This Top 5 comes from interest.co.nz's own Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

We are always keen to find new Top 5 contributors so if you're interested in contributing, contact gareth.vaughan@interest.co.nz.

1) How western advisers helped an African autocrat’s daughter amass and shield a fortune.

The International Consortium of Investigative Journalists (ICIJ) is back with another major investigation based on leaked material. The "Luanda Leaks" details "two decades of unscrupulous deals" that made Isabel dos Santos, daughter of José Eduardo who was Angola's president from 1979 to 2017, Africa’s wealthiest woman "and left oil- and diamond-rich Angola one of the poorest countries on Earth." Surprisingly for a tale that features hundreds of shell companies from dozens of jurisdictions, no New Zealand registered entities feature.

The Luanda Leaks series is based on documents provided to ICIJ by the Paris-based Platform to Protect Whistleblowers in Africa.The series includes an article on dos Santos' enablers, with consultants, accountants and lawyers providing "vital support at each step of the way."

As the ICIJ puts it;

The story of how Angolan public money came to be used to fete the 1% on the French Riviera goes beyond that of a dubious business strategy gone wrong. It offers a window into the lightly regulated professional services sector, which over the years has become a cornerstone of a thriving offshore industry that drives money laundering, tax avoidance and public corruption around the globe.

Dos Santos made her fortune by taking a cut of Angola’s wealth, often courtesy of government decrees signed by her father. She also benefited from insider deals, preferential loans and contracts fuelled by public money, a review by the International Consortium of Investigative Journalists and 36 media partners found. Over the last two decades, she acquired valuable stakes in every important Angolan industry, including oil, diamonds, telecom and banking.

And;

From storefront offices in the tiny tax haven of Malta to conference rooms in Switzerland and Angola, Boston Consulting, PwC (formerly PricewaterhouseCoopers), KPMG and other major firms helped sustain the dos Santos empire for years. These enabling relationships continued long after many Western banks had cut off dos Santos amid questions about the source of her wealth, according to ICIJ’s examination of the Luanda Leaks.

Accountants disregarded red flags that experts say should have triggered alarms. Lawyers at prominent Portuguese law firms helped set up shell companies and move money for dos Santos and Dokolo. Consultants advised them on ways to run their businesses and avoid taxes.

Financial institutions are subject to stringent regulatory requirements, which, even if not always enforced, tend to make them pay close attention to their clientele. Professional firms have faced far less scrutiny. As such, they are often less likely to say no to a risky and wealthy client.

Speaking to The Guardian at Davos, PwC chairman Bob Moritz, says he's “shocked and disappointed” by revelations PwC advised companies owned by dos Santos...

2) Money allegedly laundered through ANZ NZ bank account.

British businessman David Charles Rae is facing up to six years in prison in the United States after pleading guilty to conspiracy to commit international money laundering, and money laundering, The Lancashire Post reports. Rae will be sentenced in New Jersey February for his role in an alleged US$150 million health care fraud.

Unlike dos Santos, Rae and his associates apparently did use New Zealand entities. A forfeiture judgment and preliminary order of forfeiture from the US District Court, District of New Jersey, notes;

"...funds and other property in account no. 74USD0001 at ANZ Bank of New Zealand in the name of Sympatic Global Solutions Limited Partnership."

Slightly confusingly NZ Companies Office records show a registered company named Sympatic Global Solutions Ltd and a registered limited partnership named Sympatic Solutions LP. Ross Hanning of Wellington-based fiduciary and trust consulting service provider RPH Consulting is listed as sole director of the company and sole shareholder of its parent Craigellachie Holdings Ltd. Sympatic Global Solutions Ltd is listed as general partner of Sympatic Solutions LP.

At the time of writing Hanning hadn't responded to interest.co.nz's requests for comment. An ANZ NZ spokesman declined to comment.

3) Bankers push back against climate action calls.

