Content supplied by RoyMorgan

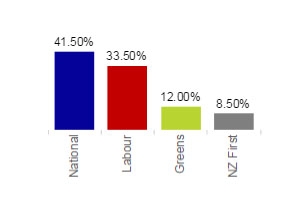

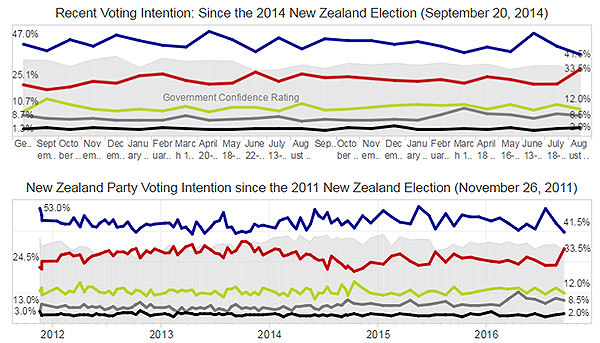

During September support for National fell for the second straight month, by 4.5% to 41.5% (the lowest support for National in three years since September 2013) now clearly behind a potential Labour/Greens alliance 45.5% (up 5.5%) for the first time in a year – since September 2015 after Prime Minister John Key attended several overseas summits in early September.

If a New Zealand Election was held now the latest New Zealand Roy Morgan Poll shows NZ First would hold the balance of power in determining whether a National-led Government would continue or whether there would be a three-party alliance of Labour/Greens/NZ First governing.

Support for the National partners was up slightly with the Maori Party up 0.5% to 2% while Act NZ was 1% (unchanged) and United Future was 0% (unchanged).

Of the three Parliamentary Opposition parties - Labour’s support was at 33.5% (up a large 8% to its equal highest support since November 2013), Greens 12% (down 2.5%) and NZ First 8.5% (down 1%). Of the parties outside Parliament the Conservative Party of NZ was 0.5% (down 0.5%), the Mana Party was 0% (down 0.5%) and support for Independent/ Other was 1% (up 0.5%).

In line with the drop in support for National the NZ Roy Morgan Government Confidence Rating has fallen to 117pts (down 10.5pts) in September with 52% (down 6%) of NZ electors saying NZ is ‘heading in the right direction’ (the lowest since July 2015) compared to 35% (up 4.5%) that say NZ is ‘heading in the wrong direction’ (the equal highest figure for this indicator since March 2013).

Gary Morgan, Executive Chairman, Roy Morgan Research, says:

“Today’s Roy Morgan New Zealand Poll shows support for National has fallen for the second straight month – down 4.5% to 41.5% - the lowest support for National for three years since September 2013. National is now clearly behind a potential Labour/ Greens 45.5% (up 5.5%) after Prime Minister John Key spent early September overseas attending regional summits in Laos (East Asia Summit) & Micronesia (Pacific Islands Forum).

“The good news for Opposition Leader Andrew Little is that the Labour Party are for once the largest beneficiaries of this month’s swing in support – Labour have jumped a large 8% to 33.5%, the highest level of support for Labour since Little became the Opposition Leader nearly two years ago while Greens support is down 2.5% to 12%.

“Despite losing a small amount of support, NZ First (8.5%, down 1%) Leader Winston Peters has reason to be happy with today’s Roy Morgan New Zealand Poll. If today’s result were repeated at next year’s New Zealand Election Peters would be in position to determine whether current PM John Key continued as Prime Minister for a fourth term or whether Opposition Leader Andrew Little stepped up to become New Zealand’s next Prime Minister.”

Electors were asked: “If a New Zealand Election were held today which party would receive your party vote?” This latest New Zealand Roy Morgan Poll on voting intention was conducted by telephone – both landline and mobile telephone, with a NZ wide cross-section of 864 electors in September 2016. Of all electors surveyed 6% (unchanged) didn’t name a party.

128 Comments

The people have spoken

John Key has ignored the issues affecting everyday kiwis for too long. He has put the rights of foreign buyers ahead of the affordability concerns of kiwis struggling to buy. Parents realising that their children may never own a home .... why ? Because nz property has the zero purchase tax in the world for foreign buyers. Zero %

Other leaders are protecting their citizens while key roles out the red carpet for foreign buyers. He doesnt even classify foreign students and temp workers as foreign buyers....

People are sick of his rambling and all the smoke and mirrors that goes with it. Short term GDP goals yet completwly ignoring GDP per capita growth which was less than 1% last year.

The tide has turned.

Election day is when the "people have spoken". You chicken littles are jumping the gun again...

Australia has CGT and stops foreigners buying, and Sydney prices are even higher than Auckland.

You are deluding yourself if you think that would fix the problem when it has failed everywhere else.

Nothing is driving this more than low interest rates.

Today I can borrow a million dollars, and my interest payments are less than they would be on a $500,000 in 2007.

When I'm making a financial commitment that could last 25 years, I try to think about more than the cost today.

