Here are my Top 10 links from around the Internet at 10 to 11am, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Thursday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream.

1. Chinese inflation reports - China Daily reports that in the first 10 days of November, China's average wholesale prices for 18 types of vegetable in 36 cities surged by 62.4 percent year-on-year.

1. Chinese inflation reports - China Daily reports that in the first 10 days of November, China's average wholesale prices for 18 types of vegetable in 36 cities surged by 62.4 percent year-on-year.

HT Reece via email who wonders how this might effects us here in NZ.

China is unlikely to become a large consumer market when about half of Chinese urban families plan to tighten their purse strings next year amid mounting inflation and stagnant incomes, a new survey has found.

This next bit is fascinating.

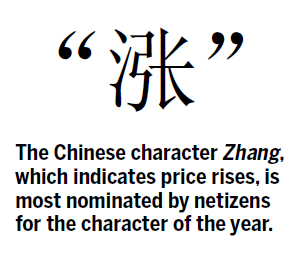

Chinese netizens have conducted heated online discussions to choose the character of the year, with (zhang), indicating price rises, the most popular so far. Inflation hits 2010 character poll voting Tianya.cn, a popular online forum in China, opened a platform for Internet users to nominate the "Character of the Year 2010" on Nov 2. The nomination had attracted more than 100,000 clicks and 4,000 replies by 4:30 pm on Tuesday.

And zhang attracted more than 80,000 clicks. Summarizing the major events of a year with a character first became popular in Japan in the mid-1990s. Some Chinese media introduced this practice in 2006. "Prices for everything are rising so much that I am panicking," said a netizen named qqq915 on Nov 3, while giving his reasons for supporting zhang as the character of 2010.

Since the beginning of 2010, the price of sugar has increased 100 percent and the price of garlic ten-fold in some regions of China. Hot pepper rose from 4 yuan ($0.60) a kilogram to 40 yuan in May in Beijing, and the price of potatoes surged 84.8 percent from January to June

2. The Age of Debt deleveraging - John Mauldin writes in detail at The Market Oracle about debt deleveraging. It's unrelenting and sobering. My must-read of the day. He reviews a new book by Gary Shilling called The Age of Deleveraging. HT Don via email.

The Age of Deleveraging: Investment strategies for a decade of slow growth and deflation, published by John Wiley & Sons, Dr. A. Gary Shilling

This deleveraging will probably take a decade or more to complete—and that’s the good news. The ground to cover is so great that if it were traversed in a year or two, major economies would experience depressions worse than in the 1930s. This deleveraging and other forces will result in slow economic growth and probably deflation for many years. And as Japan has shown, these are difficult conditions to offset with monetary and fiscal policies. The insidious reality is that this deleveraging doesn’t occur in a straight line, but is highlighted by a series of seemingly isolated events.

After each, the feeling is that it’s over, all may be well, but then follows the next crisis.Other roadblocks on the deleveraging highway may include a crisis in U.S. commercial real estate that could exceed the earlier one in housing. Then there’s a possible hard landing in China that exceeds the 2008 weakness as the government’s measures to cool the red hot property market and economy in general take hold. A slow-motion train wreck in Japan will probably occur sooner or later as her all-important exports fall along with weakening U.S. consumer willingness to buy them, and as her already subdued domestic sector suffers from her rapidly aging population.

3. The American nightmare in the Inland empire - I drove through the sprawl of new, empty houses in the desert between Los Angeles and Las Vegas in late December 2008. It seemed awful empty and desperate even then.

Here's some fresher reporting from Yasha Levine on what's happening in the wreckage of America's new suburbs in the wake of the housing boom and bust. This dispatch is from Victorville, California. HT Anthony via email.

Victorville is what they call an “exurb,” one of thousands of new sub-suburban sprawls all around the country built for poor Americans. To flocking homeowners, Victorville must have seemed like a glorious reaffirmation about everything good and right about American values, a place where the poor could finally afford a home of their own. Instead, it turned into just one more slaughtering ground in the the biggest scam of the century, a place where tens of thousands were lured to be ripped off and set adrift. Victorville was never meant for the world of the living. Out on the horizon, you could make outlines of lofty snow-capped mountains.

