By Bernard Hickey

Finance Minister Bill English has revealed a sharp deterioration in the immediate budget outlook and an increase in foreign borrowing because of slower economic growth and higher costs linked to the Christchurch earthquake.

Treasury forecast the budget cash deficit for the current 2010/11 year would rise to NZ$15.6 billion or 7.7% of GDP from NZ$9.0 billion the previous year, before declining to a deficit of NZ$4.9 billion in the 2014/15.

However, the government's operating balance before gains and losses (OBEGAL) is expected to rise to NZ$11.1 billion or 5.5% of GDP in 2010//11 from NZ$6.3 billion in 2009/10.

The Government announced that it had increased the borrowing programme for the current year to NZ$13.5 billion from NZ$12.5 billion and forecast a gross increase in borrowing over the next three years by NZ$10.5 billion from its May 2010 forecast.

This increase in borrowing relates to larger than expected cash deficits over the period of NZ$3.8 billion, NZ$1.2 billion from the Earthquake Commission selling bonds to pay for the Canterbury Earthquake, the pre-funding of an April 2015 bond and a larger increase in the 2013 bond issue of NZ$2.0 billion.

English said the deficit was at the outer boundaries of what the government wanted, but that it was still on track to bring the budget back to surplus by 2015/16.

He said the government could not afford a 'lolly scramble' during election year, but had rejected advice that it needed to introduce interest on student loans and cut pensions.

English said the budget deficit track was at the outer limits of the government's comfort zone, meaning it would struggle to handle another earthquake or recession.

He said reiterated the government's May 2010 committment to reprioritse around NZ$2 billion of spending and to limit new spending initiatives to NZ$1.12 billion.

“In each of the past two Budgets, we have identified about $2 billion of spending and redirected it to higher priority frontline services such as health, education and keeping communities safe. We expect to reprioritise a similar amount of spending in Budget 2011," English said,.

The Government remained committed to rebuilding a fiscal buffer against future shocks by keeping net debt below 40 per cent of gross domestic product and returning it to below 20 per cent by the early 2020s, he said.

Higher peak in net debt

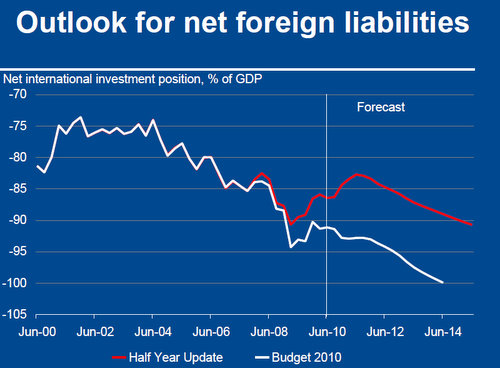

The mid-year budget forecast showed net public debt peaking at 28.5%, rather than the 27.5% forecast in the May 2010 budget. However, the net foreign deficit for the nation is expected to be better than forecast in the budget because of better than expected commodity prices.

Budget 2011 would continue to keep new spending initiatives within a NZ$1.12 billion annual operating allowance and a NZ$1.39 billion capital allowance.

Several important reviews would feed into the Government’s economic programme in 2011, he said. They included reports from the Welfare Working Group and the review of spending on policy advice, along with the Government’s responses to the Housing Shareholders Advisory Group report.

“But unquestionably New Zealand’s most significant economic challenge is increasing national savings and reducing our heavy reliance on borrowing from overseas lenders,” English said,

“This unsustainable imbalance is New Zealand’s biggest vulnerability and it means we pay higher interest rates and our exporters’ returns are squeezed by a higher dollar. The Government can certainly play a role in creating an environment that encourages more saving and less borrowing," he said.

"We have made a start in this area with the tax package in Budget 2010. The Savings Working Group is due to report back next month and the Government will consider its recommendations carefully. I would expect any policy responses in this area to be included in Budget 2011."

“With New Zealanders paying down debt and spending a bit less, economic growth is currently slower than we have seen after previous recessions. But we are building a more solid foundation for sustainable growth in the future."

