The good news keeps getting better for first home buyers, with mortgage payments on lower quartile-priced homes at their lowest point in almost four years.

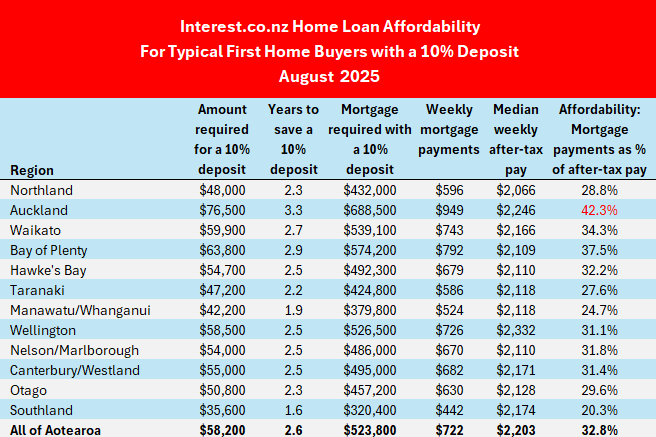

Interest.co.nz calculates what the likely mortgage payments would be on homes purchased at the Real Estate Institute of New Zealand's lower quartile selling price each month.

As well as adjusting for changes in house prices, this is also adjusted for movements in mortgage interest rates each month.

In August, the REINZ's national lower quartile price was $582,000. Interest.co.nz estimates if a property at that price was purchased with a 10% deposit, the likely mortgage payments would be around $722 a week, assuming the mortgage had a 30-year term.

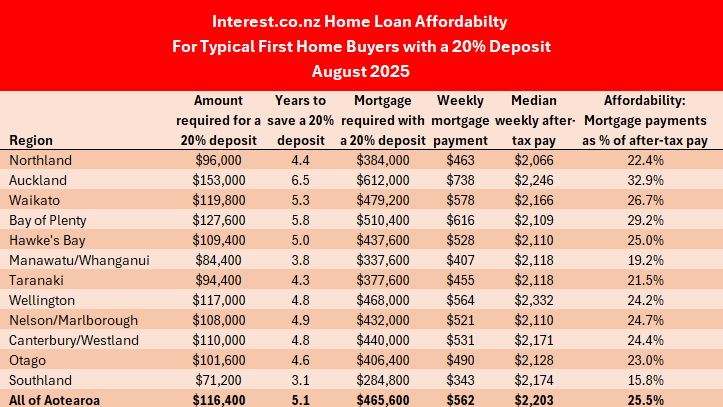

If the home was bought with a 20% deposit, the mortgage payments would reduce to around $562 a week.

That is the lowest both figures have been since October 2021.

For buyers with a 10% deposit the mortgage payments on a lower quartile-priced home hit a record high of $935 a week in November 2023. For those with a 20% deposit the mortgage payments peaked in the same month at $740 a week.

That means mortgage payments on a lower quartile-priced home purchased with a 10% deposit declined by $213 a week between the November 2023 peak and August this year. Mortgage payments on the same home purchased with a 20% deposit declined by $178 a week over the same period.

That drop in mortgage payments is mainly due to a substantial fall in mortgage interest rates, with the average two year fixed rate declining to 4.77% from 7.05% between November 2023 and August 2025. Over the same period there was also a $18,000 drop in the lower quartile house price to $582,000 from $600,000.

What about incomes?

Of course the other side of the affordability coin is what happens with incomes.

Interest.co.nz tracks the pay rates of people aged 25-29 to estimate the likely after-tax pay of people saving for their own home, which allows us to calculate affordability of mortgage payments as a percentage of after-tax pay.

By this measure, a couple who both worked full time home, would have had a combined after-tax income of $2203 a week in August this year, up from $2043 in November 2023.

That's given an aspiring first home buying couple an extra $160 a week after-tax since lower quartile prices peaked in November 2023.

This means mortgage payments have not only decreased in absolute terms, they have also declined as a percentage of after-tax pay.