But under your feet, it’s nothing but a patch of dried-out dirt. These houses were built here at the whim of WaMu and Countrywide Financial executive types just so they could have a product to push, a part of a complicated system of speculator fraud meant to do only one thing: transfer money from the lower-class suckers straight into executive bonuses. For that they needed a constant supply of fresh meat, and Victorville performed exceedingly well. In 2007, a year in which five million Americans migrated to shitholes just like this, Victorville was the second-fastest growing one of them.

Victorville’s location puts it in class all its own. It’s the most barren, most remote commuter city in the whole of Southern California, a lifeless wasteland an hour’s drive from the farthest reaches of the Inland Empire. To get here, you need to scale a huge mountain range that acts like the Shield Wall of Arrakis, a natural barricade separating civilization from the desert. Commuters burned gallons of gas climbing 4,000 ft. each way.

4. The problem with QE II - Bloomberg reports that low US interest rates and the QE II by The Bernank are simply squeezing US corporate cash out into the emerging economies and allowing foreign companies, including New Zealand ones, to borrow cheaply in America.

Chairman Ben S. Bernanke and his colleagues appear to be fueling a foreign-investment surge, underscoring the difficulty of stimulating the economy through monetary policy with interest rates already near record lows. “You’re seeing leakage from quantitative easing,” said Stephen Wood, chief market strategist for Russell Investments in New York, which has $140 billion under management.

“That leakage is going into emerging markets, commodity-based economies, commodities themselves and non-U.S. opportunities.” U.S. corporations have issued more than $1.07 trillion in debt so far this year, according to data compiled by Bloomberg. Foreign companies also are tapping U.S. markets for cheap cash, selling $605.9 billion in debt through Nov. 15 compared with $371.8 billion for all of 2007, before the Fed cut the overnight bank-lending rate to a range of zero to 0.25 percent.

Alice Rivlin, a member of President Barack Obama’s deficit-reduction commission, is trying to stir a debate over imposing a national sales tax to reduce the deficit as part of a plan that includes steep Medicare cuts and a one-year payroll-tax holiday to spark economic growth. Rivlin, as part of a separate 19-member group sponsored by the Bipartisan Policy Center in Washington, offered a plan for a 6.5 percent sales tax.

Her recommendation comes as the president’s panel prepares a Dec. 1 report on options for Congress to trim the national debt. “We are proposing a very drastic tax reform,” said Rivlin, a Democrat and former Federal Reserve vice chairwoman. “It would give us a slightly more progressive tax system than we have now and is definitely simpler and more pro-growth.”

6. The biggest villains ? - Joe Nocera reckons it was the ratings agencies and Alan Greenspan.

If you had to absolutely pick a villain, who would it be? Was it the lenders. The GSEs? The ratings agencies? Goldman Sachs?

Institutionally, the biggest villains by far were the ratings agencies. If they hadn’t sold their souls for filthy lucre, if they had stuck to what their mission was, and not slapped a triple-A rating on every Tom-Dick-and-Harry mortgage-backed security that came down the pike, this could never have happened.

Individually, I mean, I honestly think the biggest villain is Alan Greenspan. Half of his job was to be a regulator, and he not only ignored that half of the job, he affirmatively turned his back on that half of the job. He’s now blaming it all on Fannie and Freddie, which is the classic Republican excuse for the crisis because it allows them to say government did it, it allows them to take all of the failings of the marketplace completely off the hook.

7. The buck never really stops - Bloomberg reports the European banks and their governments are wriggling to try to avoid the bits of Basel III that force them to reduce leverage. How much has anyone learnt?

Banks in Europe may escape global rules designed to limit their debt, as several countries push the European Union to drop a so-called leverage ratio, two people close to the discussions said. A majority of nations in the 27-country EU oppose introducing a binding leverage ratio that was adopted last week by the Group of 20 countries, according to the people, who declined to be identified because the discussions are private.

The countries, including Sweden and France, say the ratio might encourage banks to pursue risky activities, the people said.

“The leverage ratio as it is currently constructed is a rather blunt instrument,” Rob McIvor, a spokesman for the Association for Financial Markets in Europe, said in a telephone interview. “It does not take into account different institutions' business models or structures.”

8. How Hubbard killed Team Omega - Tim Hunter at BusinessDay reports on details in the latest Hubbard book of how 'Team Omega' were shut down by Hubbard. Great detail.

