Here are my Top 10 links from around the Internet at 10 to 11 am, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Thursday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream.

1. Has Ralph misjudged the mood ? - Ralph Norris was not shy of telling governments to get stuffed when he headed the Business Roundtable here in New Zealand.

Now he's telling the Aussie government to get stuffed in his current job as the CEO of a Commonwealth Bank of Australia by increasing mortgage rates by more than the Official Cash Rate.

This is political dynamite in Australia.

CBA is the former state-owned 'People's Bank' with the biggest mortgage market share and now it's saying it needs to further boost profits that are already at a record high A$6.1 billion?

Treasurer Wayne Swan went ballistic, accusing CBA of arrogance and a 'cynical cash grab'. He is now looking to regulate the banks, who strengthened their market positions in the wake of the Global Financial Crisis and benefited from government guarantees.

Here's some of the Aussie press. It's not pretty for the banks. Here's Matthew Stevens at The Australian

RALPH Norris has put the Commonwealth Bank's mortgage pricing where his rhetoric has been for the past month or two. In doing so he has brazenly challenged the political consensus currently building around the idea that our greedy four pillars require further constraining regulation.

There is commercial logic aplenty to support Norris's decision to stare down banking's critics and add a further 20 basis points to the Reserve Bank's decision to lift the official cash rate by 25bps to 4.75 per cent. But, at the same time, the politics of banking appear to be uncertain enough to suggest Norris might have been better served by sucking-up his higher funding costs for another quarter or so.

Norris, though, is having none of that.

2. Not so smooth - Westpac took a major hammering when it did something similar to CBA's 'bigger than OCR' hike to mortgages last year.

Remember the Banana Smoothie video? Here it is again.

3. 'Hung out to dry' - Elizabeth Knight at the Sydney Morning Herald comments that CBA has been hung out to dry by the other banks.

To give you a sense of the coverage over the Tasman, I've reproduced the picture that was used this morning with the SMH story online of a grinning Norris.

The former ASB and Air NZ CEO must surely be the most hated New Zealander in Australia right now.

Sonny Bill Williams has passed that mantle onto Ralph for now. This went with a story headlined 'The Bank that stopped a nation'

The Commonwealth Bank of Australia has been hung out to dry. For a day, at least, it has been left on its own as the only bank to raise variable interest rates beyond the quarter of a percentage point announced by the Reserve Bank yesterday.

At least two of its competitors, ANZ and Westpac, will probably follow in the slipstream and raise rates beyond the cash rate over the next couple of days - hoping that hiding behind the CBA will minimise their own public relations damage. There will be pressure on the National Australia Bank to follow.

None may match the rise of 45 basis points announced by the CBA - taking the view that staying just underneath the CBA would reduced their visibility on the radar. Inside the banking industry bunker, there is a view that this could be the last opportunity to raise interest rates out of step with the official cash rate.

However, there is only so much that the public will take, and there will be a serious consumer backlash against the banks. The issue has become too hot and the banks are aware of it. Canberra has already begun its own public relations campaign. Banks see themselves as a business like any other. But the public, and most certainly their customers, do not. The public puts banks in an entirely different category. They are not selling baked beans, and customers cannot choose to stop buying the product if the price goes up and switch to a substitute item.

The public takes the view that banks are in a privileged position - the recipients of government guarantees, with a responsibility to the community. More importantly, an increase in the cost of borrowing has an enormous effect on households with a mortgage.

4. 'Boycott the banks' - News.com.au reports that a Federation of Small Businesses in Australia will roll out a campaign to boycott the big four banks in Australia.

The United Retail Federation said it was preparing a campaign to boycott banks that increase rates beyond the official Reserve Bank move. The Federation represents tens of thousands of small business owners around the country.

“What has occurred in Australia’s banking sector is nothing short of a national crisis and economic terrorism striking at the heart of the national economy," URF national president Scott Driscoll said.

"This will not be an easy campaign to inflict on the banks but we need, in my view, a popular revolution against the banks. "The message has to be clear to the banks that business is prepared to walk."