But a lot don't, or are gambling on low interest rates for a long time, with the associated inflationary effects on house prices giving untaxed capital gain; seems like a self fueling money machine too hard to ignore

What has to be considered is the $ billions of Australian Stamp Duty which is paid by all property purchasers, is poured back into infrastructure which in turn has the effect of increasing the value of each locality. Auckland suffers badly in that comparison, yet prices continue to rise regardless

Note: the "real value" of a property is influenced to a great degree by the presence and availability of quality infrastructure. As the amenities of a suburb improve so the value of the houses within that suburb rise

Note: AU CGT is not levied on owner-occupied residences. However, for those subject to CGT, it is not a big money earner, it is inflation indexed and tends not to be a huge cost. It is simply considered a cost of doing business by investors. If you dont make a profit there is no CGT tax payable. If a loss is incurred, that loss is offset against any other Capital Gains

Two points about CGT in Australia. Because it's not on owner occupied houses, it's easy for owners to shift their address to their rental when they sell it.

There are so many loopholes with exempting owner occupied homes that many call Australia's CGT a "voluntary" tax.

One effect it did have was the "mansion effect", where people put more money into their own homes. Housing experts in Australia have argued that CGT actually had the opposite effect of what was intended, and has actually caused house prices to iincrease.

Having lived in Australia for a decade, and as a property investor, I have bought and sold properties in Aus. You cannot get around capital gains on investment properties by moving in, as it is worked out on a pro rata basis if rented for 4 years and lived in for 1 year, pay 80% of capital gains tax. It is not referred to as a voluntary tax, anyone saying this has not actually bought and sold properties under this Australian tax regime. The other point is maybe Aus properties would be even higher priced without a CGT.

Austrakia only proves that you need to have a high stamp duty like Vancouver. 15% hit them out of the park....

Read below worked a treat reveresed all price gains they had seen in the last 12 months and taken them back to sept 2015 prices. Thats just the start.

http://www.bloomberg.com/news/videos/2016-09-24/foreign-buying-plummets…

http://www.bloomberg.com/news/articles/2016-09-22/foreign-buying-plumme…

Foreign investors dropped out of Vancouver’s property market last month after the provincial government imposed a 15 percent surcharge to stem a surge in home prices.

Vancouver home sales fell 26 percent in August from a year earlier, while the average price of a detached property declined to C$1.47 million, the lowest price since September 2015, according to the Real Estate Board of Greater Vancouver.

In the long term, the new Vancouver tax will have negligible effect (according to your link).

I agree it is too soon to tell, we had a bit of a downward blip on the introduction of IRD numbers for purchasers, which is why I say we need to be ready with plans b, c, d and coming up with a plan e. The tax will get factored in, in the end, BUT, maybe sellers could consider that the tax foreigners might have to pay is x amount of the price they can get and they may favour buyers who are citizens.

Already has had a huge impact.

Worst case scenario little long term impact yet billions of tax is collected to help pay for infrastructure.

Best case housing becomes more affordable.

Win/win outcome.

At the moment NZ is collecting ZERO tax from foreign buyers (Stud & temp). So zero dollars collected for infrastructure.

Cities that dont have the tax will be impacted (could include auckland in that)

Per bloomberg:

“I wouldn’t be surprised if, barring any meaningful regulatory shifts, housing continues to outperform,” she said. “Putting a foreign tax on the Vancouver housing market, perhaps that pushes demand into other markets such as Toronto, creates other kinds of distortions in the economy. I think there is a need for a national solution.”

Congrats labour, nzf and greens on the poll !!!

The message on John Key putting foreign students and temp visa buyers rights ahead of everyday kiwis struggling with housing affordability is now starting to bite him.

The chooks are coming home to roost

That's what they said about GCT in Australia - it would make houses more affordable, and collect a large amount of tax for the government.

Yet it didn't make houses more affordable - many say it led to price increases. And the tax collected has been minimal.

Natphotonz1 of course it wouldnt as citizens paid it. I am talking about a tax on foreigners.

Foreigners are not citizens

You're still totally missing the point that being able to afford a $800,000 mortgage for what a $400,000 mortgage used to cost, has a far greater impact on prices than foreign buyers.

It also ignores what was previously said to be impossible - an economy good enough to reverse the brain drain. Today thousands fewer Kiwis leave, and thousands more come home.

30% of the buyers are foreign .... equals 30% of the demand

Check Linz report 13,500 buyers ticked they were students or temp workers. This was 30% of resident buyers. Dont worry it isnt only happening in nz. Same happened in Australia and Vancouver. They dealt with this extra demand by taxing them. Smart looking after their citizens.

Putting housing affordability concerns ahead of the foreign buyer interests.

The naysayers will say this doesnt work.

*Worst case no impact and billions of dollars collected from foreigners for much needes infrastructure and affordable housing

*Best case it works and housing becomes more affordable for nz citizens

What have we to lose ?

Basic economics reduce demand (vancouver tax)

Bring in loan to income ratios

Put incentives on new supply (no purchase tax)

Price will drop

You need to remember low interest rates are only good if you can fix for 20 years..... there is no gurantee that they will stay this low so the government needs to protect its citizens from taking on to much debt... thats where loan to income ratios come into play

Joe Public for PM!

Hey there's a novel thought - taking care of your country's citizens!

