'Like WWIII on global currency markets'; America's march to protectionism; Worgl money; Dilbert

Here are my Top 10 links from around the Internet at 10 past 8pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Monday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream.

1. The biggest news all week - America's Congress and its President are gearing up for big lash out at the big foreign scapegoat -- China.

Congress pass a law this week giving Barack Obama the authority to impose tariffs on all Chinese imports, the NYTimes reports.

While tariffs have been placed on specific products, like steel and tires, because of evidence of unfair export subsidies, the threat of putting sizable tariffs on a country’s entire line of exports to the United States is highly unusual — and, some argue, of dubious legality under international trade law. It reflects both election-year politics over a loss of American jobs and great frustration over unfulfilled promises by China to allow its currency to rise in value, which would make Chinese goods less competitive in the United States.

Eswar S. Prasad, a professor of trade policy at Cornell, called the legislation “a shot across the bow that indicates a clear escalation from overheated rhetoric about Chinese currency policy to more substantive action.” While it is unlikely there will be a trade war, he said, “there is now a real risk that a cycle of tit-for-tat trade sanctions could spin out of control and cause some real, if not lasting, damage.”

2. A scarcity of suckers? - The always excellent Michael 'The Big Short' Lewis writes at Bloomberg that US banks seem to be dropping their proprietary trading desks despite having fought hard and successfully to keep them in the latest US financial reforms. What gives? Lewis has a few ideas. Firstly, he reckons the suckers, including a few big institutions, have finally cottoned on to what the banks and hedgies are up to.

The big Wall Street firms have looked anew at proprietary trading and seen a dying business. For a start, their proprietary traders, put off by subpoenas and government inquiries and the new internal aversion to short-term pain on big trading positions, are fleeing for the privacy of hedge funds. But the exodus of trading talent is only part of the problem. A general malaise has come over the world of big time financial risk taking. Everywhere you look hedge funds are either closing or shedding employees or, most shockingly, cutting their fees. At the bottom of this depressing new trend lies a deeper problem: a scarcity of suckers.

The proprietary trading business turns in part on one’s ability to find the fool -- to find people willing to take the stupid side of the smart bets you are placing. One of the side effects of our seemingly endless financial crisis is to wash a lot of fools, many of them German, out of the game.

It’s as if a casino owner awakened one morning to find the tourists had all gone, and the only remaining patrons are pros counting cards at his blackjack tables. As he looked around his casino, for the first time in his life, he couldn’t find the fool. And the first rule of the casino business is: if you don’t know who the fool is, it’s probably you.

Secondly, he wonders if the banks are just moving their risk taking and client ripping activities to their regular trading desks that deal directly with customers.

What’s really striking is how little ability the outside world retains to find out what is going on inside these places -- even after we have learned that what we don’t know about them can kill us. It would be nice to know, for instance, if the big banks are making these moves with the tacit understanding that the regulators, going forward, won’t be looking too closely at the activities of the “Client Facing Group.”

And yet news of the death of the Wall Street prop trader has been greeted with hardly a peep. And I wonder: is this the nature of our new financial order? Big decisions, in which the public has a clear interest, being made outside public view, with little public discussion or understanding. If so, it isn’t a future at all. It’s just the past, repeating itself.

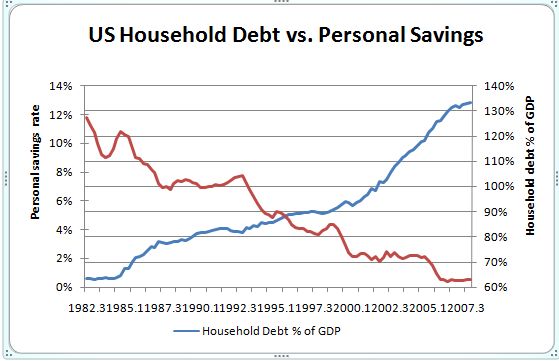

3. And you thought I was downbeat - Jim Quinn over at TheBurningPlatform has painted a picture of the next decade or so in America that is less than cheery. He backs it up with a lot of charts and such about the coming deleveraging and the scale of the problem. At least have a look if you're a sceptic. HTKiwidave via email.