5. 'Pan European bank mutiny' - Speaking of bank boycotts, here's a real doozy in Europe. A German blog called 'All is Smoke and Mirrors' has proposed that December 7 be a Pan European bank run day, Zerohedge reports.

After German blog "All is Smoke and Mirrors" floated an idea of an organized bank run (something attempted previously in the US without much success) in France in response to French austerity protests (which have resulted in no gains), the effort has since expanded to a pan-European organized bank run day on December 7, 2010, and has metastasized to Italy, Germany, the Netherlands, the UK and Greece.

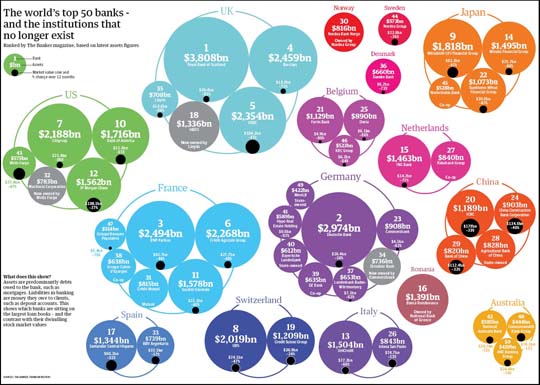

Zerohedge also includes this great chart from The Banker showing how the market values of many European and US banks have shrunk in size and are now tiny compared to their level of assets and liabilities...

Click on the chart to see a bigger version.

6. The overhang - The Wall St Journal reports that it would now take 107 weeks (just over two years) for US banks to clear their backlog of houses they have foreclosed on. House prices are falling again there now.

Banks’ vast pile of foreclosed homes doesn’t appear to be diminishing. That’s a troubling sign for the future of the housing market. Back in April, this column tallied up all the foreclosed homes sitting in banks’ inventory, as well as the “shadow” inventory of homes in the foreclosure process or on which owners had missed at least two mortgage payments. At the time, we reported that at the current rate of sales, it would take 103 months to unload it all.

Over the past six months, that number has actually risen. Banks managed to pare down the shadow inventory, but largely by taking possession of foreclosed homes. As of September, they owned nearly 994,000 foreclosed homes, up 21% from a year earlier. The shadow inventory stood at 5.2 million homes, down 7% from a year earlier. Grand total: 107 months of inventory.

According to the Sacramento Bee, CalSTRS (the big teachers retirement fund) is set to vote on Friday whether or not it should reduce its annual investment returns estimate from 8% to 7.5%, a move that will add hundreds of million to state debts (since the pension is guaranteed, and public taxpayers are on the hook).

That would be a huge decision, if they do it. 8% has been the level set since 1995 (talk about a whole nother era), and artificially high return estimates are how the pension systems aren't (on paper) even more insolvent than they already seem.

8. 'Just give it away' - In anticipation that the US Federal Reserve's QE II won't actually work if it is just done in the form of buying US Treasury bonds, CNN Money suggests the Fed buy all sorts of other assets to jump start the US economy, including securitised mortgages, small business loans and large stocks.

It's incredible that it has come to this.

Ben Bernanke may as well use that helicopter of his to tip the newly minted cash out the window.

Roger Farmer, head of economics at UCLA, proposes the Fed buy broad-based indexed stocks, and no Treasuries, as a way to boost confidence and spending in the private sector. This strategy could calm stock market volatility and encourage individual investors to put their money back into financial markets, he said.

Funneling more money into the private sector would hopefully spur businesses to start hiring and spending again.

9. Inflation squeezing out into the developing world - One of the side effects of the Federal Reserve's low interest rate and QE II policies is that it squeezes cash out into the emerging economies with closely connected currencies.

That's pushing inflation out to the fringes in the emerging economies and the commodity-linked developed economies such as Australia. That's why the Reserve Bank of India raised its official rate yesterday too, the FT reports.

Since March this year India has emerged as the most aggressive tightener of monetary policy among the Group of 20 nations, as it tries to manage high inflation, rising foreign capital inflows and growing fears that the economy is overheating.

"While the ultra loose monetary policy of advanced economies may benefit the global economy in the medium-term, in the short-term it will trigger further capital inflows into emerging market economies and put upward pressure on global commodity prices," said Duvvuri Subbarao, the central bank governor.