While I agree with the Vancouver tax, I really do believe the effect of it could be short-lived, as it won't stop the demand from foreigners, it won't change their desire to buy real estate in countries where once having purchased they own the land, so I fear they will be back once prices settle down a bit, not caring if they have to pay the tax. As long as enough reasonably desirable places do not have the tax, then it will remain pretty effective as they will just look elsewhere. I just suspect if it is taken up universally then they will be back in force.

It would be better then, to do this sooner rather than later, obviously, but I think we should have plenty of other options as back ups.

yes, maybe, but again what is the downside of providing a new source of revenue to help fund Auckland's critical housing and infrastructure needs?

None, hey I say do it and do it now, just be prepared for it not be effective for long with some back up plans is all

Totally support the Vancouver approach.

Whilst I think it would dampen house price inflation, even if it didn't it could at least mitigate the problem by pumping the revenue into building more social / affordable housing.

At least, then, there is some form of dividend to kiwis rather than the current situation of just being a get rich scheme for foreign investors with often little or no ties to this country....

Spot on Fritz.... foreign buyers are getting a free ride currently

This has helped add hundreds of thousands to the average kiwis mortgage with little to no benefit.

We are such a naive and dumb country in so many ways

Problem is that labour are more awful.

Migration policy? Fail.

Housing affordability policy? Fail.

Taxation policies? Fail.

Superannuation policies? Fail.

Good. #jkexit

The Roy Morgan poll was the one that recently had the Nats at 53%.

While some of us may like the latest result, this pollster is proven somewhat questionable in its outcomes.

I thought it was Colmar Brunton.

They're probably all somewhat questionable. If there are methodological things slightly skewing results, like concentrating on landlines, they're probably all doing them.

I think they have introduced calling cellphones but I imagine that would be a pretty hit or miss affair, there is no directory of them, and many sim cards aren't even registered in anyone's name, so I imagine that reliance on landlines is still #1.

Lets remind ourselves of where we are

- 2007 john key said house prices were at crisis level and that he had a plan to make them more affordable. Prices were 500k in auckland.

-2016 aucklands prices are now 1million. So under john keys leadership in 8 years prices have risen more than under all the PMs before him combined.

-household debt is at 250billion nzd growing at 8.8% per year

- 46% of buyers are investors

- 13,500 houses were bought by foreign students and temp visa workers in the last 12 months.

- foreign students and temp workers make up 30% of the total resident buyers

- foreign students and tenp workers spend 1billion a month on housing

- in canada and Australia these buyers are labelled foreign buyers in nz they are not

- nz has the second highest house prices relative to incomes in the world

- 20,000 homes were empty on census night

- average investor has a loan to income ratio of 7 to 1

- nz has the lowest purchase tax in the world (0%)

- Australia, singapore and canada all ensure foreign buyers pay purchase tax.

- nz immigration rate is 3 times higher than uk

-Auckland house prices up 80% in last 4 years whilst wages have barely moved

Well done john key you have left a great legacy. A housing affordability catastrophe

Would you preferred house prices to have gone down since 2007? I guess you would then be moaning about John Key failing to raise house prices.

[ Comment deleted. explanation sent . Please keep personal slagging out of comment stream. Please make comments 'reasoned'. Ed.]

I would have preferred it. Why would anybody be moaning except speculators?

@OU.Yes I would. It would mean capital has wisely been allocated elsewhere to earn the country income and raise of our standard of living.

Spot on Mike

Instead we have HOUSEHOLD DEBT OF 250billion rising 8.8% pa which will need to be serviced for the next 20 so years. Interest payments sent back to the australian bank head office.

This isnt helping nz lift its standard of living. If anything this is holding the country to ransom.

Forget education we all just need to be property investors

Is that the only option you have?

Given the choice between two potential New Zealands, you would choose the one with higher living costs? I'd certainly go for the one with cheaper housing.

Has your salary went up the same % since 2007? Where is inflation and where is house prices? Economics 101. Blatantly saying "would you have preferred house prices to go down" is like saying "would you have been happy with your salary doing down 50% since 2007....

Has it not occurred to you that there could be something in between what is happening now-unsustainable house price inflation-and falling values?

Would it not have been better for society as a whole,had we seen moderate-ie inflation linked-price rises? of course,as in any bubble,some have profited enormously,but much larger numbers have been seriously disadvantaged.

I have family in Auckland who could be said to be beneficiaries of this boom,but since their well paid jobs are in Auckland and they have a young family,they are not really better off. The tax system favours property and I would love to see changes that made speculation much less profitable.

Has it not occurred to you that there could be something in between what is happening now-unsustainable house price inflation-and falling values?

Would it not have been better for society as a whole,had we seen moderate-ie inflation linked-price rises? of course,as in any bubble,some have profited enormously,but much larger numbers have been seriously disadvantaged.

I have family in Auckland who could be said to be beneficiaries of this boom,but since their well paid jobs are in Auckland and they have a young family,they are not really better off. The tax system favours property and I would love to see changes that made speculation much less profitable.

Has it not occurred to you that there could be something in between what is happening now-unsustainable house price inflation-and falling values?

