This is a basic profile of an NZX50 listed company. It is not investment advice. We recommend you contact a qualified adviser if you need more information.

Precinct Properties

Directory

| NZX code: | PCT |

| Short name: | Precinct Properties |

| Legal name: | Precinct Properties New Zealand Limited |

| Industry sector: | Real estate investment |

| NZX50 rank: | 20 of 50 |

| Head office address: | Level 12, 188 Quay street, Auckland, 1010 |

| Chairman: | Anne Urlwin |

| Chief executive: | Scott Pritchard |

| Financial year ended: | June |

| Locations: | New Zealand |

| Auditor: | EY |

| Bankers: | ANZ, BNZ, ASB, Westpac, HSBC |

Precinct Properties

Select chart tabs

Financial statement history

A. Recent trading and performance summary:

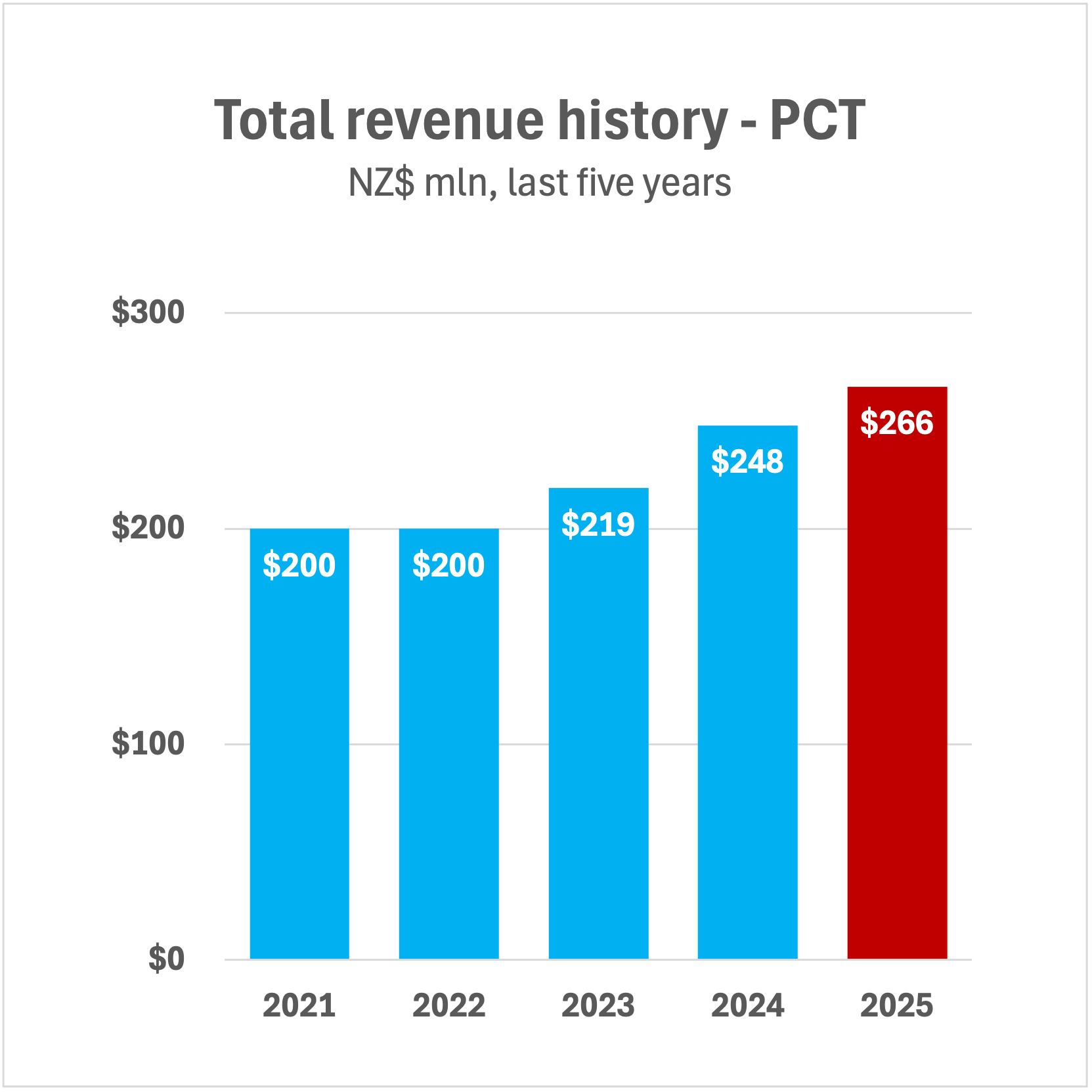

| Total revenue |

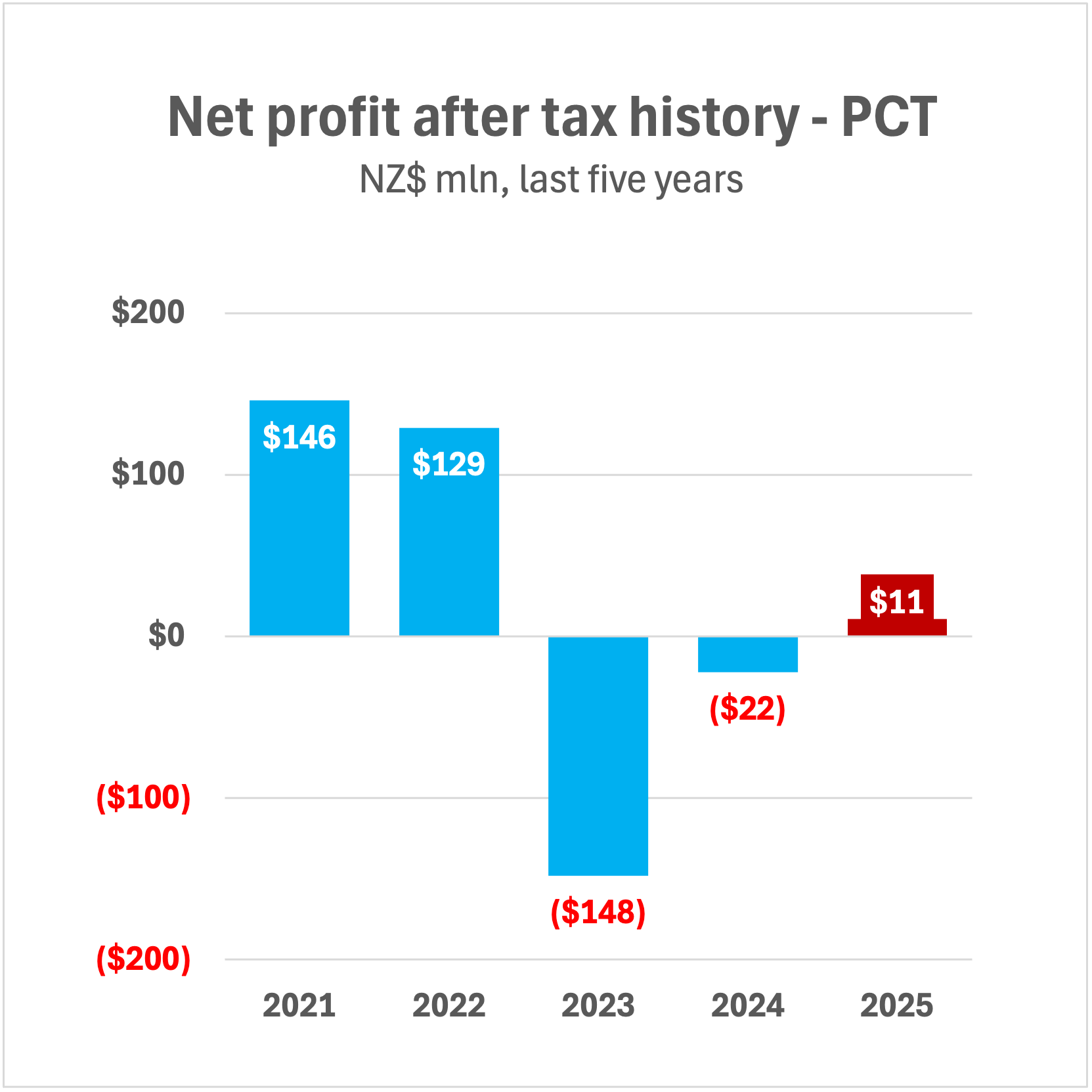

NPAT | Earnings per share |

|

| fye June | mln | mln | cents |

| 2018 | $131 | $255 | 21 |

| 2019 | $136 | $190 | 15 |

| 2020 | $152 | $30 | 2 |

| 2021 | $200 | $146 | 14 |

| 2022 | $200 | $129 | 7 |

| 2023 | $219 | ($148) | -10 |

| 2024 | $248 | ($22) | -1 |

| 2025 | $266 | $11 | 1 |

B. Recent financial position summary:

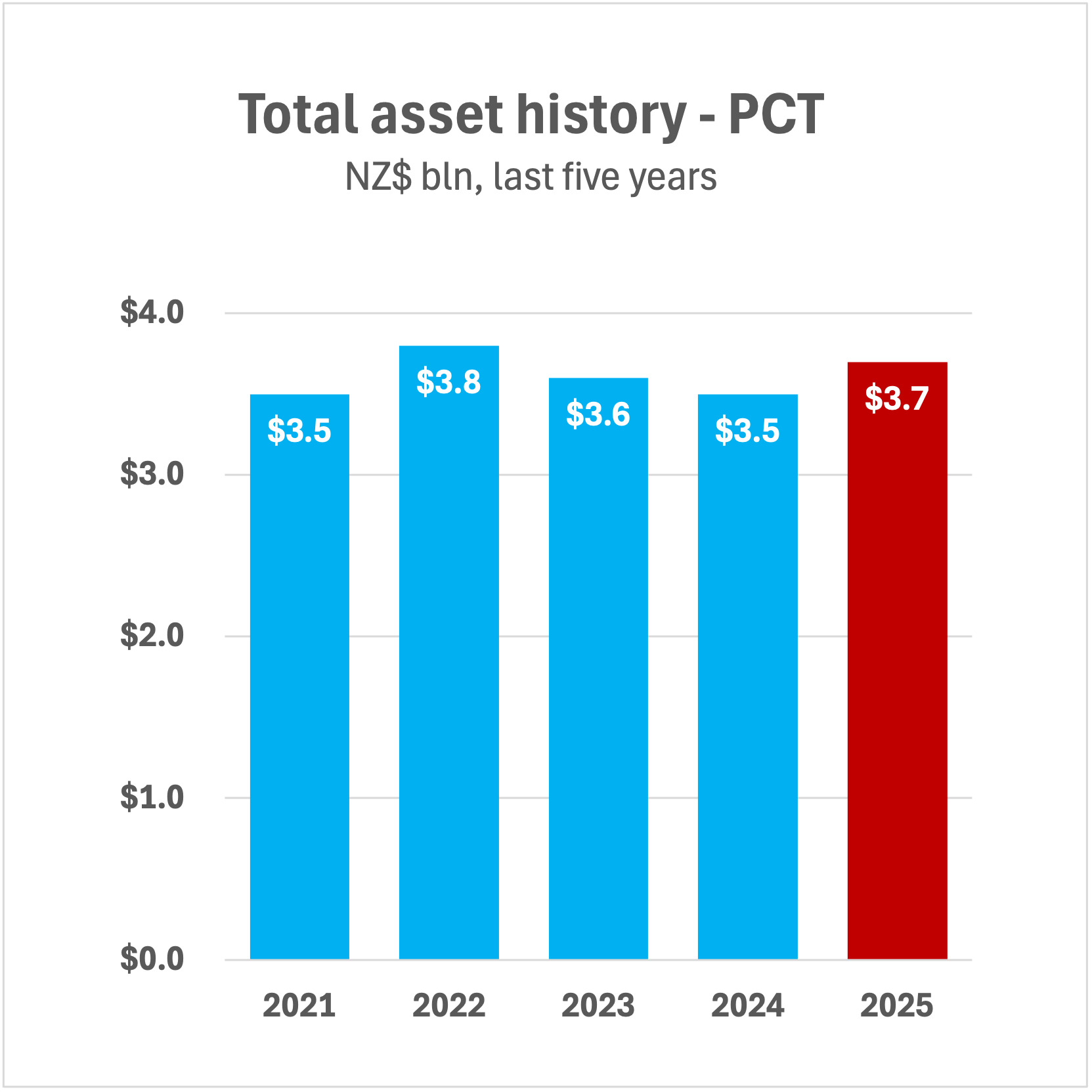

| Total assets |

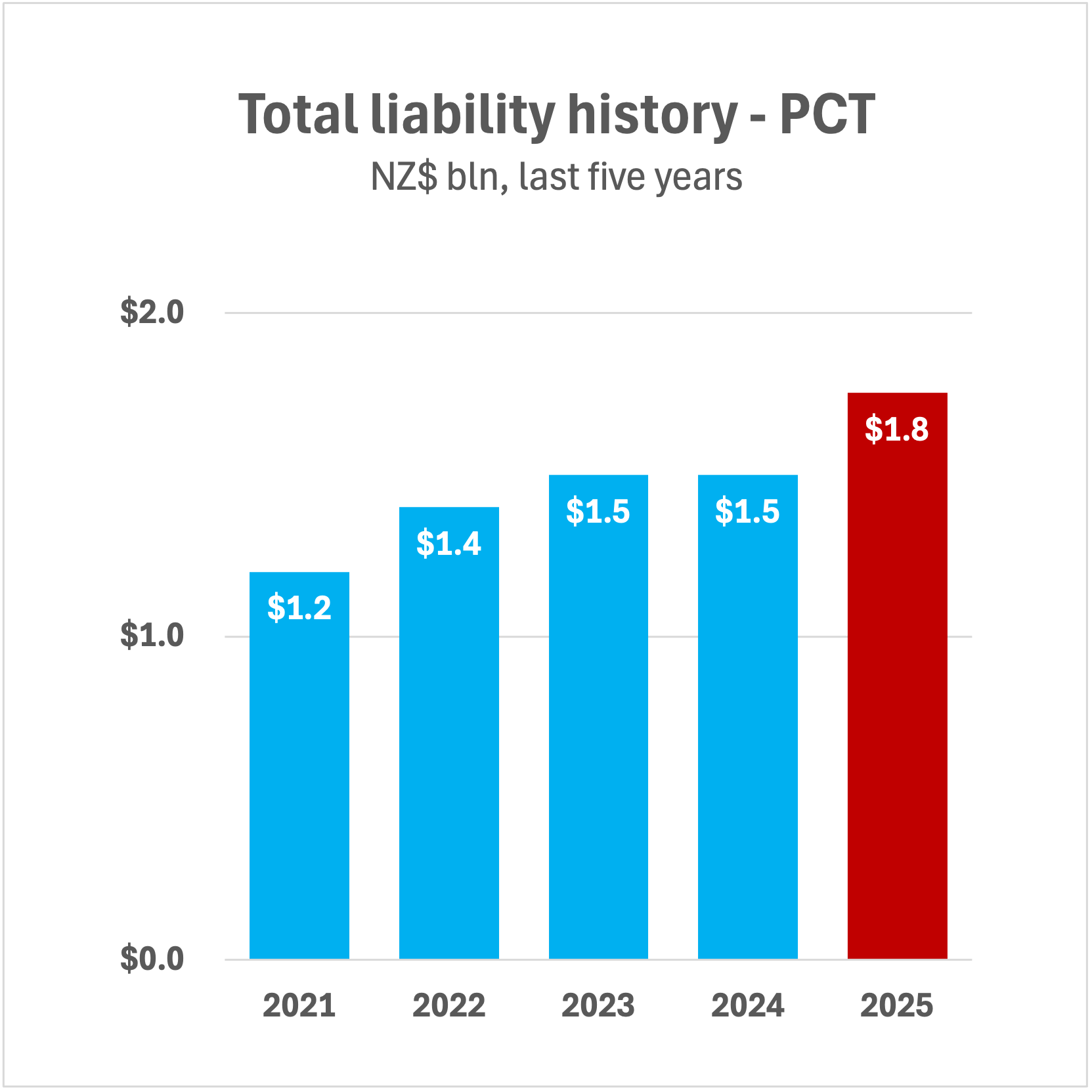

Total Liabilities |