10. Totally irrelevant video - Jon Stewart does his thing on the eve of the mid-terms

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Indecision 2010 - Republicans Can Go to the Back of the Car | ||||

|

||||

50 Comments

Love that Osama cartoon - works on several different levels.

That Zerohedge graphic is the business. One to cut and keep.

Oh yes ...he could have used the 'D'...should have used the 'D'!

The moral for bankers must be: don't smile.

Surely $A16m per year would buy Ralph a decent set of veneers. The unshaved hobo look, with a maniacal smile and bad teeth doesn't sit comfortably as an image for a banking overlord.

Bazza Norris !

Pragmatic Capitalism has a nice take on why Bernanke is pursuing QE II. He's bailing out the banks again. Here's the thinking. HT Gertraud via email.

http://pragcap.com/qe2-bank-bailout

There is one distinct benefit of such a policy – it alters the composition of bank balance sheets. At the end of the day it’s really just an asset swap and a transfer of risk via bond duration or bond type. The kicker here, is that if you’re a bad bank with a few trillion dollars in bad mortgage paper you’re delighted if a AAA rated entity comes in and swaps those assets out with their highly rated paper. This is exactly what the Fed did in 2009 and make no mistake – it was hugely successful in clearing the credit markets and altering the composition of bank balance sheets. This was Mr. Bernanke’s goal after all. He was simply trying to clear the credit markets and improve the banking system and he believed that would ultimately fix the problems in the US economy. Unfortunately, he misdiagnosed a household balance sheet recession as a banking crisis. QE1 provided liquidity in the credit markets and it gave the banks some much needed breathing room. Unfortunately, the impact on the real economy was far more muted.

I think Ben Bernanke knows all of this. He has added $1T in reserves to the banks already and it hasn’t resulted in a surge in borrowing or self sustaining economy recovery. It doesn’t take a genius to understand that adding another trillion won’t change anything either. If there is low demand for apples putting more apples on the shelves does not improve the apples salesman’s ability to sell more apples.

But Mr. Bernanke is seeing the same thing that I am seeing. He sees a weak economy and a housing market that appears to be rolling over again. Knowing that the banks are extremely fragile here and understanding that there is absolutely no political will for another bailout Mr. Bernanke is creating his own bailout by bypassing Congress.

cheers

Bernard

Indeed is he though?...ie tI wonder why he is.....if he's hog-tied by Congress its not his problem, if he does this and fails he's taking the blame and Congress will cruxify him for it....

Lucky guy he gets to sit in the hot seat for what looks like the worst depression ever...I wonder 80 years from now how history will look back on him.....I wouldnt think to well so far....

regards

Good to see the point being tumbled to by more and more people. Trillions of dollars in bubble value in the USA housing market makes a far bigger mess to clean up than your run-of-the-mill sharemarket crash.

But Aussie and NZ both have a much bigger "bubble" relative to the size of the whole economy, than the USA did. We are on borrowed time.

I do think, though, that our Reserve Bank has already been taking paper off the banks hands for months if not years already - and this may be a lot more effective than trying to clean up "post crash". I still say that Hugh P. is right - regardless of what the Reserve Bank does, if we don't get the land supply issue right, our economy is toast, whether sooner or later..

I think you think too small.

Land supply might seem a biggie to those who are inextricably involved, but its an irrelevancy in the big picture.

Our 'economy' was toast the moment the future couldn't underwrite the promisory notes extant in the present. So too was every other 'economy'. And that state was going to arrive with exponential suddenness.

Irrespective of locally-held attitudes, note. A 'communist' oilfield depletes at exactly the same rate as totalitarian or a democratic one.

The overshoot was always going to be the problem, regardless of how it manifest itself. Not surprising it was housing, given the access to same, universality of same, beats stamps every time.

The underlying reason(s) is/are more important.

FYI David Stockman does his thing at the New York Times a few weeks ago. All the more relevant today. A pity Republicans (and Democrats) just don't get America's problems.