Would it not have been better for society as a whole,had we seen moderate-ie inflation linked-price rises? of course,as in any bubble,some have profited enormously,but much larger numbers have been seriously disadvantaged.

I have family in Auckland who could be said to be beneficiaries of this boom,but since their well paid jobs are in Auckland and they have a young family,they are not really better off. The tax system favours property and I would love to see changes that made speculation much less profitable.

Let's not forget that he campaigned on not raising GST and then raised it. This has had a massive impact on the poorer people of our society.

Or the fact that he wasted $26m on a flag debate no one wanted and which this website wont accept the result of

1/ You forget that the GST rise was more than compensated by rises in benefits and cuts in income tax.

2/ Of the $26 m spent on the flag, three quarters ($19m) went straight back into the governments pocket via NZ Post

(and surprise surprise - Aussie and NZ flags got mixed up in one of the medal ceremonies at the Olympics)

Yes the lower earners got to compensate for the higher ones getting a tax cut, always a good thing, eh? And of the flags getting mixed up, Australia isn't the only country that gets their flag mixed up with those of another country, and better that than the monstrosity that was on offer.

Wrong - everyone got extra money in their pocket to compensate, including beneficiaries.

The flag you call a monstrosity, might not have won, but it got more votes than Labour and the Greens combined at the last election.

Pretty much any flag would have been better than one that tells the world that as a country we still have our training wheels on, where the main symbol on the flag isn't even from the right country.

Better that one that still can be changed anytime in future when a decent alternative can be found than a ridiculous cartoon flag that we would have been stuck with, it was ugly and as I said all along, black and blue only work together in a bruise.

And the teeny little bit that the lower paid got in tax reductions did not blow smoke up the increase in GST

Labour poster next year

JK 2007 "Its the housing, Stupid"

JK 2017" Look, er, um,......"

He presents well, is glib and smooth but "at the end of the day" has made some serious mistakes that will affect NZ badly for a long time.

A relation came in contact with him recently and she said he was lovely, courteous and friendly and she was going to vote for him because of this. How silly are we? She has 2 teenagers who will never own a house in Akl because of him.

JP am happy to listen to your comments, but a few points of order please:

Point 1: From 2001 to 2007 AKL saw a house price rise of 114% which is 4 years sooner than the double from 2007-2016, That also wipes out Point 2. Point 3: so what, Point 4: not true and is commonly misrepresented statistic that persists on this website for some reason. Point 7: not true:Point 9: another BS stat purported on this website, when i can tell you HK and SIN are much higher relative to incomes and that is just naming 2 off the top of my head....we are high but nowhere near the top (thanks Greg for this misreport) Point 10: are we not allowed holiday homes or to go on holiday anymore? Point 11: says who? Point 12: good - that is what a free market is about. Point 13: those countries also have a tax for their citizens. Point 14: not for permanent immigrants...Point 15, not true.

So explain why houses in some places (not just Auckland anymore btw) are up to 10-11 x household (not just the main earner) income? Explain the rising number of homeless. Tell us how you feel about welfare being paid to foreign landlords, of which we have many now, in the form of top ups.

It does not matter how you try to twist it, housing is a very serious issue in this country today, the likes of which almost no-one would have seen before.

Point 1 keywest... actual rise under labour 250k. Actual rise under national 500k

When you pay for a house do you pay using percentages or dollars ?

I like to compare the two using the absolute dollar amount....

Under key total house price inflation 500k

Under all leaders before Key last 150 years total price inflation 500k

500k in 8 years is 62k a year

62k a year is higher than the Auckland average wage

Point 2,3 back on track when dollars is how you pay for houses not %

Point 10. You are worried about your holiday home when some people wont ever own a home because of John Keys hands off approach.

Permanent imigrants and citizens are not foreign only temp citizens and foreign students as i noted above.

Have to say, it is more appropriate to talk about % rises rather than $ rises, inflation means that growth is exponential. Try looking at a stock market graph over a a few decades without a logarithmic scale and it looks like nothing happened except in the last few years, but that's doesn't mean nothing significant happened before that.

Both methods have their followers

What is absolute when considering repayments is the ratio of price to income.

That figure has risen from maybe 5 to 6 to an eye watering 11

Can either of the other measures argue their case..

"At the end of the day" (courtesy JK) you still have to pay back the capital borrowed no matter how low the interest rate is!!!

Re % vs price gain in an era of low inflation/interest rates personally I would put myself in the shoes of our FHBs in 2007 and then 2016.

Things were hard in 2007 with say a mortgage of 300 grand but my god how do they sleep at night owing 600 grand now? Especially in todays environment. Interest rates are low folks because the world is in the poo. The next Black Swan doesn't bear thinking about and when it waltzes along that could be the job gone. Children, forget it.

Mdf text book answer however if you look out the window you will notice inflation is close to zero at the moment

So in this case it is more appropriate as givern little to no inflation to compare using abolute dollars

500k price rises under john key

250k price rises under labour

Feel free to adjust for the small amount of inflation.

