'Sad piece of jingoism'; 'A short sharp shock'; America admits wants to inflate away debt; Cat printer hell; Dilbert

Here are my Top 10 links from around the Internet at 10 to 2pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Monday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream

1. 'Don't upset the apple cart' - Gareth Morgan writes at NZHerald about Labour's move to block foreign acquisition of New Zealand land.

His argument is that we can't afford to put up the shutters while we spend more than we earn.

He's right.

The trick then is to spend less than we earn.

Will the world end if we say no to more foreign purchases of land and other assets? I doubt it. And even if it did, what would happen?

The New Zealand dollar would fall sharply, making our exporters more competitive and forcing people to buy fewer imports. And the problem is...?

Here's Gareth in his own words.

Our overseas creditors are quite happy to keep lending to us at the interest rates we're happy to offer so long as we (a) keep paying the interest and (b) enable free conversion of those debts to other assets we own that they can buy. Ban foreigners from buying our assets, though, and there certainly will be a sharp shock to the system.

If foreigners can't use New Zealand dollars to buy New Zealand assets why would they be willing to hold New Zealand dollars?

Those dollars would become like debentures in just another New Zealand finance company, in quick time worth much less than their face value - in effect the kiwi would cease to have any asset backing. It would fall and that would deter further lending from overseas. In other words, the demand for New Zealand land from foreigners can be seen as the flipside of our penchant to spend more on imports than we earn from selling our stuff to foreigners.

2. 'A sad piece of jingoism' - Meanwhile Stuff reports BusinessNZ's chief executive Phil O'Reilly described Labour's move as a 'sad piece of jingoism'.

One of New Zealand's advantages for attracting investment was the consistency and clarity of rules governing business, Mr O'Reilly said, but the recent debate could become a "potential black mark" for companies that were considering investing here.

"The problem with this kind of thing is it starts to sow the seeds of confusion amongst investors, that they won't know the rules [about ownership], that they'll be a moving feast," Mr O'Reilly said. "That will be the quickest thing that will scare sensible businesses off ..."

3. How some Americans are starting to feel - This polemic from Charles Hugh Smith is titled 'The Loss of Trust and the Great Unraveling to Come.' It's hard not to agree with most of it, even though it comes across as a sort of rant against a grand conspiracy. I'm not a believer in conspiracies. Most messes are cockups.

But it's true the bankers in America have defended their interests well at the expense of taxpayers and the economy more broadly. The problem for us is this is the world's biggest economy by a long shot. HT Kiwidave

This sort of currency hegemony is wearing thin around the world. So the Fed is not only perfectly happy to impoverish Americans via skyrocketing commodity prices and rising import prices, its dollar-destruction policies are driving the rest of the world into creating another reserve currency.

The "free ride" the U.S. has enjoyed as holder of the only reserve currency will end, and the nation will have to live within its means. The Fed's incompetence and ownership by the Financial Power Elites is painfully obvious. Which is more pernicious and destructive hardly matters, but it seems its incompetence adds a positive feedback to its servitude to the bankers.

Was propping up the stock market to give the ruling politicos a boost on November 2 worth the destruction of the dollar? Obviously not. If they haven't already lost faith in the Federal Reserve, the citizenry soon will. They have already lost trust in the Federal government and the political lapdogs who occupy the seats of power.

The Great Unraveling has just begun, and there is much more to come.

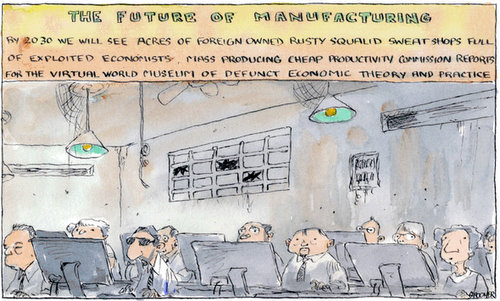

If you can't read it, this cartoon says: "The future of manufacturing. By 2030 we will see acres of foreign-owned rusty squalid sweat shops full of exploited economists mass producing cheap productivity commission reports for the virtual world museum of defunct economic theory and practice." HT John via email.

4. 'We can't make it here anymore' - This song from James McMurtry below seems to sum up the mood in America at the moment. HT Malcolm via email.

Now I'm stocking shirts in the Wal-Mart store

Just like the ones we made before

'Cept this one came from Singapore

I guess we can't make it here anymore

Should I hate a people for the shade of their skin

Or the shape of their eyes or the shape I'm in

Should I hate 'em for having our jobs today

No I hate the men sent the jobs away I can see them all now, they haunt my dreams

All lily white and squeaky clean

They've never known want, they'll never know need

Their sh@# don't stink and their kids won't bleed

Their kids won't bleed in the da$% little war

And we can't make it here anymore

It's clear now America has decided to default on its debt through money printing and inflation.

How long before Europe and the UK try to do the same. Should we?

"The U.S. economy is best described as being in a bona fide liquidity trap," and given the challenges now faced by the nation, "much more policy accommodation is appropriate today," Federal Reserve Bank of Chicago President Charles Evans said.By saying that above-target inflation will be tolerated for a time, the Fed may be able to get an overly low level of inflation back to something more acceptable. But he cautioned that it would have to be a policy communicated with clarity.

Mr. Evans said that such a regime, which he called price-level targeting, "would be a helpful complement to our current and prospective strategies in the U.S. There are quite a number of academic studies of liquidity-trap crises that find either price-level targeting or temporary above-average inflation to be nearly optimal policies."

6. China says No again to calls for a fast appreciation - Just in case everyone missed it, the Chinese are still telling the Americans to go jump when asked to let the Renminbi appreciate vs the US dollar. Cue Currency Wars. Read the quote. This is not going to end well. Reuters has the report.

