Here are my Top 10 links from around the Internet at 10 to 4 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Friday's Top 10 at 10 (the last for 2010) via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream.

1. 9 months for stealing NZ$50 mln? - William Mace from BusinessDay reports that one of the two Five Star Finance Directors convicted of stealing NZ$50 million may serve just 9 months in prison. The other one might serve 11 months, if his appeal is rejected.

I wonder how many 'common' criminals would spend longer in jail for car theft or bank robberies than for theft of NZ$50 mln.

I wonder if the court system takes into account the publicly felt need for punishment (rather than just rehabilitation) in its sentencing and parole actions.

I wonder if the court takes into account the deterrent involved in jailing someone for 9 months for stealing NZ$50 million.

Are there two laws in New Zealand. One for the poor and common? Another for the rich and connected?

I see that different approach all the time in the actions of judges who routinely grant name suppression and suspended sentences for the well-to-do in New Zealand.

MacDonald and Kirk already had their ``starting point'' sentences - six and seven years respectively - chopped in half by Judge Roderick Joyce due to their early guilty pleas, genuine remorse and willingness to cooperate with ongoing prosecutions into business partner Neill Williams.

Kirk is thought likely to be released at his first parole hearing which would occur after he'd served 11 months - just a third of his sentence. Witten-Hannah claimed MacDonald would be eligible for parole in late August, nine months after his conviction.

Wellington lawyer Michael Bott said that time spent in prison by convicted criminals is primarily based on two things sentence length and suitability for parole.

``They've got no previous offending to talk of at all and their risk of reoffending is probably minimal so they would have a strong case, depending on other factors, for making a solid application for parole at the first instance.''

2. Why inequality is worsening - Tyler Cowen has written a long, thoughtful piece at The American Interest on inequality in the modern world. He finds that financiers in Manhattan and London are making out like bandits during the good times and socialising the risks during the bad times. But there's not much can be done about it.

If we are looking for objectionable problems in the top 1 percent of income earners, much of it boils down to finance and activities related to financial markets. And to be sure, the high incomes in finance should give us all pause. The first factor driving high returns is sometimes called by practitioners “going short on volatility.” Sometimes it is called “negative skewness.”

In plain English, this means that some investors opt for a strategy of betting against big, unexpected moves in market prices. Most of the time investors will do well by this strategy, since big, unexpected moves are outliers by definition. Traders will earn above-average returns in good times. In bad times they won’t suffer fully when catastrophic returns come in, as sooner or later is bound to happen, because the downside of these bets is partly socialized onto the Treasury, the Federal Reserve and, of course, the taxpayers and the unemployed.

Cowen makes some excellent points about the dangers of bailouts. It is today's must read, although his shrugging of his shoulders at the end is a tad deflating.

Guaranteeing the debt also encourages equity holders to take more risk. While current bailouts have not in general maintained equity values, and while share prices have often fallen to near zero following the bust of a major bank, the bailouts still give the bank a lifeline. Instead of the bank being destroyed, sometimes those equity prices do climb back out of the hole. This is true of the major surviving banks in the United States, and even AIG is paying back its bailout.

For better or worse, we’re handing out free options on recovery, and that encourages banks to take more risk in the first place.In short, there is an unholy dynamic of short-term trading and investing, backed up by bailouts and risk reduction from the government and the Federal Reserve. This is not good. “Going short on volatility” is a dangerous strategy from a social point of view.

For one thing, in so-called normal times, the finance sector attracts a big chunk of the smartest, most hard-working and most talented individuals. That represents a huge human capital opportunity cost to society and the economy at large. But more immediate and more important, it means that banks take far too many risks and go way out on a limb, often in correlated fashion. When their bets turn sour, as they did in 2007–09, everyone else pays the price. And it’s not just the taxpayer cost of the bailout that stings. The financial disruption ends up throwing a lot of people out of work down the economic food chain, often for long periods.

Furthermore, the Federal Reserve System has recapitalized major U.S. banks by paying interest on bank reserves and by keeping an unusually high interest rate spread, which allows banks to borrow short from Treasury at near-zero rates and invest in other higher-yielding assets and earn back lots of money rather quickly. In essence, we’re allowing banks to earn their way back by arbitraging interest rate spreads against the U.S. government. This is rarely called a bailout and it doesn’t count as a normal budget item, but it is a bailout nonetheless. This type of implicit bailout brings high social costs by slowing down economic recovery (the interest rate spreads require tight monetary policy) and by redistributing income from the Treasury to the major banks.

3. And here's an example of how they did it - Felix Salmon at Reuters refers to an excellent report by Jesse Eisinger and Jake Berstein at Propublica on how traders at one division of Merrill Lynch (John Key's Alma Mater) managed to convince another division of Merrill to buy toxic debt off them by paying part of their bonuses to the traders at the other division....Hilarious. The greed and depravity shine through like a beacon.

