Bernard Hickey details the top 10 charts for 2010 in association with Bank of New Zealand, including this chart picked out by the Reserve Bank in its December quarter monetary policy statement.

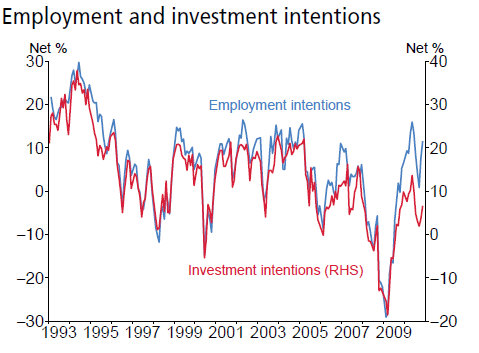

It shows employment intentions and investment intentions in the National Bank's Business outlook survey going back to 1991.

It shows how these intentions have moved pretty much in tandem through various expansions and recessions until an apparent divergence since early 2009.

The chart shows that employers appear much keener to add staff but not to invest in new plant and equipment in the current recovery.

That is a worrying sign for the government and the Reserve Bank.

The broad hope was that New Zealand businesses and the economy generally would help transform the economy from being a borrowing and spending one into an investing and producing one.

The aim is to invest more in plant and equipment to make workers more productive, therefore improving productivity and eventually real per capita GDP.

The major weakness of the economic growth seen from 2004 to 2008 is that it was powered by overseas borrowing and by businesses adding more workers, but not necessarily improving productivity.

Growth without productivity increases can lift inflationary pressures, which in turn forces the Reserve Bank to run high interest rates and keep upward pressure on the New Zealand dollar.

New Zealand's per capita GDP has actually not improved since 2004, in part because of our very poor productivity growth. It may not be a coincidence that our weakness in productivity since 2004 happened at the same time as a long term slide in investment intentions.

Most agree that the best way to improve productivity is to invest in new infrastructure and plant and equipment. Giving workers better tools usually improves productivity.

So why are businesses so reluctant to invest? Are interest rates too high? Do they lack confidence in the future? Are exporters worried about investing long term because of the currency's strength and volatility? Are businesses being 'crowded out' by the growth in government spending?

Can we achieve the step up in economic growth talked about by Prime Minister John Key without that investment?

What can the Reserve Bank and the Government do to achieve that step up in growth?

Whatever that has been done doesn't appear to be working.

61 Comments

Bollard had interest rates too high which made it too much of a hurdle to generate a return on new investment.

He could have used numerous other tools at his disposal to control bank lending on houses but chose to ramp up the OCR instead. The contortions getting through the RMA is too hard unless you have very deep pockets, witness NO new aquaculture farms for 8 years and no new gold mines despite us having great advantages and huge price growth.

Bernhard you and many of your buddies aren’t listening or do not understand the real meaning of productivity and how it is developed. The private sector cannot do it in the current worldwide environment. Too many events are accumulating and accelerating on many fronts to make investment financially reliable. The risks are simply too high. The world is changing and forever forever.

The only way out is the private production sector demanding from the government better practical incentives, as I’m describing in many of my articles since months. (see here 29.12. 2010 - 10:13am)

--

In other words we have all the knowledge/ skill, tomotas, olives, all the ingredients necessary to makes tasty pizzas, but we do not have the pizza ovens. So our tasty pizzas are just not competitive enough and therefore not marketable.

To successfully go into “NZpizzaproduction” the government should invest in Pizza ovens, means allocation infrastructure order to NZcompanies. Productivity would be flourishing making NZpizzas, NZbreads and other excellent NZproducts, also designed for the export market.

I'd say none of the above, the world's center is moving towards the East, and the East has little interest in the West, the future is in the cinergy between India and China and they will interact more with Africa and South America... the West will canibalize the West. through ever higher commodity prices and higher cost of credit. The world has been heading in that direction for quite some time now. Australia will slowly fade from Chinese demand as they find better oportunities and deals in Africa and South America for both mining and food.

The more you think about the trend the more obvious the answer becomes. Business owners and managers who were prudent during the bubble of madness are not going to become splurgers today. The prudent have had their management decisions confirmed as correct. They will not risk borrowing just to satisfy a govt or the RB. They know the banks are busting to save the bubble valued property.

This is the cost of a govt decision to prevent the property bubbles from deflating...a decision to prolonge the recession....to allow debasement of the $ to wash away the debts...so why the surprise at the trend showing up on the graph.

look at the Crafar farm farce going on...the banks loaned out way too much and are trying to get a stupid buyer to pay them all they loaned out...meanwhile the dairy business managers who are without debt will wait for the fall in property prices...they are not going to 'invest' in this non market.