The accelerated yuan appreciation of recent weeks will not last long because China's trade surplus will soon peak, an official state newspaper reported on Monday. An article in the overseas edition of the People's Daily said there had not been sufficient improvement in the economy at home or abroad to justify a speedy rise in the exchange rate.

China freed the yuan from a 23-month peg to the dollar in June and has let it gain about 2.8 percent against the dollar since then, with most of its rise coming after August. The article cited Wang Jun, a researcher at the Chinese Academy of Social Sciences, as saying that China should not and would not bow to foreign pressure.

"If the yuan rises quickly under joint pressure from the United States and some other nations, that will mean China is manipulating its currency, won't it?" the report cited Wang as saying.

7. When are Americans going to shut these monsters down? - Here the New York Times reports on the practices of JP Morgan and how it makes money from its customers.

The cynicism and greed is simply breathtaking. I'm still shaking my head at how American taxpayers have bankrolled these Too Big To Fail banks and allowed them to set the rules (and their own bonuses). Heads on pikes anyone?

How JPMorgan won while its customers lost provides a glimpse into the ways Wall Street banks can, and often do, gain advantages over their customers. Today’s giant banks not only create and sell investment products, but also bet on those products, and sometimes against them, putting the banks’ interests at odds with those of their customers.

The banks and their lobbyists also help fashion financial rules and regulations. And banks’ traders know what their customers are buying and selling, giving them a valuable edge. Some of JPMorgan’s customers say they are disappointed with the bank.

“They took 40 percent of our profits, and even that was O.K.,” said Jerry D. Davis, the chairman of the municipal employee pension fund in New Orleans, which lost about $340,000, enough to wipe out years of profits that it had earned through securities lending. “But then we started losing money, and they didn’t lose along with us.”

8.' Nudge, nudge, wink, wink, say no more' - Caroline Baum at Bloomberg captures the mood of scepticism building around the Fed's second round of money printing.

Can the Fed the really be sure it is not throwing the match onto a bonfire?

If I were a central banker getting ready to embark on another round of quantitative easing, I would be very afraid. Here’s why. Central bankers in the U.S. are being bombarded with market-based signals suggesting their fears of deflation, or falling economy-wide prices, may be misplaced. Gold prices continue to set new highs. The U.S. dollar, the global reserve currency, keeps sinking amid expectations the Federal Reserve will dilute the existing stock starting at its Nov. 2 to 3 meeting.

Commodity prices, both industrial and agricultural, are on a tear. The CRB Spot Raw Industrial Price Index, which includes scrap metals, cotton and rubber -- but not oil -- hit an all- time high this week. Junk bond issuance already set a record for the year, with demand for high-yield debt narrowing spreads to Treasuries. Investors are pouring money into emerging markets debt issued in local currencies by countries that used to be considered banana republics.

Mexico sold $1 billion of 100-year bonds last week, double the announced issue size, at a yield of 6.1 percent. Just ask yourself: Would you lend money to Mexico for 100 years? Exactly.

If the Fed’s goal was to make investors move out the risk curve, it succeeded. An alternate interpretation: Zero-percent interest rates are causing a misallocation of capital, a nice way of saying, “asset bubbles.”

9. Totally irrelevant video - An Australian comedian is very grumpy with Julia Gillard about the way she pronounces 'Negotiate'.

10. Totally irrelevant video - A cat is very grumpy with a printer. Hilarious.

73 Comments

Here's John Robb on the US banking crisis and mortgage market HT Rob via email

http://globalguerrillas.typepad.com/globalguerrillas/2010/10/journal-mo…

Why is this market failing? It's being gutted -- from wholesale fraud and ruthless profiteering at the bank/servicer level to strategic defaults at the homeowner level -- because a relatively efficient and effective moral system is being replaced by a burdensome and ineffective one. What shift? Our previous moral system featured trust, loyalty, reputation, responsibility, belief, fairness, etc. While these features were sometimes in short supply, on the whole it provided us with an underlying and nearly costless structure to our social and economic interactions.

Our new moral system is that of the dominant global marketplace. This new system emphasizes transactional, short-term interactions rather than long-term relationships. All interactions are intensely legalistic, as in: nothing is assumed except what is spelled out in the contract. Goodness is solely based on transactional success and therefore anything goes, as long as you don't get punished for it.

In this moral system, every social and economic interaction becomes increasingly costly due to a need to contractually defend yourself against cheating, fraud, and theft. Worse, when legalistic punishment is absent/lax, rampant looting and fraud occurs.

cheers

Bernard

How obtuse .. Gareth Morgan says: we can't afford to put up the shutters while we spend more than we earn. Bernard Hickey says: He's right ... But .. the propostion contains the solution .. put up the shutters .. OS won't lend .. and if they won't lend .. you can't spend .. problem solved.

Problem is while I like it I wonder on the effect on our economy...lets look at how much of the economy is serviced or functions with a debt component....As JK says now we should be growing at 6% but we are not because of a slow pay down....what happens if you force that paydown by doing this?

regards

........and just possibly if we did not have to service the accumulated debt to those overseas robbers(?) we would be growing at 6% -easily.

Basel, those 'overseas robbers(?)' didn't force us to borrow a single dollar.

The collective decision of Kiwis to behave like trailer trash and borrow more than we earn to buy crap was our own.

But you're probably correct that growth would have been way higher if we didn't have that monkey on our back, so are we willing to make the very hard sacrifices to get back to that state?

@ 8

"The US Dollar, the reserve currency, keeps sinking.."

