This is a basic profile of an NZX50 listed company. It is not investment advice. We recommend you contact a qualified adviser if you need more information.

Hallenstein Glasson Holdings Limited

Directory

| NZX code: | HLG |

| Short name: | Hallenstein Glassons |

| Legal name: | Hallenstein Glasson Holdings Limited |

| Industry sector: | Consumer Cyclical |

| NZX50 rank: | 49 of 50 |

| Head office address: | Hallenstein Glasson Holdings Limited Level 3, 235-237 Broadway, Newmarket Auckland 1023 |

| Chairman: | Warren James Bell |

| Chief executive: | Chris Kinraid |

| Financial year ended: | August |

| Locations: | New Zealand, India, Asia, UK & Europe, Australia |

| Auditor: | PricewaterhouseCoopers, Auckland |

| Bankers: | ANZ Bank New Zealand Ltd |

Hallensteins Glassons

Select chart tabs

Financial statement history

A. Recent trading and performance summary:

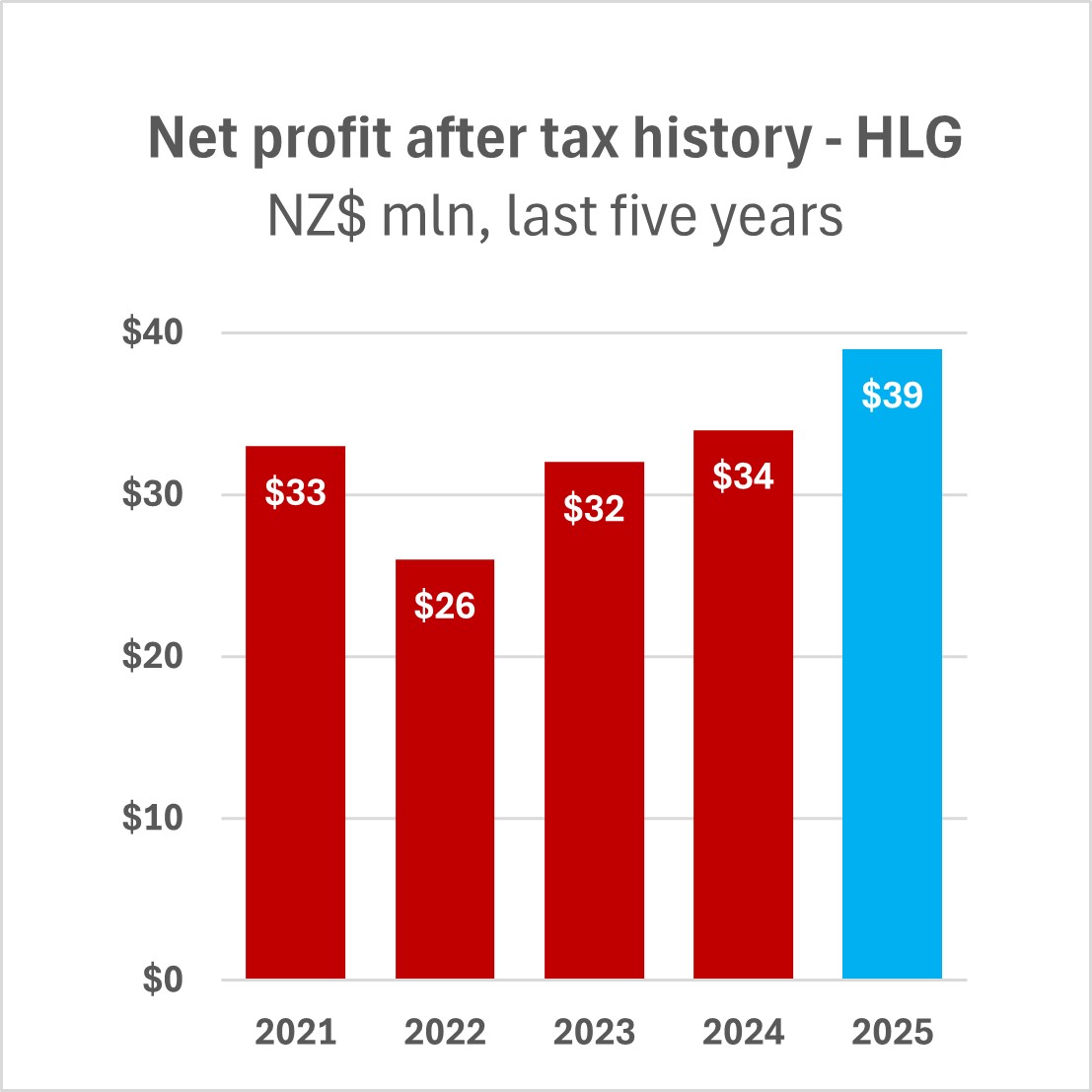

| Total revenue |

NPAT | Earnings per share |

|

| fye August | mln | mln | cents |

| 2016 | $223 | $14 | 23 |

| 2017 | $239 | $17 | 29 |

| 2018 | $278 | $27 | 46 |

| 2019 | $288 | $29 | 49 |

| 2020 | $288 | $28 | 47 |

| 2021 | $351 | $33 | 56 |

| 2022 | $351 | $26 | 43 |

| 2023 | $410 | $32 | 54 |

| 2024 | $436 | $34 | 58 |

| 2025 | $471 | $39 | 66 |