Tweak and Fiddle are trapped within their 6 part strategy and the spin they ran with. So expect no change from them. We either witness a continuation of this recession level activity leading to the ratings agencies stepping in and swinging the blade to force the changes....or we see an abrupt intervention of the market forces with rates heading higher and the blade cutting away the losses.

One way or the other and no other way.....welcome to the consequences of trying to prevent a normal market correction.

A "normal market correction" could also mean tens of thousands more unemployed, more business collapses, and a zombie economy for decades.

Current real interest rates are already too high acting as a dead weight on every aspect pf business. Bank overdrafts remain at 15-21%, credit cards up to 22%, higher purchase rates around a real 15% ( much hidden in the buy price) and mortgage rates around 6.2-8.5%.

High interest rates considering the state of the world and local economy, holds business in a strangle hold and is the main reason why busines will remain flat or even contract .

In Japan, (perhaps not the best example) bank rates are virtually zero, mortgage rates are under 2% while property investment still returns 8% plus. It may not be ideal, but at least you get a return for the risk and effort.

So you are suggesting what.....continued govt and RB manipulation of the market place to prevent looses.....that's what we have now....all I am saying is do not expect the prudent and thrifty to change their spots and go on a splurge of spending when all they see are reasons to do the very opposite.

You are I think very wrong in suggesting a "zombie economy for decades" would result from letting the market correct the bubbles. But then you cannot allow for a quick end to a bad event because it would knock the support from beneath your belief in the soundness and prudence of current govt and RB policies to wait and hope and prevent a correction.

The thing is RRM1...we are in a recession because the correction has been blocked and you need to explain what it is that can lift the economy out of the recession...don't count on savings and investment because there is little saving going on and the wise will not invest in this game.

Rushing to Wolly`s defence,as if he needs it,but agreeing with him,I wonder if a swift "punishment" is better than a long drawn out handringing endeavour to hide the facts long enough so nobody ,except the lower 70% of the population,have to face up to the reality that we`ve just been financing "things" ,not earning them.Is it because our present leaders have had work experience that only involves conjouring money with sums on projections, and short selling currencies,not work that involved risk of not earning enough to eat.Sure JK brings out the "born in a state house" but isn`t most of NZ "born in a state house"?

May the New Year bring us all a clear sense of where we need to head ,and a preparedness to only spend what we need,and expect that we will "care" for our own needs and if fortune shines ,will care for the needy.We surely can`t carry on expecting our government to take leadership if it can`t get it`s own finances on a realistic footing.

Mate the best lessons in life are often the hardest lessons.

This country tried to soften the blows by propping up the bubble even as it was falling apart and look where that got us!

It's time to pull the plug on the bubble and everyone who was dumb enough to think it wasn't just a bubble. Once it is behind us and people have finally shaken off the bubble mentatlity this country will be able to rebuild itself as a much better and stronger place.

Nicely put, LB.

" BUBBLES " is the name of the debt elephant , that led to the Global Financial Crisis . The bankers , love to blow Bubbles . When they exhausted themselves ....... Ben Bernanke blew the banks . The bankers have sheepish grins again . And Bubbles is back .

Everyone is happy again . Because we blow !

Wolly you are really starting to show how ignorant you are. You have obviously never been in business. Even the people who have been prudent are struggling. I know of one major business whose owners predicted the downturn,who have never taken any dividends out of the business while they owned it and who did their best to get ready for what was coming. They are struggling also and need to look at laying off staff. They do not want to do that but there is just not enough turnover and margin from what turnover they are getting to cover the overheads. I have had successful businesses. They need cashflow and profits to survive.Even with little or no debt at all they need certain levels of sales. I just wish you would back off and talk about a topic you know something about. Turn the tv on and turn off the computer and do us a favour.

Straight to the point !

I think minister Hide, Brownlee and Joyce have a lot to answer. You guys are importing infrastructure needs such as Telecommunication, Energy and Transport in the Billions with devastating consequences for our economy and society in the near future - to be honest because of underperforming - you three would not be in my cabinet any longer !

Isn’t time for New Zealand to look into possible new strong sectors of industries ? As a consequence of Climate Change http://www.economist.com/node/17572735 agriculture and tourism as the two most important pillars of our economy, will see inconsistence results in the years to come – in my opinion with rather shocking outcomes. The bloated Real Estate industry is hopeless, because it doesn’t make our nation wealthier – even worse it pushes Kiwis out of the market. The world situation is forcing us for diversity, flexibility and security in our economy.

Isn’t time to consider adding real, sustainable and long term value to our economy ? Isn’t time to add - our skilful, talented and educated NZpeople to our economy http://www.countercurrents.org/hartmann120210.htm in stead of exporting them or keep them in low wage jobs ?

Small countries have to think small, but with great ideas - a "100%NZpure Economy" - making real money in the Billions !