At the national level, the mortgage payments on a lower quartile-priced home purchased with a 10% deposit would have eaten up 32.8% of a typical first home buying couple's after-tax pay in August this year, down from 45.8% at the November 2023 peak.

For buyers with a 20% deposit, affordability has improved to 25.5% from 36.2% over the same period.

Those are substantial improvements in affordability over the last two years.

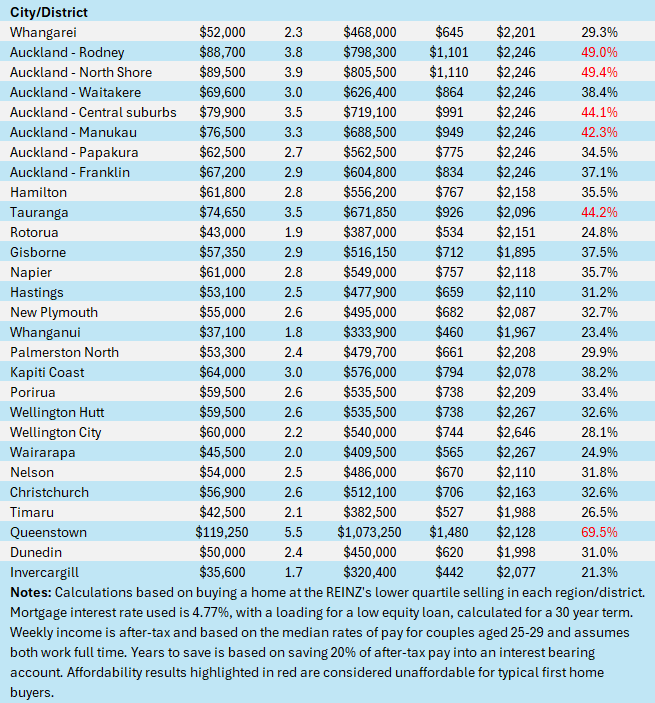

Interest.co.nz considers mortgage payments to be unaffordable when they chew up more than 40% of a couple's after-tax pay.

By that measure, the only urban districts that could still be regarded as unaffordable for buyers with a 10% deposit are Auckland, Tauranga and Queenstown, while the mortgage payments in all other urban districts round the country are well within affordable limits.

Even within the Auckland region, the districts of Waitakere, Papakura and Franklin are affordable for typical first home buyers, regardless of whether they have a 10% or 20% deposit.

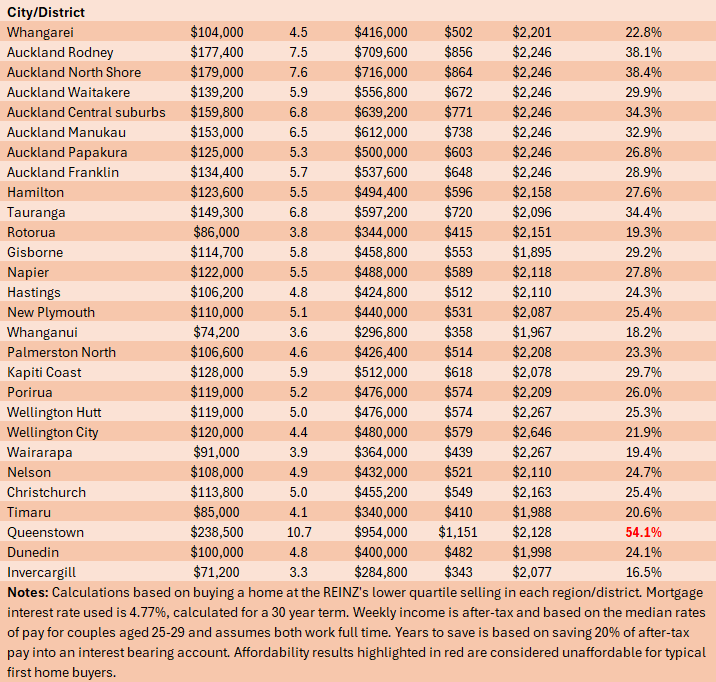

For buyers with a 20% deposit, everywhere except Queenstown is now affordable.

