Here's my Top 10 links from around the Internet at 10 to 8pm in association with NZ Mint.

I'm bringing back the cartoons. Quite rightly, one of our readers from Christchurch said he wanted the real thing, including light relief. Fair enough.

We must take our pleasure where we can find it. Dilbert returns. And the cartoons. And even The Daily Show. I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz .

1. Cheeky buggers - South Korea better be careful what it wishes for.

Reuters reports it has just started dropping leaflets onto North Korea detailing the riots in Egypt and Libya to the good people of North Korea who may not have been informed.

Does South Korea really want a civic meltdown/exodus/civil war on its border?

South Korea's military has been dropping leaflets into North Korea about democracy protests in Egypt and also sent food, medicines and radios for residents as part of a psychological campaign, a legislator said on Friday.

The campaign was aimed at encouraging North Koreans to think about change, conservative South Korean parliament member Song Young-sun said. The food and medicines were delivered in light-weight baskets tied to balloons with timers programed to release the items above the target areas in the impoverished North, Song said in a statement.

2. Lessons from Kobe - ScienceMediaCentre reports from an expert on the lessons from the Kobe earthquake in 1995 that Christchurch could learn.

A geographer and former urban planner who has written a book about the aftermath of the devastating 1995 Kobe earthquake in Japan, says New Zealand will likely need to respond with a national-scale multi-faceted project to assist Christchurch long-term, in the same way the Japanese Government did to revive Kobe.

That could involve the Government injecting money into business sector ventures and efforts to resurrect tourism, as well as subsidising the building of new housing and rebuilding infrastructure.

3. Some dumb fun - Here's some advice for investment bankers from former i-banker Ash Bennington at CNBC. Here's 25 guys to avoid on Wall St. And a selection of the worst:

Avoid the banker who never seems to close a deal but still manages to remain employed. He's got something ugly on somebody—and you don't want to be involved.

Avoid the guy who offers his clients 'a very special opportunity' to invest in anything. He has a problem with cocaine.

Avoid the guy who gets drunk and loves to brag about never losing in arbitration: He's going to get indicted. (Trust me on this one.)

4. Just like a company - Wall St analyst Mary Meeker has analysed the US government accounts as if it was a corporation.

I'm not sure this is useful, but people are talking about it in America.

5. Richer and older - Most of the gains in life expectancy in America have gone to the rich, stateofworkingamerica.org shows in this chart below.

6. This struck a nerve - Roosevelt Institute fellow Matt Stoller writes here at Naked Capitalism (run by a hedge fund trader) about why there aren't many strikes in America (or New Zealand for that matter) any more.

It all sounds a bit ideological. But I'm struggling to find arguments against it. Modern multinational capitalism and our system of free movements of capital have failed.

Something else has to be thought of.

What you’ll notice is that people in America just don’t strike anymore. Why? Well, their jobs have been shipped off to factory countries, their unions have been broken, and their salaries until recently have been supplemented by credit.

It’s part of a giant labor arbitrage game, that the Federal Reserve and elites in both parties are happy to play. Strike, and you’re fired. Don’t strike, and your pay is probably going to be cut.

Don’t like it? Sorry, we can open a plant abroad. And we have institutions, like the IMF, to make sure that we get goods from those factory-countries, and get them cheap. But it’s not cheaper, or better, or more efficient. Firing your teachers isn’t exactly “winning the future”. And outsourcing manufacturing, as Boeing found out, is often a good way to increase coordination costs, create more operational risk, and destroy value.

However, the system is good at maintaining the power of oligarch-style control of cultural institutions. If no one but the kids of rich people can read, only the kids of rich people will be able to organize society’s resources.

7. Something fundamental - Mark Thoma points out something fundamental about the US economy that many market-watchers forget. This chart shows the median duration of unemployment.

Yet there are no riots in America... I found the situation in America profoundly depressing when I visited.

There is a huge underclass that blames itself for its situation and an elite that blames the underclass too. It won't change in a hurry.

Not with 43 million on food stamps.

8. The great Firewall of China - Now the social network for professionals, LinkedIn, has been blocked in China after someone posted on it that Tunisia's Jasmine Revolution should spread to China, Bloomberg reported.

Since 2009, the world’s largest Internet market by users has shut out sites such as those operated by Facebook Inc. and Twitter Inc. that don’t comply with Chinese rules to self censor information on politically sensitive subjects.