The same ministers who are jointly responsible for poor jobs, unemployment and social unrest are crying for more police, prisons - causing more red tape, etc. What an economy !!!!!

Pretending economic life can return to be as it was in the bubble is plain dumb..but there are those who battle on for this pipe dream to eventuate. The govt has taken us to a tipping point where the ratings agencies now have control. This is the cost of endless borrowing...cash used to prop up a debt based economy.

Keep an eye out for loud mouthed know alls who will claim to be experienced business owners in the past and that their understanding of economics and finance MUST be taken as the best on offer. They are just noise.

We either follow the govt along the recession pathway for a very long time until the debasement of the $ has eaten away the debts and stolen enough from the savers.....or we get a visit from the bond market and a lesson in market economics.

The Press had a series on Property developpers. Bob Robertson (Pegasus Town) is complaining the the local authorities are making them add all sorts of whistles and bells that people can't afford. Most which collapsed had an enormous appetite for risk. One of the survivors Cooper(?) has a posh beachfront development. The point is that the industry needs subsidy or rich foriegners. So where too for the less well off. Do we have to degenerate further into ugly infill or box apartments? The surveys in Fortune etc showing the best cities to live in are largely for people who can take the cream off the top.

I am not wanting us to go back to where we were Wolly. I have never said that. But where we are going is scarier than where we have been and if we do not do something about it we will have unemployment like we have never seen before. Obviously you can survive on the unemployment benefit and I presume you do not steal off others to survive but if we go to levels of unemployment that we have not seen before then the social consequences and the cost will be huge. You obviously want that as you want to punish those bad people who borrowed too much. They are already being punished. They are inflicted their own problems on themselves. I am just trying to stimulate some discussion on how we avoid the inevitable if we dont do something to get the economy going again. Borrowing will not be necessary to do that. Just start moving around some of those huge amounts of deposits going into the banks. The bank staff tell me it is pouring in.

Perhaps if you put away your inclination to lash out with personal attacks ExAgent..and accept that you might have something to learn...then you may well come to see the answers.

" if we do not do something about it we will have unemployment like we have never seen before."...in this you are correct...but what you are saying is...'if we allow the market to correct we will have serious unemployment'....notice the difference!

One more step now....the "doing something about it" you speak of amounts to the govt borrowing $50oooooo a day....with only wishful thinking and spin about an export recovery leading to a fiscal surplus...that's the pipedream bit.

The Reserve Bank meanwhile is trying to prop up the other table leg with cheaper credit for longer in an effort to prevent the market collapsing the property bubbles. The govt is helping out in this effort.

So you have your "something" and it amounts to an endless recession until such time as the $ has been debased by about 30%...about ten years. That is why the market looks dead out there. That is why so many who were prudent will also get a bashing. The losses are being socialised across the whole country.

Now, you make up your mind....do you want short and sharp or long dragged out pain. While you are thinking, S&P Fitch and Moodys are preparing to turn you into toast.

Ex agent I think you are perhaps thinking a bit short term. When you say you know of businesses that have predicted the downturn but are still struggling, well they didn't predict it far enough ahead. If they had thought more like PDK then that might have been sufficient. We will see massive unemployment in this country, there is even a precedent for 30%+.

Phil Best posted some info here a short while back about how demographics also effect economics. It was the work of Colin Clark.

We are facing a new paradigm, and to be honest even though I predicted the recession I have had some shortcomings in my assessment of the magnitude and effects we are facing. My last read "The New Empire of Debt" was quite fascinating. Conclusion of it all was that fiat currencies are stuffed and to buy gold.

I am not sure I would go that far, particularly about the total demise of the west at the hands of the east. I think we may see the exercise of coercive force by the worlds current empire, in an effort to keep it.

There are good businesses out there scarfie who had next to no debt or no debt at all when the recession started for them on the 1st January 2009 and two years later they have a lot of debt they did not bargain for or want. The overdraft has crept up and then when you have three bad months in a row like we have just had in October, November and December this year the red ink has really flowed and this is among the prudent as well as the over committed businesses. People just did not come through the door.What do the prudent businesses do? Lay off staff. That is the obvious thing to do but the hardest as there are a lot of innocent and capital poor people among those workers. Not all these workers have contributed to the recession. And the cost both financially and socially is going to be huge if we let it carry on. What I am saying is that it has gone on for a lot longer than predicted the recession that is and no matter what businesses did in preparation it was never going to be good enough. Business owners can put more capital into their businesses but not all of them have deep pockets.

