This is a basic profile of an NZX50 listed company. It is not investment advice. We recommend you contact a qualified adviser if you need more information.

Goodman Property

Directory

| NZX code: | GMT |

| Short name: | Goodman Property Trust |

| Legal name: | Goodman Property Trust Limited |

| Industry sector: | Real Estate investment |

| NZX50 rank: | 14 of 50 |

| Head office address: | KPMG Centre, Level 2, 18 Viaduct Harbour Avenue, Auckland, 1010 |

| Chairman: | John Dakin |

| Chief executive: | James Spence |

| Financial year ended: | March |

| Locations: | New Zealand |

| Auditor: | Pwc |

| Bankers: | Commonwealth Bank of Aus, Westpac NZ, ANZ, BNZ, HSBC |

Goodman Property Trust

Select chart tabs

Financial statement history

A. Recent trading and performance summary:

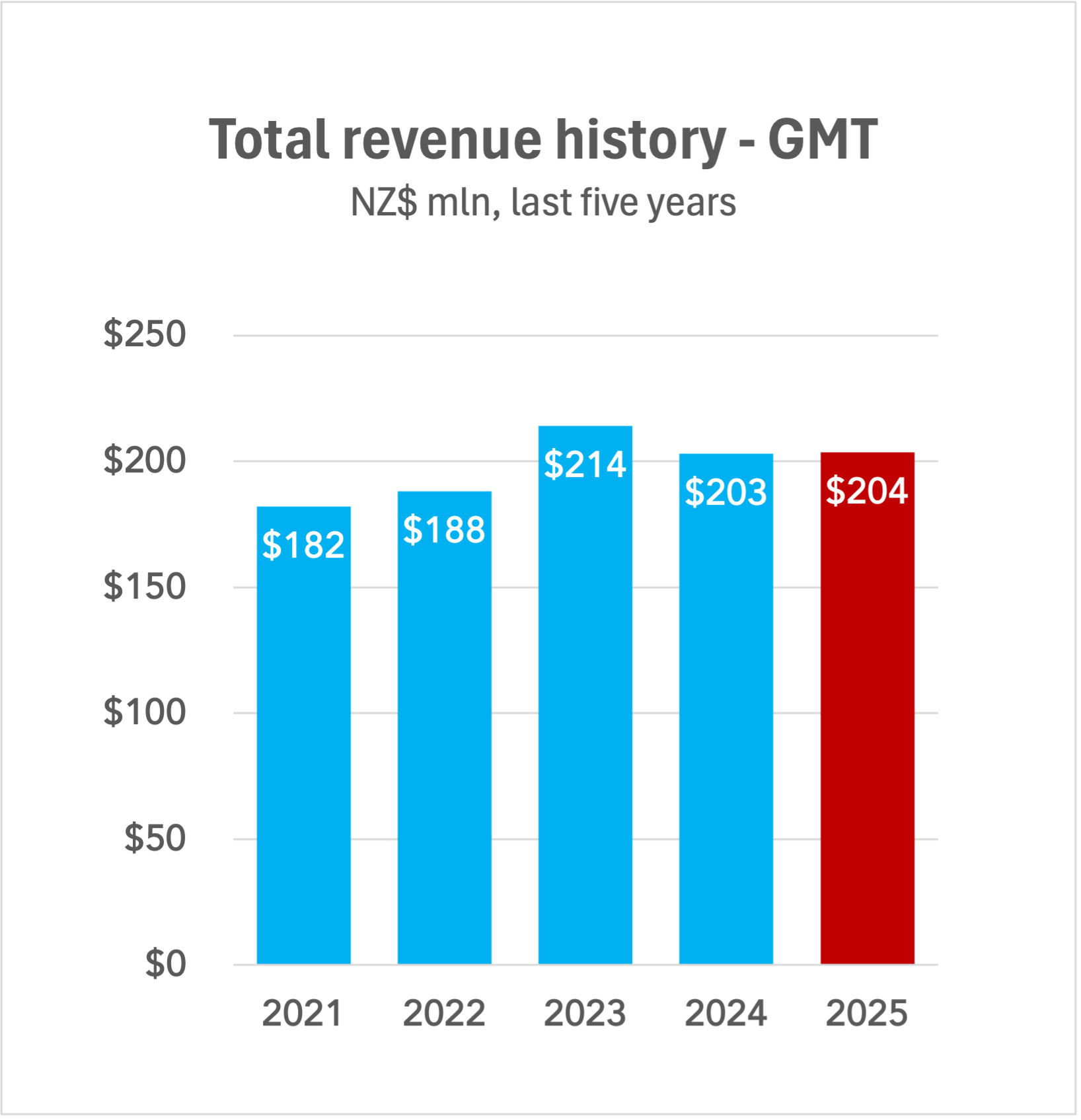

| Property revenue |

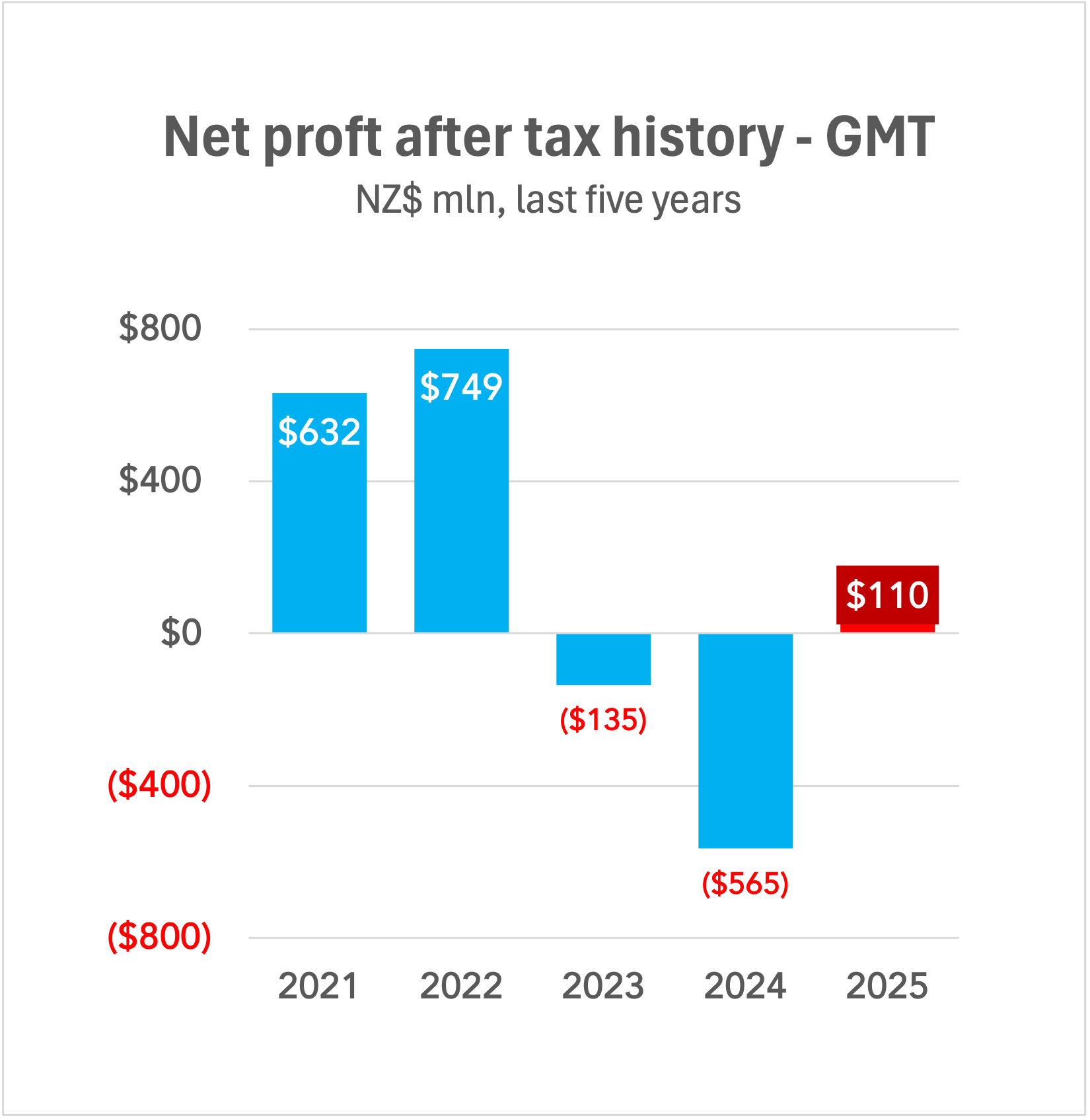

NPAT | Earnings per share |

|

| fye Mar | mln | mln | cents |

| 2018 | $160 | $194 | 15 |

| 2019 | $155 | $320 | 25 |

| 2020 | $172 | $262 | 20 |

| 2021 | $182 | $632 | 45 |

| 2022 | $188 | $749 | 54 |

| 2023 | $214 | ($135) | 54 |

| 2024 | $203 | ($565) | -40 |

| 2025 | $204 | $110 | 7 |

B. Recent financial position summary:

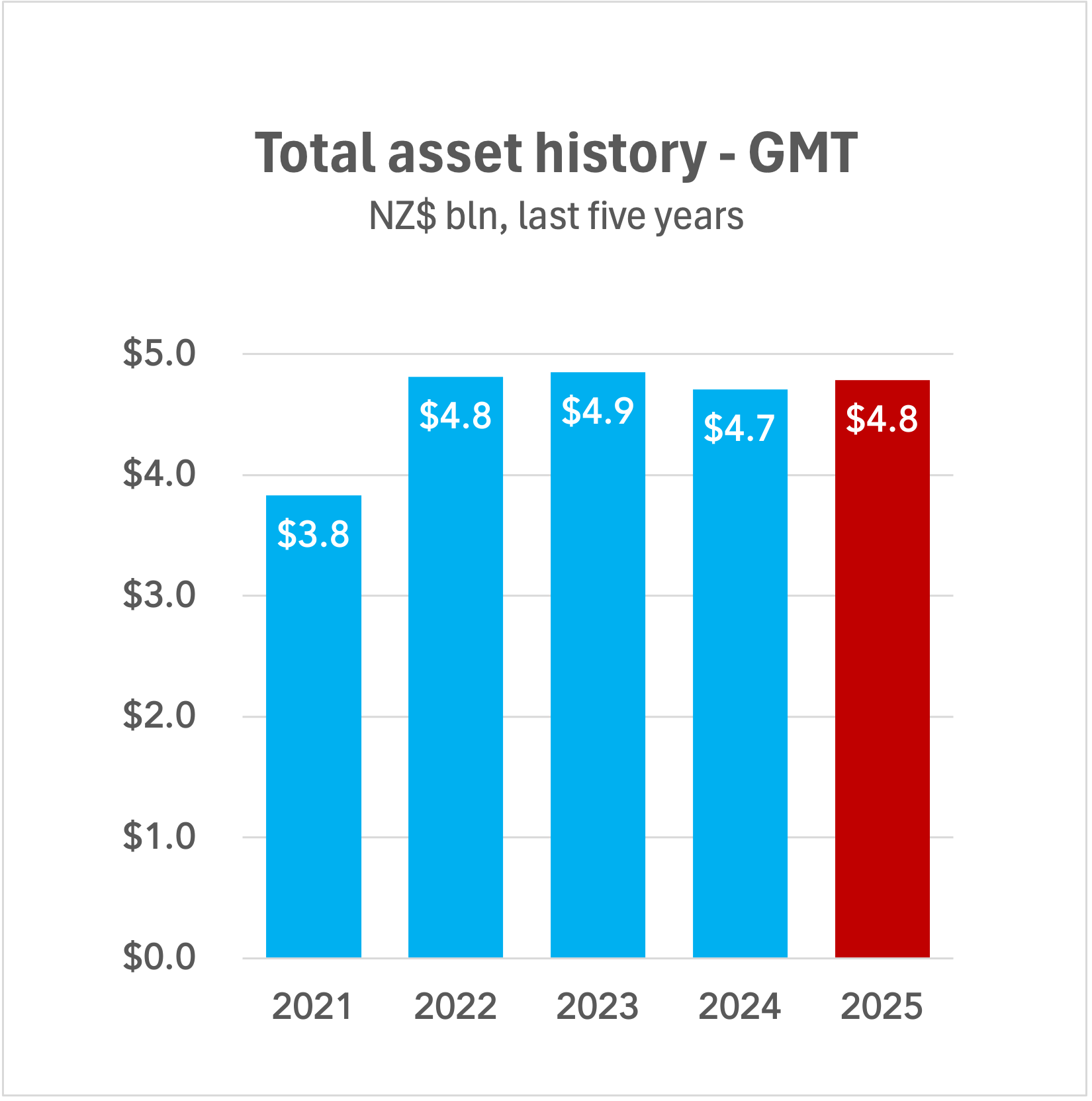

| Total assets |