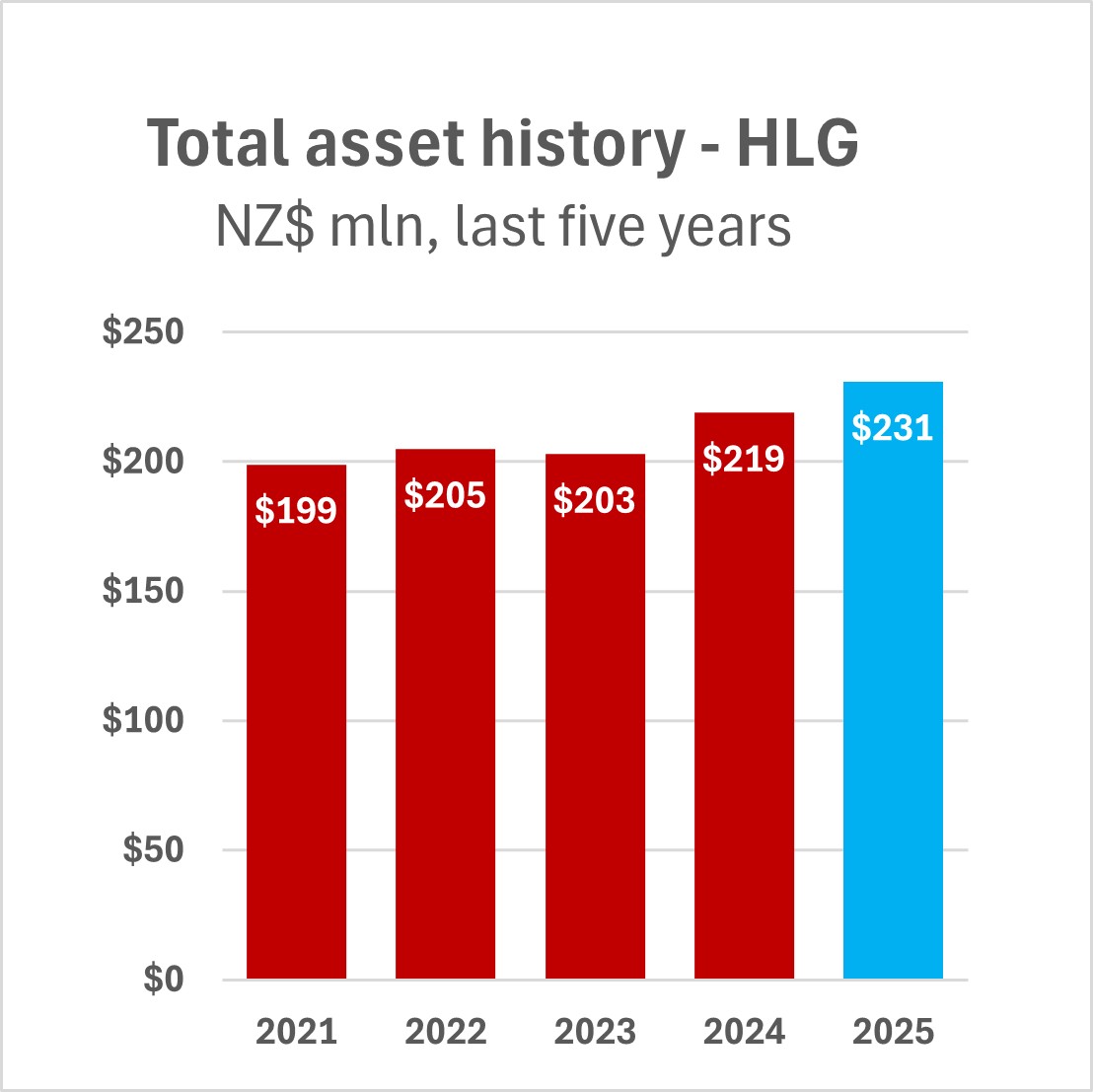

B. Recent financial position summary:

| Total assets |

Total Liabilities |

Equity ratio |

|

| fye August | mln | mln | % |

| 2016 | $79 | $23 | 71 |

| 2017 | $84 | $27 | 69 |

| 2018 | $92 | $24 | 74 |

| 2019 | $105 | $30 | 72 |

| 2020 | $211 | $124 | 70 |

| 2021 | $199 | $110 | 81 |

| 2022 | $205 | $115 | 44 |

| 2023 | $203 | $106 | 48 |

| 2024 | $219 | $116 | 47 |

| 2025 | $231 | $119 | 48 |

C. Recent cash flows and positions:

| Cash inflows |

Cash outflows |

Cash and equiv. at year end |

|

| fye August | mln | mln | mln |

| 2016 | $14 | $24 | $14 |

| 2017 | $29 | $31 | $16 |

| 2018 | $35 | $30 | $17 |

| 2019 | $36 | $37 | $17 |

| 2020 | $71 | $38 | $50 |

| 2021 | $61 | $72 | $39 |

| 2022 | $52 | $57 | $35 |

| 2023 | $68 | $71 | $32 |

| 2024 | $85 | $72 | $42 |

| 2025 | $89 | $76 | $58 |

D. Recent key ratio analysis:

| Earnings per share |

Price: Earnings ratio |

NTA /share |

Dividend yield |

|

| fye August | cents | annual avg | dollars | annual avg % |

| 2023 | 50 | 10 | 1.6 | 11 |

| 2024 | 40 | 18 | 1.7 | 10 |

| 2025 | 57 | 15 | 1.8 | 7 |

Description of trading activities