See the full news conference presentation by Finance Minister Bill English here,.

The full budget policy statement is here.

The full half year economic and fiscal update.

Meanwhile, the government also released its first investment statement. See the full statement here.

Reaction:

Business Roundtable executive director Roger Kerr said a drought or a financial crisis were downside risks for the budget.

The underlying problem is excessive government spending, which risks putting unnecessary pressure on monetary policy and the exchange rate A striking point is that the projected path of core Crown expenses as a share of the economy is higher in each year out to 2014 than in any year under the previous government.

This calls for stronger legislated spending disciplines and a willingness to reexamine major spending programmes. The accompanying Investment Statement also signals the need for the government to reprioritise its asset management and in particular to divest commercial assets that belong in the private sector.

The government has rightly stated that it will not alter commitments it has made on spending programmes and asset sales without seeking an electoral mandate. “In the interest of boosting growth and reducing economic risks, that is a course it should now follow."

See reaction from politicial parties here, including Labour, the Greens, ACT and John Key in this piece titled 'Don't Panic', Key says.

(Updated with more detail, quotes from English, Reaction from Business Roundtable links to full document.)

78 Comments

So that $10.5 billion of public sector borrowing gets added to the private sector mountain. Our gross national debt figure must be heading into a worrying territory for those expected to fund this little lot ~ especially given the talk of no bail-out of European sovereign debt after 2013.

"because of slower economic growth"...crap...it's slower economic activity.....quite a different beast.

Let's do the job for Bill since he seems incapable....how do we cut state spending back to match state revenue?......where are the wasteful departments that can chopped and dropped.....what can be lopped off every other dept....how many tens of millions can be saved by applying a sinking lid to the fatter state salaries....the higher salaries old boys club can go first.

Are we now a South Pacific PIIG?

Piignz.....!

Piignzzzzz in spaaaaaaace.

Bernard, can you dig up a youtube of The Muppets, Pigs in Space for this please?

Here we go. I'm a big muppets fan. This is going in tomorrow's Top 10

http://www.youtube.com/watch?v=cFvZtROeJrE

cheers

Bernard

Effectively we have just gone and borrowed a whole lot more money to have tax cuts, some might call that crazy. It was obvious the spin about how the tax changes were tax neutral, was nothing more than just that - spin.

That is not right, the operation was budget neutral. Unfortunately.

The trouble was the tax cuts weren't neutral in the end. The GST hike didn't have the intended effect because we're all not spending so much...

cheers

Bernard

It's not so bad - could be worse..... Could it ????

Is 7.7% GDP deficit cause for concern or will Pansy Wong feature more in the Tv news tonight ?

Until such time as a land tax becomes a reality - we can expect these budget blowouts with a tax system based on fickle consumers (GST) and rates of employment (income tax)

Based on comments on here by farmers & those in the know, a land tax would more than likely be the straw that broke the camels back for farmers.

So apply the Land Tax according to the number of residential dwelling per site, not acreage? One farm, one house ( or a few workers houses etc). One house in Ponsonby, one house in Ponsonby....

There has got to be some way to make a land tax work. The point is, basing a governments ever increasing expenditures on a tax system that is subject to the whims of the economy (GST and Income) is not a good idea. Never has been.

Because they paid too much for their land.....problem is you dont really start doing redical reforms when things are delicate, which they are right now....so yes a land tax today seems a bit much.....despite what ppl say we dont want to kick off a slide in values and incomes....

"those in the know" hmmm a mask for smug know it alls that actually know diddly but have a vested interest maybe?

Tis simple NZ has to get into a position that the land is productive and not bought for capital gain and in the mean time make a tax loss or do nothing with it...that isnt a business that does NZ any good, we need to cure that mind set IMHO.

regards

The slow down in the economy certainly wont be helping the numbers either. I wonder if they have allowed for "The new normal".

Perhaps the tax take may have been higher had engineering works projects gone to local companies rather than offshore (i.e. the rail wagons & NIWA's vessel Tangaroa refit). It seems they cant look past the lowest price on the tenders, rather than look at the bigger picture.