Oh, this is not true, Geithner vows in a speech on monday there is no devaluation of the US Dollar!

http://www.marketwatch.com/story/geithner-vows-no-devaluation-of-us-dol…

On which planet is this man living? They are actively devaluing it quite for a while now.

Hot off the PEC press ...

'It’s not about left or right. It’s about business, says PEC'

“John Key has characterized Labour as having a “road-to-Stalin experience,” over its plan to restrict foreign ownership of assets. It’s another disappointing response from the Prime Minister, in what is becoming a track record of failure to enter debate on the economy. In cynically applying the ultimate in far-left labels to Labour’s shift in policy, Key is doing the country a disservice. This isn’t about ideologies of “left” and “right”, and it’s of greater significance than mere labels can convey. This is about finding policies that will allow our economy and thus our country to get back on track, and about accepting that the past two decades of policy have failed us dismally. Both Labour and National were compliant in creating the problem. It is important that both of them now become part of the solution,” says Productive Economy Council spokesman Selwyn Pellett.

“As someone who presented at the recent Labour Party conference, what I heard was a call for a return to the real economics of designing, manufacturing and selling things, not a desire to embrace outmoded ideologies. The reality here is that Labour’s new policy shift has a significant overlap in objectives with policies promoted by the New Zealand Manufacturers and Exporters Association, BERL, the Productive Economy Council, and the New Zealand Institute. These are organisations whose memberships run businesses which account for well over $3 billion in high value exports. To label this as a jump to the left thus both trivializes a complex issue, and is fundamentally flawed thinking,” says Pellett.

Labour - as any party that aspires to govern should - wants an economy that generates better jobs, with higher salaries. Implicit in that statement is stronger businesses, designing higher value products and exporting them with a supportive rather than destructive policy environment. This, presumably, is what National wants too. If they don’t, you’d have to ask what they are doing in government.

Labour is embracing policies that will support the real economy and reject the excesses of the financial economy that plunged the world into the global financial crisis. John Key is ready to dismiss this as “Stalinism”.

“The Prime Minister and Business NZ head Phil O’Reilly both want us to believe that it is business as usual. But before they convince themselves of that they would do well to read the reports from the IMF on how countries that implemented the kind of policies Labour is now advocating survived the global economic crisis better than those with policies similar to our own. If such policies are a return to old-school socialism, how does John Key explain how we have a massive national debt of over 90% of GDP while these countries have an equally large surplus?” asks Pellett.

It is time for our politicians to stop throwing the old “left” and “right” labels around with regards to economic policy, and start thinking about “right” and “wrong”. The policies we need are those that will allow us to succeed as a tiny nation in the middle of nowhere, and we need to judge such policies on their merits, and not on the throw-away labels politicians hang on them. Right now, the empirical data appears to strongly support Labour’s new found belief in such policies, especially when measured against the failure of the Washington Consensus in serving our economy. If John Key and National truly believe otherwise, then they need to step up, debate the issue, and make their case. They helped create the mess, and we all deserve their full attention in trying to clean it up.

Couldn't agree more.

Yesterday, he looked like a possum in the headlights - today a headless chicken - tomorrow....?

My guess - a stunned mullet.

I wonder if Steven Joyce might do better at the helm?

Steven Joyce would make a better Sea Anchor....

Borrowing 11 Billion to build a bunch of Autobahns for which there is no sound Business case... at a time when we are staring Peak Oil down the barrell... is not an excercise in sound judgement.

http://www.parliament.nz/en-NZ/ParlSupport/ResearchPapers/4/6/a/00PLEco10041-The-next-oil-shock.htm

The sooner he is tossed overboard... the lower the debt burden.... and the smoother the sailing for the old SS NZInc.

okay then.... but surely there is some thinking person in their ranks?

um.......so.......um........you want to join the National party?

;]

regards

#1 "The trick then is to spend less than we earn."

Would be better said, "The trick then is to EARN MORE than we SPEND."

ie. top line thinking as well, which is a point GM has made before:

http://www.interest.co.nz/opinion/opinion-gareth-morgan-argues-baptists-and-bootleggers-favour-compulsory-savings-are-just-plain-wrong Quoting from my comment there: "Economist and motorcyclist" - methinks Gareth must have done some engineering somewhere along the line, given common sense statements like:"The government would be more astute to understand what underlies our atrociously deficient record on investment. It’s not lack of savings that’s led to our slide down the OECD per capita income rankings; it’s the tax breaks and directives to banks to lend to those who have accumulated property rather than put it to work, and have purchased farms rather than invested in farm productivity."

"If the horse were put before the cart just for once, it would be obvious that reforms that aligned tax and credit policies with income generation have to come first, and then surprise, surprise, the savings for investment would automatically be more than adequate."

But as we know, the 'status quo'ists' like that cart just where it is, thank you very much, and SWG have been told not to mention it! What a surprise."

Cheers, Les.

The New Zealand dollar would fall sharply, making our exporters more competitive and forcing people to buy fewer imports. And the problem is...?

A plummeting standard of living. Look around you, including when you get home tonight, and cross out or stop using every single item that has been imported.

Now - and I realise you're crossing your legs because although 'some' of the pipes are made here, the crapper component in your toilet isn't - tell me what your material standard of living has fallen too. (Exports are merely the price of our imports. If China wants to artifically keep their exchange rates low, then I'm quite happy to set up my next home cinema cheaply on the back of the hard work of the poor peasants in China, being cheated out of profits by their out of control State, but why do you want to put hard working and enterprising Kiwis in that position?)

They can't afford imports in North Korea either Kim Jong ;)

(Actually, I've just done a Google: we do make toilets here - those composting monstrosities, and port-a-loos. Just as well we have all those crafty people at the Farmers Markets selling soap).