The GDP of the country is $14.5 trillion. Over the next decade consumer expenditures as a percentage of GDP will fall from 70% to 65% because it must. With stocks destined to return 5%, bonds yielding 2.5% and no equity left in their houses, consumers have no choice. The annual reduction in consumer expenditures will be north of $700 billion. The annual disposable personal income of Americans is $11.3 trillion. The savings rate is 6%. It will rise to 10% over the next few years. This would be $450 billion more savings and $450 billion less spending. This will not happen overnight. It will take at least a decade. Mass delusion wears off slowly and one person at a time.

Charles McKay summed up the last 30 years in two quotes from his book Extraordinary Delusions and the Madness of Crowds, written in 1841. “Money, again, has often been a cause of the delusion of the multitudes. Sober nations have all at once become desperate gamblers, and risked almost their existence upon the turn of a piece of paper.” “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

Does this paint a picture of an economy roaring ahead? We have at least a decade of low or no growth ahead. Deleveraging after the biggest debt party in history is really a bitch. The industry which is about to be dealt a mortal blow is the retail industry.

4. 'They always seem to win' - Ian Cowie has done a nice job at The Telegraph of highlighting how fund managers, and hedge fund managers in particular, always seem to do very well out of their funds and often much better than the investors in these funds. How long before investors lose confidence in fund managers generally. It's happening in the United States where the investors have piled into Exchange Traded Funds, which allow investors to circumvent fund managers and cheaply buy access to a market or index.

There is growing resentment among investors about high charges and low returns. Earlier this year, The Daily Telegraph revealed how fund managers pocket more than £7bn a year from charges despite a decade of falling share prices.

Mr Miller, a founder of Spencer Churchill Miller Private said: “The time is right for exposure of various elements of the industry. “It is riddled with blatant self-interest and conflicts of interest that would never be tolerated elsewhere. Investors have become victims as the charges they have to pay have risen and risen while the returns they get have been consistently below par and the actual cost of managing their money has continued to fall.”

Data from Morningstar, a research company, shows the average investment fund has an annual charge of 1.25 per cent. But lesser known administrative fees amount to 0.45 per cent. And trading costs total another 1.35 per cent, according to the Financial Services Authority and Financial Express. When this 1.8 per cent is deducted from the total £406 billion invested, that amounts to £7.3bn being “skimmed off” each year.

5. Currency Wars bulletin board - Ambrose Evans Pritchard has a nice lap around the various skirmishes in the currency wars.

Brazil, Mexico, Peru, Colombia, Korea, Taiwan, South Africa, Russia and even Poland are either intervening directly in the exchange markets to prevent their currencies rising too far, or examining what options they have to stem disruptive inflows.

Peter Attard Montalto from Nomura said quantitative easing by the US Federal Reserve and other central banks is incubating serious conflict. "It is forcing money into emerging market bond funds, and to a lesser extent equity funds. There has truly been a wall of money entering many countries," he said.

"I worry that we are on the cusp of a competitive race to the bottom as country after country feels they need to keep up."

6. Currency Wars bulletin board - Pheonix Capital Research writes at Zerohedge about how the Japanese and the Swiss are intervening in the currency wars to protect the Yen and the Swiss franc. The detail is ominous. It starts off looking at the Yen intervention in the last couple of weeks, the first done since 2004 and first done openly and nakedly.

The Japanese Yen is one of the primary carry trade currencies to borrow in (the US Dollar being the other). It marks a major turning point in the financial crisis. Going forward, the key issue for the financial markets will be currency interventions.

Japan’s move can, in a sense, be seen as an open declaration of war between the BoJ, the Federal Reserve, and other Central Bankers. Indeed, we can’t leave the European Central Banks out of this. Indeed, the most noted currency intervention prior came from the Swiss Nation Bank which bought Euros by the billions in an attempt to keep the Swiss France/ Euro trade low. And Germany and other European countries want the Euro low to boost their exports. In plain terms, the currency war has officially begun.