HT Andrew Patterson via email http://www.nytimes.com/2010/08/01/opinion/01stockman.html?_r=2&pagewant…

Having lived beyond our means for decades by borrowing heavily from abroad, we have steadily sent jobs and production offshore. In the past decade, the number of high-value jobs in goods production and in service categories like trade, transportation, information technology and the professions has shrunk by 12 percent, to 68 million from 77 million. The only reason we have not experienced a severe reduction in nonfarm payrolls since 2000 is that there has been a gain in low-paying, often part-time positions in places like bars, hotels and nursing homes.

It is not surprising, then, that during the last bubble (from 2002 to 2006) the top 1 percent of Americans — paid mainly from the Wall Street casino — received two-thirds of the gain in national income, while the bottom 90 percent — mainly dependent on Main Street’s shrinking economy — got only 12 percent. This growing wealth gap is not the market’s fault. It’s the decaying fruit of bad economic policy.

The day of national reckoning has arrived. We will not have a conventional business recovery now, but rather a long hangover of debt liquidation and downsizing — as suggested by last week’s news that the national economy grew at an anemic annual rate of 2.4 percent in the second quarter. Under these circumstances, it’s a pity that the modern Republican Party offers the American people an irrelevant platform of recycled Keynesianism when the old approach — balanced budgets, sound money and financial discipline — is needed more than ever.

cheers

Bernard

Stockman is conveniently overlooking the fact that US company's have benefited enormously from " globalisation " . They have adjusted , relocated , formed new alliances , set up new facilities .

It is the state and federal governments who have failed the people of the USA . And let's not get started on government agencies such as Fannie Mae and Freddie Mac . ............. . As for those feckers in the Federal Reverse , Greenspan & Bernanke .......... words fail me , for once !

My opinion on this has been getting stronger and stronger lately. I agree with you, Gummy.

Here is my poser for all those who say that "Wall Street" or "the banking system" failed.

Land values start rising. (I say that is because of anti-urban sprawl regulations, but whatever).

People still want to buy houses.

Banks still want market share.

Thousands of highly paid regulators are following the economy, and from Greenspan down, none of them say there is a problem - in fact, they all say there isn't one.

NOW, let's assume the bankers WERE smarter than the regulators, and saw the bubble for what it was. What difference would it have made UNLESS the entire banking system colluded to stiff-arm home buyers beyond certain critical trigger points? AND, if the entire banking system HAD so colluded....? Can anyone else imagine a big, fat, anti-trust action happening - probably pushed by the same politicians who had already forced the banks into at least SOME of the unwise lending practices.

The sheer unreasonableness of the "blame the private sector, not the government" types is astounding.

GOP are Keynesians? since when?

Twisted monetarists with an objectivist bent from of Alan greenspan more like....

regards

Ireland has one month to prove to bond markets it can fix its budget, Bloomberg reports. It seems Angela Merkel is also worrying bond holders. Europe is far from out of the woods.

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aKk7ed3gy4HU

While Ireland doesn’t need to raise money this year, its 20 billion euro ($28 billion) cash pile may only last until the middle of 2011.

German proposals to put in place a permanent debt-crisis mechanism at EU level are also adding to Ireland’s problems, says Harvinder Sian, a London-based analyst at Royal Bank of Scotland Group Plc. While German Chancellor Angela Merkel reiterated today that she wants to force bondholders to foot some of the bill of any future bailout of a euro member, some officials argue that could spook investors at a time when countries such as Ireland and Portugal are trying to cut deficits.

“Up to last week, I would have said that Ireland could avoid a bailout by taking the measures needed to reduce the deficit,” said Sian. “Now, the measures being proposed by Angela Merkel are casting a shadow, not just on Ireland, but across the periphery.”

cheers...i think

bernard

John Hathaway from Tocqueville Asset Management has this view on gold and the US dollar at Bloomberg

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aLigPpbxbK24

The breakdown of the monetary system will be chaotic. When inflation commences, it will be highly disruptive. The damage to fixed-income assets will seem instantaneous. Foreign-exchange markets will become dysfunctional. The economy will become even more fragile and unpredictable.