Labours % rise was from a very low base

Keys % rise was from a base that key called "crisis level" in 2007. See his speech below. I never get sick of seeing it

http://www.scoop.co.nz/stories/PA0708/S00336.htm

John Key MP

Leader of the National Party

20 August 2007

Speech to Auckland branch

New Zealand Contractors Federation

Conclusion

Over the past few years a consensus has developed in New Zealand. We are facing a severe home affordability and ownership crisis. The crisis has reached dangerous levels in recent years and looks set to get worse.

This is an issue that should concern all New Zealanders. It threatens a fundamental part of our culture, it threatens our communities and, ultimately, it threatens our economy.

The good news is that we can turn the situation around. We can deal with the fundamental issues driving the home affordability crisis. Not just with rinky-dink schemes, but with sound long-term solutions to an issue that has long-term implications for New Zealand’s economy and society.

National has a plan for doing this and we will be resolute in our commitment to the goal of ensuring more young Kiwis can aspire to buy their own home.

It’s a worthy goal and one I hope you will support us in achieving. Thank-you.

Labour and NZ First should deliberately plagiarise this speech and use it in the huskings next year. Simply change National for Labour or NZ First where required.

If National complain about the plagiarising then it will be providing extra free advertising on how shallow JK is.

This could be followed up with excerpts from JK's utterances on firstly how little buying is being made by "foreigners" and then secondly on how hitting these "few foreigners" with a sales tax would decimate NZ housing. Do this against a backdrop of Collins, Smithy, Brawnlee and that silly foreign minister.

Then take the rest of the election period off.

Message to JK "It is the housing, Stupid"

All I am saying JP, is don't let the facts get in the way of a good story...

Thats what i am saying NatWest ... the facts is prices up 500k under key, 250k under Labour

Its a fact auckland average is up 500k under key. Fact.

Key has 100% more prices rises than labour had... doea that % make sense to you ???

Loan to income highlights the problem

5 to 1 and now 10/11 to 1

read my comment below $250k in 2007 was worth more than $500k in 2016 in housing terms

No good blabbing about housing prices without you are counting incomes in comparison. Remember you can use numbers to tell you anything you want them to, so long as you pick the right ones in the first place. Fact is, the gap between income and housing has widened enormously, no matter what equation you try to use to say something else.

It is the almost impossible task of saving for a deposit (that will have stretched out way beyond what you needed when you set out by the time you get somewhere near it) that is the first insurmountable hurdle. Then you need to bear in mind that interest rates have very little ability to go down any further, but there are a whole lot of numbers on the up side, and a lot of years of mortgage for them to go up.

The fact is we DO have the situation we have, and as for the rest of the world, well, they have no damned business buying our houses anyway.

10 to 1 is still OK......many countries and cities in the world have 20+ to 1 so we are a long way to go before we are totally screwed...although credit given for my new nick name though...

Say what!! You do understand that 10 to 1 here is pretty much 10 to 1 HOUSEHOLD income, so for simplicity's sake that kind of equates to 20 to 1

"10 to 1 is still ok" seriously NatWest (haha glad you like it) ... Other places with ratios in excess of 10 have put measures in place to

1. Curb foreign buyers with a PURCHASE TAX

2. Curb Investors with a PURCHASE TAX (2nd home purchasers)

In NZ John Key has done zilch

Canada, UK, Australia and Singapore and all put in Purchase Tax on Investors and foreign buyers

Wake up John Key

These measures only make people poorer...as the money gets sucked back into paying for other things people want a hand out for...we still have cheap property compared to many other major cities, Sydney and Melbourne are two that come to mind

We have expensive property compared to the earnings here in this country, that is ALL that matters, foreigners have no business buying job lots of houses and renting them back to us, that is an even surer and quicker path to poverty!

'10 to 1 is still OK'. I would like to think that you have a strong sense of irony,but sadly,I think you really mean it.

On what possible grounds could such a price/income ration be OK,whether or not other cities have even worse ratios?

I would be interested to know just which cities have ratios of 20 to 1 and over. According to Demographia, Hong Kong at 17 to 1 was the highest(worst).

would you rather $250k in 2007 or $500k in 2016? (I know what I'd rather have...)(p.s. the answer is $250k)

Depends whether you were actually there or not

Your comment makes no sense

Not necessarily meant to, but it makes more sense than people who are in outright denial of the plight of NZers in the housing market, a plight that is only worsening, and merely opening up land will not change that. You're promoting yourself as some sort of genius is not going to change that. As I said somewhere else, there is land for Africa being opened up in Hamilton, houses springing up like mushrooms and prices have increased phenomenally all the while. You are completely unconvincing, time to try our way. Too bad if you don't like it.

% terms are the correct way of measuring the amplitude of price rises. Arguably a $250k price rise is worth more at that time than a $500k price rise now (in fact it was, which proves my point)

for instance $250k would have bought you 40% of a grey lynn villa in 2007 and today $500k would only buy you 33% of a villa...you get where I am going with this...

This Grey Lynn villa? http://www.trademe.co.nz/property/residential-property-for-sale/auction… I think it might be the sort of thing you had in mind.

yup even goes further to say you were better off with $250k in 2007 than $500k today...house prices are a bit expensive at the moment, that's for sure...good time to buy is now I'd say...

