The number of properties offered for sale at the latest auctions might not have changed, but the sales rate dropped.

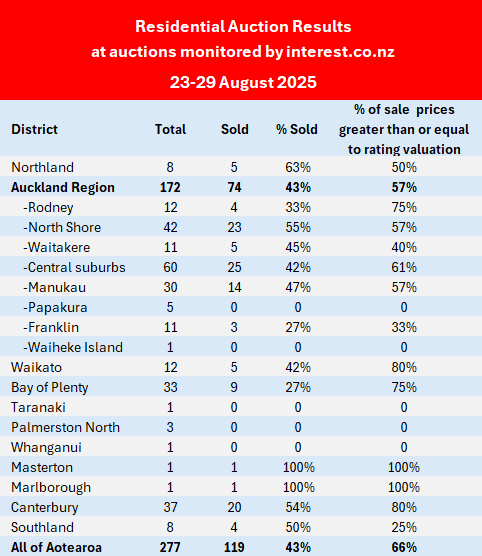

Interest.co.nz monitored the auctions of 277 residential properties around the country over the week of 23-29 August, which was exactly the same number as the previous week.

However the sales rate was slightly softer, with 119 properties selling under the hammer. That's down from 135 the previous week.

That pulled the overall sales rate down to 43% from 49% the previous week.

That wasn't a bad result for the tail end of winter, however results can be a bit more volatile when the total amount of activity is low, so it's difficult to draw too many conclusions from the latest results.

With the market now sitting on spring's doorstep, the next few weeks' results should give a better idea of where things are headed.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the prices achieved for those that sold, are available on our Residential Auction Results page.

The comment stream on this story is now closed.

23 Comments

These numbers generally bounce round a bit from month to month. I look at how many achieve above CV. This month for Auckland just under 25% achieved 2024 CV (57% of the 43% that actually sold)

Shows a very weak market......and significant price drop since the CVs were set mid 2024. The property crash will roll into the late 2020s.

Yet ole Spruiky, the rentals investor, would say ignore CV - we need moonbeams for our unmaintained pile of sticks and soggy dirt.

Its our specinvest and must double every 10 years, its what our high priests A Churchless and Tony Comb preached from the Housing investor, "can't lose" Onewoof gilded pulpit!!!

They all promised a crash was impossible...... Well, this aged worse, than a rotten pile of fish.....

Well, those grifter, tax free gains, was much the case, until the investment world changed in 2021.

Pooperty is now the laggard investments again, as it was, until the 1980s.

I do though, now think, some of the money worshipping Churchless adherents are now getting the message, that the old jig is up and now faulty housing money train, has jumped the track, beyond repair and a pit of capital destruction.

Nz pooperty and orkland in particular was propped up in the 1970s by all those immigrants from the pacific Islands buying houses in freeman's Bay, grey Lynn, ponsonby and renting houses in otahu, new lynn. Those who bought turned into squillionaires, not laggard investments at all.

Are we talking about the same pooperty market or did the nzgecko just swallow a fly

Ps get your fill of oneroof property talk at 4pm

Hey Booms, yes looking forward to the Oneroof aligned, property pushing drug dealer on the ZB.

- how they keep a straight face and keep lying to the sheeple about the "best investment is the world is pooperty" whilst we are amidst the deepest property crash, since the 1970's - in REAL terms.

So you sound donkey deep Booms, in the Onewoof advisors - "best bets"?

Disc: I've got a toe in many pies.

PS - just live my fly pies. Keeps the Gecko full of vim and winning:)

What was your highlight/lowlight of the wonwoof show

Here is Oneroof’s property report from the future: Auckland house prices have dropped to their lowest point in more than four years.

Homes bought at the height of the market in the capital are worth almost 30% ($395,000) less, a huge equity hit from which homeowners are unlikely to recover before 2030.

Add in the inflation rate loss on monetary value and this adds -20% to the specuvesters pain.

So Wellingtank and Auckless is now down an effective REAL rate of -40 to -50% since 2020/21

Best thing that could happen, with hardly any bank sell ups, how is that possible... a lack of over-leverage is how

Perhaps just wanting true price discovery to occur. Can have the stats trend to the truth can we.

Wow prices are dropping despite what the Spruikers are still saying.

We have a high chance of a another leg down given overhang , cost of living pressures and the fact the cuts have not moved the dial

At about 7.4 times incomes houses are no where near affordable.

in uk news even

https://www.theguardian.com/world/2025/aug/29/new-zealand-house-prices-…

“House prices outright falling would actually be advantageous,” Olsen said, adding that decoupling investment and housing is a good thing.

That will be difficult, because many people have their wealth tied up in a house, Olsen said. “But over time, we’ve seen the sort of social ills and social challenges that have been created by having an overly hot and too expensive housing market.”

the 2.8% quarterly is going to look ugly on a PA basis, 2 more cuts coming and perhaps more or they have a crisis on there hands and we will see a lot of mortgagee sales and negitive equity will become common, further slowing sales and hampering recovery

As they say in the UK, NZ is the canary (Choking) in the long awaited, western world want and genuine need, of a crash in home prices.

Good ole NZ, Leading the way again. Winning.

The next major leg down in prices, is occurring.

yeah 2.8 in a Q is actually a major move if not arreseted

thats $300 a day in AKL. so dither with your offer and save $2100 a week

Be SLOW

Th property lady on the Onewoof yesterday, let the "cat out of the coveted Property bag", and may yet be disciplined by the Onewoof cabal....

She said, with somewhat nervousness, the risk of continued housing prices dropping, "was everyone waiting to the future or next year to get and even better lower price".

- Most of us here, know this (little uttered) fact, when seeing deflation or a crashing market, as we now 100% have a crash, in our housing market.

This Onewoof lady may now be banned or cancelled by Onespoof? But this was the one truth said in the whole hour session, of her otherwise spruikishness and promise that the "bottom is now in" - hahahahaha.

This "market bottom" has been fully reamed out, by the real estate gurus and is now so flogged out, the guts and organs are falling out of it.....

A 3 month moving average has to remain positive for 3 moths to indicate buyer support, the bottom is not in, the last Q was down 2.8%. ffs... The Ponzi has failed in a spectacular manner and is not over until prices stabilise.

With excessive stock overhang and withdrawn stock that will come back we are not at the bottom, 2.8% is about 14%pa if this continues. Hence the RBNZ is going to cut hard, negitive equity at 35-45% off peak will be an issue as any house with negitive equity is effectively off the market , so no sales no new mortgages no renovations, its worst outcome.

4.99% is def not the bottom re rates, I can imagine 4.25% yet

Silverdale and waitoki is heading north... in the motorcar. Chris Bishop to the rescue

No new builds silverdale due to water connections issues

unless rural

2 million pooperties up from 600,000 for orkland

Spot on! Our 10yr will track towards China's ~1.8% and it will go even lower from there

House prices are probably dropping in my area, about as quick as the land area around the house shrinks in size. Am not sure that's truly more affordable when you have to pay for cricket balls through the neighbours double glazing

https://www.youtube.com/watch?v=6-g1yzQJMkA

worth the watch

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.