Gold is an imperfect, but comparatively reliable, market gauge for the extent of current and future monetary destruction. The recent acceleration in the dollar price of the metal to $1,381, a record high in nominal terms, coincided with talk of a new round of quantitative easing and highly visible discord among major nations on trade and currency-valuation issues.

Naysayers’ Bubble

Naysayers point to gold’s price and see a bubble, without understanding that the only acceleration that is taking place is in the rate of decline of paper currency. The Fed is organizing an attack on the dollar’s value, believing that this is the most expedient way to defuse deflationary market forces. The man in the street is unaware, a perfect setup. Inflation can only be successful when the public doesn’t see it coming.

Now China is telling how the Americans should stimulate. This should be fun.

China's sovereign wealth fund has urged the Obama administration to spend $1tn (£624bn) on infrastructure over the next five years, to create jobs and improve American competitiveness.

Zhou Yuan, head of asset allocation at China Investment Corporation (CIC), said Beijing would be willing to invest in such projects.

"We are advocating that the US government start a programme to invest a massive amount of equity, in the form of public and private equity partnership, in US infrastructure," he said at a conference of the Chinese Financial Association in New York over the weekend.

"Infrastructure projects of this kind will serve to create a lot more jobs than simply QE2, or QE3," Mr Zhou added.

http://www.bbc.co.uk/news/mobile/business-11671004?SThisEM

cheers

Bernard

Here's Jim Kunstler on what the mid-terms really mean. He doesn't hold back. HT Nikki via email.

On Tuesday, when the Republican Party and its Tea Party chump-proxies re-conquer the sin-drenched bizarro universe of the US congress, they'll have to re-assume ownership of the stickiest web of frauds and swindles ever run in human history - and chances are the victory will blow up in their supernaturally suntanned, Botox-smoothed faces.

It's really too late for both parties. They're unreformable. They've squandered their legitimacy just as the US enters the fat heart of the long emergency. Neither of them have a plan, or even a single idea that isn't a dodge or a grift. Both parties tout a "recovery" that is just a cover story for accounting chicanery and statistical lies aimed at concealing the criminally-engineered national bankruptcy that they presided over in split shifts. Both parties are overwhelmingly made up of bagmen for the companies that looted America.http://kunstler.com/blog/2010/10/now-what.html

cheers

Generally I think he's right.....though whether the tea party will be the stooges that many (including me) thought, I am now not so sure....if these ppl really are that nieve that wont last about past about March....I think if any of them is genuine they will be gutted....by what they find and see. Will the Republicans find them a push over? Im really not so sure...

I agree on their victory blowing up on them, the democrats had two years of blame for their inadequacy....and go what they deserved IMHO. I think the Reps now take power just as the second dip occurs and its their policies or lack of them that will see if that fall can be checked like the first one or actually accelerate it....Im going for the latter.....so 18months of sweet nothing (as in achieved something positive what I expect is mayhem and a depression and rocketing un-employment) then 6 months of finger pointing and blame to Nov 2012.....Obama might now find that sure he has 2 years of having his hands tied but find the blame now does not fall on him....if he has the balls to stand up to them.....and if he doesnt well he's toast....

regards

FYI "An estimated 1.4 million Spaniards are facing potential foreclosure proceedings, according to Spain’s consumer protection association" HT Darryl via email

http://www.nytimes.com/2010/10/28/world/europe/28spain.html?pagewanted=…

cheers

Bernard

As an OECD report several months ago said, there has never before been so MANY OECD members with property price bubbles simultaneously. Spain is just one of the many.

The narrative that this GFC is all because of Wall Street or the USA's property price bubble, is misleading in the extreme. The USA's one has just had the most coverage, and opportunist politicians everywhere love to deflect the blame from THEIR own policy failures.

THIS global recession is the "urban planning" induced recession. It is not going to go away until we have removed the logjams to progress that caused it in the first place. The world would never have recovered from the 1930's one if they had had urban planners strangling their economies.

Absolute rubbish.....its a cheap credit, lack of control aka Greenspan induced depression....

regards

I think the main idea behind Obama`s QE programme is to lower the value of the dollar so that America`s exports become cheaper for the rest of the world and therefore boost production for American producers.