Sending engineering projects off shore looks like a good topic for further scrutiny, perhaps an article Bernard, and then some robust debat on the sight.

The rail wagons was sent offshore because it couldnt be done here with any guarantee from what i recall....?

....Im sure a business would look at the lowest price, so with a budget constriant a Govn dept......

regards

I am afraid we need to cut govt spending and sell some assets. It is not about tax cuts for the rich that the left go on about. There is too much poorly allocated money in this country. You get rewarded handsomely for doing nothing in NZ.

WFF, funding for quangos (women's affairs etc), tax breaks for property need to go quickly.

Raise retirement age immediately to 67 over 4 years.

We have had enough socialising in NZ, need to get commercial. Social policy in NZ is hurting us more & more each year.

You are right. Unfortunately we need big changes. We are to poor as a country to keep our gold plated welfare system.

Greenies/lefties want all these social scheme's, but dont want the industries that could help fund part of them (i.e. mining). Rather they want to "tax the rich" because how dare they have so much or earn so much. I didn't read the whole post but Cunliff's rant in Alex's Polictico blog but from what I skimmed it shows what an envious little man he really is.

National do not have the balls to attack the gold plated cradle-to-grave welfare state . They know that outraged voters will punish them in the 2011 election if they do so . We've bred several generations of citizens who live on their government hand-outs , or " entitlements " .

WFF is just one of many seriously dopey policies bequeathed to us by Michael Cullen . MED to appease Jim Anderton . Family's Commission to placate Dunne . Interest-free-student loans to bribe the kiddy vote .

If Labour win in 2011 , expect Cunny & Co. to add onto these piles of rubbish . They love it , it buys more voters into their camp .

You are wrong, equally unfortunately.

'Lefties' and 'Greenies', are not the same thing.

Bradford was a leftie, not a greenie.

If you're right, get it right.......... :)

Lefties and Greenies are not the same thing.....try talking to some hard core lefties they are just as anti green polices as the hard right....I used to be in the Green party and left, they to busy being little lefties and too anti business.....there has to be a balance.

In terms of taxing the rich, well looking at the rich that get their bonuses from working for GS etc I'd tax at 90% they dont do any productive work in the real economy....and in fact are stifling businesses....

Mining is being done and can be done profitably and environmentally well...as a society we make those choices....the trade offs....

regards

Coming from a Libertarain I'd expect no less.......

Worse, its simple, you cant be on or get on a "growth path" without cheap oil......it wont be cheap any more and it wont be plentiful...

There is a reason we have our own "pdk" thats our and the World's reality for the next 30 years......sooner it dawns on the Govn and the voter hat their job is to protect our economy as we move to less energy use and to a very different local economy the better.

regards

And the reality, Hugh, is that Key, unlike almost any before him, had the opportunity to go down in our school books as "Our Greatest Prime Minister". Sadly for our contry, he is looking like going down as 'The Man who never was'

It's not even about growth anymore. Just to stop going backwards and to maintain what infrastructure we've got now would be a great start...

Given that there is no such thing as ''a sound growth path", Hugh, that is an ignorant statement.

do some homework.

I suggest physica, as a start, but any of the real sciences will do.

Time to get Roger Douglas back out of the cupboard

He was let out a while back.....he's currently in the corner drooling and giggling....

regards

If Douglas was there we'd probably be in twice as much debt, his main policy is a flat tax rate, so tax revenue would have been cut considerably more.

The guy is a radical, it's no surprise that virtually no countries anywhere adopt his policies.

So .. you have a choice .. get something done by someone who has the balls to do it, and get it done, or continue into the sunset following a media tart

Funny how the difference between the left and right disappears just as quickly as democracy would if they had their way....

You forget ACT got 3% of the vote....say an equal 3% on the left leaves 94% that dont want what either offers....

regards

That must be the biggest defence for John Key: anyone else would be worse.

Yeah right.