Equity ratio |

|

| fye June | bln | bln | % |

| 2018 | $2.6 | $0.9 | 66 |

| 2019 | $2.9 | $0.9 | 68 |

| 2020 | $3.2 | $1.3 | 60 |

| 2021 | $3.5 | $1.2 | 64 |

| 2022 | $3.8 | $1.4 | 64 |

| 2023 | $3.6 | $1.5 | 60 |

| 2024 | $3.5 | $1.5 | 58 |

| 2025 | $3.7 | $1.8 | 53 |

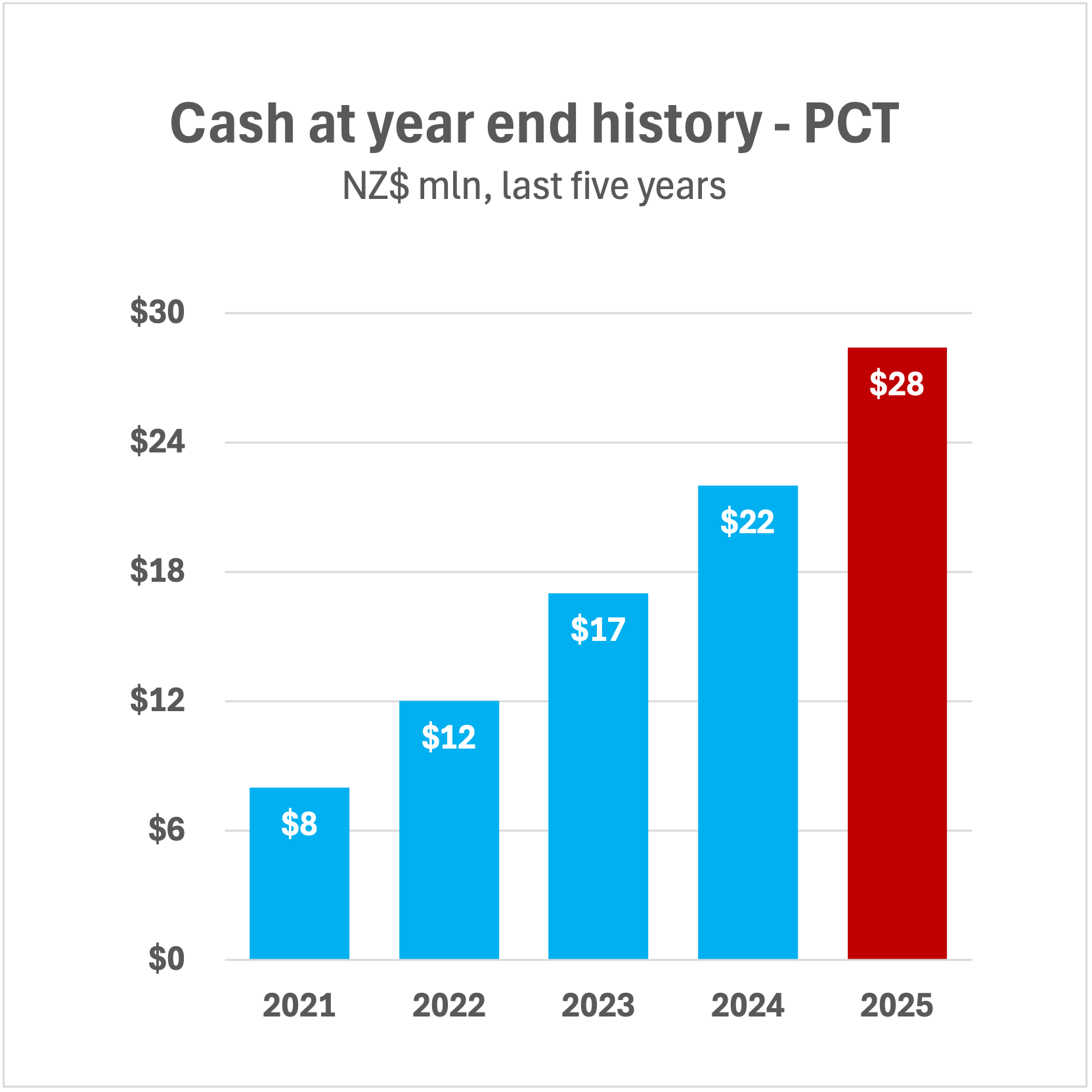

C. Recent cash flows and positions:

| Cash inflows |

Cash outflows |

Cash and equiv. at year end |

|

| fye June | mln | mln | mln |

| 2018 | $435 | $306 | $3 |

| 2019 | $229 | $94 | $7 |

| 2020 | $392 | $239 | $8 |

| 2021 | $230 | $229 | $8 |

| 2022 | $288 | $351 | $12 |

| 2023 | $118 | $113 | $17 |

| 2024 | $80 | $74 | $22 |