The Omegas were SCF director Stuart Nattrass and three of Hubbard's senior executives, Andy Borland of apple company Scales Corp, former SCF chief financial officer Graeme Brown and Hubbard Churcher partner Nigel Gormack. On returning to Timaru, Hubbard called the Omegas to a meeting. ``It was the Omega's turn to be stunned,'' wrote Green. ``Allan [Hubbard] handed the phone to Borland.

On the other end of the line was an Auckland lawyer telling him that the Omega team was stripped of their authority, their services no longer required. They were given no chance to explain their case.''

In sacking the Omega Team, Hubbard turned his back on the solution they had been working on. In particular, they had lined up an Australian private equity buyer for one of Hubbard's companies, Helicopters NZ, which could produce a much-needed cash injection for SCF of about $117 million.

They also sought out a new adviser, First NZ Capital, to bring a fresh approach for SCF and were advocating a scheme to bring in new capital that would have seriously diluted Hubbard's shareholding. ``However, word reached the ears of Neil Paviour-Smith, managing director of Forsyth Barr.

Paviour-Smith was a long-time consultant to Allan Hubbard who'd earned $1m in fees advising Allan and the SCF board on their proposed stockmarket float in 2005 ... No professional adviser wants to lose a client, and Paviour-Smith wasted no time in protecting his patch.'' In Green's account, Paviour-Smith produced an option more palatable to Hubbard - the float of Southbury Group with a $100m capital raising - which enabled him to keep control.

9. Merkel's stuffup? - The FT reports Everyone in Europe with too much debt is grumpy at Angela Merkel for suggesting they will have to stop kicking the can down the road at some point and actually repay their debt, and if they don't, bond holders might have to take haircuts. Oh, the audacity of the woman. The euro is eventually toast.

The drive by Angela Merkel, the German chancellor, to rewrite the European Union's treaties to set up a new bail-out system for future Greek-like collapses -- and her insistence that private investors bear more of the cost of such rescues -- was quietly resented when she bulldozed it through last month's summit of EU leaders.

But as bond markets have reacted and plummeted in the weeks since, that resentment has begun to boil over, with increasing accusations that Ms Merkel has put many of her fellow eurozone leaders in untenable positions in order to reinforce her own standing with German taxpayers.

10. Totally relevant video - Jon Stewart talk to Bethany McLean, who exposed Enron, and Joe Nocera about the global financial crisis.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Bethany McLean & Joe Nocera<a> | ||||

|

||||

19 Comments

Whether you think Angela Merkel made a mistake suggesting that bondholders might have to take a 'haircut' depends on what assumptions you are making about her end-game.

If you want to de-shackle Germany from the economic basket cases of the last hundred years (Greece, Ireland, Italy etc), then it make perfect sense for her to make those statements.

Alan.

So she's responding to her German voters who pay the bill(s)....the rest of the EU leaders dont care about their voters thats obvious....no hard decisions please we might lose votes....

I just wish the rest of the EU countries had some of the legal framework the german ppl have to stop Pollies saddling them with the bills....or more appropriately their kids.

regards

Too right - Perhaps next she'll stand up and say out loud:

"Give us our money back!"

She should demand a 'German Rebate', and encourage the parallels.

Alan.

Bernard, you are early today....worked through the night ??

Re QE II seems Ben didn't get too much bang for his 600Billion Bucks afterall...USD is going up again and the markets are going south....every eye is on Ireland....

Seems the world is finally ignoring the US and everything it is trying to do...good sense finally.

Considering the "wise" ppl seemed to be saying 2 Trillion was a starting point and 4 or 10 trillion more appropriate 600billion would seem a non-event....except for the bankers who get the extra xmas bonuses who Imsure wll be very happy with the state handout.....and then critisie medicare and social securty etc with their next breadth....

I really dont understand why no one in (any) Govn is prepared to start telling some home truths......oh wait no one loves a non-yes man....I can see that around me every day. Try and give some bad news while someone else is saying all is well vote for me and I'll keep it so and the "all is well" stooge gets the vote.

regards

RE 9.

Merkel is no mug, has a PhD in physics (actually, more quantum chemistry), and absolutely knows what some of us bang on about.

Here's a 1998 essay of hers:

http://www.sciencemag.org/content/281/5375/336.full

and an excerpt:

"The key is to sever the traditional link between economic growth and the consumption of resources, which increasingly threatens the natural basis for life and the preservation of natural and landscape diversity".

She knows.