Speaking at the World Economic Forum in Davos, Switzerland, some senior executives of major international financial service providers are pushing back against calls for their institutions to be more proactive in combating climate change. This comes against the backdrop of teenaged climate campaigner Greta Thunberg hitting out at companies for not doing enough. Additionally tennis superstar Roger Federer has come under criticism at the Australian Open over his sponsorship deal with Credit Suisse because of the bank's links to the fossil fuel industry. And the Bank for International Settlements has aired "green swan" risks.

From Davos The Financial Times reports on push back from Citibank's CEO Mike Corbat, Goldman Sachs's CEO David Solomon, and AIG CEO Brian Duperreault.

“I don’t want to be the sharp end of the spear, meaning I don’t want to have to be the one telling [companies] or enforcing standards in an industry or business,” he [Corbat] said.

He added: “We don’t want to find ourselves being the person that dictates winners and losers. A bank’s job is to support the communities in which it operates. It is not to dictate outcomes.”

And;

“If you’re looking for a line, there’s not a line. There’s a transition that’s going on, and my view is this is going to be a multi-decade transition where we see changes in the way people allocate capital,” Mr Solomon said during a panel discussion.

“Should we not raise money for a company that is a carbon company or a fossil fuel company? The answer is no, we’re not going to [stop doing] that.”

Meanwhile, someone else made an impression at Davos too. (Cartoon by Morten Morland).