By the way, you get a dishonourable mention here: http://www.tvhe.co.nz/2010/10/08/more-on-macro-controls/

Quote:

When the environment changes, for some reason people want “control” – they want to feel like they can change what is going on for the better. Although this is a noble goal, without trying to understand the underlying rationale and trade-offs associated with any choices, we are more than likely going to hurt people.

Fundamentally, I am willing to go out on the limb and say that, in this case, Bernard has no implicit model of the economy to base his policy prescriptions on – and so such prescriptions are both internally inconsistent and dangerous. If he provides us with a model, and an actual description of why, I would gladly discuss it – but from the last few weeks of reading through his writing on the issue (I decided to pay more attention following the initial article – especially given that I was receiving a lot of pressure from others to respond) I have not yet ascertained what it is.

Perhaps you could answer that one for us?

‘Will the world end if we say no to more foreign purchases of land and other assets? I doubt it. And even if it did, what would happen?

Bernard I find it hard to believe that you would advocate a return to form of fortress New Zealand you cannot at this point of the game go back we simply owe to much to the rest of the world. You ask what would happen “the dollar would do more than drop” it would collapse and literality impoverish us interest rates would go through the roof along with the cost of imports. Asset values would collapse, they are going to anyway at some stage in the future but self infliction is just dead dumb. We are simply not in a position to start arbitrarily changing the rules .

Colin, if you admit that asset classes are going to "collapse... anyway sometime in the future..." what is the point of the wait?

The best time in my opinion to take the hit in living standards by reducing debt is now - while inflation is low, interest rates globally are low and our property market hasn't quite yet died altogether.

Better in my opinion, that the folks who over-extended themselves get out with the smaller losses, or maybe even break-evens during this relative calm before the storm really hits on a global scale.

I believe NZ does need to move fast however. Each month this Government pontificates about business as usual ... we become more vulnerble to external shocks.

While 'taking a hit' now "by reducing debt is now - while inflation is low, interest rates globally are low..." makes good sense, you go on to ruin it by this non-sensical "the folks who over-extended themselves get out with the smaller losses..." . So who do they sell to? Someone else who will be similarly overextended and looking down the barrel of a plummeting housing market perhaps? Doesn't really sound like a solution to me - unless you are proposing selling all this housing and land to overseas buyers. Oh I get it.

Tim, I suspect there is alot of local demand for both farmland and residential housing sitting on the sidelines. These are people who will not pay the inflated prices of 2006/2007 on because they sensibly refuse to extend themselves beyond a comfort zone. One of our kids is a prime example - sold in 2006 and rented for 3 years until they found a suitable place which they could afford on one salary (even though they are presently a two income household). Similarly, we bought a place in 2008 which had been on the market for some 12 months. Finally, the owner of some 20 years just accepted significantly lower than the "nice-to-have" (others might say, pie-in-the-sky) asking price.

We did the improvements he wasn't capable of or willing to do - and we sold it a year later in under a month - simply because we had paid what was a realistic price given the state of repair - and we sold at what was a realistic/affordable price to a young couple who had sold down in order to reduce their debt.

The only reason the market is slow presently is because asking prices are too high - not because of a lack of local demand.

I think I have to dis-agree on some points here,

A hit now would plunge us into a depression....I dont think we want to go there....Property strikes me as looking like a drowning man....this would be like standing on his head.....If that normal ratio of 3.5:1 is holding true then we have to drop from 7:1....thats a long drop....

I dont think now we can get in first, to me I think its happening very fast the mortgage fiasco looks to unravel things....so....NZ I think is a follower.....6 maybe 12 months behind....too small to get noticed mostly....

Nothing will come from the Govn, no Pollie is going to do anything negative of their own accord willingly...just wait for "oh we didnt expect that"........Im really wondering if its going to carry on as is into next year I didnt think this would blowup before xmas now I cant see why it shouldnt.....

regards

Ahh - Phil O'Reilly is like a old mad Aunt that you havn't seen in 20 years... and when you meet her again... she is still blathering the same old shite.

If we keep doing the same old stuff, We will get the same old results... Can BusinessNZ evolve, or will it go the way of the Dodo?

Gareth Morgan's point is important, and a few others have discussed it here already. It was pretty much my first reaction on the thread yesterday too.

I think the problem is that the voters generally have NO IDEA of the trade-offs they are making by default, or the consequences they will incur.

Of course we will have to get by with less borrowing, which means less consumption and eventually less government spending too. Of course we have to PRODUCE and EARN our way out of this mess.

But the Greeks differ from us only in the level of violence of their reaction to unpleasant news. I think this era is the decadent, "fall" phase of our civilisation. Everywhere, the State has got too big and people's expectations of it, encouraged by politicians, is just completely unrealistic. The mass reversion to Keynesian confidence trickstery is just another sign that we have run out of wisdom.

blah blah.....keynesian...blah blah....

This mess wasnt keynesian in its making....Greenspan was not a follower of that particular cult, he followed a worse one....

regards

@ Les Rudd

I agree that an open debate on the futire of NZ Inc needs to be held. NZ'ers need to be educated on the utmost importance of the productive economy and we all need to strive towards this together.

Singapore has this long term vision.

NZ shuld be mocving towards and investing in a hydrogen-based economy and should focued on high-value add protein products and world leading agriculture, marine and water management technology and science. We should be sponsoring top research facilities and pay the top scientists to come here.

However, I am not convivnced about Labour's motives or skills in this area. They have already said they would increase taxes on the "rich" earning over $100k in income from labour and savings. How can you build a productive economny when you tax your productive people out of existence.

Drop the tax on a labour and savings to a flat 20%, with an exemption for the first $20k of income. The Company tas rate should also be 20%.