If you are able to is the problem for far too many, that is what house prices out of whack have done to people. I think all this concentrating on this fact or that figure is no substitute for what you see right in front of your eyes, they are far too open to manipulation.

You see, all you have concentrated on is house prices and conveniently ignored what you need to buy it and how much you have to have on hand to even get a look in. That is the ONLY equation that matters.

Well put.

Under Key and his policies, what has happened is:

- Property investors / speculators have got richer and richer, whilst those doing the really important work in society (teachers, health and social workers, police etc) have in the main got effectively poorer whilst working harder than ever

- Owner occupiers have gained 'illusionary wealth' ie. they are not any better off

- an increasing chunk of kiwis are effectively locked out of home ownership

- Homeless number have increased significantly

What a wonderful country we have become. Thank you, esteemed leaders

Edititor (David) i have a suggestion for your site.

Drop the section for edititors choice on the right hand side and replace with most liked comment.

Edititors choice seems a little out dated and only includes comments that agree with your views so is biased.

Just a thought.

Thanks mate

[Unacceptable sophomoric name calling deleted. Reasoned argument is welcomed, but not this type of personal smear. Explanation sent direct to commenter. Ed]

Have been voting for national but not to see smirk on their face.

There are two types of pride, both good and bad. 'Good pride' represents our dignity and self respect. 'Bad pride' is the deadly sin of superiority that reeks of conceit and arrogance - John C Maxwell.

Correct nzakl. Will like to have David C and/ or experts say/ view on your comments.

Many of our friends voted for national - many have good business and investement property but today they all support #JKEXIT and will keep on growing till election day. Arrogance and Ego leads to downfall and the trust deficit is at lowest of John Key and his gang.

Some people must be on dumb down drugs,, or asleep with the consequences.

This is not a new phenomenon.

If they could not see the problems created by this bunch of more-ons, then they are bigger..morons.

When you steal from one bunch to give freely away to others, and ignore the people in the bunch in the top, who actually caused the problems, issues and yes, benefits, you get bigger issues.

Ask any thinking 'Middle Class' worker, where his money went, in a puff of weed and virtually over the past 8 years....or even overnight in some cases.

A little interest, gets blown out of all proportion, when you leverage up to the Max.

I was gonna use the "Term"...deposits' but that would be taking away the real story.

Especially when money is supposedly borrowed into existence, imported from overseas, plonked on houses,leveraged up to the hilt, by world-wide escape artists, looking for a safe haven and then rented out or left unattended, or constantly flippin em, it causes shortages, so what does the next bunch do, tries to emulate them,

Doubling the problem, will never fix things, never mind tripling. A crisis is not fomented over night. It is created to distract and benefit the people, you blindly "Look up to"

Ask Douche Bank, where their ill gotten gains went.

Ask a Farmer just who encouraged them to borrow to the hilt,

A coal miner to dig even deeper, into the mire.

A steel miner, who had his job stolen and moved overseas.

A foolish couple who borrowed up to the hilt, with a free ???????????..IPAD.... or similar...with Mummy or Daddy's deposit..

Not knowing when you are being scammed, played, is half the problem, the other half is the interest rates have been forced down , repeatedly, repeat, repeatedly to remedy the 2008 fiasco, created by Bankers, Politicians, and debt collectors and trillion dollar beneficiaries. (Some say China, Some say Russia, some say Armaments Factories, I cannot possibly comment)

I think some beneficiaries should come clean and stop taking the hallucinogenics....

But you voted for em and you keep em in comfort. It is a world-wide problem.

You can see the bigger fool in the American Elections. Syria, the Middle East, no equitable answer. Would you vote for any system in power, or any

The war on "want "is being played out by Beneficiaries. And it costs a pretty dollar and guess who funds it.

DEBT...plus more debt. Oh and a few Flag wavers, using your money to fund their own ends.

I don't believe this poll as I cannot see people jumping from national to labour.

in saying that I do believe national are losing support and it is over too main issues house affordability and high immigration,

I have many comments from national voters over how their young will never have the chance to buy and this is starting to spread outside of Auckland, and fear is a big catalyst for change

they have a survey running on FB which is asking people to rank issues and it is missing these two major issues which make up most of the comments section.

my guess is you can lock in Tax cuts for the next election to pay their way into power, whether that will sway the sheeple we will see

You don't suppose they polled different people, do you? :D

Housing - we all know this is the "issue" expect John Key. I struggle to understand why he won't seriously act on this issue. Normally he is on the button where most NZers sit but on this he has failed to act. In the NZ Herald yesterday nearly 75% of CEOs were saying that housing and house prices are a concern for them. If he won't listen to the average voter, business leaders, economists, Treasury, the RBNZ then the only answer is the ballot box. There is still a year to go but unless the PM comes out with something big that people can understand then this will be the last term for Mr. Key as PM.