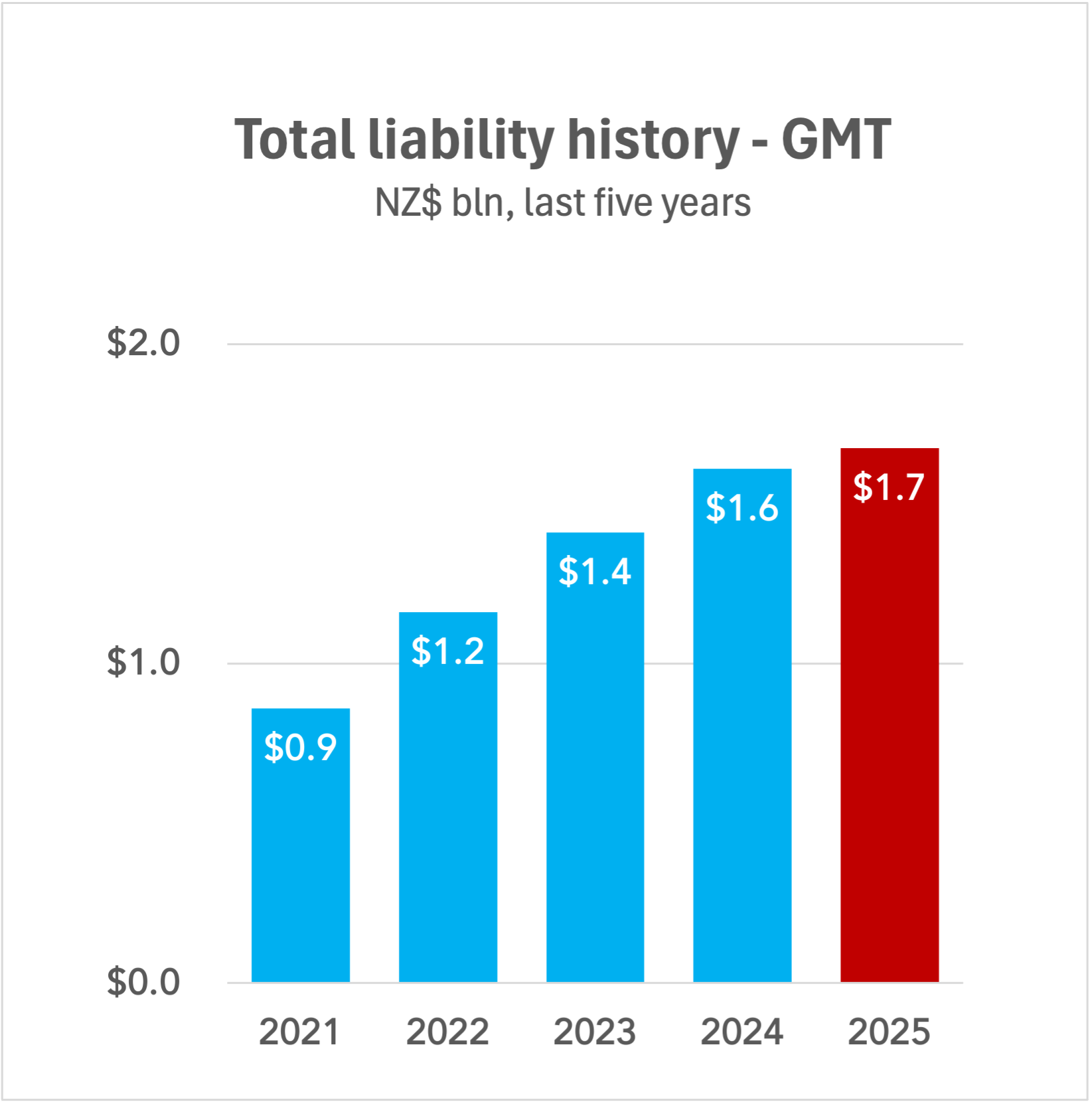

Total Liabilities |

Equity ratio |

|

| fye Mar | bln | bln | % |

| 2018 | $2.7 | $0.9 | 66 |

| 2019 | $2.7 | $0.7 | 75 |

| 2020 | $3.2 | $0.8 | 76 |

| 2021 | $3.8 | $0.9 | 78 |

| 2022 | $4.8 | $1.2 | 76 |

| 2023 | $4.9 | $1.4 | 71 |

| 2024 | $4.7 | $1.6 | 66 |

| 2025 | $4.8 | $1.7 | 65 |

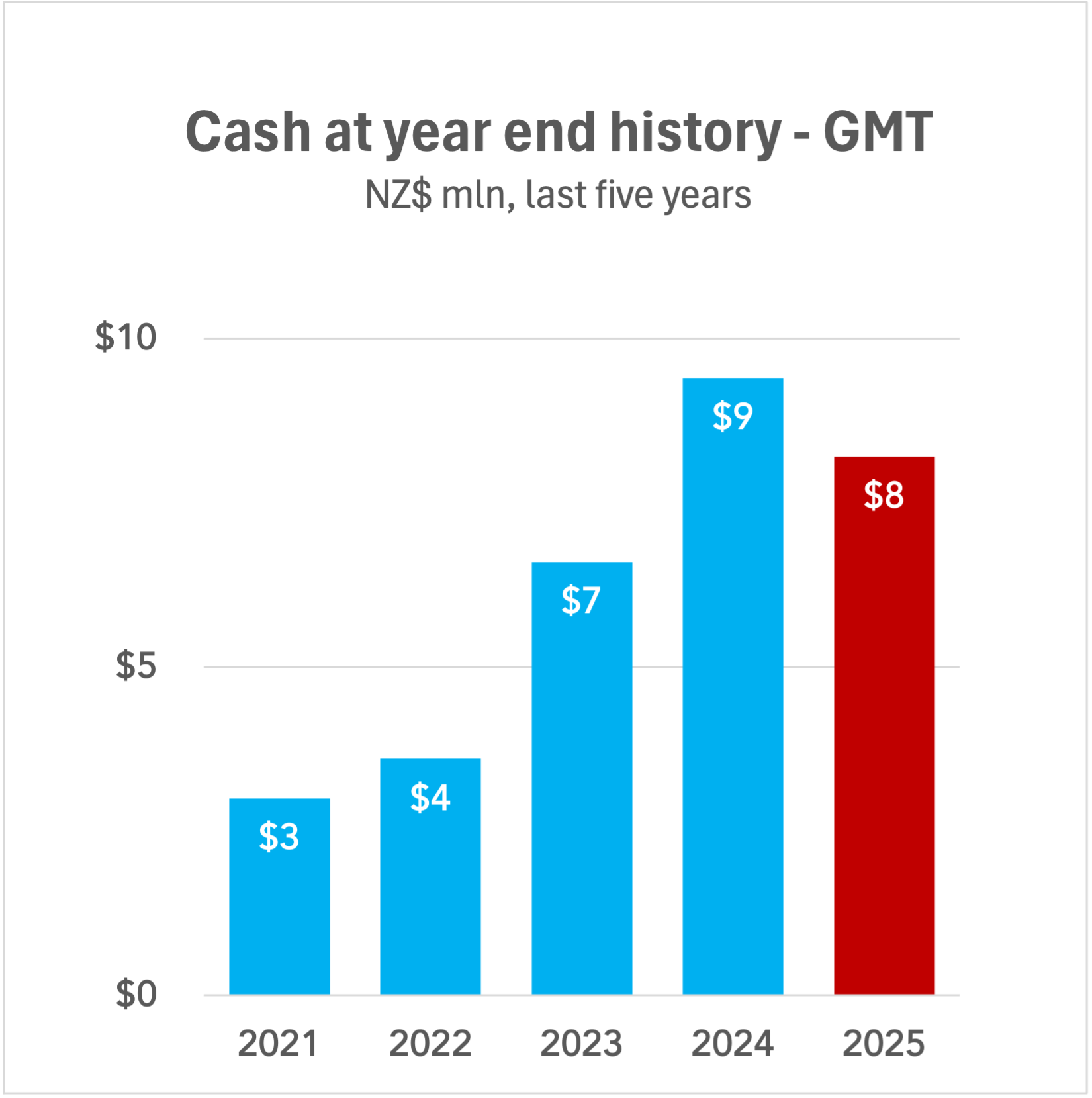

C. Recent cash flows and positions:

| Cash inflows |

Cash outflows |

Cash and equiv. at year end |

|

| fye Mar | mln | mln | mln |

| 2018 | $135 | $132 | $5 |

| 2019 | $333 | $335 | $3 |

| 2020 | $182 | $176 | $9 |

| 2021 | $152 | $158 | $3 |

| 2022 | $314 | $314 | $4 |