Since Japan’s announcement, numerous other countries have begun intervening in the currency markets including Brazil, Colombia, Peru, Russia, South Korea, Serbia, Romania, and Thailand.

In plain terms, WWIII is already being staged in the currency markets. Predicting exactly how this will all play out is impossible, but the clear result is that market volatility will be increasing and we are absolutely guaranteed heading for a Crash.

7. Currency Wars bulletin board - The type of currency intervention is also ramping up. Tyler Durden at ZH points to Mexico's latest move, which effectively is betting on a lower dollar. HT Troy.

The FX war recently launched by every central bank in the world, just entered its modern warfare stage: we have learned that the Mexican Central Bank has just sold $600 million worth of USD options. That's right - the central bank of our southern neighbor has moved beyond merely pedestrian cash interventions and has entered the derivatives game, in their attempt to raise the US peso and lower its Mexican equivalent.

Either way, the incremental systemic complexity introduced by this action will make plain vanilla interventions increasingly more unpredictable, and it is a likely validation that many other central banks also engage in this kind of synthetic trading. Also, who is to stop the counterparty on such trades to suddenly ramp up colletaral requests, very much in the fashion that Goldman and JPM destroyed AIG and Lehman, respectively?

8. The next landmine - Meredith Whitney, the analyst that picked the banking implosion in 2007 and 2008, reckons the US government will have to bail out bankrupt state governments within the next year to stop the implosion of the US$2.8 trillion municipal bond market.

While saying a bailout might not be politically viable, Whitney joined investor Warren Buffett in raising alarm bells about the potential for widespread defaults in the $2.8 trillion municipal bond market. She said state and local issuers have taken on too much debt and that the gap between public spending and revenue is unsustainable.

“People will think the federal government will bail these states out,” Whitney, 40, the founder of Meredith Whitney Advisory Group Inc., said in an interview on Bloomberg Television’s “In the Loop.” “It’s going to be an incredibly divisive issue.”

9. Worgl money - This is a fascinating story of a town in Austria in 1932 that invented their own money to solve the problems of the depression. It worked, until the Austrian central bank shut it down. Then the depression came back then a short man with a small moustache took over. Remember him? HT Les via email.

Worgl money was a stamp script money. The Worgl Bills would depreciate 1% of their nominal value monthly. To prevent this devaluation the owner of the Bill must affix a stamp the value of which is the devaluation on the last day of the month. Stamps were purchased at the parish hall.

Because nobody wanted to pay a devaluation (hoarding) fee the Bills were spent as fast as possible. The reverse side of the Bills were printed with the following declaration: “To all whom it may concern ! Sluggishly circulating money has provoked an unprecedented trade depression and plunged millions into utter misery. Economically considered, the destruction of the world has started.

- It is time, through determined and intelligent action, to endeavour to arrest the downward plunge of the trade machine and thereby to save mankind from fratricidal wars, chaos, and dissolution. Human beings live by exchanging their services. Sluggish circulation has largely stopped this exchange and thrown millions of willing workers out of employment.

- We must therefore revive this exchange of services and by its means bring the unemployed back to the ranks of the producers. Such is the object of the labour certificate issued by the market town of Wörgl : it softens sufferings dread; it offers work and bread.”

The Central Bank panicked, and decided to assert its monopoly rights by banning complimentary currencies. The case was brought in front of the Austrian Supreme Court, which upheld the Central Banks monopoly over issuing currency. It then became a criminal offence to issue “emergency currency”. Worgl quickly returned to 30% unemployment. Social unrest spread rapidly across Austria. In 1938 Hitler annexed Austria and many people welcomed Hitler as their economic and political savior.

10. Totally irrelevant video - Jon Stewart makes jokes about Belgians and waffles.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Mob Swap | ||||

|

||||

29 Comments

And here's what Paul Krugman is saying about the Chinese

China’s government has shown no hint of helpfulness and seems to go out of its way to flaunt its contempt for U.S. negotiators. In June, the Chinese supposedly agreed to allow their currency to move toward a market-determined rate — which, if the example of economies like Brazil is any indication, would have meant a sharp rise in the renminbi’s value. But, as of Thursday, China’s currency had risen about only 2 percent against the dollar — with most of that rise taking place in just the past few weeks, clearly in anticipation of the vote on the Levin bill.