Small businesses employ a huge part of the workforce.If we let them fall over then the consequences are huge. I for one would not want to be on the dole and bringing up a family. I think we can spend our way out of it. That spending has to be sensible and be done by the large number of people who have deposits in the bank. Bank managers tell me that their vaults are fall of money they never used to have. People are selling their useless rentals and are saving and are banking the proceeds. Fortunately the banks have no one to borrow the money so the best thing that could happen is that the billions of dollars being squirreled away get circulating around the communities and keep everyone in employment and paying taxes.

Now I know I will be abused by Wolly and co for this line of thinking but all they say is let the markets take their course.Let the people who are most vulnerable be put on the dole scrapheap. That outcome will bring upon us a lot of social unrest and a drop in national wealth that would be so huge it is hard to imagine. Wolly you need to get away from your very narrow way of thinking and put up some ideas that will allow the nation to press on without the kind of world you seem to want. ie a world like the 1930's depression.

ex agent - a good practical description of what’s happening in smaller businesses all over the country. I also think by June 2011 we are back in recession with far more dramatic consequences.

" I think we can spend our way out of it"....you are correct ExAgent...we can indeed...just one wee problem....we don't have the savings to go out and spend....for decades we have been living on borrowed money....then came the stupendous age of mindless property splurging helped along by an idiot Clark govt and greedy banks determined to build a bigger slice of mortgage revenue.

You seem to think the savings that exist and I am one of those who have a pile of cash, can be used to pork the market...to save the system....but then what....what do you do when that has run out.....this is the bit you refuse to accept....this country/economy fails to earn its keep.

Or perhaps you think borrowing $50ooooo a day, which is what English is doing...will somehow by magic turn the economy into one that can pay its way...earn more than it spends....fat chance.

And you skip past the matter of the banks feeding off the lending they encouraged during the bubble blowing...this is where the spare income is going....into the banks as profits and out from the banks to those who own the shares in the banks....

You have to wait until the bubbles have been deflated due to years of dollar debasement and then you will see families that survive having spare income to invest and that investment will bring real growth if it is directed into export earning areas.....sadly I think you will see another property bubble. Some time in the 2020s.

Is that the Bonner book, Scarfie?

Gets so much of it right, but misses the 'why'.

Misses energy.

The East carries much of the West's debt, so I think they stand to 'lose' too.

But at the end of the day, It will be a war over resources, not to be 'the strongest', just to be 'the survivor'. Empire against empire, for sure. USA vs China - question is who hangs-out with whom.....

Am just back in broadband land and am delighted to find that you have not all gone away on holiday!

Basically labour is cheap here. Why invest in new equipment when its cheaper to just employ some more labour. No one has invested in any major infrastructure in years - take roads for example.

Here is another good quote from my next read, before I head off to the beach.

"There is a remarkably simple rule about how political systems reacted to the depression, reflecting what happens when an international finance system freezes up. Countries that owed money were now cut off from more lending, saw no virtue in continuing to depend on an international system that had let them down, and moved towards economic isolationism and political authoritarianism. Countries to whom money was owed sustained smaller economic damage and remained wedded to democracy and the international economy."

"We will not change direction because we know we are right and you are wrong and if things go wrong it will be your fault for not having enough belief in our being right"...Govt coalition mantra.

Bernard, you have it slightly worped. Investment in plant machinery eliminates many employment opportunities in most cases. It can help make businesses become more 'productive' however.

Also wage increases are 'extremely inflationary' and just mean NZ becomes less competitive and a more expensive place to live. Better productivity means creating a ' better product for less'. so paying higher wages for most NZ businesses is not an option in this environment

What we need is LESS government spending (benefits particularly) , smaller government, and less personal taxes and business taxes WHILE at the same time making luxury consumption and property taxes as high as possible.

Example: Make starting a business incredibly easy while at the same time make owning 2-5+ houses extremely differcult and unattractive with very little financial incentive. Starting businesses is the REAL investment this country needs

No Justice he had it right. Investment in tech plant etc leads to the creation of MORE employment....just have a look at the Fisher P Health story.

Your not serious Wolly? It's moved to Asia and the US last time i look!

You confuse Appliances with Health Justice!....Health has expanded the Auckland factory and employed more people while investing in new tech etc. A perfect example of exactly what should be going on in NZ.

Wolly, what's to stop them doing it with "Health" also? This is one of our major problems here in NZ. They get to a certain size or share of the market all off the many hardworking NZders backs and THEN sell-out! I make the prediction that they will, I give 3 years. You can make me eat a hat if I'm wrong

Then buy some shares in the firm Justice. Or you could put your faith in Labour getting back to the pig trough in November and doing an aia on fph!....nothing like a bit of Marxism to keep the Labour fodder happy.

I stand to make a fortune when they are bought out. Current price in the low $3 range....potential value near $8.....ask yourself how long it will be!

" all off the many hardworking NZders backs"...oh come on ...that's as close to socialist twaddle as one could get.