Hallenstein Glasson Holdings Limited was formed in 1995, as a merger between an iconic menswear retailer Hallenstein Brothers, and fashion retailer Glassons. The company operates more than 130 stores, 36 of them being in Australia. The stores provide market-leading trends in men's and Women's fashion providing fashion, clothing, footwear, and accessories, ranging from street and lifestyle right through to contemporary formal dress.

Chairman Profile

Warren James Bell was appointed Chairman of Hallenstein Glasson Holdings Ltd in 1986. Bell holds appointments on several Boards for both the public and private sectors. Bell is also a Director of different companies.

[back to full list]

CEO profile

Chris Kinraid was announced as Chief Executive of Hallenstein Glasson Holdings Ltd (HLG) in July of 2023, starting the role in early 2024. Kinraid was previously the CFO at KMD Brands where he has operated for nine years. During Kinraid's involvement with KMD brands, a noticeable contribution was his execution of high-profile acquisitions of Rip-curl in 2019. Kinraid has previously held roles at PWC, Cadbury, and Alliance Boots.

Links:

| Company website: | https://www.hallensteinglasson.co.nz/ |

| Investor information: | https://www.hallensteinglasson.co.nz/investment-centre |

| NZX listing: | https://www.nzx.com/companies/HLG |

| Annual reports: | https://www.hallensteinglasson.co.nz/annual-report |