So what will the bill accomplish? It empowers U.S. officials to impose tariffs against Chinese exports subsidized by the artificially low renminbi, but it doesn’t require these officials to take action. And judging from past experience, U.S. officials will not, in fact, take action — they’ll continue to make excuses, to tout imaginary diplomatic progress, and, in general, to confirm China’s belief that they are paper tigers.

http://www.nytimes.com/2010/10/01/opinion/01krugman.html?_r=1

PK at the saem time seems to have no appreciation or care about the Chinese problems...Im not so sure the Chinese have that much leeway in allowing their currency to appreciate, in effect the US is trying to export its un-employment to china....and that has nasty implications for chinese stabilty on the one hand and probable agressive expansion in the china sea by china....the problem has to go somewhere....its just musical chairs....

regards

Jeffrey Sachs talks about America's deepening moral crisis

An already bad situation marked by deadlock and vitriol is likely to worsen, and the world should not expect much leadership from a bitterly divided United States.

Much of America is in a nasty mood, and the language of compassion has more or less been abandoned. Both political parties serve their rich campaign contributors, while proclaiming that they defend the middle class. Neither party even mentions the poor, who now officially make up 15% of the population but in fact are even more numerous, when we count all those households struggling with health care, housing, jobs, and other needs.

The result of all of this is likely to be a long-term decline of US power and prosperity, because Americans no longer invest collectively in their common future. America will remain a rich society for a long time to come, but one that is increasingly divided and unstable. Fear and propaganda may lead to more US-led international wars, as in the past decade.

And what is happening in America is likely to be repeated elsewhere. America is vulnerable to social breakdown because it is a highly diverse society. Racism and anti-immigrant sentiments are an important part of the attack on the poor, or at least the reason why so many are willing to heed the propaganda against helping the poor. As other societies grapple with their own increasing diversity, they may follow the US into crisis.

The lesson from America is that economic growth is no guarantee of wellbeing or political stability. American society has become increasingly harsh, where the richest Americans buy their way to political power, and the poor are abandoned to their fate. In their private lives, Americans have become addicted to consumerism, which drains their time, savings, attention, and inclination to engage in acts of collective compassion.

The world should beware. Unless we break the ugly trends of big money in politics and rampant consumerism, we risk winning economic productivity at the price of our humanity.

http://www.project-syndicate.org/commentary/sachs170/English

Indeed, listening to Obama's recent specches, all he says is "middle class" at every opportunity....

regards

Just in case you wondered if America is corrupt.

Lobbyists – paid advocates who aim to influence the decisions of legislators or government officials – play an increasingly important role in the political system of the US and other democracies. In 2008, for example, $3.97 billion was spent on lobbying US federal officials – more than twice the amount spent ten years earlier.

It really is time for absolute transparency within political funding.

No i dont wonder....they have been totally corrupt for at least 30 years...........probably in fact since the early 1960s......

regards

Seth Godin has a slightly different view. I think he's being a bit optimistic on the e-economy saving the developed world...

"Protectionism isn't going to fix this problem. Neither is stimulus of old factories or yelling in frustration and anger. No, the only useful response is to view this as an opportunity. To poorly paraphrase Clay Shirky, every revolution destroys the last thing before it turns a profit on a new thing.

The networked revolution is creating huge profits, significant opportunities and a lot of change. What it's not doing is providing millions of brain-dead, corner office, follow-the-manual middle class jobs. And it's not going to.

Fast, smart and flexible are embraced by the network. Linchpin behavior. People and companies we can't live without (because if I can live without you, I'm sure going to try if the alternative is to save money).

The sad irony is that everything we do to prop up the last economy (more obedience, more compliance, cheaper yet average) gets in the way of profiting from this one.

http://sethgodin.typepad.com/seths_blog/2010/09/the-forever-recession.html

Not really sure if I buy that, although in the industry I work in, advertising, in a large global company the shift is rapidly on within my organisation to all things 'digital'.