A LinkedIn user identified as “Jasmine Z” last week set up a discussion group to post opinions on whether the revolutions that brought down the leaders of Tunisia and Egypt should be brought to China. “Often, this is done as a sort of a warning signal -- sort of a shot across the bow,” said Doug Tygar, professor of computer science at the University of California at Berkeley.

"A portion of that is symbolic.’’ The problems accessing the site are “likely” connected to the creation of the LinkedIn group, Tygar said. Chinese citizens can use Internet services to work around blocked sites, he said

9. 'Build me another 45 airports, and make it snappy' - China plans to build another 45 airports over the next 5 years, taking the total in the country to 220, FT reports.

Just imagine what that will do for demand for concrete and steel, which means iron ore and coal.

It does mean however that China remains addicted to investment in infrastructure rather than encouraging consumption, thus worsening the global trade and savings imbalances being baked in by a fixed exchange rate.

The imbalances show no signs of being righted.

Li Jiaxing, the head of the Civil Aviation Administration of China, said that the new investments would take the total number of airports in the country to 220, even though most of the existing airports were losing money.

Although demand for air travel has grown rapidly in recent years as the purchasing power of Chinese consumers has risen, the expansion in airport infrastructure, which accelerated during the stimulus programme over the past two years, has become one of a number of potential sources of over-investment across the economy.

Mr Li, who used to run Air China, the country's biggest airline before moving to the regulator, said that the government would invest Rmb1500bn ($228bn) in the aviation sector in the period to 2015, although he did not say how much of that would go to airports.

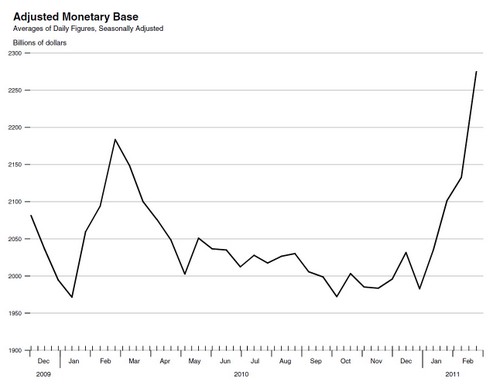

10. Totally relevant chart - Here's what has happened to US money supply in the last three months as the US Federal Reserve bought bonds (and printed money). And we wonder why commodity prices and oil prices are going through the roof... HT Zerohedge.

11. Bonus from The Daily Show explaining the situation in Wisconsin, where a union busting governor is slashing and burning. It's sparked a huge fight in America.

And here's Jon Stewart on what American workers need to do.

72 Comments

Very interesting discussion about Free Trade over at The Economist

http://www.economist.com/blogs/freeexchange/2011/02/trade_0

And this piece from 2007 (!) from Alan Blinder which resonates

I'm becoming less and less enamoured with the current versions of 'free' trade that governments and multi-nationals are keen on. Hence this is why I'm against the TPP with America.

Corporates win and the richest 1% of the population (big shareholders and managers) win. The rest lose.

cheers

Bernard

I did find the emphasis Julia Gillard made of the TPP disturbing. I think she referred to it as the biggest opportunity our two nations have ever seen (or something to that effect).

I felt she was the trained mouthpiece for Wall Street, and particularly the pharamceutical lobby. What is it America holds over Australia? I've often wondered.

Where does China fit into the tier 1 level private investment bankers?

Are they too as a nation indebted/owned by the elite number?

Curious how that works out from a geopolitics point of view.

Overheard last night at one of Nelson's best restaurant - a local leading light in the local real estate industry rubbing his hands with glee (literally) at the thought of floods of Cantabrians relocating to Nelson. Apparently he is looking forward to a boost in business of 25% or more.......

Scum.

And the tipping point nears in Japan...

Japan’s public pension fund, the world’s largest, said it may become a net seller of bonds to cover payments in the world’s most rapidly aging society.

The Government Pension Investment Fund, which oversees 117.6 trillion yen ($1.4 trillion), in September forecast that it would sell 4 trillion yen in assets in the business year ending March 31 to fund payouts.

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aFuqHkNIJVYM

This is interesting from Umair Haque at Harvard Business School about how companies create real value.

He has written the New Capitalist Manifesto.

http://blogs.hbr.org/video/2011/02/a-better-path-to-prosperity.html

Here's a precis of his idea:

"Welcome to the worst decade since the Great Depression. Trillions of dollars of financial assets destroyed; trillions in shareholder value vanished; worldwide GDP stalled. But this isn't a financial crisis, or even an economic one, says Umair Haque. It's a crisis of institutions--ideals inherited from the industrial age.