Treasury forecast the budget cash deficit for the current 2010/11 year would rise to NZ$15.6 billion or 7.7% of GDP from NZ$9.0 billion the previous year,

A 73% rise in the government deficit over a one year period.

It's only going to get worse. Election year next year, government will just looking for votes and may tackle the problem 2012/2013 but be way to late by then. May as well waste some more money going over the foreshore bill yet again..and again one of many etc etc..form some more committee's to report about nothing. Build a bike track to nothing.

"The US government is now servicing $13.8 trillion (£8.7 trilion) in declared liabilities – making it, by a long way, the world’s largest debtor. Around $414bn of US taxpayers’ money went on sovereign interest payments last year – around 4.5 times the budget of America’s Department of Education."

QUick!!! Everyone join Kiwisaver so the government can monetize the pension fund!!! Trust your government leaders to do the right thing!!!

Government faced with deficit? Borrow more!

People, John Key has no plan. When he has left, we will be as much in debt as his popularity is high. Smoke and mirrors governing. Dumping our debts on the next generation. What a cunning plan.

BdeB - on this one, I agree with you.

Debt, national and private, at this point numerically equates to an environmental overshoot, a debt to habitat.

It's not the fiscal debt that's the problem, that's just numbers. It's the real debt - the depletion, degradation, pollution, chemical alteration, that is the problem.

Did you listen to the Editor of the Fisheries Mag on Nat Radio this morning? "the depletion of fishing stocks worldwide, is forcing boats into waters they're not equipped for".

He's no 'greenie', but what he described is what is happening across the board - there must have been a 'peak fish caught year', we now know that there was a peak oil year, and Keys (our) society runs on it. Look around. What doesn't?

Hughs 'growth path' is unattainable and unsustainable from this point. Neither Key, nor English, nor Cunliffe have a Plan B, and the time to execute one was about 5 years ago.

Better late than never, of course.

Key could throw all our resources at electrifying rail (urban first, main-trunk second) then the urban public transport system, them interfacing them.

It'd be a damn good start.

And sooner or later, cumulative incomes have to reduce, given that reduced energy reduces opportunity. There will be squeals, but it must happen, and better if controlled.

I don't care whether it is done by increased tax, or reduced public-service wages/salaries. I do care if I'm going to be asked to fund private profit too, though.

And the alternative to JK & Wild Bill , Hugh ? .............. Cunliffe wants to add to WFF , to adjust and tweak the seriously dopey vote bribing policies of Cullen . Goofy wants alot more government control over the fiscal levers and the direction of the economy .

We need a new act , to replace ACT ! .............. Before Winnie gets in on the act .

Shy and humble ? C'mon Hugh , us drooling & giggling fools have more fun !

Enlighten me , within the National Party , where does the talent lie , if JK & Wild Bill were to do a Clark & Cullen , and weasel off , with their tails between their legs ?

So why is it Key's fault when Wild bill was the one that came up with a budget that forced us to borrow more?

Isn't Bill the one that's failed? ie - replace Bill.

It was obvious he was in dreamland when he tried to pretend the budget was going to be tax neutral.

I reckon that Wild Bill is being loyal to his PM ........ . I suspect that Bill's greater political experience is telling him that he needs to do more , but that the leader in training is saying " No ! " .

Hugh... Rome wasn't built in a day.... It has taken us 40 yrs to get to this current state.

I reserve my judgement of John Key until after the next election.

looking back over the last 30 yrs.... I'd say he is my preferred Prime Minister. I think he has a better sense of Business, economics and Markets than any previous Prime Minister. ( sure.. that does not say much )

Ruth Richardsons "mother of all budgets" .... and Bolgers broken promises was the demise of National in the 90s'.

With McCully as Keys confidant..???? one can see why they are practicing the "art of the incremental".

Having said all that..... I do agree that on the policy front there is nothing fresh.... and a $15 billion deficit is a Shocker... ( outer limits of the comfort zone...yeah right )

All these task forces and working groups are composed of the same old , tired thinking people....