An example of Labour's lack of skills is that they would only sell land to foriegners if they created new processing capability here in NZ. Additional competing milk processing capacity would seriously undermine Fonterra, one of our only productive exporting companies.

GG - I agree, the notion of reinstating Cullen's "get the rich pricks" envy tax would be a mistake. I'd rather see broader, flatter and include wealth generation that isn't taxed now. The debt fuelling same is as distortionary and inflationary as the untaxed revenue itself. Nevermind taxing the rich, just tax those who are not being taxed and are being carried by the rest. No harm in that is there?

As for Labour's FDI policy proposal, I didn't think what I was hearing (in news reports) meant the likes of Fonterra had anything to worry about in terms of stripping out volume from them, quite the opposite, I think, but open to be corrected, because I've not read their proposal in detail. I would have thought as they (Lab) seem to be proposing something like an aggregate value-add dimension for NZ Inc in the analysis, this would bring any negative impacts against, eg. Fonterra, (with it's criticality to NZ Inc) into the evaluation.

We need the debate.

TA'RA, Les.

Hydrogen isnt viable and probably wont be for 20 years....there just isnt any part of the hydrogen "story" that can be invested in now and in fact may never be, its a possible technology...the best bet is probably battery. Even if hydrogen becomes commercialised pretty much its a conversion process to take electricity and make hydrogen so its at best a 1:1 process, we need 14:1 processes....thats wind, tide and hydro.

Taxing out of existance....not so sure what Labour's plans are, I would hope they arent serious on the $100k....$500k yes

20% well thats ACT territory and there is no evidence that low taxes help an economy, in fact the reverse seems to be mor elikely. This is a choice for a society anyway, and ACT polls 3%.....So low taxes and limited public services or higher taxes and public services....if you take Sweden as an example of the latter well there appears to be a success story....ACT type policy? cant think of a successful country off hand.

regards

hey steven did you see this in wired?

http://www.wired.com/autopia/2010/10/hydrogen-highway-one-station-closer-to-reality/

i'm not an expert in hydrogenification, but they sure make it sound attractive...

“The other places, it’s mostly delivered hydrogen which is made from natural gas,” said Tom Sullivan, SunHydro’s founder. “The biggest difference is that ours are solar powered and it’s made on-site with a proton electrolyzer. You’re literally driving on fuel that’s made from water and sun.”

You can't tell me that doesn't sound good eh?

Les,

Could you please expand your logic behind this statement:

"Additional competing milk processing capacity would seriously undermine Fonterra, one of our only productive exporting companies."

I would like you to include a perspective looking at economic benefits to the nation.

Thanks.

You need to address that to GG. Reply to GG's comment and an email will get sent to GG.

Sorry less - I got the wrong author.

GG,

Could you please expand your logic behind this statement:

"Additional competing milk processing capacity would seriously undermine Fonterra, one of our only productive exporting companies."

I would like you to include a perspective looking at economic benefits to the nation.

Thanks.

I put this on anther thread, but it should be here too:

'Placing Business Over Property'

"It adds weight to Bernard Hickey's argument for land tax or a Hong Kong style stamp duty on transactions to raise funds in property boom times and redistribute it to the productive sector. The problem in New Zealand is that the very small in numbers, but powerful Farmers Union, Federated Farmers wouldn't have a bar of it. They want all their capital gains to themselves and all their tax deductions from interest on their excessive borrowing,

If however New Zealand is going to be more that a country that sells land to itself and foreigners, SME's with all the entrepreneurs and productive talent there are going to have to be either given a hand up or have obstacles to their success removed to level the playing field up against business and individuals who merely buy and sell up chunks of land."

http://asianinvasion2006.blogspot.com/2010/10/placing-business-over-prop...

Well said Cactus Kate.

Click onto Kate's blogsite and have a read of the whole article. Interesting stuff.

Cheers, Les.

Given that farms are both part of the productive sector and a business, then they too could qualify for any redistribution of monies received.

I would apply for it to put in a high speed internet service to myself. :-) After all that would have to be as productive as Kate's 'big and expensive' server. One does have to wonder though, if Kate's company had to fund the server themselves, if it would have being cost efficient instead of 'big and expensive'.

Methinks you guys are probably doing ok as it is:

"They want all their capital gains to themselves and all their tax deductions from interest on their excessive borrowing,"

So I guess you can afford it anyway, with that kind of subsidy.

Besides I seem to recall you didn't mind the idea of a CGT in preference to a land tax, why was that again? Somewhere in this thread I think:

It was fun.

Cheers, Les.

They want all their capital gains to themselves and all their tax deductions from interest on their excessive borrowing,"

Ah well, Les, your comment applies to ALL businesses not just farmers so why just single us out?

Because it's a well known fact, many of your peers have used a business model not unlike like the average latter day PI, expensing themselves out of paying income and corp. tax by farming for primarily for capital gain, which isn't taxed. Whereas this is not the case with other productive enterprises, including the farmers not farming purely for capital gain. That said, my preference is for a land tax and a cgt, (to tax presently untaxed non-land based wealth generation) so that PAYE and corp. tax could be reduced.

If your'e not farming primarily for capital gain, why wouldn't you want lower PAYE and corp. tax?

Cheers, Les.

So St Pat you have a problem with Graeme Harts business style -buy an underperforming business get it up and running and sell it off for a profit? Afterall that is what alot of the 20% of the dairy farmers with 80% of the debt were doing/were wanting to do. Most of them will be paying for their cavalier attitude to debt in the next short while and some already have.

A significant amount of 'capital gain' in dairy farms can in fact be as a result of production increases. Same amount of land, but more production from that same land = more valuable asset or 'capital gain'.