Hey Wolly , my man in Goldmoney Sacks says that JK has already ruled NZ First & Winsome Peters out , as a coalition partner after the 2011 election . Did you catch that on the news , too ?

Nah...I think Peters has a problem...several to be honest...the one he fails to see is the demise of his voting base. JK and crew will deeply into the game of electoral whodunnits in 011...every event measured to distract the punters from the economy.

Really? Who made F&P the nations brand for nearly 50 years? us! who put these machines together and did the R&D? us ! That's why it's called an 'iconic' brand. NZders made F&P what it is. Nothing to do with 'socialist twaddle' (by the way I don't vote Labour ). More to do with mutual respect and nationalism.

"I stand to make a fortune when they are bought out"

so.....your just as selfish as the parasites in government who rape this country! It's all about the $$$, nothing else. NICE real nice You have acheived your 'masters' in Hypocrisy

I thought you had a better grasp of finance and economics Justice...FPH is owned by the shareholders not NZ inc.....if it is sold, the buyers are likely to pay a bundle above the share price and the % of that money paid to NZ shareholders will likely be reinvested in new startup companies that may go on to earn export revenue and help shrink the fiscal hole.

This "us" you go on about....I bet you don't have FPA whiteware and you're not likely to need FPH stuff....so why don't you calm down....count to 100...then go and buy some shares.

I know one thing for sure Justice...you would scream "NO" if FPH were to go down the gurgla and a bailout for shareholders be suggested. Did you rush to support FPA shareholders when they lost most of the company value...not bloody likely.

Come on Wolly it is all about confidence, if we all just say it is going to be alright and spend then we will be fine.

Yes, this is 110% true! Just think positive and you can't lose!

@ Hugh. I wonder if it is meaningful to compare New Zealand to Texas? Texas is the 2nd largest State economy of the United States and it is about the 15th largest economy of the whole world in its own right. It has a large population and vast land area. It has petrochemical, biomedical and large manufacturing industries that supply the US military (and the Pentagon read the Federal Govt. has deep pockets) - all of which New Zealand does not have and most likely never will have. I also understand that there are no State taxes in Texas.

Wouldn't it be better to compare us to one of America's Midwestern largely agricultural States that also doesn’t have these sorts of tertiary industries and low taxes and which also have smaller populations and land areas? Missouri or possibly Colorado come to mind.

Hugh I just came across this statistic in my new read.

The average area of land and water required to support residents of rich cities is 5 hectares, whereas Houston is 14 hectares.

It would seem to me that even 5 hectares is not a sustainable number but Houston is resource hungry at nearly 3 times the average.

I would say from these figures that the rich cities are in fact highly inefficient, as in practice I think 5 hectares is capable of supporting a lot more than one person. I would be interested for PB to have a look at that one.

I know you and PDK have not found much common ground, but when you speak of the desire for growth, do you realise that so far growth=increase energy consumption? Do you see us having limitless energy available to carry out your plans?

I to want to see affordable housing but where my interest lies more to a higher standard of living. I don't see this as purely the material effects of a house (or other material items) but rather in the framework of better housing design, underpinned by urban design to promote harmonious social relationships. This isn't happening in the development of modern cities.

I will quote here from Alexander's 'A Pattern Language', pattern 10: Magic of the City.

"There are few people who do not enjoy the magic of a great city. But urban sprawl takes it away from everyone except athe few who are lucky enough, or rich enough, to live close to the largest centres.

He states of the need for multiple CBD's, but gives an indication of the required density.

" Other patterns in this language suggest a city much more dense than Los Angeles, yet somewhat less dense than Paris...... If each centre serves 300,000 people they will be at least two miles apart, but probably no more than nine miles apart.

I would suggest the pattern that you might be really interested in would be 'Community of 7000', where he states "Individuals have no effective voice in any community of more than 5-10,000 persons.

Any greater than this and there is a loss of any immediate link between individuals and their elected officials, or a loss of accountability is the way I read this.

Cheers

Scarfie

Scarfie - Texas got off to a head-start by having a good source of compact energy right at hand, as did the USA, taking the baton from coal-fed Britain.

I suspect the topography helps too, but they're on top of the Ogalla, and that ain't pretty, in fact, it's terminal.

Those in the Transition Towns, Sustainable Cities, and Peak Oil movements, guess that what worked on the way up, will be applicable on the way down. (assuming social cohesion). They suspect that the optimum social size is the village - big enough to share effort and to have a variety of expertise, small enough not to out-demand its food-supplying area.

Housing - there isn't the lead-time to replace the existing stock - but retro-fitting is easy and achieveable.

Go well

Well I didn't know about that Aquifer PDK. So they will be a few years behind Aussie in their decline in food production through lack of water. Combined with the oil running out with which to make fertiliser, they might struggle to feed themselves after all.