"These ideals include rampant exploitation of resources, top-down command of resource allocations, withholding of information from stakeholders to control them, and a single-minded pursuit of profit for its own sake.

"All this has produced "thin value"--short-term economic gains that accrue to some people far more than others, and that don't make us happier or healthier. It has left resources depleted and has spawned conflict, organizational rigidity, economic stagnation, and nihilism.

"In The New Capitalist Manifesto, Haque advocates a new set of ideals: (1)Renewal: Use resources sustainably to maximize efficiencies, (2) Democracy: Allocate resources democratically to foster organizational agility, (3) Peace: Practice economic non-violence in business, (4) Equity: Create industries that make the least well off better off, and (5) Meaning: Generate payoffs that tangibly improve quality of life."

And here's Raf Manji at Sustento with a proposal to do with the economic shock from the Christchurch earthquake et al. I worry about inflation from money printing, but here's his view.

http://sustento.org.nz/christchurch-quake-time-for-public-money-and-a-n…

"I want to go back to 1936 and the First Labour government which introduced low interest loans as part of a system of public finance to rebuild the country’s post-war economy. Think of it as New Zealand’s New Deal. The Reserve Bank governor can direct this at any time. This is certainly one possibility.

What I would like to see is fresh new money being injected directly into the economy by the government. The Treasury can action this at any time. The New Zealand economy has been struggling for a few years now since the GFC hit and deleveraging started. Business is struggling and cash is constantly tight. This latest quake will have finished off many business hanging by a thread.

I am proposing the Treasury create $5bln of new interest free money and credit it to the Government Earthquake Department for use in the rebuilding of public infrastructure. This is real money (not debt) and it will flow through into the economy thus giving it a boost as well as providing liquidity to the economy.

The money supply will increase by $5bln but I don’t believe there will be any inflationary risk. We are currently in a period of deflation and deleveraging with falling house prices and economic stagnation. NZ needs all the help it can get and there has never been a greater need nor a better time for this proposal."

cheers

Bernard

Wouldn't affect domestic inflation one bit - as Raf points out - in that regard we are in a period of delveraging. It would have no effect on wages either, as so many will be looking for work.

Imported inflation is another thing, but not related to this proposal. Indeed, far better than increasing our overseas borrowing to cover the cost - al that does is add to our interest bill - which requires taxes to be raised, which requires local businesses to raise prices to pay the addtional imposed levies/costs. And that is inflationary.

So, to my thinking - Raf's proposal might save us some of the domestic inflationary effects associated with raising the $5bln by traditional means.

"I don’t believe there will be any inflationary risk."

You are joking right!

Expect building sector prices for all inputs to jump 20% overnight.

Anyone rebuilding in Chch will be hit by the quakeflation extra charge from every quarter.

That hike in prices will hit every home builder in NZ top to bottom.

Throw another 5 billion at the problem and the only outcome will be to make the quakeflation worse.

The govt and RBNZ has to get a grip on the pace of the rebuild if they want to prevent mayhem across NZ. We are looking at a jump in activity in Chch for four to five years as labour and material suppliers, trucking and related services stream in....BUT...elsewhere activity will grind to a halt very quickly. Why would skilled builders be happy with $80 an hour in Auckland when they can get $160 an hour in Chch? Will the suppliers of cement, steel, timber and whatever, sit back on their 2011 Feb 1 prices......not a chance in hell.

And here are your words below Bernard..... "And the ponzi scheme goes on, thanks to Bernanke's zero % interest rates and money printing to try to inflate the stock market... guess what... this creates moral hazard and more bubbles....".........so how come you think flooding Chch with 5 billion in new toilet paper will not amount to a ponzi scheme??????

The point is, what is the overall impact....will it be inflationary......In simple terms, inflation happens when there is more money chasing the same quantity or less goods....the key is the same money....so are we looking at more money, or diverting it?....If we are diverting from elsewhere and at the same time we have deflation in other goods then that has to accelerate, the net effect might still be deflationary or negligable inflation....

Building Labour is certianly in short supply now and it will get shorter, so yes building labour costs can but go up....Materials costs, not so sure....Bunnings for instance is doing kitset kitchens below the costs of mitre10 and Placemakers....now there is an opportunity for them to ship in bulk to NZ and Chch....and make them cheaper...