Corporate tax @ 28% I can live with (I am also a corp tax payer). I would prefer to see the first ? (say $10k) of income not taxed. It incentivises people, especially young people to take up holiday/part time jobs and therefore develop a work ethic early in life.

The tax take is not necessarily the issue here - the size of govt and welfare spend is. I read somewhere that Peter Dunne is now wanting the elderly to have some sort of tax deduction for their health insurance costs. A young family deserves the tax breaks for health insurance more than the elderly.

my preference is for a land tax and a cgt, (to tax presently untaxed non-land based wealth generation) So as a farmer I would pay the land tax but not the cgt or do I get hit both ways under your scenario?

Methinks you need to think on this: The difference between theory and practice in practice, is greater than the difference between theory and practice in theory.

Hi Marie - your first paragraph, oh please, and so loaded.

Second para, sure, but another driver has been the debt splurging, same as domestic PI dynamics. (Ponzi scheme is an ugly label though, I'll not mention it.)

Third, I reckon we could go lower than that and as you say by shrinking government. Tax thresholds would be a better way of helping those on lower incomes, rather than the likes of WFF paid for by PAYE "taxing rich prick" 39% envy taxes.

Dunne - no comment, but IMO young families get well catered for under public health.

Both ways, but with land taxes offset against realized capital gain, so you don't effectively get taxed twice, government get steady revenue, owners don't have to lock themselves down to avoid the realized cg tax in one large chunk at sale.

Great quote, fearing failure and embarassment should not disuade us from debating and developing solutions.

Keep up the good work Marie.

Cheers, Les.

Hi again Marie - see:

http://blog.labour.org.nz/index.php/2010/10/20/cactus-kate-on-fdi/comment-page-1/#comment-111695

"Many farmers barely cover their interest and principal obligations yearly to the bank. Therefore the only rationale is they are in farming for the end capital gain."

How true is that?

Am keen to see an analysis of revenue and actual tax take by sector.

Can anyone help with that?

Cheers, Les.

Cactus Kate's statement is fairly subjective. How does she define 'many'? If there are 1200 farmers in her 'many' then while numerically it may appear a lot as a percentage of all farmers it won't be. Cactus Kate and I grew up in the same area and went to the same primary school though I am of a different generation. I am not sure if she is referring to the farmers in that area (some of which are struggling because of easy credit) or farming in general. Either way I do not believe that a majority of farmers are struggling. In fact a number of them are sitting on a very nice pile of cash.

Cactus Kate also goes on to say: The rest of NZ presently especially SME’s are bleeding cash. No one seems to be holding them irresponsible for thier investment decision, yet some of those struggling SMEs will be struggling for the same reason those farmers are - easy credit and bad investment decisions.

St Pat any tax info for the sector will need to be spread over say 7-10years as the Income Equalisation Scheme is used from time to time and this could have the result of skewing any tax take for just a single year.

Marie - veracity, dunno, but given her background and work area I have a deal of respect for her view here, plus it's not as though she is the only with that view.

As for "a majority of farmers not struggling", then why the need for this very successful lobbying effort by FF:

'You cannot implement a problem – only a solution'

http://www.infonews.co.nz/news.cfm?l=1&t=0&id=53064

"We have worked with the Reserve Bank to ensure that the speed of implementation has been slowed down on their new “prudential measures” and capital asset ratio requirements of banks. While there has definitely been a tightening on availability of capital, the implementation of these new policies will now be at a far slower pace than originally planned, thus reducing even more stress among the farming community. We argued that speed on implementation was not the solution New Zealand needed."

Perhaps Conor English was referring primarily to this:

Maybe it's just a few at the margin? But it's the few at the margin that set the market, probably as you infer, streching to the margin with the easy credit readily available from the debt pushers. If it's only a few, is it really a too big to fail situation? I guess so, where the big thing that will fail would be land prices yet further and the Auzzie banks would be quite unhappy I suppose and looking for OS buyers to bale the situation, hence Key's concern, I think.

The thing is we should learn from this kind of situation and do stuff that avoids a repeat in the future.

Cheers, Les.

PS - noted on the IES effects, thx, if I see an analysis I'll bear it in mind. (Doubt an analysis is going to be forthcoming though.)

John, Les - a different approach is needed !

NZexorts are obviously at risk under the influence of worldwide situation. Among many other problems protectionism is a major problem and worse to come.

Why does the NZMEA not focus on developing more widgets for the national use ? Most all NZinfrastructure needs are imported. We are depending not only too much on imported widgets, but also foreign money/ investment/ company skill/ knowledge - to an extent that even the national security is at risk.

The private sector should engage the government for more commitment/ efforts in order to award infrastructure orders to NZcompanies. Higher NZproduction is clearly a very important issue and of national interest.

Now is a brilliant chance to develop the relatively low profile manufacturing industry and secure full employment and develop skill and higher wages.

……and Les, do what ever is needed to make positive progress. Your (NZMEA) are constantly fighting the government, when you should communicate and engage the government.

Firstly, listening what most ministers say in parliament, I think they have the wrong perception what production means. I told you several times education is the key to change that, among politicians, but also among the public. Of course without a culture change it is very difficult to achieve progress.

Where lay the potential to increase quality manufacturing here in NZ and what are the many advantages for our economy are the key questions. Can you please answer these questions- thank you.

Please, read and understand this with many previous articles about the same issue.

Walter - in Switzerland do business associations get involved in centrally planning what is produced? I must say, NZMEA have not tried that before, to my knowledge, maybe that's where they are going wrong.

Maybe it is all my fault. I should just jump back on m' lathe and get turning out some widgets asap. I don't don't know what sort of widgets of course, but should we care, so long as I'm busy?

