This is a basic profile of an NZX50 listed company. It is not investment advice. We recommend you contact a qualified adviser if you need more information.

Investore Property

Directory

| NZX code: | IPL |

| Short name: | Investore Property |

| Legal name: | Investore Property Limited |

| Industry sector: | Property |

| NZX50 rank: | 43 of 50 |

| Head office address: | Level 12, 34 Shortland Street, Auckland, 1010 |

| Chairman: | Mike Allen |

| Financial year ended: | March |

| Locations: | New Zealand |

| Auditor: | Pwc |

| Bankers: | ANZ, BNZ, CCB, CBA, Westpac |

Investore Property

Select chart tabs

Financial statement history

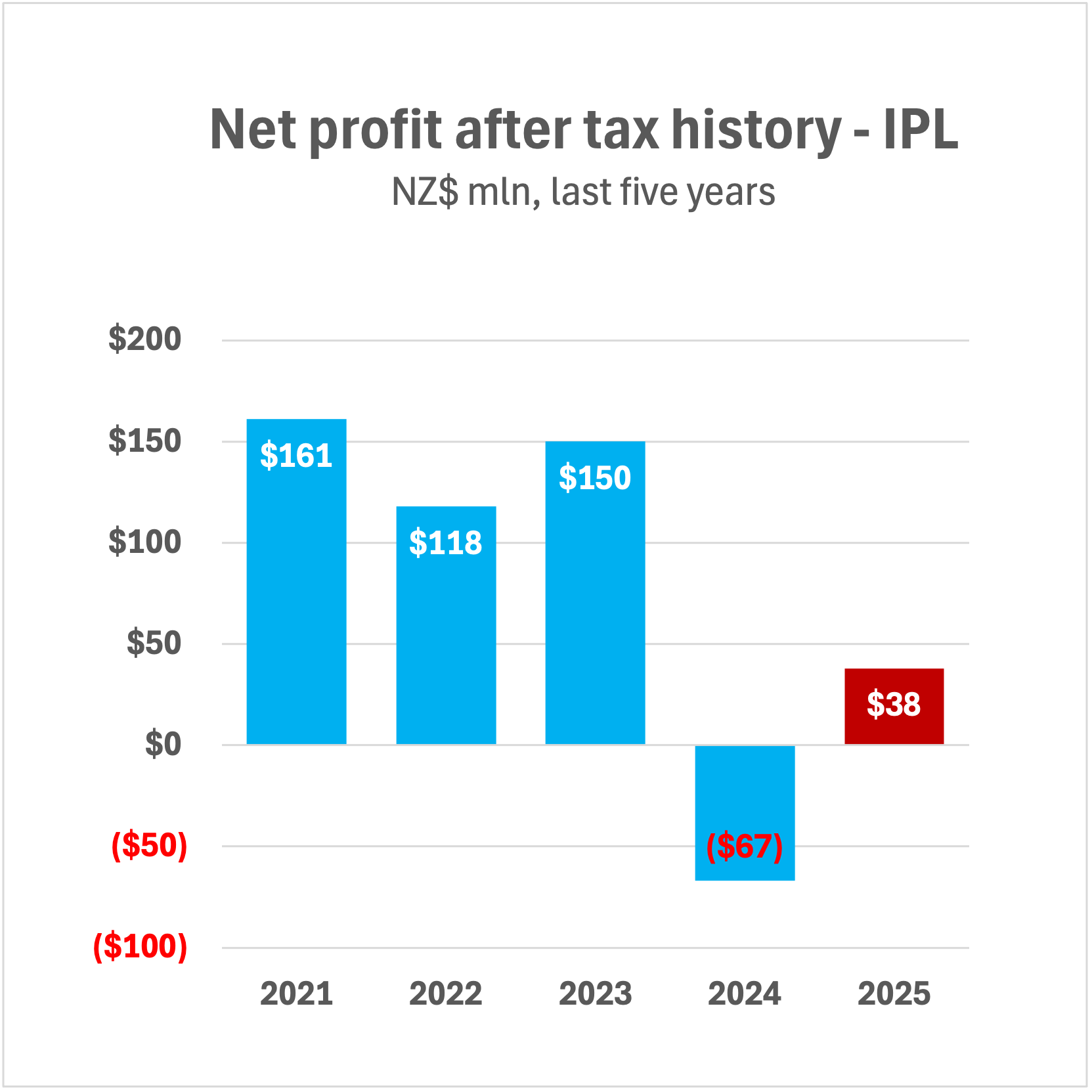

A. Recent trading and performance summary:

| Total revenue |

NPAT | Earnings per share |

|

| fye March | mln | mln | cents |

| 2020 | $54 | $29 | 10 |

| 2021 | $65 | $161 | 45 |

| 2022 | $68 | $118 | 32 |

| 2023 | $71 | $150 | 41 |

| 2024 | $61 | ($67) | (18) |

| 2025 | $62 | $38 | 10 |

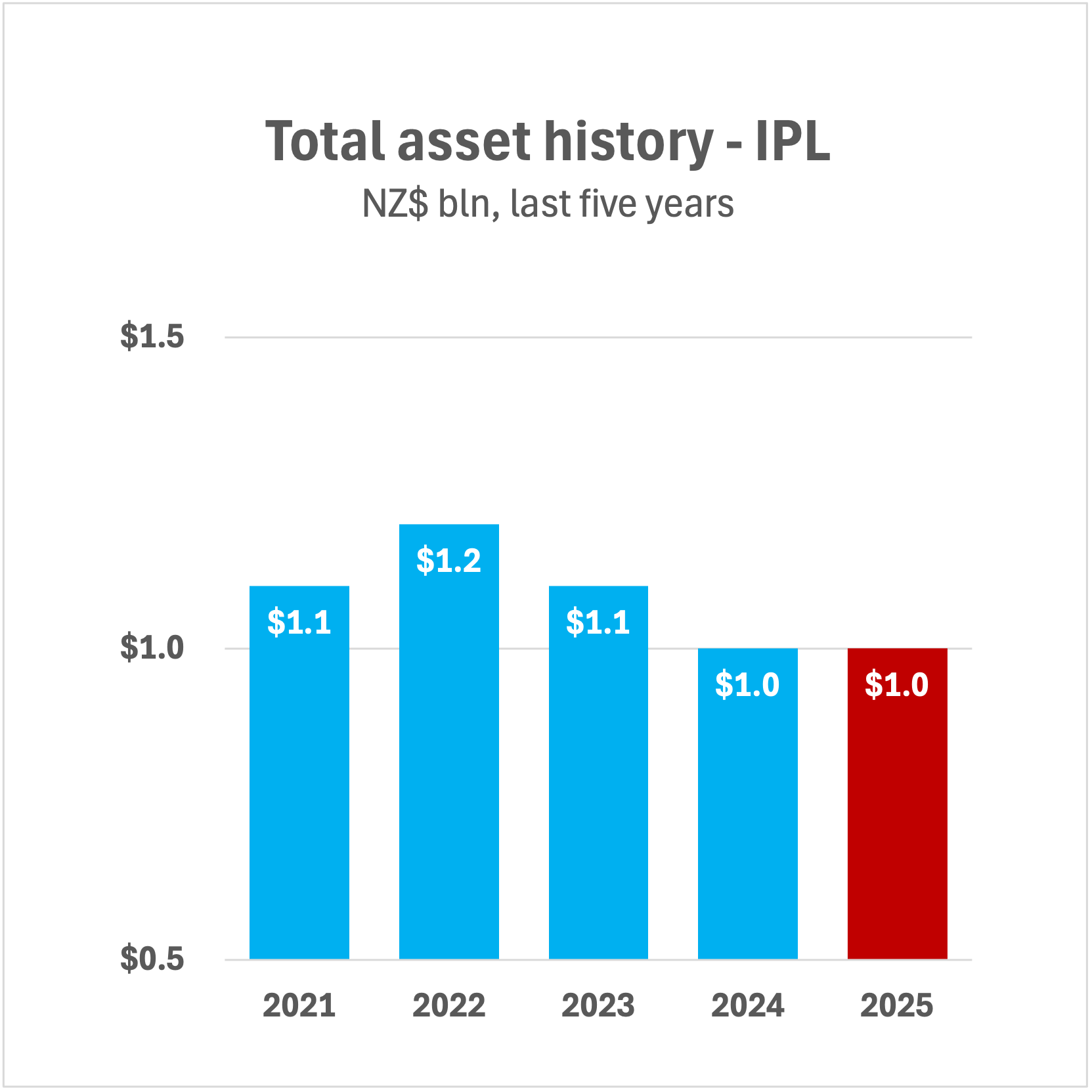

B. Recent financial position summary:

| Total assets |

Total Liabilities |

Equity ratio |

|

| fye March | bln | mln | % |

| 2020 | $0.8 | $260 | 67 |

| 2021 | $1.1 | $305 | 72 |

| 2022 | $1.2 | $384 | 69 |

| 2023 | $1.1 | $405 | 63 |

| 2024 | $1.0 | $427 | 58 |

| 2025 | $1.0 | $410 | 60 |

C. Recent cash flows and positions:

| Cash inflows |

Cash outflows |

Cash and equiv. at year end |

|

| fye March | mln | mln | mln |

| 2020 | $26 | $26 | $4 |

