NZ$ set to ride higher with Aussie dollar as market watches Rudd challenge, possible end of mining tax

By Mike Jones*

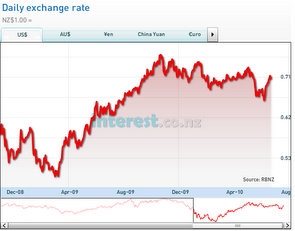

The NZD has been the strongest performing currency over the past 24 hours, benefiting from both a softer USD and strong gains in NZD/AUD.

Yesterday’s Balance of Payments figures registered a slight surplus for the March 2010 quarter, further shrinking the annual deficit to $4.46b (or 2.4% of GDP, from 2.9% in Q4).

This was clearly better than the 2.7% ratio the market was looking for. At a time when the strength of economic data globally has started to falter, yesterday’s solid set of current account figures served to keep the NZD well supported over the past 24 hours.

In particular, solid demand for NZD/AUD from a range of short-term speculative players and macro accounts saw NZD/AUD surge to 2½ week highs of nearly 0.8180 overnight. In addition, overnight news that Australian Prime Minister Rudd will face a challenge for his leadership from his deputy Julia Gillard has plunged Australian markets into political turmoil, weighing on the AUD.

Along with a softer USD (the Fed watered down its assessment of the US economy overnight), gains in NZD/AUD dragged NZD/USD up to nearly 0.7150 overnight – a 5 week high. This was despite a fairly dour night in global equity markets. European stocks slipped 1.0-1.5% and the Dow and S&P500 both registered modest declines.

Looking ahead, today’s Q1 GDP figures loom as a key test for the NZD.

We suspect we’ll need to see something in the order of 0.6-0.8%q/q for the NZD to hold onto its recent gains. The market’s expectation has been toned down to 0.6% – we are picking 0.5% (1.8% y/y).

This morning’s 11am vote on Australian PM Rudd’s fate will also have relevance for the currency. Whatever the outcome – a win for Rudd or, more likely, his Deputy Gillard – there appears to be a high chance the Australian resource mining tax will be watered down. If so, we’d expect the AUD/USD and, by association, the NZD/USD, to find some support. Still, NZD/USD may struggle to breach solid resistance towards 0.7200 on the day.

Majors

The USD weakened against most of the major currencies overnight as disappointing US housing data and a downbeat Fed statement undermined attitudes towards the US recovery. There were relatively few surprises for markets from this morning’s FOMC policy announcement. The Fed funds rate was left on hold at 0-0.25%, as expected. However, the Fed did adopt a more cautious tone in the accompanying statement.

Not only did it note underlying inflation has “trended lower”, but the risks from the European debt crisis were clearly acknowledged – "Financial conditions have become less supportive of economic growth … reflecting developments abroad."

Still, reaction to the statement was fairly muted. US Treasury yields ticked down 1-2bps across the curve, while the USD moved modestly lower. Prior to the FOMC statement, USD sentiment was already under pressure. US new home sales fell a whopping 32.7%m/m in May (-18.7% expected) which, along with Tuesday’s poor existing home sales data, spurred fears the US housing recovery is stalling.

US 2-year Treasury yields fell 4bps to 0.66% and 10-year yields slipped 6bps to 3.12%. Against this backdrop, most of the major currencies posted modest gains against the USD overnight. USD/JPY slumped 0.8% to below 90.00 and EUR/USD jumped from 1.2220 to above 1.2300. EUR gains came despite figures revealing borrowing by Portuguese banks from the ECB doubled to €35.8b in May. CAD bucked the weaker USD trend. A disappointing April Canadian retail sales report (-2.0%m/m vs. -0.4% expected) saw USD/CAD climb from 1.0350 to almost 1.0450.

In contrast, the good news for GBP just kept coming. Indeed, GBP/USD surged to 6-week highs above 1.4950 overnight. Following a similar endorsement from Fitch, ratings agency Moody’s said the UK’s ‘emergency’ budget was “supportive” of the UK’s AAA rating. But the real kicker for last night’s GBP strength came from a surprising revelation that one MPC member voted for a rate hike at the Bank of England’s June meeting – the first vote for tightening in nearly two years.

That the member was Andrew Sentance was not that surprising, given he is regarded as the most hawkish member of the MPC. However, we’re still of view the benign UK inflation outlook, combined with upcoming fiscal tightening, means it’s more likely the BoE will dole out another slug of QE this year, rather than a rate hike. As a result, GBP/USD is expected to struggle on any rallies towards 1.5400 in coming months.

* Mike Jones is part of the BNZ research team. All its research is available here.

No chart with that title exists.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.