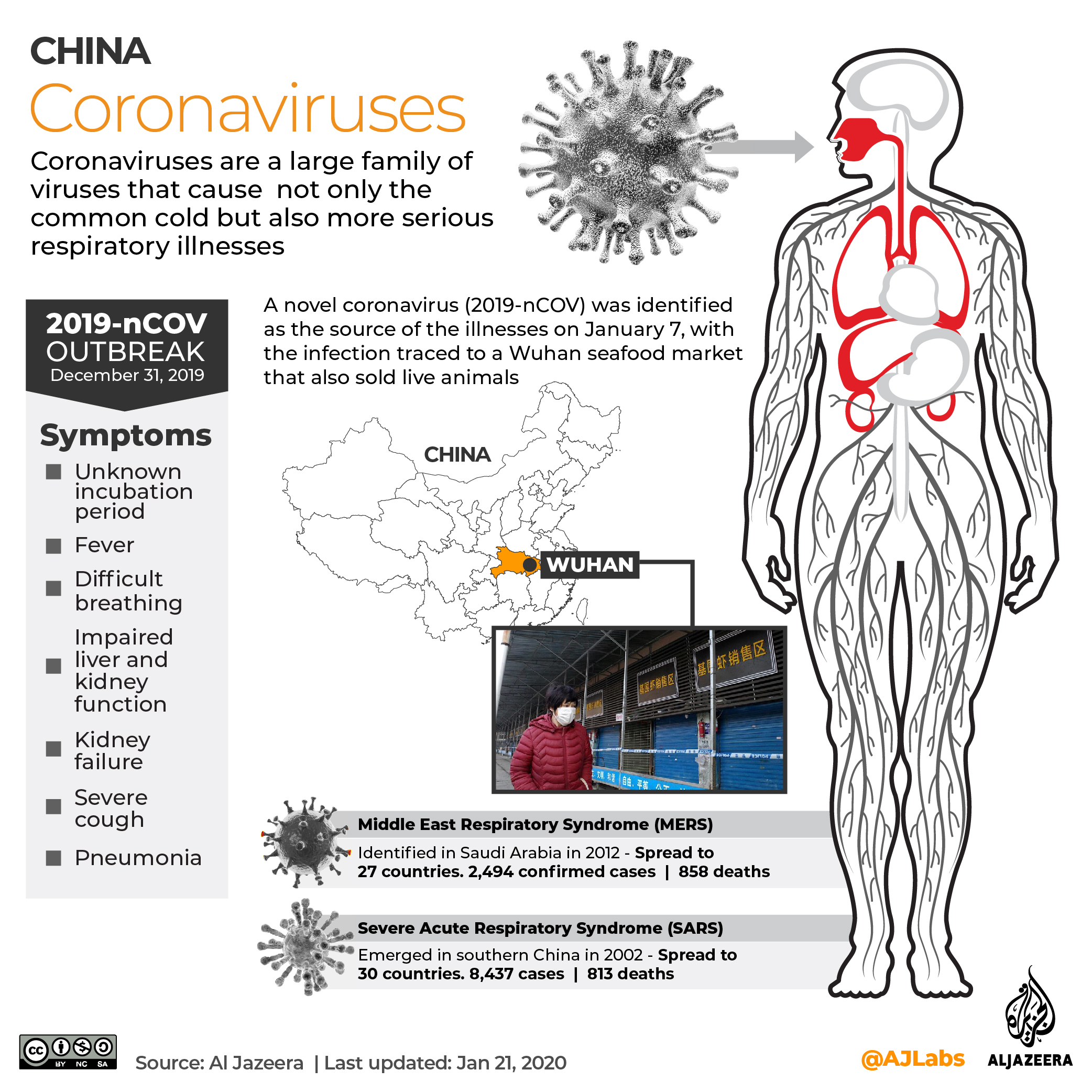

4) Coronavirus, - what it is plus the symptoms, vaccines and risks.

Believed to have originated in a seafood market in the Chinese city of Wuhan, Coronavirus has spooked financial markets this week. At the time of writing at least 17 people have died from coronavirus, it's spreading out of China and concerns are mounting about the virus spreading further as hundreds of millions of people travel for Lunar New Year celebrations.

So what is it?

Al Jazeera has a useful explainer.

According to the World Health Organization, coronaviruses are a family of viruses that cause illness ranging from the common cold to more severe diseases such as Middle East respiratory syndrome (MERS) and severe acute respiratory syndrome (SARS).

These viruses are transmitted between animals and people. SARS, for instance, was believed to have been transmitted from civet cats to humans while MERS travelled from a type of camel to humans.

Several known coronaviruses are circulating in animals that have not yet infected humans.

A novel coronavirus, identified by Chinese authorities on January 7 and currently named 2019-nCoV, is a new strain that had not been previously identified in humans.

Little is known about it, although human-to-human transmission has been confirmed.

The signs of infection include respiratory symptoms, fever, cough, shortness of breath and breathing difficulties.

In more severe cases, it can lead to pneumonia, severe acute respiratory syndrome, kidney failure and even death.

Apparently there's no vaccine for the new virus.

Chinese health authorities are still trying to determine the origin of the virus, which they say came from a seafood market in Wuhan where wildlife was also traded illegally. WHO also says an animal source appears most likely to be the primary source of the outbreak.

And snakes may be the source.

Chinese researchers conclude that the coronavirus most likely came from snakes. Or as they put it: "Homologous recombination within the spike glycoprotein of the newly identified coronavirus may boost cross‐species transmission from snake to human"https://t.co/FIs234X79z

— Anna Fifield (@annafifield) January 23, 2020

5) Eating like Warren Buffett.

Business Insider reporter Bob Bryan ate like legendary investor and renowned junk food fan Warren Buffett for five days. The experience left him "food drunk" and with "knee sweat," pledging to eat nothing but vegetables for 48 hours. As Bryan puts it in the video below, 87-year-old Buffett "eats like a child." Over the five days Bryan says he consumed 20,537 calories and 1,260 grams of sugar helped by drinking two litres of Cherry Coke every day.

One of the world's richest men eats primarily junk food pic.twitter.com/hFkJTEgApH

— Business Insider (@businessinsider) January 22, 2020

26 Comments

The cartoon reminds me of the German national anthem 'Deutschland über alles' and wondering why Trump hasn't had a version written for America, because he seems to be singing it all over the world!