| 2021 | $143 | $140 | $7 |

| 2022 | $74 | $73 | $7 |

| 2023 | $34 | $36 | $5 |

| 2024 | $37 | $28 | $7 |

| 2025 | $43 | $44 | $5 |

D. Recent key ratio analysis:

| Earnings per share |

Price:Earnings ratio |

NTA/share | Dividend yield |

|

| fye March | cents | annual avg | dollars | annual avg % |

| 2020 | 10 | 16 | 2 | 5 |

| 2021 | 45 | 5 | 2 | 4 |

| 2022 | 32 | 5 | 2 | 5 |

| 2023 | -0.4 | 0 | 2 | 7 |

| 2024 | -0.2 | -7 | 2 | 7 |

| 2025 | 10 | 11 | 2 | 7 |

Description of trading activities

Investore Property Ltd is a business that provides property investment services with a portfolio singularly based on large format retail spaces in Āotearoa, New Zealand. The Investore strategy is to invest in ‘Quality, large format retail properties’ throughout NZ and actively manage shareholders’ capital in order to maximise distributions and total returns over a medium-long term basis.

Chairman profile

Mike Allen became Chair of Investore Property in 2016. Allen has a considerable amount of experience in the governing body of business, he is currently Chairman of Vincent Capital Limited, and Wool impact limited. Prior to joining Investore, Allen worked in investment banking and general management based both in New Zealand, and the United Kingdom.

Links:

| Company website: | http://www.investoreproperty.co.nz/ |

| Investor information: | http://www.investoreproperty.co.nz/ |

| NZX listing: | https://www.nzx.com/companies/IPL |

| Annual reports: | http://www.investoreproperty.co.nz/ |