Isn`t China getting accused of basically the same thing?

It is a funny old world.

A major flaw in this thinking is that the US has exported most of its manufacturing industry - last time I looked US manufacturing only made up 15% or so of its economy.

That hike in the Aussie floating rate (courtesy of our Ralph) brings it to 7.81% - bubble pricking stuff for their crazy housing market. Watch for a big slowdown in Aussie house sales as the number of active buyers dwindles to cashed up Boomers, wealthy Asians and the clinically insane.

BTW can anyone explain why Norris can't raise money under 5%?

People are willing to lend to Uncle Sam for 10 years at 2.5%, they're printing money, have a big trade deficit, have debt closing in on 100% GDP and are committed to trashing their dollar. Doesn't make sense. According to Bloomberg, 30 year mortgage rates in the US are under 4.5%. What's up with that, that's less than the Aussie banks say they can raise funds wholesale.

The cost of covering the exchange rate risk eats up the advantage. Of course, the CBA could do a carry, and run the exchange rate risk. But that's kind of what got a lot of people who borrowed cheap swissy and yen into trouble, when it came to repayment time.

Thanks Nick, I understand that, my point was really that surely the US has a higher risk profile yet, perversely a lower interest rate.

Apologies. I completely missed your point, and was concentrating on the mechanics!

New chairman Michael Cullen wants Kiwibank to be "the biggest bank in New Zealand.''

http://www.stuff.co.nz/business/4302405/Mr-Grumpy-relishes-normal-life/

Hugh Pavletich's analysis above is sobering.

Maybe Ralph Norris will be thanked one day by his shareholders if he manages to get as much mortgages OFF his bank's books and onto those of his competitors BEFORE the big crash. Maybe he is aware that international hedge funds are recommending Aussie banks with mortgage market exposure, as a "short selling" opportunity? These people have seen it all before, in California.

As for our own Kiwibank; how many MORE billions of dollars of dead loss does Michael Cullen have to inflict on the NZ taxpayer before he cops the disgrace he already deserves? It is all very well for John Key to be Mr nice guy, but myths like "Cullen was a good finance minister" have serious consequences.

As long as Kiwibank takes the low risk ie well < 80% mortgages because of its size I dont see a huge issue...Kiwibank has obvious costs, but in-obvious savings, ie they act as the ppl who keep the cost of mortgages down.....how much has that saved? I know my mortgages for the last 7 years has been 0.25% below anyone else almost consistantly....I dont think the banks will unload their mortgages its the only hand they have left....

In terms of Cullen, this is of course your opinion as a Libertarian, so oh how surprising, which franky simply doesnt matter as thats all of 1000 of you....

He has achieved some not so bads....he certianly could have done a lot worse....at least he got our debt down so National can borrow at a reasonable rate....lucky for them. and kicke doff some saving funds to try and alieviate the future issues...more than BE & JK is achieving....

regards

Cullen did NOT "get our debt down", he inherited a situation where debt was already being paid down. Secondly, he presided over an entirely false boom in which our economy "grew" 15% while the tradables sector shrank 12%. This was fuelled by a massive blowout in NZ-ers indebtedness.

Not only did Cullen NOT do anything about the coming crunch, he found numerous new ways to spend taxpayers money and to hobble the forementioned tradables sector still further. He could hardly have left the Nats with a more poisoned and scorched earth. I have said again and again that John Key SHOULD have stuck to the truth and let these charlatans win the last election as well, so there would be no doubt at all about who "owned" the crisis, and that nanny state big spendin' gummint only ever makes things worse.

I also think it is hilarious that you regard government interference to keep your mortgage costs down, as a good thing, and yet you argue that "cheap credit" was to blame for the global financial crisis rather than regulatory-caused land price bubbles.

We shall see. Certain "Government Sponsored Enterprises" played a role in the US's bubble; Kiwibank is just our version of those. The poor ol' taxpayer, of course, is the means by which the costs of these follies are "socialised", which is tough on people who acted responsibly. This whole political trend is doomed to collapse in a welter of state-incentivised irresponsible behaviour. As Maggie Thatcher said, it "runs out of other people's money"; and it runs out even faster if you convert "other people" into "our people" in the process.