1- 3 Why are we surprised? many of us have at least suspected that the banks are significantly complicit in the economic mess the world is in today. Politicians are too as they have succumbed to the Banks lobbying. The run beginning in Switzerland reported by CNN could easily spread and cause a lot of issues for them. Could be well overdue - just remember get in early before the OBR is enacted here to get all your money, not most of it.

I think #1-3 are quite intimately linked from a behavioural science perspective. The same types that deny environmental carnage in pursuit of money are the same immoral type that would happily be enablers of dishonest financial activity.

#1 - who cares about "shock and disappointment" - they should be blacklisted by every government entity the world over. NZ could lead the charge and effectively bankrupt them in NZ.

The problem for the banking fraternity, is the same as for all modern society. If they carry on burning the carbon that was locked away in-ground for longer than their species took to evolve, they take the climatic range out of their required-to-support-life one.

If, on the other hand, they abandon what's left of the fossil carbon (and we're down to fracturing rock while not turning a buck even now) then the replacement energy sources (lower in EROEI) simply don't support the current level of real activity (real work, not the ' work' done in offices). So their economy crashes, because the 250 trillion of currently-held debt cannot be repaid - let alone interest be charged.

And even if they push on pushing on, the fossil carbon is leaving them in lower EROEI terms - which is why they can't do real growth anymore (there's more debt than growth, dollar for dollar, and interest-rates cannot be raised without crashing the system also.

So they're on a hiding to nothing, with no way out. As was always going to be the case with a growth-requiring system on a finite planet. How many in the banking fraternity understand their real problem?

And how many of those dare talk about it? Reminds me of the MSM who report their utterances.

Post-fire effects coming out of Australia. I'm beginning to wonder whether there will be any kind of recovery. Always felt nature was quite resilient,but...

https://www.smh.com.au/environment/conservation/wall-of-mud-and-ash-fis…

https://www.smh.com.au/national/nsw/sydney-wakes-to-hazardous-air-quali…

The murray river fish population was already being decimated by water diversion for irrigation and town supply

https://www.theguardian.com/environment/ng-interactive/2018/apr/05/murr…

And drought

Their are a lot more than one tenth of the Murray river cod population have been wiped out by bad water volumes and conditions over the last few decades.

Earth's Climate History: What the Doomsayers Don't Want Voters to Know

Absent historical context, extreme weather can be over-hyped in ways that lead uninformed voters to conclude that acts of God such as severe droughts and floods never happened before humans began using fossil fuels.

In fact, extreme weather has occurred with monotonous regularity for millions of years. Below is an infinitesimal sampling of the endless multitude of catastrophic weather events in Earth’s past, many of which occurred long before the Industrial Revolution.

● The Great Hurricane of 1780 killed 30,000 people in the Caribbean.

● Epic dust storms in the 1930s caused catastrophic ecological damage to the Central Plains of the U.S. and Canada.

● Massive flooding that hit Tokyo, Japan, in 1910 destroyed more than 400,000 homes.

● Consecutive years of extreme weather took the lives of one-third of the population during the Russian Famine of 1601-1603.

● In 1927, weeks of heavy rains in Mississippi caused flooding that covered 27,000 square miles, leaving entire towns and surrounding countryside submerged up to a depth of 30 feet.

● A catastrophic hurricane that hit sparsely populated Sea Island, Georgia in 1893 killed 2,000 people.

● The Blizzard of 1888 was so extreme that snow and ice covered the entire northeastern U.S., from Maine to the Chesapeake Bay.

● On Sept. 8, 1900, a Cat-4 hurricane obliterated the island of Galveston, Texas, killing an estimated 10,000 residents.

● In 1889, heavy rains that lasted for days caused massive flooding in Jamestown, PA, killing 2,200.

● Caused by a protracted drought, the Bengal Famine of 1770 killed 10 million people in South Asia.