Still.... he is my preferred Prime Minister...

Is that the same McCully mentioned in 'Daylight Robbery"? Re the BNZ, late '80's early '90's?

Anyone who reserves judgement should really just move along. This is the same old crew of failed career poly's with a smiley new wheel. JK has nothing, nor do any of the 122 politicians currently sucking more than $1bn per year out of the economy (cost of parliament). People of NZ need to take a good hard look at the way they contribute to the country, because we all allowed to this point the take over of the country by groups of people who have zero accountability, and continue to make decisions to the detriment of NZ, while lining their own pockets..

Is this acceptable to the majority of the country. It appears so!

7,7% deficit is more than double what's allowed to members of the EU.

If we would be in the EU, we would be (are) already in the PIIGS Group.

Great!

Top 10 Ways to reduce the Government Deficit that will not lose votes.

1. Freeze the maximum salary available for Working for Families (WfF)

2. New Migrants not eligible for WfF for 2 years.

3. Freeze WfF entitlement increases.

4. Increase overseas student loan repayment criteria

5. Change Student Loan criteria that debt is cancelled on death. OAP's are taking out loans and laughing!

5. Freeze Kiwisaver Government contribution increases.

6. Migrants not available for Kiwisaver for 2 years.

7. Disensetivise investing in property by not allowing 'partnership' holdings of investment properties to be negatively geared against losses that reduce PAYE tax liabilities.

8. Change IRD law that enables some welfare services to be obtained if investment income is stored in PIE funds.

9.Re write ACC legislation that enables up to 18 years of part salary to be paid to accident victims families (cancer victims get nothing so why should accident victims?).

10.change legislation that allows for a spouse of a supennuitant to claim (via work and income) a pension even though they are under 65.

All not massive but not 'clangers' in terms of voting public which is the reality of every budget.

Excellent post.

That's exactly what is required - concrete suggestions - solutions - ideas.

Memo Bernard - You should start a "solutions" page for these big-ticket items so they dont get lost. Create a reference site for those powerful elites who have no ideas

WAY TOO TIMID! WFF's needs to go completely, DPB gone!, ACC gone and opened to private insurers, Kiwi saver gone! Unemployment Benefit limited to 6 months max over 3 year period. Capital Gains Tax on all +2 property owners payed annually and NO super for those owning 2+ properties after 65

Harsh but effective.

Although I'm sure your intentions are noble(?), the solution for economic success in NZ is not a mixture of arbitrary tax increases and benefit cuts.

We need strategic solutions, not just ideas with no consideration to downstream impacts.

How about a levy on interest on residential mortgages collected by the banks and paid straigt to the government. Say 10 points to start with moving to 50 points over say 5 or 10 years. On $130b of household debt that would raise around $130m moving to $650m of cash annually. Add a flat stamp duty of say $5K per sale on say 50,000 transactions annually and that would generate another $250M. Both can be adjusted to reflect economic conditions at any time and would be a more effective tool then the OCR.

Rewards those who are debt free, reduces demand for residential borrowing, makes business lending more attractive by default, takes any heat out of the housing market, reletively simple to administer (compared to CGT and land tax) and generates a decent and reliable income for the government.

We all knew that with the lack of economic activity that the tax take was going to be way down didnt we!!

so why didnt they??

is it that they live in a different world, where their incomes are paid for buy the taxpayer?

Yup most people other than wild bill knew this.

No, they knew, and they lied to you , again!

Quick question - what do you think the chances are of NZ getting a rating downgrade? Also, what do people think will be the impact on interest rates?

OCR goes to 0%? After all; if no ones going to lend to us from offshore at an economic rate, why not tax the daylights out of property and drop the interest rates to zero to offset the landlords costs? That way we incentivise what's left of our manufacturing base; allow lower wages to filter through with lower rental/property costs and look to our reserves to muddle through?

I think this govt has done very well to hold govt spending where it is and as a result government managers have had to manage their costs for the first time. Even cost recovery govt agencies have to not increase costs. And inflation does the rest.

