of ESG-related debt

Retirement village operator Ryman says it's taking 'decisive' action to reset its balance sheet and provide the company with the foundations 'to deliver further transformation initiatives'

24th Feb 25, 12:18pm

32

Retirement village operator Ryman says it's taking 'decisive' action to reset its balance sheet and provide the company with the foundations 'to deliver further transformation initiatives'

Rising number of liquidations sees wholesale trade sector, construction and transport hard hit, credit bureau Centrix says

3rd Dec 24, 5:00am

9

Rising number of liquidations sees wholesale trade sector, construction and transport hard hit, credit bureau Centrix says

Company liquidations hit highest monthly level in a decade, Centrix says

[updated]

Statistics New Zealand figures show household net worth dropped by $47 billion in the June quarter, while total income fell for the first time since this data series began in 2016

10th Oct 24, 11:30am

41

Statistics New Zealand figures show household net worth dropped by $47 billion in the June quarter, while total income fell for the first time since this data series began in 2016

ASB economists say they hope that households will base their future decisions 'on a more realistic outlook' for household incomes, house prices and borrowing costs

9th Jul 24, 8:25am

43

ASB economists say they hope that households will base their future decisions 'on a more realistic outlook' for household incomes, house prices and borrowing costs

Statistics New Zealand figures show household net worth increased by $7.8 billion in the March 2024 quarter, even though house and land values dropped by $2 billion

4th Jul 24, 1:11pm

3

Statistics New Zealand figures show household net worth increased by $7.8 billion in the March 2024 quarter, even though house and land values dropped by $2 billion

Murray Grimwood says the future will be so different we need to go back to basics, and with degrowth inevitable it'd be better done voluntarily

15th Jun 24, 9:21am

65

Murray Grimwood says the future will be so different we need to go back to basics, and with degrowth inevitable it'd be better done voluntarily

Centrix reports 5,000 less overdue consumer accounts in April but sees business liquidations and insolvencies surge by 19% and 30% respectively

5th Jun 24, 5:00am

6

Centrix reports 5,000 less overdue consumer accounts in April but sees business liquidations and insolvencies surge by 19% and 30% respectively