Housing is now at its most affordable level in more than four years, thanks to relatively flat prices at the bottom of the market, falling mortgage interest rates and slowly rising incomes.

Interest.co.nz tracks all three of these market indicators monthly to plot changes in affordability for typical first home buyers. Here's what the numbers are saying:

Housing prices

According to the Real Estate Institute of New Zealand, the national lower quartile selling price was $590,000 in September.

The lower quartile price is the price point at which 25% of sales are below and 75% are above, so it represents the most affordable end of the market.

That's down by $80,000 from the record high of $670,000 in November 2021.

However, lower quartile prices appear to have flattened over the last six months, with the monthly figures bouncing around within the fairly narrow band of $580,000 to $599,000.

Mortgage interest rates

The average of the two-year fixed mortgage rates offered by the main banks was 4.72% in September, down from its recent high of 7.04% in November 2023.

That puts it at its lowest level since March 2022.

Incomes

Interest.co.nz tracks after-tax incomes based on median pay rates for couples aged 25-29, who are likely to be at the stage of life where they are starting to think about what will be required to achieve home ownership. This gives a better indication of their likely incomes than other measures such as household income, which includes incomes for groups such as beneficiaries, superannuitants and existing home owners, whose incomes are irrelevant to typical first home buyers.

By this measure, a typical first home buying couple would have taken home around $2208 a week between them after tax in September, assuming they both worked full time.

The income measure is the least volatile of the figures tracked. It rises slowly but steadily and very rarely declines.

In September this year it was up by $82 a week (3.9%) compared to September last year.

So what does all of this mean?

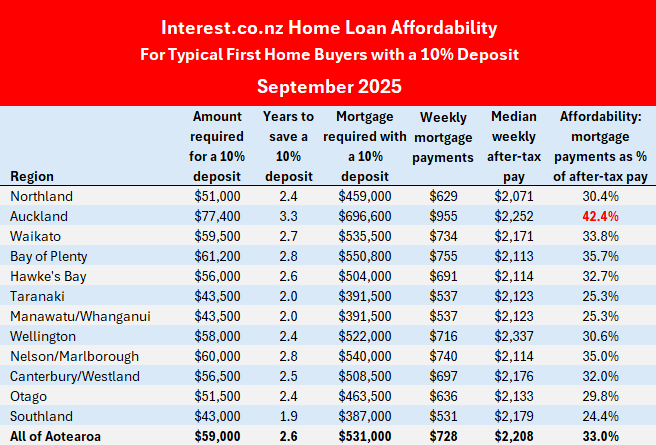

What these figures tell us is if a home was purchased at the September 2025 lower quartile price of $590,000 with a 10% deposit, the mortgage payments would probably be around $728 a week.

The August mortgage payment figure was slightly lower at $720 a week. But apart from that, September's mortgage payment was down $207 a week since it peaked at $935 a week in November 2023.

It's now at its lowest level since October 2021.

That means the mortgage payments on a lower quartile-priced home would take exactly a third of a typical first home buying couple's after-tax pay.

That is the most affordable it has been since June 2021.

Mortgage payments are considered unaffordable when they take up more than 40% of after-tax pay. Therefore at the national level, home ownership should be considered well within affordable limits for first home buyers on average incomes.

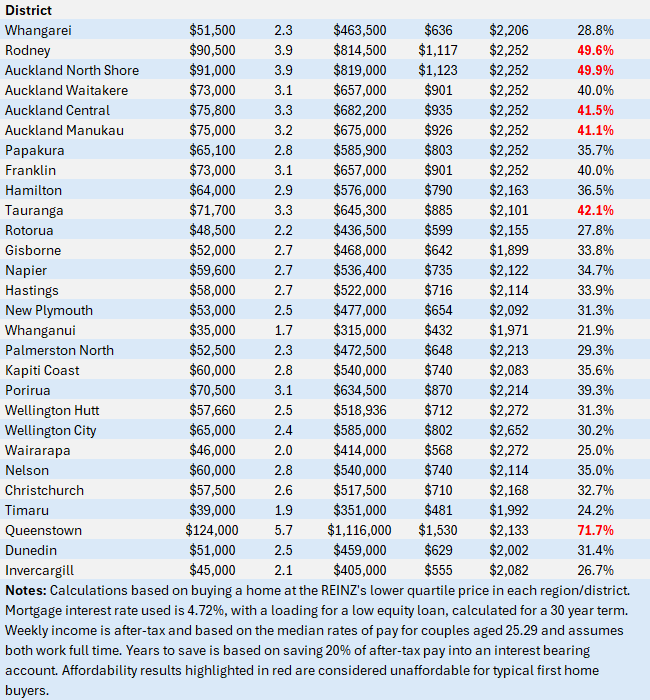

Of course there are regional differences, and the main measures of affordability for all major urban districts around the country are shown in the tables below.

These show the only places that would be considered unaffordable for typical first home buyers if they had a 10% deposit would be Auckland, Tauranga and Queenstown.

Within the Auckland Region, Waitakere, Franklin and Papakura districts would all be considered affordable for typical first home buyers (Waitakere and Franklin only just with mortgage payments at 40% of after-tax pay).