Getting welfare people out there visiting/verifying these families on invalid benefits etc has to be an important step. Privacy act stop them? whooey lets have some some real accountability. Some of these guys can just do such a great acting job the doctors make them invalids. Such talents shouldn't be wasted. Met a guy the other day on invalid benefit ... nothing wrong with him. And DPB ... don't get me started. Why bother working with such a system.

"I think this govt has done very well to hold govt spending where it is..."

You'd be the only one.

Let me be sure I got the math right?

$15.6 billion deficit for year

4,315,800 Kiwis

equals

$3,615 more per person .

AND this is just the top-up needed beyond what we have already paid in taxes!

Updated with my Double Shot interview with Bill English. Up above.

Or here http://www.youtube.com/watch?v=FwcsiBOtsxU

"There's no mood for a lolly scramble in 2011."

He doesn't think the budget deficit will be an issue for Standard and Poors, which he says is more interested in national savings and the total net investment position.

cheers

Bernard

Memememe, you are wrong about restrctions on acccident victims unless one can sue once again in the Courts= that was the trade off, the govt wanted/needed to avoid the courts being clogged up with accident cases so brought in the acc compensation system.

Helen Clark did everything, but National doesn't revert any of their policies? That makes sense!

that's funny - from where I sit, it looked like they were just letting people like Hugh do what they do.

Without the balls to blow the whistle.

Many whistles were being blown !..... I recall Gareth Morgan and B.Hickey ( separately ) ripping into the packages and programmes of M.Cullen . But he wasn't listening . Nor doing interviews . He " knew " better than them , or any of us ...... he arrogantly thought .

At least JK & Wild Bill are approachable ........... useless , ineffectual , but affable .

A warm glow in the cockles of our hearts , as the " NZ Debtanic " sinks !

Geez, you know things are grim when you start ageeing it Wolly! Your point old boy about needing a rateings downgrade to finally jolt JK into action, is spot on. To run such a high deficet is insane. When can we expect to see some action over and above smileing and waving.

JK the real job starts now! Roll your sleves up and be prepared to actually take some action as unpopular as it may well be. The gold plated opportunity was missed last budget when you chose to tinker instead of the much promised"step change"

mememe, made some good suggestions above. I would add a tax on foriegn exchange transactions exempting redgistered exporters to clip the ticket on currency speculating. I believe Brazil has done it and although it hasnt dropped the currency it will be raising revenue. I also favour a land tax as opposed to capital gains tax. It should be at a low rate but as it is impossible to avoid and spread widely it should bring in good steady tin.Ditch WFF, interest on student loans, genuinely slash govt departments.

Dont recklessly spent what we dont earn.

Mr Smile-and-wave has out-smarted you lot that's for sure. Run a huge deficit, start slashing healthcare and education et al., and then what? Multinational corporations come in and take them over. Private Health Insuarance and Private Schools will be the norm in five years if Mr Focus-Group can pull it off, and all you lot thought he was stupid.

He's playing you.

Set it up properly, then pass it on to the 'opposition'...choose to lose the next election?

Quite a popular game. Nah, doesn't feel like this yet.

Now you see it ..now you don't. Earlier tonight I was reading on computor " Canterbury earthquake responsible for $15 billion Govt blowout. Then the article seemed to vanish.

No wonder..quote from 20 sept 2010..Earthquake Commission has enormous funds $15 billion invested off shore including $6 billion in cash.?

I am wondering if anyone else is starting to feel a bit nervous.? Please don't mention bankruptcy!

I've been thinking about this very thing, though I didn't see the article you're referring to Paul E. I thought we paid a levy to the EQC through our household insurance.....where has all this money gone? I thought it was supposed to kick in at times like this, but somehow now it all rests on the Govt's coffers instead? I don't know much about all this, so my assumptions mght be wrong. Unlike ACC, the EQC is not paying out money hand over fist day in day out, so where have all the levies gone that we paid?