| 2023 | $250 | $247 | $7 |

| 2024 | ($315) | ($405) | $9 |

| 2025 | $161 | $163 | $8 |

D. Recent key ratio analysis:

| Earnings per share |

Price:Earnings ratio |

NTA/share | Dividend yield |

|

| fye March | cents | annual avg | dollars | annual avg % |

| 2018 | 15 | 9 | 1 | N/A |

| 2019 | 25 | 7 | 2 | N/A |

| 2020 | 20 | 11 | 2 | N/A |

| 2021 | 45 | 5 | 2 | N/A |

| 2022 | 54 | 4 | 3 | N/A |

| 2023 | -0.1 | 0 | 2 | 3 |

| 2024 | -40 | -5 | 2 | 3 |

| 2025 | 0.1 | 28 | 2 | 3 |

Description of trading activities

Goodman Property Trust is New Zealand's largest listed property investor by market capitalisation. The manager of the trust is the ASX-listed Goodman Group, which holds a 21% cornerstone Unitholding in the trust. Goodman Property investments have an investment grade rating of 'BBB' from Standard & Poor's

CEO Profile

James Spence was appointed as the CEO of Goodman Property Trust on the 1st of January 2023. Spence has over 17 years of experience in the corporate, property, and fund management sectors. Spence was based in different locations within Europe, before coming back to New Zealand. Before being appointed as CEO of Goodman Property Trust (GMT), Spence was the Director of Investment Management, which meant his role was to oversee the investment decisions of GMT. Spence holds a Property degree which he received from the University of Auckland, as well as a Graduate diploma in Applied Finance from Kaplan Education in Australia.

Chairman Profile

John Dakin was appointed Chair of GMT on the 29th of May, 2023. Before Dakin was appointed Chair, he was a Goodman group executive and a non-executive director of the Goodman-NZ Limited Board.

Links:

| Company website: | https://nz.goodman.com/ |

| Investor information: | https://nz.goodman.com/investor-centre/investor-faq |

| NZX listing: | https://www.nzx.com/companies/GMT |

| Annual reports: | https://nz.goodman.com/investor-centre/annual-and-interim-reports |