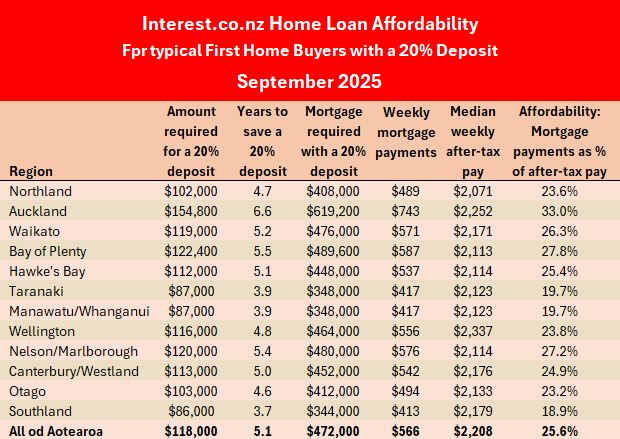

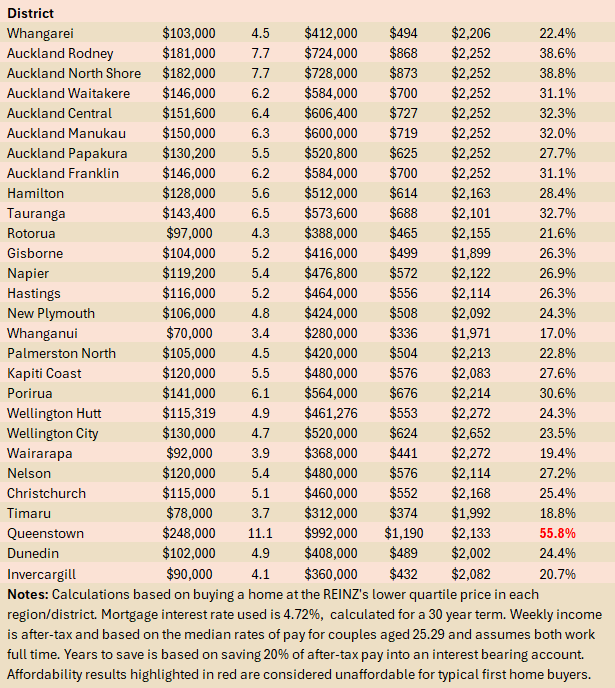

If the first home buyers had a 20% deposit, the only place that would still be considered unaffordable would be Queenstown.

Of course scraping together a deposit is still a challenge but even that has become easier over the last few years.

The amount required for a 10% deposit on a home purchased at the REINZ's national lower quartile price has declined to $59,000 in September this year from $67,000 in November 2021.

Interest.co.nz estimates if typical first home buyers saved 20% of their after-tax pay into an interest bearing account, the amount of time it would take to save that deposit has declined to 2.6 years in September 2025 from 3.7 years in November 2021.

That's still no mean feat.

But then getting the wherewithal together to buy a first home has never been easy. Perhaps surprisingly, it has been getting easier over the last four years.

The comment stream on this article is now closed.

17 Comments

Good to see this trend continuing in the right direction.

I wonder though if the data set being analyzed is a bit incomplete to draw concrete conclusions from.

In addition to housing prices, mortgage interest rates, and incomes, a small elephant in the room is the broader cost-of-living situation. The combination of cost changes (either up or down) in rates/insurance/maintenance/food/power could be quite a big determinate of what is deemed 'affordable' in terms of servicing a mortgage at X% of after tax income.

That works both ways though. For years wages outpaced inflation, yet interest.co.nz didn't increase the affordable % accordingly.

For years wages outpaced inflation

No. Wage growth was never greater than "inflation". You might have periods when wage growth appears to outstrip the price of goods and services, but the data being fed to you about inflation is a construct and understated.

Little bit tin foil hat-ish that one

Little bit tin foil hat-ish that one

And that's part of the problem. People think that questioning CPI data as representative of inflation is the stuff of conspiracy theorists.

Right now I’m sipping on a nice cold bottle of lion red. It’s about 66% dearer than the very first dozen I bought 30 odd years ago.

“In 1995, the adult minimum wage in New Zealand was approximately $5.00 to $5.50 per hour” according to google. Now it’s $23.50, up 330%

This is why I trust stats NZ more than people’s anecdotes. People only see the bad, not the good. I got petrol for $2.24 a litre the other day, it was a dollar more a few years back. I could anecdotally conclude that the cost of living is now much cheaper based off these two examples.

Lion Red. There’s your problem.

In a world with craft brewers, I wish I could thumbs-up that comment more than once.

Unless you retired, unemployed or a govt servant. Then inflation has well and truely "beeped" you.

Hope you never need police or nurses/doctors when the ferals come for your quality lion red. Or the people that teach the next generation of those people. For they all have to, truely been inflated away.

Hardly. No one can seriously argue that cost of living increase matches the inflation figure of 3%. Heck, the CPI doesn't even include home and contents insurance.

Doesn’t include homes either.

It includes rent.

.

Maybe if there's a bird in one box going cheap cheap, I hope it isn't a canary

"Housing is now at its most affordable level in more than four years, thanks to relatively flat prices at the bottom of the market, falling mortgage interest rates and slowly rising incomes."

Was housing affordable 5plus years ago?

Affordable is not something that’s easy to define.

Not really....price to income ratios measure it pretty well. And in 2019 we had an affordability crisis if you remember.

We may have retreated slightly from a terrible position but that does not make it a good position.

To be fair, the author is not making a value judgement on what is defined as "affordable" -- just that it is more affordable than any time in four plus years. But perhaps "at its least reaming level" would be more accurate, albeit not appropriate.

A definition of affordable that still puts us high on the international price-to-income ratio is cold comfort.

https://www.statista.com/statistics/237529/price-to-income-ratio-of-hou…

https://www.stats.govt.nz/news/the-current-state-of-housing-in-aotearoa…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.