Earlier in 2025 we started tracking premium quotes for car insurance. We wanted to understand how this industry was changing its prices to consumers.

To do this, we tracked the online quote tools of five insurers.

After ten months of weekly tracking, that shows a wide variety of changes depending on the model, and the city in which the vehicle is based. The range was +5.2% for an Auckland new car, to a -7.7% decline for a used import in Christchurch.

Insurance premiums are all based on risk-based pricing. For a motor vehicle, the car itself, its age, where it is parked at home, where the base address is, and the age of the main driver are all key 'risk factors' that go into determining the eventual premium cost. And there are a range of other factors, including things like the claims excess you choose.

Overlaying all this are the policy coverages, limitations, and exclusions from each insurer.

Our monitoring tries to capture some of this. We track the most popular new car (the Toyota RAV4) and the most popular used import from three years ago (the Toyota Aqua). In each of Auckland, Wellington and Christchurch, we identified an address that matched the current median house price.

We then tracked the premium for a 35 year old male driver for each of those specified locations (parked off the street in a carport), where the policy had a $500 deductible.

Over the ten months, we can now see some patterns emerging. We will start reporting on these in more detail in early 2026 when we have a full year of weekly tracking.

In the meantime, we have partnered with insurance comparison site Quashed to launch a new tool that can suggest how your own specific vehicle will attract insurance premium cost.

Here is the tool. You only need enter your registration number to get a result.

This tool will appear across this whole site, and in the desktop RH sidebar.

It is only an estimated range and at this time uses the very large array of Quashed client details to generate that range. So it is based on real-world, current pricing.

Car insurance pricing is a highly specific and individualised process that needs details about your car and you.

Pricing like this makes sense, but it does give the insurers a free pass on transparency. It is complex so most people don't compare. They don't compare the premiums between insurers, and they really don't compare the policy coverages, by and large.

What consumers do see is extensive advertising about how great each insurer is.

So it is a challenge to keep things competitive and in the best interests of the car owner. Brokers can help, but they are paid by the insurer so the core conflict of interest spoils that option somewhat.

And the insurers want you to enter their universe and use their online application process. That cuts out broker advice, and given the time-and-effort commitment involved in doing this, they know it is unlikely you will do the same thing comprehensively across all companies offering this option.

This is where we may be able to help. We are doing this tracking weekly. And in partnership with Quashed, we have a very good overview of what others are paying.

You will see more from us on car insurance starting soon. Hopefully what we report can guide you on where you should look and what you should look out for, when you come to buy or renew your car insurance policy next. There can be potentially many hundreds of dollars to be saved.

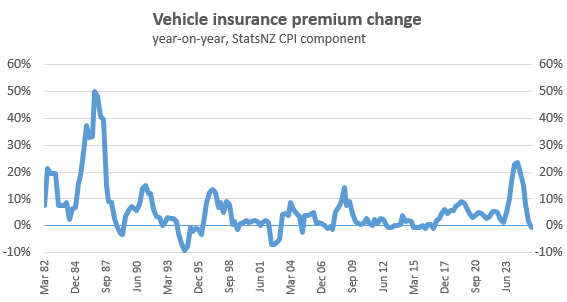

Finally, we should put all this in perspective by offering a chart from the StatsNZ CPI database on the history of car insurance premiums. This alone should give you a very good reason to take a direct interest in what you are paying for car insurance, and follow our reporting.

It can be very volatile, so it deserves your attention so you don't get caught out.