And from Chicago's own Institute for Supply Management comes the good news that their barometer of business activity rose to 60.4 % , from 56.7 % in August .............. They had predicted that the September figure would fall to 55.9 % , must've been talking to our Bernard "Chicken-Little" Hickey .

Anne Applebaum at the Washington Post talks about China's quiet power grab. The Americans are worried in many ways.

We still haven't realized that the scariest thing about China is not the size of its navy or the arrogance of its diplomats. The scariest thing is the power China has already accumulated without ever deploying its military or its diplomats at all.

Hmm she must have been going thru old posts her a yr or so ago...

I was talking about the Chinese having set this all up starting back in the 80s/90s.

An Economic coupe basically..The Chinese have know this for generations now.too bloody dangerous to blow a few countries up and anyway its far better to have the resources intact....

There is the military option, and the only tactic to go for is the Hitler method....move fast, battles use and destroy resources. Coal miner tips his hat to the local Bobby on the way home, Next morning lifts his hat to scratch his head "Why are there foreign solders every ware?" But a war like that in this day and age, cost too much, and weapons are a little more sophisticated than a royal enfield 303..

The Chinese knew and have been setting up for generations now...basically the new Rome, and The US is so in debt, and so reliant on China for its goods and spare parts.

Any Army or Navy it has is if the US or someone starts getting stroppy, a wave of a finger "think before you do anything rash, because it will end up being very destructive...now sit down and be a good little boy ....and here are some more cheap wheel bearings "

US Treasurey Secretary Timothy Geithner has said of the currency dispute with China , " We are not going to have a trade war . We are not going to have a currency war with China ". This was soon after the House of Representatives voted to take action over China for pegging it's currency against the greenback .

Martin Wolf's comments at FT.com about the currency wars are fascinating.

The inevitable adjustment towards current account deficits in the emerging world is being shifted on to countries that are both attractive to capital inflows and unwilling or unable to intervene in the currency markets on the needed scale. Poor Brazil! Could we even be seeing the starting gun for the next emerging market financial crisis?

John Connally, Nixon’s secretary of the Treasury, famously told the Europeans that the dollar “is our currency, but your problem”. The Chinese respond in kind. In the absence of currency adjustments, we are seeing a form of monetary warfare: in effect, the US is seeking to inflate China, and China to deflate the US. Both sides are convinced they are right; neither is succeeding; and the rest of the world suffers.

What is needed is a route to these needed global adjustments. That will demand not just a will to co-operate that now seems sorely lacking, but greater imagination about both domestic and international reforms. I would like to be optimistic. But I am not: a world of beggar-my-neighbour policy is most unlikely to end well.

http://www.ft.com/cms/s/0/9fa5bd4a-cb2e-11df-95c0-00144feab49a.html

For the calender month of September , stocks closed in the U.S. , having achieved their best September return for 71 years .

A pick up in China's manufacturing has raised hopes that the PRC is not slowing their economy as fast as previously thought .

Shares across Asia and into Europe rose on the news .

Good economic sentiment helped push oil back over $US 80 / barrel .

In Japan the unemployment rate has fallen .

.................. the good news just keeps on coming . And you finally got to read some , a snippet of it , here at interest.co.nz

A snipet in amongst all the bad is all there is........

What we see here is a very few minor good points compared with a lot of significant bad ones almost to numerous to mention.

Glad you are stating your position so nicely...

regards

Gummy Bull? Where have you been hiding?

3. retail industry, indeed Ive thought that for months, but behind that is of course ppl who make/supply to it as well...everything is so inter-related...

My concern is the attempt to prop up this section of the economy with say less tax or other biases which will dis-encourage it to migrate to new areas...as staying where it is isnt as painful as it should be.

regards

"Key has no plans to increase GST to 15 per cent... to offset major personal tax cuts as Labour did in the 1980s." That's the ironic bit in your link, for me, Iain !

The smiling assassin stikes.

Also from Fran's article.

"Prime Minister Helen Clark and Finance Minister Michael Cullen will soon put their record in front of voters and campaign for a third term in Government based on their experienced handling of the economy.