| 2025 | $248 | $242 | $28 |

D. Recent key ratio analysis:

| Earnings per share |

Price:Earnings ratio |

NTA/share | Dividend yield |

|

| fye June | cents | annual avg | dollars | annual avg % |

| 2018 | 21 | 6 | 1.4 | 4 |

| 2019 | 15 | 12 | 1.5 | 3 |

| 2020 | 2 | 68 | 1.4 | 4 |

| 2021 | 14 | 11 | 1.5 | 4 |

| 2022 | 7 | 19 | 1.5 | 5 |

| 2023 | -9 | N/A | 1.4 | 6 |

| 2024 | -8 | -15 | 1.4 | 5 |

| 2025 | 0.002 | 628 | 1.2 | 5 |

Description of trading activities

Precinct Properties is the largest owner and developer of premium inner-city real estate in Auckland and Wellington. They invest in high quality concentrated ownership of city centre real estate in strategic locations.

CEO profile

Scott Pritchard has been the CEO of Precinct Properties since 2010. Pritchard has previous experience in various property roles at Goodman Property Trust, Auckland International Airport Limited, and Urbus Properties Limited. Pritchard holds a Masters degree in Management from Massey University. Pritchard is National Chair of Property Council New Zealand, and a Trustee of the Tania Dalton Foundation.

Chairman profile

Anne Urlwin has been a Director of Precinct Properties (PCT) since 2019 and is the Chair of the Audit and Risk committee. Urlwin was appointed Chair of PCT in early 2023, effective in the last quarter of the year. Urlwin has experience in a diverse range of sectors including infrastructure, property development, construction, health, telecommunications, renewable energy, regulation, and financial services. Urlwin also holds current governance roles for Vector Limited and Infratil (Both NZX listed companies). Urlwin was made an Officer of the New Zealand Order of Merit in 2022 for her services to business.

Links:

| Company website: | https://www.precinct.co.nz/ |

| Investor information: | https://www.precinct.co.nz/investors |

| NZX listing: | https://www.nzx.com/companies/PCT |

| Annual reports: | https://www.precinct.co.nz/reporting-and-disclosure |