- Some form of default looks inevitable for debt-laden Chinese property developer Evergrande

- We examine why markets don’t hold concerns that a default will put sand in the global financial cogs

- However, concerns are spreading to other developers which could increase volatility

Last August Chinese authorities drafted the “three red lines” policy putting constraints upon property developers’ balance sheets with the long-term aim of increasing financial stability. Evergrande is one of the largest developers and one of the highest geared. To meet these policy constraints, it began discounting apartment units and selling its assets. Strapped for cash, it has even settled debts by swapping properties with creditors. These liquidity concerns have been helped along by a slowing property market, reducing margins on the apartments it sells. Things have become so bad that bondholders will be sweating on coupons due to be received on the 23rd of this month.

In its most recent financials, Evergrande had NZ$125bn in borrowings outstanding and significantly more owing to trade creditors. For context, those borrowings are about half the bonds of Australia’s largest bank, CBA, or about 100bps of capital across the Chinese banking system (which currently sits at 11.9%), or a seventh of Lehman Brothers’ debt pile when it failed.

So, should we be worried?

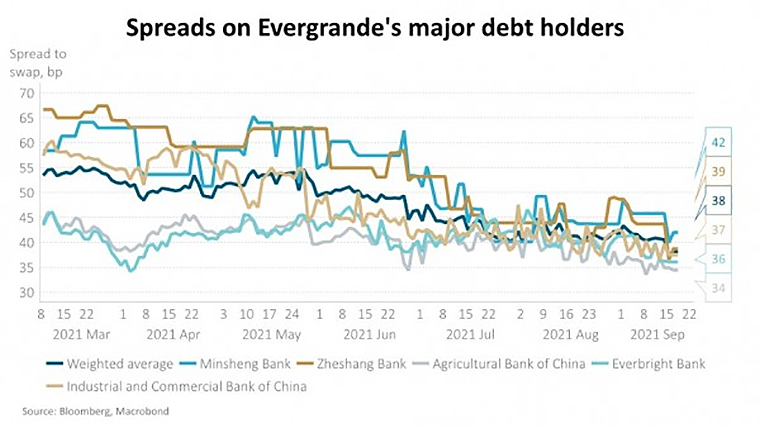

Evergrande has NZ$125bn bonds outstanding, however it is not a service business. Because it owns hard assets, there may be some recovery value. The magnitude of losses is absorbable across the financial system, but as we have learnt from previous crises, trust between financial institutions is vital. For now, the Chinese interbank lending market is unperturbed. Below we have created a composite of the spreads on the debt of five of Evergrande’s lenders demonstrating trust prevails.

In formulating the “three red lines policy”, Chinese authorities have considered the implications of allowing property developers to fail and they have experience at surgically removing dominos. Last year saw the rescue of Anbang Insurance, and authorities also immunised the wider sector from the failure of Baoshang Bank.

Over 10% of Evergrande’s debt is issued offshore. Against a backdrop of Chinese regulators’ desire for companies to be more self-reliant (and fears of data sovereignty), it is plausible that recovery rates are lower offshore. Debt registers list most large global asset managers as holders, likely impacting 401(k) balances, however we note its 2025 debt has been marked below 50 cents in the dollar for the past three months.

There may be some form of Chinese Government intervention to lessen the pain. It’s very common in China for families to put deposits on homes before they are built, rather than developers building properties in the hope of buyers turning up. That means there is a lot of depositors’ cash at stake, around 53 million square metres of homes worth, motivating the Chinese Government to ensure these people aren’t left without a home.

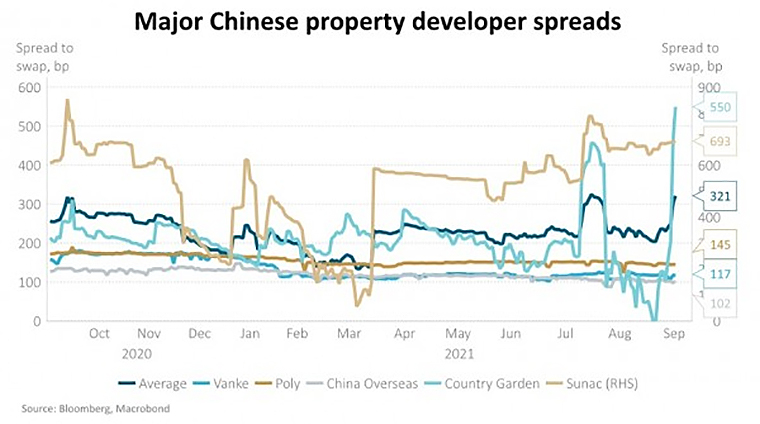

Looking beyond Evergrande to the broader development sector is less comforting. In large part, other developers aren’t in a similar position, given they are not as over-extended and still have access to finance, but there are a worrying number of exceptions. We demonstrate this below by plotting a composition of the spreads on the debt of 5 of the largest players. This is important, not just for the direct financial implications and the potential to constrain broader liquidity, but also given the feedback loop via construction activity, a large source of employment.

The market has good reason to believe Evergrande defaulting on its borrowings is manageable, however this shouldn’t equate to complacency. We have combed Evergrande’s disclosure for the largest holders of its debt. We will continue to watch for any undisclosed and less obvious ramifications, including the wealth management products it backs but holds off balance sheet. Examples like this reinforce that Australasian assets may be a more easily understood second derivative exposure to Asian growth.

Simon Pannett is a Senior Credit Analyst in the fixed interest team at Harbour Asset Management.