CEO's will have a bigger concern if house prices drop significantly and people can't move for work due to being in negative equity.

their concern at the moment is pressure on wages as their staff are getting to the stage they cannot afford to live in Auckland.

we need staff at the bottom of the pile to do many many jobs in Auckland not everyone can be on 100k +

Not only 'staff at the bottom of the pile'

How bout teachers, nurses, carers, police. People whose work is critical to the functioning of a sound society.

My mother is in a dementia home and I was talking to one of her wonderful carers, an Indian woman, married with two children. her husband is also a carer. They are having to cram in to a 2 bedroom flat just to survive, let alone save.

We've become a f#$$en sick society where speculators make a killing but the majority of people doing productive and/or highly valuable work are actually going backwards financially whilst working harder than ever.

In a just world there would be riots on the streets

Imagine if people could afford to pay off their mortgage quickly and retire early. CEO's can't have that - gotta keep the middle class on the treadmill. All that extra productivity from modern technology, free trade and women in the workforce has gone to the top. Decades ago it didn't take two salaries to afford a house and a car.

Yes...geez...... heaven forbid Auckland and/or NZ households actually had more disposable income left over every month to spend on the products or services these CEO's companies provide instead of pouring it all into mortgage repayments to an Australian Bank.......that then go offshore

I mean who needs the actual productive economy that employs people and pays tax....

Do we actually want to enshrine the fallacy that house prices only go up and you can borrow to the eyeballs and enter the market at any time with no personal risk undertaken? <------THIS IS THE PROBLEM!

Question is not if John kee will lose or not, for lose it is but what has to be seen is the margin by what he will lose.

It will be by huge margin and also this time the voting percentage will be high.

I think you are right. MSM have been avoiding constructive reporting, focusing instead on distraction offered by Nat spin doctors. This site, many others and social media are filling the void. How long before MSM realise they are both loosing and antagonising their market and come join the party? Not long I'd suggest.... and when they do it will be open season on Key.

That's exactly what people were saying last election, and the one before that.

But the fact is that polls and election results have had not had any major shifts at all, for the whole time Key has been in power.

The problem for Labour, is they need the Greens AND middle NZ.

And much of middle NZ sees the Greens as a bit flakey.

Who really cares, all it really means is that every 10 years or so you swap out one bunch of clowns for another.

correct that is the problem it is the same ideas and round and round we go.

dont follow leaders, watch the parking meters

True.

But at this point in time I'd much prefer the other clowns to the current clowns

Based on these figures Johnny would be back in power, as party with the most votes he would have to get support from other parties. That's where Winston comes into it. Everyone has their price.

Labour is finished, we all know this is the most unreliable poll of all….it is too late, it’ll be another 3 years for the Nats next year. Wish Labour could actually sort themselves out, long gone are the once vibrant, challenging ideas. The right used to be the dreary ones. Now the left now suffer from closed minds and have become backward-looking. They seem to run from ideas and the public know they are run by the Unions. New Zealand is past that, nobody is interested in that ideal anymore, it is a shame as we all want them back here in Wellington!

they do have some people in their ranks that could lead with fresh ideas but they will never get to the top as you say they are hampered by the union voting block.

its time they sat down and looked at where they need to be and changed to get there

as for WP his drum banging has never changed and I will be surprised if he joins the Nats, but everyone has a price and WP prime minister for six months could be one of them

They are not pragmatic at all. They need to play the game and start by choosing a likable face for the would-be PM.

Little’s sharp rejection of Helen Clark’s view that Labour must capture the centre if they want to be a majority government, was telling. She’s right of course, as she so often was and is. Andy throwing in the towel and becoming Metiria’s BFF means he’ll be forced to accommodate some of the Greens more extreme economic doctrines so he’ll have to steer left quite a bit more. These polls are being taken well before Labour’s election campaign policy positions are fully known. A long way to go. I doubt Key’s minions will be overly concerned about these polls just yet.

Not so sure. I think the swing will be to NZ First. I do think Labour will continue to decline until they wake up and realise they are supposed to support the lower and middle classes, which they have failed dismally at for ages, and especially under HC. I think if Winnie is on to it, NZ First will grow significantly in the next year.

The people of NZ have been voting for 150 years hoping for change but it always stays the same.

Time to try something different

No wonder the political system does not work. Just look at its history.

It grew out of warlords and feudalism. The into evil kings and queens. Then it was devised by wealthy land owners.

The ordinary people never had a say. They were just told to vote for this system, take it or leave it.

Time to change the system

Labour is pushing the proverbial uphill - it's all about persona, persuasion and propaganda. They need the word Left to mean something aspirational to be proud of. I hear Little the other day not even wanting to use the word Left. What a regressive muppet. Progressives need only be progressive to highlight the privileged corruption of the status quo.

IF National get another term then the reality is the NZ many of us knew and hoped our kids would also inherit WILL be lost forever. Its almost too late even now. Housing, cost of living, environment, recreactional activities like fishing even.....all of it being eroded and destroyed. Next election people, GET OUT ON THAT STREET!

Justice.......... . mate the Greens would like to BAN fishing outright .

Recreational fishing? I seriously doubt that. Im quite sure though the Maori party also might for non maori but nevertheless a confidence of supply agreement they have made with National.