Have you ever read Vitruvius? A Roman that was really the earliest architectural author and and architect/designer himself. You can find his books on the internet if you look. One of them gives guidelines for choosing a site for a town, right down to things like looking at the local wildlife for signs of disease that might indicate a deficiency in minerals in the soil.

Today we don't give a toss, and build our biggest city on some of our most fertile land. Auckland was so good that the Maori had deserted it, because occupation meant defense from someone else who wanted it. Defending the volcanoes was easy, until the water ran out .

http://www.eoearth.org/article/Aquifer_depletion

http://en.wikipedia.org/wiki/Ogallala_Aquifer

"As of 2005, the total depletion since pre-development amounted to 253 million acre-feet (312 cubic km).[5] Some estimates say it will dry up in as little as 25 years. Many farmers in the Texas High Plains, which rely particularly on the underground source, are now turning away from irrigated agriculture as they become aware of the hazards of overpumping.[6]"

The dreamers overlook the inconvenient.....

Housing - I'll have a look, thanks. I note that the south-facing suburbs in Dunedin are the cheapest, and always sell in Summer (to out-of-towners) but they are the exception to my 'retro-fit' rule. As all energy is solar in origin, it makes sense to assume that at the end of this mad orgy, where we chew through millions of years worth of stored solar (fossil fuel/carbon) energy in a 200-year period, we will be forced to rely more and more on solar gain - which means your site has to see it during the southern winter!

We've got an old Pa site here, a coastal outcrop without water - they lost that one too.

Nothing makes sense without population control, though. Once you do that, there are enough houses, and it just requires things like solar columns (mine is made from two ranch-slider doors, one above the other, mounted 50mm off the house wall - they pump about 1.5 kw in of a morning, free - the 4 metre column creases a draught you can feel, and it melted out first plastic vents...) solar water heating, and one which I find works well:

A sacrificial piece of single-glazing, downstairs, as central as you can get. It attracts the moisture as the house cools of a night, and with a channel and drain, removes it. Much cheaper than the nonsense of a de-humidifier, and no power required.....

I run my fridge outside the south wall, too. In winter, the ambient shaded south is about fridge temp (4deg ave). It is top-loading (more retention of the cold air) and the lid is the bottom of a bay outcrop, accessed indoors.So much less energy required to pull down a few degrees, than from 20-something degrees, as an indoor fridge is asked to do....

Often wonder if you could combine the sacrificial condensation window, with the evaporator panel.......

Hehe all good stuff and if you don't have to fork out for a power bill each month, well that makes for one less stress in life. Better quality in my books.

With the fridge, one way is simple to have it in a cabinet with a double hinged door. It can then just be vented to the subfloor area and to the room at the top.

There really is no excuse in this age for building houses that require space heating, except maybe down in your neck of the woods.

Out professor for thermal performance is quite a find for the uni, but hard to follow at times as he is hong kong chinese. While there are a number of other factors for thermal design, orientation and thermal mass are of paramount importance. I did a case study of a five year old school, and although some accomodations have been made, the energy consumption is still apalling. It would have only taken some quite minor design changes to make it perform.

I think population control will be forced by starvation at some point as history unfortunately shows that people will ignore the warning signs of resource depletion. The Monty Python skit is spot on. Those that can see are unfortunately usually not inclined toward controlling others lives, as much as they try to help.

If you want to see growth, you have to justify two things:

a) that it is sustainable. (it is not, this is a finite planet, end of discussion, it's only a matter of 'when', and it's sooner rather than later because your growth is exponential.

so you can't do that one.

then

b) you have to do whatever you do, without hamstringing those who inherit the planet. Denial of (a) is not good enough, I'm sorry. You actually have to prove that my yet-to-be-born grankids will have the same life quality (not your 'standards of living' - that just means 'more aquisitions') before you can take any detrimental action. The concept that was in the Palmer version of the RMA, but got watered-down to appease your kind. (It got 'The right's of current generations to make moolah' added).

This debate was thirty years ago, and has now been overtaken by events. Look around. Think. Can the USA get out of her debt ? No. Check out the IEA world energy outlook graph, and it's quite clear they're out of time, in fact, if the USA was a business, it would be obligated to call in the receivers.

Will China get there? No, we've been using raw resources at 3x the sustainable rate, a cross-over which happened in 1980. Documented by a New Zealand writer, at the time, Canty Uni if I recall correctly (Will Catton / Overshoot). He coined the phrase "homo collosus" to describe ou effects on our habitat. Ever read it?

No offense, Hugh, but there's no excuse for ignorance of fact, ( physics and chemistry are immutable fact, economics is an artificial man-made construct which fitted the growth phase in our resource/energy extraction, the difference is crucial) not at this stage.