Bank executives came up with a fix that had short-term benefits and long-term consequences. They formed a new group within Merrill, which took on the bank’s money-losing securities. But how to get the group to accept deals that were otherwise unprofitable? They paid them. The division creating the securities passed portions of their bonuses to the new group, according to two former Merrill executives with detailed knowledge of the arrangement.

The executives said this group, which earned millions in bonuses, played a crucial role in keeping the money machine moving long after it should have ground to a halt. “It was uneconomic for the traders” — that is, buyers at Merrill — “to take these things,” says one former Merrill executive with knowledge of how it worked.The agreement, according to a former executive with direct knowledge of it, generally worked like this: Each time Merrill’s CDO salesmen created a deal, they shared part of the fee they generated with the special group that had been created to “buy” some of the CDO.

A billion-dollar CDO generated about $7 million in fees for Merrill’s CDO sales group. The new group that bought the CDO would usually be credited with a profit between $2 million and $3 million — despite the fact that the trade often lost money…

Within Merrill Lynch, some traders called it a “million for a billion” — meaning a million dollars in bonus money for every billion taken on in Merrill mortgage securities. Others referred to it as “the subsidy.” One former executive called it bribery.

4. And the Brits are borrowing heavily too - America unveiled plans to borrow an extra US$99 billion between Christmas and New Year last night. It is on its way to borrowing another US$1.3 trillion this year (9% of GDP), with almost half of that printed by the US Federal Reserve.

Now The Telegraph reports Britain is borrowing more than expected.

What happens when all this stimulus is withdrawn? Or will governments keep borrowing and printing and hoping no one notices?

Or will all the cash leak out the sides and blow up bubbles in emerging markets? And what happens when those bubbles burst?

Is it just me or has the world gone mad? HT Darryl via email.

Public sector net borrowing jumped to £23.3bn in November - excluding bailing out the banks - the highest for any month since the Office for National Statistics (ONS) began its records in 1993. The borrowing figure was almost £6bn up on the £17.4bn seen in the previous November, disappointing forecasts for a small improvement.

"These figures really are a bolt from the blue," said Andrew Goodwin, senior economic advisor to the Ernst & Young ITEM Club. "The November figures pretty much wipe out all of the 2010/11 reduction in borrowing in one fell swoop."

5. Deutsche the dodger - Reuters reports Germany's Deutsche Bank has admitted to Amercia's Internal Revenue Service that it set up fraudulent tax shelters. It has agreed to pay a US$553.6 million fine and has admitted criminal liability. The IRS is getting tough, as UBS found out to its cost.

Is our IRD being as tough on such tax shelterers here?

The settlement is part of a larger U.S. government effort to crack down on banks that help wealthy Americans evade taxes.

Prosecutors last year settled with Swiss bank UBS (UBSN.VX), which paid $780 million in fines for helping clients with roughly $20 billion in assets hide their accounts from the U.S. Internal Revenue Service. Leads from the UBS case are pointing investigators to potential criminal behavior by other banks in Asia and the Middle East, the head of the IRS said earlier this month.

The IRS has also offered amnesty to wealthy people who declared their assets, and is now using information from some of those taxpayers to build cases against other banks that facilitate tax evasion. Prosecutors are already moving forward with a probe of clients at Europe's largest bank, HSBC Holdings (HSBA.L), some of whom received a letter in June notifying them they are the subject of a criminal probe.

6. Spanish ghost towns - We've seen pictures of Irish ghost towns and Las Vegas ghost towns of houses built during the boom but never lived in. Now here's some Spanish ghost towns, courtesy of the New York Times.

It is a measure of Spain’s giddy construction excesses that 250 row houses carpet a hill near this tiny rural village of Yebes about an hour by car outside of Madrid. Óscar Lorenzo de Amo, 34, bought his home in Yebes in 2007. He is now trying to sell it, saying that the house is a nightmare for him and his wife. Over a decade, developers built hundreds of thousands of units; 800,000 went up in 2007 alone.

Most of these units have never sold, and though they were finished just three years ago, they are already falling into disrepair, the concrete chipping off the sides of the buildings. Vandals have stolen piping, radiators, doors — anything they could get their hands on. Those few families who live here keep dogs to ward off strangers.

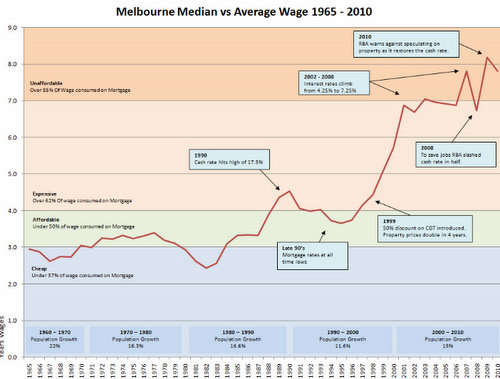

7. They're simply over-valued - Melbourne house prices are simply overvalued and here's the chart to prove it. HT Hugh via email.

8. Beware late 2011 - The boys and girls at Leap2020 have come out with their forecast for 2011 and it's a doozy. Be very, very careful is their prognosis.