You arent actually claiming the Greens will ever get such legislation through Boatman? I also dont recal advocating for the Greens but your attempt at scaremongering is noted

Well, as a Boatman, I think you would understand that trawling, especially bottom trawling, needs to be a thing of the past.

Commercial fishing needs to be limited to citizen owned owner operator outfits, operating smaller craft. With extensive marine reserves ( ie. most of our ocean.)

Total end of foreign owned crewed floating factories.

No, that's something you just made up.

Here is the actual policy:

https://home.greens.org.nz/policysummary/sea-and-ocean-policy-summary

Boatman must love a few porkies on a Wednesday night.

Interesting reading Heralds mood of board room political rankings yesterday. Apart from English and a lesser degree Key CEO's were pretty Luke warm re balance of cabinet. True that opposition pollies didn't rank well either but to be expected given they don't enjoy incumbency. Says to me the reshuffle is critical if the Nats want to address slide. Carrying Smith, Brownlee, McCully etal into next election will be untenable.

LOL so many people forecasting the demise of National ... BUT nothing has changed at all.

Quite simply , there is no viable alternative

You have nothing to worry about then so stop showing your insecurity

Everything has changed Boatman; look around you! Only five years ago average Kiwis could afford a home in the cities now they can't. That's a HUGE CHANGE!!! Key has lost it and is on his way OUT!!

I know quite a few people who have voted for Key in the past who won't be doing so again. I'm in that camp.

I'm not sure who exactly I'll vote for, what I do know is I will vote for a party that contributes towards John Key's exit

John Key has treated the country just like a banker / trader would

- Maxed out the debt

- Chased short term targets however ignored long term impacts

- ignored social issues completely

We all know what impact this had on the banks in 2008

Now we are seeing the impact of his policies in NZ...

He has charmed the NZ electorate, by and large, but under his leadership NZ is turning into a shameful place.

It's sort of like, on the surface, Key - and NZ generally - seems pleasant and rosy enough...

but dig below the surface....

Put aside housing for a minute, I was totally astounded by that Court decision on that Wellington rugby thug the other day. I heard a retired judge, an English fellow, on National Radio bemoaning it and basically saying our law is a farce to even contemplate the possibility of that ruling.

What a joke

The longer he goes on it's becoming more apparent he is completely out of his depth in terms of knowing what's good for an economy long term, trading money and stocks for a short term gain is completely different to running a country.

He obviously can't get past his entrenched ideology he has embedded in his psyche, such as around thinking deregulation is always good, and philosophies around the market always knowing whats best.

Yeah that judge's decision was pathetic.

So if National goes up in the polls by merely 1% there are massive headlines all over mainstream media, and calls to get rid of the Labour leader.

But when Labour goes up by even more than that, and National goes down, it's tumbleweeds in mainstream media, and you're lucky if you can even find the story..

I can't find the story at all on the NZHerald website, I would say it was bizarre if there wasn't such an obvious explanation for it.

Our mainstream media aren't biased at all - yeah right.

Once upon a time journalists / media tended to be left leaning, and there was a decent social consciousness.

Now they seem to be, more often than not, centre -right and just plain horrid (eg. Mike Hosking)

exactly lacking social consciousness..... greed and self gain has blurred their judgment

Just one question.

Why is NZ 100 billion extra in debt, on Don Keys watch, after selling off the SOE's and where did the money go?. Cos it was not supposed to spent on a gold plated watch. ... was it.? but someone got a hefty pay out., if it all went missing.

Appalling judgement for the rich and infamous. Seems a trend.

Gold plated assets were sold to give people with money a safe haven to invest. The business case for selling the power companies returning in excess of 10% to retire debt costing half that was never there. The next to be targeted are the local Govt assets.

The Auckland Super mess is all about easier deal-making, not economies of scale.

it was pure ideology to sell, not good economics In which the price received was derailed by the opposition parties.

don't get me wrong some businesses government should not be in, and I would have preferred they sold all the power companies except one that had generation in both islands and if needed they could pump money into every now and again to ensure adequate generation capacity is there if the private companies hold back on investment

we I did calculations for national sheeple they looked at me blankly with the JK line but we are going to buy more assets again I pointed out the difference between income producing assets and cost producing assets and how much worse off we will be especially in an era of low debt still blank looks.

and this as someone that took advantage of the sale to get a slice.

as they say a fool and his money are soon parted

mmm thats where I differ; if this was an ideologically driven govt then why worry about Auckland house prices, why bail out South Canterbury Finance losers, why worry about first home buyers; the market knows best. The efforts of Govt are directed to remove valuable assets from the public sphere and therefore influence, and put them in the hands of moneyed interests. The privatisation of water in this country is one obvious example; the Canerbury Regional Council was squashed in order to facilitate the removal of water from public ownership to private gain. There was no market mechanism there; it was via legislation. Don't anyone tell me Labour is any different. Its the nature of Centralised power, and its unveiling becomes more obvious the more desperate people get as they look to a safe haven.

Ever noticed how Labour's fortunes rise when Andrew Little is out of the country? This trend in the polls will quickly reverse when he returns and puts his ineptitude on display again.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.