Walter, we've been round this bouy before. Nutshell in a, NZMEA's approach is to advocate for policy that allows productive enterprises in the real economy to get on and do what they do with as few impediments as possible. I think you need to understand a bit more about, what they do and how they do it - and then I think you'd see NZMEA is not too far off the mark with it advocation, remember who sets and endorses it, NZMEA's Council and CEO Forum, here:

http://www.mea.org.nz/document.ashx?id=704

I'm happy they have got the approach right.

Cheers, Les.

Q - Walter - in Switzerland do business associations get involved in centrally planning what is produced? I must say, NZMEA have not tried that before, to my knowledge, maybe that's where they are going wrong. - Q

Yes, that is where you are going wrong. As many times described, there are enough and good reasons why infrastructure needs have to be planned, designed, manufactured, installed and maintained by Kiwi. To make that clear to the government, experts and the wider public should be one of your currently very important tasks.

Les, John can you please answer my questions above – thank you.

Sorry Walter I did not reply here see further down the thread.

Interesting talk.....

Thanks Steven,

the Michael Hudson talk below Keen's piece is well worth the time to listen to. All the juicy stuff - rentiers, neo feudalists and all.

This is the best talk I have ever seen for its quality....

regards

It is pretty simple. Imagine that you are 17 years old and walking down the street. A wealthy visitor to NZ, who is just off the cruise ship, pulls up beside you in his limosine and asks you if you will spend the night with him if he gives you $500? What do you do? Incidentally, his name is Mr Market. He is a practiced, remorseless, sociopath and pervert. He will not be gentle with you. He never has been. What do you do? Get in the car or keep walking home? It is a simple decision.

Especially when you realize it is not just a one night stand, as intimated. Mr Market is going to kidnap you and sell you and your kids into slavery.

Better to keep walking and figure out inexpensive or free ways of having fun- like learning to social dance. (ceroc, jive, tango, salsa, rock and roll, swing, bachata etc)

What, $500 for my blessed sacraments? Make it $5000 and I'll call you Daddy!

David, you chose the correct box and you win the prize! Concratulations! (It was a trick question to see how modern you were- you are very modern!)

Hi Walter

For the record my Council and CEO Forum does not support central planning of any sort, does not support grants or any winner picking interventions by central or local government - often I refer to this as picking which animals win, rather we believe that what need is a supportive system (better jungle) so the right animals thrive.

Read a the "A Goal is not a Strategy" from the New Zealand institute particularly the things South Korea does to shelter its export sector and marvel how many Kiwi firms stand in world markets with no help from the jungle. South Korea is nearer the norm than New Zealand. See it here:

In regard to import substitution on elaborate products, people based markets in New Zeeland are simply too small to sustain the R&D necessary to stand in elaborate product markets - New Zealand companies must be born global (well Australasian) to have even a chance of survival. Sad but true.

Winners cannot be picked, good Venture capitalists would be happen to get better than 3 in ten having discarded 100s if not 1000, of the balance 4 will pay back their money and the rest either de or be zombies.

Hope that goes some way to answer your questions.

I’m not a supporter of traditional, ideological thoughts John. I even go a step further and claim such thoughts currently do massive damage for our economy.

The world changed forever. As I described many times, we are currently living in a new, fast changing worldwide economic environment. Signs of trade wars, protectionism and the strong possibility of the introduction of a period of mercantilism are reflecting the situation and apply massive pressure to our NZexport business.

Internal production markets are struggling with unemployment rising. The nation faces a massive youth unemployment problem. Fact is youngsters without skill after school and an economy not capable of providing enough skilled jobs for the skilful, often leaving the country. As a nation without a solid secondary sector, wages remain low and even the middle class is increasingly struggling to pay their ever increasing bills.

With the worldwide current economic scenario in my opinion, but we do need urgently a rather structured economy - a “Mixed Model Economy”.

In stead of importing most everything stepping into production of our infrastructure needs is a brilliant opportunity with an almost endless list of advantages.

Please, read and understand this article in correlation with many of my others dealing with the same issue.

Leaders and senior policymakers must remain on heightened alert. With the risk

that protectionist sentiment may now intensify rather than subside, continuing and further

enhancing the monitoring of protectionist measures and maintaining the high-level political

awareness of the macroeconomic risks of protectionism will help to resist these pressures.

Les, John

One example: The Osec portfolio also includes free access to advisors and country experts, market studies and analysis, brokerage of business partners and participation in key international trade fairs. The enhanced Cleantech portfolio is available following the allocation of funding by the federal government under a program of economic stabilization measures.

John and Les, reading through your comments again this morning and I’m thinking for how much longer can an economy afford such a divorced relationship between the private sector and the government ? Isn’t urgent to ask serious questions about the massive problem this nation is facing on general national issues, particularly as far as our society concern ? Under the increase influence of world events solutions can only be found – working together !

Now is a brilliant chance to develop the relatively low profile manufacturing industry, reducing quality imports, secure full employment, national security, develop skill and higher wages, etc, etc, etc.

…and John I asked you important direct questions - so no I’m not convinced about your answers about my questions.

Are you two short of gunpowder ?

John, Les - the current dispute in the NZfilm industry is a classical example why the private sector and the government need to work together. In an environment where most economies are struggling, aggressive behaviour is unavoidable. Therefore for economic insignificant countries internal consensus is vital.

When it really matters having productive debates – the NZMEA – silence !

..or just short of gunpowder ????????

There is a very good paper from Treasury here:

http://www.treasury.govt.nz/publications/research-policy/tprp/09-01/08.htm

It is worth a good read then think about good and bad inwards investment.

Do I smell a war between Treasury and the RBNZ?