I've gotten to the stage where I can't see why continued pushing of unfettered 'growth' should not be classified 'criminal'. Rape victims can and do survive their ordeal, my studies tell me that if you and your kind are let to go unchecked, my grandkids won't survive. Which do you think I regard as the bigger transgression?

Happy new year........

While Hugh has concentrated on the housing affordability issue, my research has me aghast with horror at the total effects we are submitting our economy to, regarding economic efficiency. "Land use" is one of the primary issues for economic efficiency, "cities" happen to be where most of the economic growth in the world has been for decades, and "new business start ups" are the main source of econ growth.

Land that is artificially inflated in price through regulation, distorts land markets, reduces "location efficiency" of households and employers, increases travel and transport distances and costs, reduces "churn" in land use, leaves land in below-optimum productive uses, and "prices out" new business entrants to the market.

I have posted appropriate quotes from studies by Alain Bertaud of the World Bank, and by Paul Cheshire of the LSE. These guys deserve a Nobel Prize for their work - but no-one who makes or influences policy is taking any notice. We are killing our economy - any nation or State or region that practices urban growth controls is killing their economy over the long term - AND none of the claimed "benefits" of all this is true in real life. Just as the former USSR's planners did not understand economics, neither do our urban planners, and the damage that is being done differs only in degree.

Joseph Schumpeter referred to "Capitalism in fetters", to describe a partly-regulated, partly-planned, highly-taxed economy. Urban growth control planning is another layer of heavy fetters.

Now I have discovered that the economist William Fischel, in his book "Do Growth Controls Matter"? in 1990, predicted or suggested the effects that Cheshire and Bertaud are now analysing after the event.

The following was published in 1990; unfortunately not online, you'll have to get the book:

"......The few analyses of land use regulations that

attempt to measure both benefits and costs of land use regulation indicate that

growth controls are likely to be inefficient. The major costs are probably wasteful

decentralization of firms and too much commuting by households. Higher housing

costs are actually a measure of the benefits of growth controls, but such benefits to

existing owners are costs to outsiders....."

"..........While this essay does not attempt

to distinguish growth control motivations, I have two observations about the

suburban traffic issue. One is that at least some of the traffic problems have

resulted from the antigrowth movement of the 1970s. Highway construction

slowed during that time, and environmental activists urged that fixed-rail transit

systems (e.g., subways) be built instead.

The problem is that fixed-rail systems are even less efficient for carrying

suburban commuters than highways. Economic studies of the Bay Area Rapid

Transit system of San Francisco, whose setting is ideally suited for a commuter rail

system, found that BART had little effect on highway congestion. The reason is

that the dispersal of homes and jobs in modern metropolitan areas is already too

great for any new rail system to be less costly than a highway system that

accommodates both cars and buses........"

"........I have pointed out that high prices could result

from amenity creation as well as monopolistic exclusion. On balance, however, I

am inclined to believe that most growth controls impose a net cost on society........

".........Growth controls and other aggressive extensions of land use regulations

probably impose costs on society that are larger than the benefits they provide. The

higher housing prices associated with communities that impose growth controls are

more likely the result of wasteful supply constraints than benign amenity

production.........

"......Recent growth management programs occur in two instances. One is in small

cities and suburbs that are relatively affluent.........

".........Growth controls are seemingly beyond judicial reproach on exclusionary grounds because they

democratically exclude everyone. Indeed, many growth management programs go

out of their way to mention that what little growth does occur should contain a low

and moderate income housing component. Such benevolence may not offset the

overall effects of restrictions on the housing market..........

"..........The cost of voting for extreme controls is not brought home to the voters or

suburban councils because those adversely affected are either a small fraction of the

electorate or not resident in the community at all.

Aside from their adverse effects on the cost of housing, inefficiently

restrictive growth controls probably cause metropolitan areas to be too spread

out.56 This is not to deny that growth controls may make development in

individual municipalities more compact. My claim is that such local ordinances

cause developers to go to other communities. The most likely alternative sites are

in exurban and rural communities, where the political climate, at least initially, is

more favorable to development. As the more rural communities become partly

developed, the newcomers wrest the political machinery from the pro-growth

farmers and business interests. Then these communities, too, adopt growth

controls, sending development still farther from employment and commercial centers. Eventually, employment and commercial activities also disperse from traditional population centers as they find that employees and customers are harder to find...........

".........The more subtle loss from inefficiently dispersed homes and businesses is the

loss of agglomeration economies for firms. The basis for urban economies is the

advantages of operating a business in the proximity of many other businesses.

Location in a city allows firms to have access to a more skilled and flexible labor

force. It also permits the face-to-face exchange of ideas, which promotes

innovation. Forces that tend to disperse firms erode such advantages and reduce

potential output from the industry........."

