By Mike Jones*

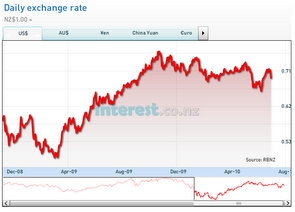

A drying up of global risk appetite has knocked “growth-sensitive” currencies like the NZD for six over the past 24 hours. From around 0.7100 this time yesterday, NZD/USD was pitched below 0.6950 overnight, unwinding all of the past 2 week’s gains.

The NZD’s woes began with yesterdays disappointing NZ building consents data for May. Seasonally adjusted residential consents fell 9.6%m/m, while non-residential consents values were down 40% on a year ago. The softer data, combined with a gloomy day in Asian equity markets (the Shanghai index slumped 4.3%), soon had NZD/USD beating a path back towards 0.7000.

With the NZD already looking fragile, a collapse in global equity markets overnight simply reinforced the NZD’s downward trajectory. Investors are nervous about how the European banking sector will fare after the ECB pulls its €442b 12-month liquidity facility on Thursday.

At the same time, the tone of global data seems to have taken a turn for the worse. Most recently, last night’s US consumer confidence survey showed June confidence plunging from 63.3 to 52.9 (62.5 expected). European equities were belted 3.0-5.5% and US stocks fared little better.

The S&P500 and Dow are down 2.7% and 3.1% respectively.

Our risk appetite index (which has a scale of 0-100%) tumbled 5% to 35.1%. Sliding risk appetite and widespread equity market weakness saw investors take flight from “growth-sensitive” currencies like the NZD and AUD, in favour of “safe-haven” currencies like the USD and JPY.

NZD/JPY skidded from above 63.00 to below 61.50, and NZD/USD was dragged below 0.6950 amid heavy selling from leveraged and speculative-type accounts.

For today, there is nothing to watch out for on the local data calendar, with only second tier data due to be released across the Tasman.

As such, we suspect the NZD/USD will continue to trade at the whims of equity market sentiment and global risk appetite. Initial support is seen ahead of 0.6860.

Majors

“Safe-haven” currencies like the USD and JPY have outperformed over the past 24 hours. Rising risk aversion has been the major theme in currency markets overnight. Fears over the health of the European banking system appear to be the main driver.

As we flagged earlier in the week, investors are worried Thursday’s closure of the ECB’s €442b 12-month liquidity facility will make it even more difficult for European banks to roll over short-term funding. Indeed, a group of Spanish banks blasted the ECB’s decision to end the scheme as “absurd”.

Concerns over a liquidity shortfall have already been reflecting in rising interbank funding costs. Three month euribor rates jumped to 9-month highs around 0.761%. More generalised global growth concerns have also provided headwinds for investors’ risk appetite over the past 24 hours.

The Japanese unemployment rate unexpectedly rose yesterday (5.2% vs. 5.0% expected), the Conference Board revised down its April leading indicator for the Chinese economy (to 0.3% from 1.7%), and June US consumer confidence was downright awful (52.9 vs. 62.5 expected).

Without exception, equity markets are a sea of red. The rot started in Asia, led by a 4.3% slump in the Shanghai composite index.

European indices plunged 3.1-5.5% and the S&P500 and Dow are down 2.5-3.0%.

The VIX index (a proxy for risk aversion) jumped from 29% to 34% and the CRB index (a broad measure of global commodity prices) slipped around 2.8%.

Against a backdrop of plunging equity markets and fears about the durability of the global recovery, investors shunned “risk-sensitive” currencies like AUD, CAD and NZD in favour of “safe-haven” currencies like the USD and JPY.

Indicative of investors’ demand for safe-haven assets, USD/JPY fell from 89.40 to nearly 88.40 and US 10-year bond yields fell below 3% for the first time since April 2009. AUD/JPY, CAD/JPY and EUR/JPY all fell 1.5-3.0%. Investors largely ignored a report from the UN calling for an abandoning of the USD as the world’s reserve currency.

Indeed, the USD index rose around 0.5% last night. Looking ahead, whether markets can be shaken out of their gloomy mood will ultimately depend on the strength of upcoming global data. UK GDP, the June Chinese PMI and US non-farm payrolls will all be important in this regard.

Markets will also be watching the ECB to see if there are any concessions on its liquidity policy. In the short-term, equity market weakness and widespread pessimism about global prospects should keep the USD index supported on dips towards 85.20.

* Mike Jones is part of the BNZ research team. All its research is available here.

No chart with that title exists.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.