However, while paying off a mortgage has become a lot more affordable for first home buyers, scraping together a deposit remains a major challenge.

Around the regions, a 10% deposit on a lower quartile-priced home ranges from $35,600 in Southland to $76,500 in Auckland and you can double that for a 20% deposit.

If aspiring first home buyers with incomes similar to those used in the examples above saved 20% of their after-tax pay each week into an interest bearing account, it would take them between 1.6 years (Southland) and 3.3 years (Auckland) to save a 10% deposit for a lower quartile-priced home, and double that for a 20% deposit.

So unless they have access to other funds, such as KiwiSaver, assistance from the bank of mum and dad or a large Lotto win, accumulating the deposit is now likely to be the biggest obstacle to home ownership for many.

The tables below show the main affordability measures with either a 10% or 20% deposit, for the main urban areas throughout the country.

The comment stream on this article is now closed.

26 Comments

Great news, and it will keep getting better over summer.

Yes the sooner we get to DTIs or 3 to 5x across the land, the better!

SpecuPonziLand be damned!

Can we build to those DTIs?

You can barely buy an RV for that, so we'd struggle to build a trailer park.

I'd buy now before the collective decides its is a good time to buy and FOMO kicks in.

Sounds very much like you have a stinking pile, to offload?

I've just been around for a while. History tends to repeat.

Do you normally go straight insulting assumptions when people disagree with you, or is it an online comments anonymous thing?

Not an insult, just an obvious observation from your many attempts, in vain since 2022, to refire fomo.

Yes history did repeat until the generational property tsunami high tide peaking in 2021/2022. It won't be seen again for years/decades.

-You are stuck in rearviewland, I really believe. Offloading while you still have value...... maybe the best option?

"Do you normally go straight insulting assumptions when people disagree with you"

That would be a definite "YES" for Gecko

Only during forecast major weather events

FOMO just as applicable to sellers wanting to cash out while they can

I have never seen gold so strong during a good time to buy property...

always a first though

I have never seen gold so strong!

So its as easy to buy a house now as it was at the house price peak!

yes because rates where so low... prices where high though

what a great improvement!!!!!!

If there isn't enough supply, people will pay what they can afford to pay, which is mainly dictated by interest rates. Increasing interest rates will reduce house prices but not increase affordability. In fact the end goal will be less affordability as the lower house prices will reduce the incentive to build.

The only way to make houses more affordable is to increase supply or decrease demand. We are seeing this work in Auckland I believe where supply has increased a lot.

Less chance of having your mortgage rate double or treble and your equity wiped over 2-3 years though.

Not zero chance, but less chance.

Rejoice and celebrate......the Aussies look on in wonderment, at the NZ crashing housing market:)

New Zealand celebrates crashing housing market - MacroBusiness

The latest REINZ data (August 2025), shows the HPI, being the best measure of house prices, up 0.4% over the last year and up 3.2% compound (= up 17%) over the last 5 years. "Hell of a crash" isn't it ?

BTW, I'm glad that houses are more affordable for young people, I just don't like people claiming absolute nonsense.

Not sure the 5yr CAGR will look so flash in 6 months’ time…

Unless there's a serious up turn, we'll have to switch to CALR for a little while.

Aussies are on their way down and I'm picking that will pick up pace. They've worked form the same playbook as NZ and have growing wealth divide also. Moving to Aus now isn't necessarily a great idea but dependent on your line of work.

CBA lost 165, testing higher but next real test is 160

Take note

NZ and austraalia are in lock step... wait a minute

The real test going forward is will the decreasing interest rates cause house prices to rise as demand increases?

It had over the last three decades due to supply not being able to equal demand but as recent interest drops have shown, this is not a given, especially when there is no increase in demand and an increasing supply.

But if Govt policies to allow supply to equal, at the rate of demand, whatever that rate of demand is, are enacted then as interest rates fall and demand increases, then prices will not increase due to non value added costs that are due to speculation.

Prices will still increase at the rate of general inflation and more new houses being build, or from adding value-added inputs.

And we need incomes to increase relative to inflation so that house prices will rise in relative terms but will be cheaper in nominal terms.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.