The gospel according to PhilBest:

The Earth is flat

The Earth is flat

The Earth is flat

The Earth is flat

Therefore infinite

Chorus:

Growth forever is poooooosssssssiiiiiiiiiiiiiiiiiiiiiiiiiiible

(repeat ad-infinitum)

Second verse, worse than the first:

Cheap land is all you need

All you need

All you need

Cheap Land is all you need

Thise who point out the obvious limits

Must be (wait for it) decrieeeeeeeeeeeed.

Chorus.

Repeat

repeat

repeat

repeat

if you repeat it enough

they come

to believe it...

Amen.

(note, like all economic illiterates, the quoted spiel fails to address energy. Which is needed for work. Which is what builds things. Which activity the spiel seems to think can grow with no limit mentioned. I suspect that if you ask this person about EROEI he'd go "what?")

That isn't fundamental economics, PB, it's economic fundamentalism, and like all fundamentalist doctrines, it got exposed by changing circumstances. You should have listened to the Finlay Macdonald / Lloyd Geering interview on RNZ. You probably won't get what Geering was saying, but he's dead right.

http://www.energybulletin.net/stories/2010-10-05/work-exergy-economy-mon...

Come on, PB, if you ditched the need to believe, you'd be able to think. Hugh too, come to that.

Be fair PDK....we have a whole new planet to pillage and it's just 20 light years away...5 times the size too....heaps of flat land....Hugh and PB have booked their seats...wanna go?

Ahh but have they got any of that cheap Marlborough wine that must be running out your ears by now.

I knew someone was off the planet.....

Thoughts meander like a

restless wind inside a letter box

they tumble blindly as

they make their way across the universe

Jai guru deva om

:)

om namah shivaya to you too.....good doco on the maharishi the other night....texas is where they are fixated tonight...nobody says anything different anymore...all theories and mental masturbation...coney island was never like this..sometimes i feel like a motherless child when ir ead this stuff...but then there's none so blind as those who do not want to see, eh, cobbers?

happy new year

Let’s manage the exchange rate in favour of the exporters instead of the importers as it is now. Once it is in favour of the exporters new export businesses will be set up. That will enable the overseas debt to be reduced through exporting and reducing the amount of imports. As it is now the exporters don’t know which way is up. Business will start to see opportunities to make make things for New Zealanders instead of importing. Government must start to govern for the people.

Yes, and then listen to the importers whinging about how the exchange rate is managed in favour of exporters.

Vested interests and special interest groups should not be determining the direction of the exchange rate, although of course they are.

While ever the exchange rate is in favour of the importer NZ will get further and further in debt and then we will end up being owned by overseas interests. Why people have this lemming approach to economics I do not understand.

...And then importers will respond to your assertions with something equally self-serving.

OK, today I am off to the beach where I plan to stay till March 1st, but I am packing my notebooks because I will remain in touch with the world. It was a tough but good year and if you all survived the mkts then we will be here next year. Good luck to all and have a great 2011.

OMG! listen to all you economists and accountants bleating on about fiscal inbalances and so forth!

Yes, you have part of the story ... but you are missing a big chunk.

Productivity is not a simple equation. ie capital spending (does not equal) productivity.

It helps if employees have the right tools to do their jobs, but you have all heard the old adage 'a poor workman blames his tools'

Other things which enhance productivity are:

training (to use the old tools to work better, smarter, faster, and with more quality)

incentive (to do the above)

a sense of ownership of what the company is producing and of your role within it

being able to work at the things that you are best at (eg, if you are a good salesperson, then someone else should do the administration ... if you are a good manager then THROW OUT the i-pad and let your secretary use it ... etc)

being happy at work ... in times like these the accountants and economists who largely make up the ranks of the CEO's like to crack the whip .. now is the time to get employees involved in the Company and it's success and reward them for it. Rewards do not have to be cash either BTW.

And there is more, but you get the gist.

The bottom line is that although we are in recession, and although (I agree) the debts are high and balance needs to be restored and productivity will help us to get out of this. Productivity is not simply achieved by spending money, it is a mind or paradigm shift ... it is in the realms of human psychology.

I do not see you guys talking about the psychology of what has happened and what can be done about it, your heads are all up in your numbers :)

LET'S ALL BUY MORE HOUSES!!!!!!!!!!

It was kind of funny the first 10 times. Now you just look like a dick.

Talking about economists, for those interested, google around the potential development of a code of ethics for the American economist association which will be discussed at their up coming meeting. The relationships between individuals public debate positions and who they advise privately (which are often not disclosed) makes for interesting reading.

Disclaimer: Yes a trained economist however not directly in the game currently

thanks speckles ... I appreciate your reply and will go google ...

bah! that was nothing new ... come on you guys ... think outside your squares! I am disappointed with your lack of interest ...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.