Never underestimate Angie Merkel, she is one of the most intelligent politicians for a long, long time.

Besides, other countries also listen to their voters and act accordingly:

Finland seems strongly opposed to Ireland EU bailout

http://reuters.com/article/idUSLDE6AF0SS20101116

And Austria is refusing to pay it's december installment of the Greek bailout, also because people are angry.

Nice find.....and wrote in in 1998 as well....

"In the long term, “progress” works against us if it continues to be detrimental to nature. This realization will find increasing acceptance. Environmental protection will play a central role in the 21st century and will be a major challenge for politicians and scientists alike. "

Its slow coming.....

I think she does....

regards

Wondering what those that are against urban planning think about Victorville? A success story just like Houston?

Chuckle. :)

For he led us, he said, to a joyous land,

Joining the town and just at hand,

Where waters gushed and fruit trees grew,

And flowers put forth a fairer hue,

And everything was strange and new;

The sparrows were brighter than peacocks here,

And their dogs outrun our fallow deer,

And honeybees had lost their stings,

And horses were born with eagles' wings:

from the Pied Piper......

he must have put the fallow deer in for Wally

JJ, urban planning helped cause Victorville to grow because house prices in major cities in California were so high people were prepared to commute 100 miles each way to get cheaper houses (which were still relatively expensive and they still defaulted on). In Texas where house prices are affordable this was never an issue and people didn't have any incentive to buy houses in the middle of nowhere.

and the relative populations are?

you're a joke

and, I strongly suspect

someone else

however u can look at other US states that also allowed building any where and see basket cases...

In Texas very hvy regulation on mortgages probably played a huge part in preventing a property bubble on the same scale as elsewhere.

regards

First thing to note is the price of copper, down nearly 10% from $4.08 to $3.71 in just a week. Look at these charts, I'd say $3 is a fair target within a month...copper is renowned for its predictive abilities..

Dr Copper says 'The game is up'

Anyone still investing for growth in risk assets is in for a rude awakening fairly soon in my opinion, and we can't say we weren't warned, the canaries are singing loud and clear, as long as your head isn't buried in the sand, you will hear them!

http://wealthadviseruk.blogspot.com/

Interesting - the 5 year. The shorter ones are just the noise of knees jerking.

The blogger is a giggle - he's right, but I wonder if for the right reason

At the end of the day, tradeable items which are a necessity, held physically, take a lot of beating.

Copper is one of them. I'm not talking 'investment', we're past that. I'm talking 'having to trade'. It's one of the few pipe materials post oil. Doesn't break down in UV......

"Average weekly wage hits $1257"...oh bugger...it's about aussies

Im a bit of a Greg Pytel fan, here he is on Ireland

http://gregpytel.blogspot.com/2010/11/irish-crisis-why-british-governme…

The ongoing financial farce in Ireland shows with crystal clarity why Britain was "persuaded" by the, so-called, "financial markets", pundits and all sorts of experts to cut the public spending. If British kept on spending as much as they used to it would not have enough money to rescue Ireland. The UK would have been on the financial edge itself.According to the Bank of International Settlements in Basel the UK banks' exposure to the Irish debt is 222.4 billion euros (page 16 of the report). If Ireland is bailed out, in fact, it will be British financial insitutions that will be bailed out too. Without having made the spending cuts a few months ago Britain would not simply have money to do so. Hence the UK banks would have ended up in a very deep trouble (if not bankruptcy). To summarise the whole saga (which shows the, so-called, "financial markets" modus operandi):

- first Irish banks were run out of money, thanks to a pyramid scheme that was operated, and ended up in a deep financial trouble; Ireland was "persuaded" to make deep cuts to rescue them; i.e. banks' debt was propagated as the country's debt;

Its got beyond funny........given in this day and age, the Internet I ie information so readily available, I wonder just how long these clowns think they can continue to screw things up....

regards

Dis-inflation is still heading towards 0% and negative territory next year.....so for the inflationists, just where is it?

http://krugman.blogs.nytimes.com/2010/11/17/disinflation-continues/

and this (USA) is the economy JK wants to sell to.....the one heading into a double dip with a huge housing collapse (further) increasing un-emplyment, increasing energy costs, huge fraud and down right unfairness...etc etc so a collpasing consumer.........and a do nothing fringe loon Congress determined to do no end of damage just as long as Obama gets the blame....what a lucky population.

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.