"Clark and Cullen" - as the Prime Minister often says - have presided over a golden growth period.""

And from Michael Hudsons http://michael-hudson.com/2010/09/america%E2%80%99s-china-bashing-a-com…

"By lowering U.S. interest rates to near zero, the U.S. Federal Reserve is doing what the Bank of Japan did after its financial bubble burst in 1990, when it helped Japanese banks “earn their way out of negative equity” by providing cheap credit to obtain a markup by lending to speculators and arbitrageurs to buy foreign bonds paying higher rates. This came to be known as the “carry trade.” Arbitrageurs borrowed yen cheaply, and converted them into Euros, dollars, Icelandic kroner or other currencies paying a higher rate, pocketing the difference. The practice threw yen onto foreign-exchange market, weakening the exchange rate and hence helping Japanese automotive and electronics exporters."

It all adds up to a massive transfer of wealth.

Bernard : The Worgl situation was debated amongst the crew several years ago here at interest.co.nz . We can forgive you forgetting that , 'cos you seem pre-occupied with your new economic theorem . Which is why you were so softly softly with Alan Bollard ? Don't want to offend the em-powered brokers of the new centralist controlled economy !

Nah, methinks your'e getting, "The Worgl situation .." mixed up with this situation:

http://www.youtube.com/watch?v=EP7CDvQULXw&feature=related

Show the wee fella, he needs to know there are other bear clans besides The Gummy clan.

Cheers, Les.

May 6 Dow plunge of 1000 points finally uncovered ! The SEC ( Securities Exchange Commission ) believe that a single trade of $US 4.1 billion by Kansas firm Waddell Reed initiated the panic on Wall Street . The computer generated sell order contained 75 000 contracts , and these were rushed through in a mere 20 minutes . Ordinarily , such an order would require 5 hours to unwind . The trade was on the S&P futures index .......At the time market sentiment was weak ...... And this one trade fueled those fears into a mini panic ....................... Only in America , folks !

You mean, only in America can such lies / cover ups be perpetrated by the highest regulatory authority on such matters;

Thanks for the Charles Eisenstein link Iain, I have enjoyed his essays. Also "Money and the turning of the age" http://www.realitysandwich.com/money_and_turning_age

In a desperate attempt to find things to monetize the financial system is now devouring itself with derivatives of derivatives of money.

The endgame aproaches

Iain

'no more (human) capital left to convert into money ' Really ?. Everything I read says the human soul seems to be creating and innovating at a dazzling rate.

' Money creation leaving us so destitute we have nothing left to sell ' - what about the increasing container traffic out of NZ - all empty are they ?.

The introduction of money as a medium of exchange hugely enhanced human living standards - the self sufficiency/barter based lifestyle you hanker for sounds fine from the perspective of a comfortable developed society but its grim reality is highly unpalatable. To describe such a lifestyle as an 'asset' is rose tinted hyperbole.

'very very good ' , no . A collection of creatively packaged sound bites which tap into a variety of themes popular among dystopian end of timers, yes.

Creation and innovation will stop, even probably regress, there was an interesting piece I read saying to get to out technology needs a certian population....therefore if our population growth reverses and thats very likely within 20 years then that should slow significantly. Inovation is just really the converion of materials and energy....

Money creation as in look at our debt....its hefty....the money is being created out of thin air which we then borrow to mostly gamble on or consume....The US in particualr is crippled by it...not so sure how safe we are.

"its grim reality is highly unpalatable" but the thing is its reality.....so unless you want to descend into an opium den and smoke your brains out....start swallowing.....ie the point is if our system is broken it has to be replaced....

regards

Good grief Bernard !!!!

"9. Worgl money - This is a fascinating story of a town in Austria in 1932 that invented their own money to solve the problems of the depression. It worked, until the Austrian central bank shut it down. Then the depression came back then a short man with a small moustache took over. Remember him? HT Les via email."

Look at what I have just written:

The Future of Money by Bernard Lietaer. Quotes from the book

http://neuralnetwriter.cylo42.com/node/3617

Coincidence or what?!

Please note "Page 151: The German "Wara" system."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.