And it always mentions Texas.

I've got an old LP like that.

The article states Michael Cullen had a negative impact on Treasury. Didn't he also just get booted out of office for doing a bad job?

Surely giving failures plum jobs is corruption. No wonder people lose faith in our social institutions.

What do all these mean to NZ?

She's rooted , Billy !

It means we are facing a very rough ride....

Anybody with sense right now would be sitting tight.....ie dont take on any more debt....

regards

http://www.spiegel.de/international/world/0,1518,726447,00.html

That's a very insightful article - this was one of the more thought-provoking lines:

How strong is the cement holding together a society that manically declares any social thinking to be socialist?

Inflation in essential commodities.

It's dirty filthy stuff but we need it:........ I made the good bits stand out!

http://www.marketoracle.co.uk/Article23969.html

"USA Joint Operating Environment report, issued earlier this year:

By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD.

A severe energy crunch is inevitable without a massive expansion of production and refining capacity. While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds. Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India. At best, it would lead to periods of harsh economic adjustment. To what extent conservation measures, investments in alternative energy production, and efforts to expand petroleum production from tar sands and shale would mitigate such a period of adjustment is difficult to predict. One should not forget that the Great Depression spawned a number of totalitarian regimes that sought economic prosperity for their nations by ruthless conquest."

I pointed out JOE months ago Wolly, and since then we have had the German one and recently there is a NZ parlimentary piece/briefing paper on it....

So our Pollies know and in fact Brownlee was seen dribbling over the hydrates that we could get to "easily".....no one would go for that sort of cost to extract unless there was no choice....he's regared as pretty thick but it seems to have finally sunk in.....Peak oil that is.

In fact you can go back to the Robert Hirsh report of 2005 to read paragrpahs just like this....and even earlier for other ppl considered tin foil hats by the "serious" people....Twilight in the Desert for instance.....and if you want even back to the 1950s....

"Harsh economic adjustment" yes it will be hence im out of stocks or any other investment, all of them are over-valued in a energy constrained world....panic sometime in the next 2~5 years.....

Sure we saw ruthless conquest from Germany and Japan, except this time there isnt really anywhere to go invade to get resources......and what cost Japan and Germany the war? lack of oil.....the US was the world's biggest exporter at the time (until 1950s?)....this time its the US that has no oil/energy....so even if the loonies like Palin get in they wont be able to do much....

regards

Just when he and Gerry were learning their Hobbit lines..along comes a bloody thief!

http://www.stuff.co.nz/business/industries/4300903/Air-tax-rise-to-mean-fewer-tourists-PM

"Prime Minister John Key has attacked Britain's huge increase in airport departure tax this week, suggesting it is an over-the-top green tax which unfairly hammers those heading down under.

The British air passenger duty for New Zealand rose by 55 per cent on Monday, raising the tax bill for economy passengers from 55 to 85 and for premium passengers from 110 to 170.

In New Zealand dollar terms, that means departing economy class passengers will be paying about $178 in tax and premium passengers about $357"

So what's to stop the passengers taking a train to France and flying from there.?

few direct flights? actually....any direct flights?

I think Frankfurt does 2 a week....

If you have to go via OZ then they have taxes as well.

regards

Is it that difficult to establish new direct flights...what the hell is wrong with the managers and pointy heads...AirNZ should be moving at speed to organise it........stupid if they don't.

Our dollar will kill tourism long before any departure tax does.

Not to keep the 100% pure Green and Clean image kills tourism with the high $ and the departure tax.

2: LOL , Westpac and there justify our profit propaganda. Home onership via borrowing is nothing more than a prison/slavery sentence. Some are beginning to see that but still not enough.

Someone put it this way once: it's just "renting plus debt".

So let's do something to keep our currency from heading towards parity with the US dollar

Gareth Morgan once said that New Zealand is a pimple on the bum of the world.

Have things changed? Any bright suggestions on how to manipulate the NZ $ to artificaially increase its value against the S$/A$/€?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.