The second half of 2011 will mark the point in time when all the world’s financial operators will finally understand that the West will not repay in full a significant portion of the loans advanced over the last two decades.

For LEAP/E2020 it is, in effect, around October 2011, due to the plunge of a large number of US cities and states into an inextricable financial situation following the end of the federal funding of their deficits, whilst Europe will face a very significant debt refinancing requirement, that this explosive situation will be fully revealed.

Media escalation of the European crisis regarding sovereign debt of Euroland’s peripheral countries will have created the favourable context for such an explosion, of which the US “Muni” market incidentally has just given a foretaste in November 2010.

9. How the cash squirts out the sides - When America keeps interest rates low China doesn't have much choice but to keep interest rates low because it effectively pegs the Yuan to the US dollar.

The longer US rates are kept near zero, the greater the risk that investors will squirt it out the sides hunting for lower yields elsewhere. They take crazy risks and blow up bubbles.

That's why we're seeing stock markets being relatively strong and companies, including many in New Zealand, borrowing money at low rates in these US markets.

Here's an example of how even investors in India are borrowing at low rates. From China. Bloomberg has the report.

Billionaire Anil Ambani’s companies borrowed $3 billion from lenders including China Development Bank Corp. to gain cheaper funding after rupee borrowing costs climbed the most in four years. Reliance Communications Ltd., India’s second-largest mobile phone operator, will borrow a part of $1.9 billion from the state-owned bank, which lends to support China’s policy aims, using $1.3 billion to repay existing credits, the company said Dec. 15.

Reliance Power Ltd. will borrow $1.1 billion to help fund an electricity plant. The yield on India’s top-rated five-year rupee corporate debt rose 73 basis points to 8.95 percent this year, the biggest gain since 2006, according to data compiled by Bloomberg.

“Reliance has to repay the debt and the China loans are an immediate solution because interest rates there are 1 to 3 percent cheaper,” said FIM Asset Management's Taina Erajuuri.

10. Totally cheesy video from Reeves and Mortimer. HT JuhaSaarinen via twitter

11 Comments

Where's the picture of you in a Father Christmas costume Bernard ? ............. You did promise ............ C'mon , don't disappoint the girls and boys !

I'll be wearing a hat on tomorrow's 90 at 9.

cheers

Bernard

Excellent ! ........ I was under the impression that Friday was a public holiday in NZ . Seemingly not . Cool .

[ Bill English says to Larry Williams on Newstalk ZB , that he is positioning the government such that next year , when economic recovery grows , he will be better able to constrain spending . ]

Bags not to sit on his knee. You reckon his sacks are fill?

FYI here's how to prepare for bad news. Buy all the domain names with the company name or CEO's name and the words 'blow' or 'suck' in them. Heh heh

In recent days, at least 439 Internet domain names that are critical of the bank’s top officials were taken off the market. The registrations of the domain names, which include imaginative swipes at the bank’s CEO, such as BrianMoynihanBlows.comand BrianTMoynihanSucks.net, effectively stop BofA-haters from slamming the bank’s top executives and directors –- or at least blocks any slams using a couple of very specific pejoratives.

http://blogs.wsj.com/deals/2010/12/22/439-ways-to-hate-bank-of-america/?mod=e2tw

cheers

BernardHickeyPredicts.com ?

9 months in prison for 50 million what a joke, you'd probably get more than that for breaking into someones house and stealing a $50 DVD player.

Are these Chinese men of good character , Minister English ? Agria and New Hope Group , both of China , are to offer PGG Wrightson shareholders 60 cents for up to 38.3 % of their holdings . The consortium are seeking to add a further 235 million PGW shares to their existing holding , giving them effective control of NZ's largest stock and station company , with a 50.01 % stake . The offer is 25 % above PGW's close of 48 cents on the NZX .

Pyne Gould Corporation has already agreed to sell all of it's stake in PGW to the Asian invaders .

........ We quiver and quake about letting Chinese bid for our dairy farms .......... No problem for them to control our largest rural supplies company ?

Great job gummy. You scooped everyone in New Zealand on this one.

And I agree, a very big story.

I wish they'd stop releasing news on Christmas Eve.

Still have my shopping to do...

Off to the Warehouse again for me....

cheers

Bernard

GBH. Your point resonates. It is serious. The grocery chains learned their history lessons well. The Chinese have learnt their history lessons well. From Anthony Sampsons book "The Seven Sisters". In 1850 John D Rockefeller demonstrated that "owning" the distribution of oil was more powerful than "owning" the production of oil. The same lesson was played out again in 2006 in the dispute between Russia (producer) and Ukraine (distributor) over the means of distribution of Russian gas. Russia capitulated in one day. The same contest exists in the search engine space. The product is incidental. Fonterra, an organisation that is larger than the largest company on the NZX displays the same characteristics. It doesnt own farms. It controls the means of distribution.

Absolutely .

I hope that Bernard enjoys getting a Christmas bargain at the Warehouse .......... Before too long our festivals will be over-shadowed by those of our new masters ........ A moon-cake , anyone ?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.