31 Comments

If there's anything to learn from Evergrande, it is to buy existing and not build.

With materials and labour costs escalating locally, the risk of house building has increased dramatically. I won't be surprised some NZ builders may go under or come up with an excuse for an indefinite delay.

If there's anything to learn from Evergrande, it is to buy existing and not build.

Garbage. The biggest lesson for NZ from Evergrande is not to bid up the price of land so that capital is misallocated through non-GDP qualifying credit creation.

Hi JC. Could you please explain the difference between gdp qualifying and non-gdp qualifying credit creation? I’m not sure I understand.

Lending into existence for buying houses is non-GDP qualifying while lending for creation of goods and services is GDP qualifying. I recommend you look up the Werner's quantity theory of credit.

With Evergrande going under, more than likely, it'll lead to cheaper material costs (due to more supply and lesser demand from one big developer) that can be passed onto home builders and buyers. This would provide another opportunity for first home buyers to enter the market at a more affordable price point.

Long gone are the days of a global financial collapse due to the collaboration of global central banks to bail out their local industries and provisions for economic and wage stimulus to keep everyone afloat amidst of excessive household and corporate debt balances sheets in G7 countries.

The doomsdayer narrative and collapse story always captures people's attention out of fear except more than ever this would not play out because governments cannot afford to let it happen. Everything will just keep chugging along albeit the challenge of switching off the animal brain.

Long gone are the days of a global financial collapse due to the collaboration of global central banks to bail out their local industries and provisions for economic and wage stimulus to keep everyone afloat amidst of excessive household and corporate debt balances sheets in G7 countries.

Nonsense. You have no evidence that central bank actions are omnipotent.

Sure they do. That perennial adage: This Time It's Different.

Material cost benefits at best are likely to be minimal, I would bet on them being nil.

Defaults and haircuts are a normal part of the business cycle, that's why investing is different to a bank account. China has long signalled that it wants to reign in rampant house building and create a more family friendly housing environment.

Defaults and haircuts are a normal part of the business cycle,

Not on this scale they're not.

The “market” is NEVER worried

It is utterly biased to optimism as this is only way to ensure people give funds to share holdings. In 2007-8 they were not worried. Nor in 1999 etc

When did you ever see a forecast for lower GDP or profit a year ahead???

March 2020 world bank forecasts

Good summary of the situation even though it's quite likely understated. Simon can only understand so much from the readily available data in countries like China (comfy desks at Harbor Asset Mngmnt is far from the reality of how markets work in China). All of that what he cannot see, like in the shadow banks, is a real 2nd-order threat to the whole financial ecosystem.

Yes it's an OK piece, although I think the risk is greater than he conveys.

The risk is always downplayed, its an attempt to talk people out of thinking there is a crash ahead. Understandable really as anything negative would be self fulfilling after pure fear sets in. Sooner or later reality hits home and like the GFC, it comes as a complete surprise to most people.

😀

Some more interesting findings. The former head of the CSRC says that, compared to other countries, too much of China’s household wealth is tied up in real estate, and too little in financial assets. Property accounts for 70-80% of Chinese household wealth. Won't be much different to NZ.

https://www.yicaiglobal.com/news/too-much-of-china-wealth-is-in-real-es…

Nz and China really are a match made in heaven!

Both extremely vulnerable to a property correction or crash.

America will be happy if Aussie and NZ have less trade with China. May be the West will take up the slack ?

The Chinese trade and the Chinese flooding of cheap products in to the world market wrought its own havoc in several countries, for their businesses, families, etc. So less trade with China may actually boost local economies.

May be Milk will become cheaper in NZ and we all will drink more of it at a cheaper price, compensating for the loss of China exports ? Same with meat and wine and fruits ?

There will be a tidal wave of defaults in NZ if we lost exports to China. There would be bigger issues to worry about than the price of a 2l blue top

The same was said about exports to Japan in the 90's. It should really be no surprise when export strategies have been too focused on one customer (China), any country has a problem. Whenever that happens, the only way to solve this is to diversify again.

Here's a question - to what extent could the USA subvert the property market in China?

I expect the answer is it can't (at least not directly), and it probably hasn't, but would be interested in opinions.

This thread throws some light on the Evergrande situation… https://threadreaderapp.com/thread/1438171695685283847.html

This is like listening to sharks gossiping about where the next tasty morsel is. Hopefully the Chinese govt won't repeat President Bush's mistake, the one he made with Lehman Bros. Sometimes bureaucrats can be too clever for their own good though, even Chinese bureaucrats.

His other thread on incoming volatility is a good read as well!

https://twitter.com/TheLastBearSta1/status/1424833306781159433?s=20

Cheers for the link mate!

As long as foreigners are not heavily invested/leveraged in the Chinese Construction market, it will not become a global crisis.

Issue is RE is huge portion of their savings/investment and a run on this will be dire for NZ exporters… China sneezes NZ and OZ catch COVID

If Evergrande falls, others in the sector may too. This may cause a recession in China, which may affect other sectors in which foreign capital is invested. In addition, if consumer demand for luxury Western products dries up in favour of cheaper local commodities, what happens to us? The excesses and risks in the Chinese property market have been known for many years but it may be finally reaching breaking point.

Get ready for the 'Bounce'. The bailout!

The giant money go round of printed money to try to mask poor management and over spending. Who does this giant model of ponzi paper really benefit?

https://twitter.com/INArteCarloDoss/status/1438944431734919175?s=20

Another good thread for a more in depth analysis

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.