Days like this I feel nothing but despair for what's going on. Way too much taxpayer's money being wasted on stupid things, which mightn't be so bad if our Govt didn't have an enormous deficit. But at times like this the only thing to do is trim the fat, and keep trimming it back to the bare essentials and necessities. I mean it's all good and well to have MO Women's Affairs etc, but are we going to die without it? This country is trying to live a champagne lifestyle on a beer budget. If householders can face up to the reality then why can't the Govt?

Another thing, do any of the pollies visit this website and read what NZers are saying about the state of this country? I wonder........and I sincerely hope so.

Seems like a good start...

2010 Investment Statement of the Government of New Zealand

Nice interview Bernard.

I think we need a lot less tax. The average wage earner needs more money in their pocket, that they can then spend more, mostly just to keep their chin above water. We got into this position because our Government is too big, it needs to be a lot smaller and the sooner the better.

I might be old fashioned but I think a lot smaller tax take, more money in the hands of working people,less interference in our lives from government, would encourage business and create real wealth not the crappy debt we have a present. There is no easy answer just hard graft, many will lose a lot because their debts are too high, but what sort of crazed idiot would start a business up in this country under the present bureaucratic overload. The people who work hard and save need to be encouraged the speculators need to have a change of heart we need to get away from inflationary assets as our main source of wealth and back to risk taking business with a smart capable work force, not degrees in resource consent processes and the like. We have a formidable foe and competitor in Asia are we up to the challenge?

We are fighting economic warfare and we are losing.

But as we have just seen with the recent income tax cuts - the extra cash in hand for the PAYE worker is being used to pay down debt - not to spend up or reinvest. The tax cuts effectively did not generate any new economic activity - nor will further cuts given the bloated state of borrowing in the broad middle class sector.

The Government needs to increase its income and reduce its borrowing whilst maintaining a level of social services that will keep a lid on widescale public unrest, crime and the 'black market'.

I don't see many options for the Government but to go after stores of excess capital with some form of land/capital tax and perhaps death/inheritance taxes as well... or to sell off assets in a big way.

No matter what - it's going to be ugly. And if inflation takes off.... well, game over for many.

"Don't panic" has to be the worst advice given by Key so far in his woeful performance.

........or declare a Jubilee Year. Well practiced since pre-biblical times, all debt wiped out, start fresh.

Kate

There is nothing wrong with paying down debt, it's as good as saving. The economic advantage comes from reducing the interest bill and thats our big problem the interest.

All this Government borrowing is causing a compounding effect on the interest bill.(unless our government intends to pay it back, which i doubt)

We need to encourage exports and except for asset sales I dont see that as a function of government.

Winding back entitlements is always going to be difficult. For my farm friends selling the boat,car, beach house and anything else not tied down, is not an easy choice but a discipline imposed by the market thats sadly missing in government. All this borrowing has an interest component and if its compounding then in a fairly short time we are facing a huge problem and poverty is coming without the choices we have now.

I think some frankness would go a long way, frankly we are in trouble there is no plan to pay our debt back, our short term thinking has to stop and yes we have have to all share in the discipline and retrench a little. I can tell you what happens if you target the rich, a. they dont have enough money to make a difference anyway, get Mr Fay to run Auckland hospital and see how far his money goes. b. They stop economic activity which is the very thing we need their capital to be involved in and go into avoidance mode. Im not a fan of the rich, while I admit many deserved to make good money in their enterprises, I also admit that many took more than their fair share.

Today the money is being made by corporations involved with government contracts and thats crazy and needs to stop. There is little or no economic benefit to a lot of this activity and its adding to the debt and the interest. Imagine how much better off we would be without our 37 billion dollar interest bill. The government has no answers to create wealth only how to redistribute existing wealth, its going no where and destroying private industry because of the knock on effect of higher cost structures.

Like they say - No Money - No talk

Click click - http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10694263

Bill: "What it shows is I'm completely delusional and trying to spin this as much as it's worth"

Try being honest Bill JUST FOR ONCE! We are right up shit creek and YOU and KEY arent fooling anyone with even half a brain

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.