" Access to foreign capital allows domestic investment to exceed domestic saving. The ability to access foreign saving allows countries to run current account deficits and support their economic growth. Foreign saving is, however, not a perfect substitute for domestic saving because information asymmetries between savers and investors increase with distance. These asymmetries may bias the destination of foreign saving toward funding debt and foreign direct investment rather than, for example, early stage finance. Foreign saving can also raise issues of increased risk premium (from country macroeconomic risk), taxation distortions, and ‘home bias' effects. Consequently, domestic saving and capital market development are also important"

This reads very much like Treasury think the "covered bond" idea is very very stinky.

I don't understand why they are consulting about covered bonds anyway. The reserve bank has already bought these things from the banking system.

The whole point of capitalism is efficient allocation of capital right? When it comes to housing, once it's built, that's it, the capital has been allocated, and barring improvements that's the sum of the contribution to the economy..... for that investment......, it's a good bet and pays off or a bad one and borrower and bank lose their money.

When the dust settles after this lot and the culprits are found someone is surely going to ask the question; so why is it exactly that a house should be worth more than it cost to build it (plus improvements (not maintenance)). Not it's replacement cost, the cost to build that particular house.

The fact that the best that financial system can do is spruik up the value of the housing stock (what's the % of lending on housing in the US it's something like 98%) then that's a clear misallocation of savers money.

So I say forget capital gains tax, forget loan to valuation ratio (sorry Les), make it loan to original cost to build ratio (plus improvements and show receipts and council approvals). Or even better than this lending is restricted building new houses, or funding improvements and when the house is sold the loan can be transferred at the value of the oustanding principle for the same payments and same remaining term. If it's good enough for the banks to be able to sell the loans it should be good enough for the borrower to do the same.

"So why is it exactly that a house should be worth more than it cost to build it (plus improvements (not maintenance)). Not it's replacement cost, the cost to build that particular house."

Thanks for this Fred.... The same thought had recently crossed my mind - and I've had enormous difficulty dissuading myself of it. Nobody seems to like this way of valuing though...

It would put valuers out of a job. Anyone can add up the costs.

Surely valuers would continue.

Whilst the naked costs of the property would be detailed, the more subjective judgements of 'area desirability', proximity to good education, what other similar properties have sold for in the past, decorative/structural condition, neighbourhood, transport etc. would still need to be added in order to justify the price asked! These would be separately detailed as a sort of 'goodwill' payment.

Less need. If anyone wanted to pay a price "above par" that should be their subjective assessment if they need advice they can ask their friends. They would know the maximum any bank would be able to lend would be the outstanding principle on their loan. The bank wouldn't need any third party opinion to support their ponzi scheme, the receipts should do.

Bernard shame on you!!

Why can I not comment on one of the best days in PGW shareholder history, the up ending of Tim Miles??

It is absolutely fantastic news, another Norgate buddy gone.

Great work Sir John Anderson - it is a true shame he was not available for SCF.

Golden fox- how many Crafar type deals have PGW got involved in?

Re James McMurtry and "We Cant Make it Here". Its a pretty old song written as criticism of George W. It sums up how Jame McMurtry felt about George W ten years ago rather than how the US is feeling now.

I would like to see foreign purchases of NZ assets blocked. Our exchange rate would fall and we'd have to start making things and selling to our own.

Could kiwi's make what we import? Would the raw materials have to be imported?

Im tending to agree...with blocking foreign ownership...on balance its seems the lesser of the evils.

Sure we could make this stuff, however from what I was told the import taxes on say shoes years ago made the price horrendious....just who benefits? Sure some un/semi-skilled workers have jobs, but they cant afford the shoes they make....

And yes we would have to import raw materials....

Given the way the world is trying to kill their own money via QE maybe this is how we combat it without printing ourselves.....

In terms of our exchange rate falling, yes, but would it necessarily fall that far? it would probably ballance at some lower point...plus of course if other countries are also devalving there maybe no difference as the differences dont change....

The thing for me is to get the ponzi finance capitalists out of our system, looks like our GDP would be 50% of what it was, but that would be a real economy....with workers and employers benefiting and not gamblers/speculators....and this is why I agree in my first para...blocking the financiers has to happen IMHO.

Gareth Morgan I think has it wrong....at least he's right we will suffer, but until the financial ponzi crap is purged we will stay crippled and workers and employers in teh real economy will continue to suffer...

So forget the kiwibank loser saying please borrow more...that just keeps him in a job at your expense...

regards

Could it be that Gareth is afraid such laws might hurt his KS scheme? Gareth, whether we borrow money or not it's OUR f**king country! WE will do as we please, Got it?

gareth is the finance part of our economy....the bit we have to get rid of....or at least put it back in the cage and keep it there....

So of course he isnt keen....

regards

This is just the flip side of Gareth's earlier article...it's the nice rational side telling us that we should do and act nice and it's really for our benefit. Which I agree by the way.

FYI in case you have forgotten, Gareth's earlier article basically says " Sell our farms at bubble prices and then stiff the foreigners with sky high charges for enviromental and pollution cost " Then we can have our cake and eat it too !!!

There is some method in his madness here...The kiwi farmer who paid too much unloads it to foreigners who pay too much then at some point the bubble bursts and sell it back at a huge loss...(but maybe ignoring our currency appreciating as other countries race for the bottom).

This doesnt hide the fact that the business model of the original kiwi farmer was flawed ie he was afrming for capital gain....it just means some else ends up with the tab...

Which actually is something Ive noticed kiwi's are very good at....passing the buck to someone else...at home we used to call them "wide boys".....ie here its very much buyer beware....which is sort of fine.....as long as you know....

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.