● And, for those who believe in the Bible, Genesis 7:12 reports that rain fell upon the earth for 40 days and 40 nights, an extreme weather event by any definition.

https://www.americanthinker.com/articles/2020/01/earths_climate_history…

You lost me when you brought in the Bible..

... the bible is one of the most useful books in our house ... it's so thick ... if I stand on it , I can reach the baked beans tins on the top shelf ... Gummy loves beans .... praise be ....

Thought you were a fan of tinned Tuna

... tuna might be just the thing ... to settle a gummy tummy .... got through 24 different beers by 13 brewers at the Chch Beer Festival yesterday . ..

Wow ! ... what a blast ....

I use a beer crate..hope you leave the windows open at night Gummy.

#2 - Given of course the big bosses there know all about this and many other instances of money laundering within their organisation, it does make you wonder whether JK got the job there due to being 'trusted' by them to 'take care of it' locally.

Banks are the major money laundering vehicles...duh.

Banks are the major........

And

What better place than NZ - Tax Free Safe Heaven for Money Launders.......Also the reason / survival of so called NZ Rock Star Economy.

There's plenty to wonder at about John Key. Why and how would he have a meeting in October in a 'personal capacity' with Xi Jinping? And did he really tell Xi Jinping - as reported - that he’d "continue to play an active role in promoting the understanding and cooperation between the two countries"? Unrelatedly, earlier this month, a Financial Times article said New Zealand was “on the edge of viability as a member” of its allied relationships because of its “supine” attitude to China and “compromised political system”. The jiggery-pokery at the ANZ is small-fry.

Read this article

https://www.stuff.co.nz/business/industries/64838045/bankrupt-kiwi-evan…

There are 3 crooks in the photo from 2004 - and that's not counting you-know-who

Yes, we are compromised alright. And have been for a while. We need them both, but it's looking increasingly unlikely that the two beasts can co-exist. What are we to do?

C'mon folks, ANZ, JK, Nat.. Does anyone notices the colour of ANZ? Liked JK claimed though for sure, NZ - specially ANZ NZ are all clear from all this mumbo jumbo money laundering speculation. They are squeaky clean.

Coronavirus : Dr Chris Smith , a well known UK virologist talked to Kim Hill on Radio National this morning .... he said , don't panic ... and that its fortunate that Chinese authorities gave us early warning of Wu Flu ... which , they did not do back when Sars took off ...

.... don't panic !

And , don't buy a disposable face mask .... complete waste of money ... absolutely useless ... he recommends spending that money on something useful , go get a beer he says ( love it ! )

Incubation period ~5 days, R0~2.0 however one sick person infected 14 healthcare workers in China. There appear to be asymptomatic carriers. First cases just showed up in Europe.

Here's an almost live map showing new cases.

Applying an exponential model to the first 6 data points gives a good fit:

china_cases = 258*exp(0.321t) and ex_china_cases = 3.9*exp(0.438t)

where t is days since 20/1/2020

Which means china doubling time is ~ 2.2 days and ex_china doubling time is 1.6 days

If that exponential model is correct then there will be 245 million infected people outside of China by 1 March 2020!

I'm surprised that virologist was so chilled out.

The Warren buffet : he got lucky .... damned lucky that he didn't get diabetes 2 at the very least , heart valve blockages , dementia from his food and drink regime ...

... there is a school of thought ( theory , not proven ) that the typical American diet is responsible for brain damage , constriction of blood vessels , plaque build ups ... which lead to strokes , dementia , possibly Alzheimers ..

Warren B. proves the point that a person can be totally brilliant in one discipline ( investing ) , yet completely silly in another ( nutrition ) .... bless him !

Or perhaps very happy.

Cherry Cola is bloody nice ... just a shame about all that sugar ... I'd guzzle it happily , but ... gotta keep the svelte Gummy figure .... must look super sassy in my mankini this summer ...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.