The four energy companies earmarked by the government for partial privatisations have retained their values as Treasury readies itself for the first sale of shares next year.

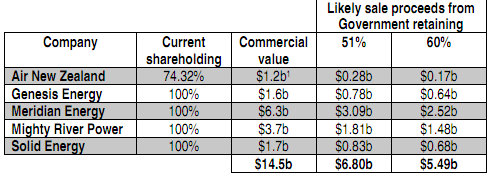

The government is planning to sell up to 49% stakes in Mighty River Power, Meridian, Genesis, and Solid Energy, as well as selling down its 73% stake in Air New Zealand to no less than 51%. It is banking on the share sales raising between NZ$5-7 billion, which it will use over its next five budgets for capital spending on infrastructure projects such as schools and irrigation schemes.

The government has promised to spend NZ$1.48 billion of the proceeds already: NZ$1 billion on school upgrades, NZ$400 million on irrigation investment, and NZ$80 million towards a technology institute.

Prime Minister John Key in October indicated funds raised from the share sales could go to bolstering Kiwibank’s capital. A First NZ report released yesterday estimated Kiwibank needed an extra NZ$200 million of capital over the next four years to become self-sustaining. See Gareth Vaughan's story here.

A report to Cabinet in 2010 outlined the commercial values of the companies shown in the chart below.

Valuation reports released by Treasury yesterday show those valuations largely similar to the table above:

Mighty River Power, the first company to have shares sold in it, was given an equity valuation of NZ$3.63 billion by First NZ Capital.

Genesis was valued at NZ$1.76 billion, by Macquarie Research.

Solid Energy was valued at NZ$1.6 billion, by Forsyth Barr.

Meridian Energy was valued at NZ$6.53 billion, according to Macquarie Research.

All up, the four companies had a combined value of NZ$13.52 billion, compared with NZ$13.3 billion a year ago.

Getting the highest price

Treasury noted in the Cabinet paper last year that the valuations, and therefore possible proceeds, assumed no foreign ownership restrictions or price discounts.

Despite the government indicating New Zealand institutions and investors will be at the front of the queue for shares, the sale process will invite bids from potential overseas investors in setting the share prices for the sell-downs. This means those New Zealand investors given 'front-of queue' access should not be paying a discounted rate for the shares.

“New Zealanders will be at the front of the queue for any offers arising from the extension of the Mixed Ownership Model, but overseas investors have an important part to play in providing pricing tension to support the Government’s fiscal objectives,” it says in the 2010 Cabinet paper.

2 Comments

I am not in favour of selling the Energy companies, but if it is going to be done, then a KiwiBank capital injection could be the best use of the sale proceeds.

I know it's pie in the sky stuff, but having the big 4 Aussie banks snub thier collective noses at OCR policy, could be mitigated by a strong local Govt Bank (KiwiBank). e.g The big 4 don't pass on the full rate reduction, but the well capitalised Govt Bank does. Interest rate sensitve borrowers would then move to KiwiBank, thus causing the big 4 Aussies to rethink thier position.

Money that can be made (really made) without energy being expended?

Nil.

Energy that can be made by waving money at it? If it doesn't exist........

Nil.

Extra energy to be made from this transaction?

Nil.

So this is a reduction in the share of a resource, forced onto those too poor to play, but who currently jointly own it.

That's theft.

And it's theft of something more valuable than money.

Air NZ, on the other hand, will one day be worth diddly-squat.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.