Activity will grind to a halt....yes I expect so...ppl are deleveraging now, push up prices and that will only happen quicker.........I expect there will be some earthquake levy...I dont think the bulk of NZers will object and money has to ocme from somewhere.

Also consider the instability in the middle east and what it is doing to oil price and then petrol price.....and what that will mean for the world's economy....aka post July 2008....but probably worse...

Hmmm, also If we see a 40% collapse in house prices, what happens to the building costs?

regards

The 10 billion is coming from the EQC sell down of assets owned and cash accumulated from those paying insurance Steven...plus the billions in reinsurance cover from overseas. The funds exists right now. There is no need for a levy, and in any case we can expect our insurance premiums to go up very quickly.

The aim must be to ensure the rebuild activity is not used as an excuse by companies to boost profits and that goes for building labour as well. No bloody way should Chch firms or any others be hiking charge out rates just because they can. But this is what will happen. Right now the big materials suppliers will be flatout planning on raising margins until the pips are flying.

The slack building sector in the regions is the normal economy. There is activity but at a pace the market can afford. Along comes $10ooooooooo and kaboooooom...prices for every friggin item under the sun shoots higher. Count on this Steven...it will be happening right now.

QED...expect building costs to explode higher. Profits for companies like Fletchers to rocket up. Building activity outside Chch to stop dead. The regional economies will be ghost economies.

First items that will shoot up in cost....Timber supplies and cement...followed by steel and aluminium joinery....with charge out rates for labour jumping right now(not the wages...that takes a bit longer)....council fees will be boosted quickly....all service sector rates will rise....glazing and gaswork....electrical service rates....painters and so forth....let's not forget the freighting rates...

Oh we have us a rip snorter wave of inflation and what will bollard do?......make it worse by shoving the ocr to the roof because he is already behind the curve and this will lead to a knee jerk jump...bang goes the property bubble...down come the stupid prices and kaboom go the banks....hello Ireland...make room for another please!

And finally this from Taiwan...

Taiwan is considering a 15 percent tax on homes sold within a year as it seeks measures to curb speculation after home prices surged to a record last year. The property stocks index fell the most in six months.

The tax, which will be imposed on investment properties and not resident owners, will fall to 10 percent for homes sold within two years, Chang Sheng-ford, Taiwan’s deputy finance minister, said in a phone interview today.

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aQuDBAtqlyug

And the ponzi scheme goes on, thanks to Bernanke's zero % interest rates and money printing to try to inflate the stock market... guess what... this creates moral hazard and more bubbles....

http://www.bloomberg.com/news/2011-02-24/hedge-funds-are-borrowing-most…

Hedge funds increased their net leverage in January to the highest level since October 2007, as they took advantage of record-low borrowing costs to bet that the U.S. equity rally will continue.

Debt at margin accounts at the New York Stock Exchange minus cash and unused credit from margin accounts climbed to $46 billion, according to data released by NYSE yesterday. Hedge funds had $290 billion of debt from margin accounts in December, the largest sum since Lehman Brothers Holdings Inc. collapsed in September 2008.

Looks like Libya is going down the tubes...

http://www.telegraph.co.uk/news/worldnews/africaandindianocean/libya/83…

I must fill up tomorrow...

:/

regards

Printing (or counterfeiting) money used to be punishable by hanging - so what happened?

Andyh - try listening to more positive scuttlebut and uplifting stories. No need to pour petrol on that crap mate.

At the end of the 'just like a company' report the summary suggests America's only option is sacrifice and hard work. I'd say that's our only option now too. Rather than commit a crime and print money to kick-start the economy, JK should put those on the dole to work rebuilding Chch.

Lowering interest rates right now would be crazy. It will only make Kiwis think it's time to buy another house. Use tax breaks and subsidies targeted at those in need instead.

Comment under the following article (old) in The Guardian "The revenge of Trickle-down economics"

"Free market capitalism eats itself because:

1. Those who it makes powerful have least personal interest in keeping it free

(they make more money in the immediate term if they can fix the market, thereby corrupting the system)

2. It pushes enterprises toward shorter and shorter term profit-making, eroding long-term planning.

The only way to run a relatively free - and effective - market system properly is to have a strong state which intervenes to stop 1 and 2.

The state also, it is now evident, needs to redistribute wealth from the rich to the poor

- not only for obvious moral reasons, but because wealthy people tend to do things with their money which are much less good for the overall economy than do poor people.

All sensible Scandinavians know this - as do the Chinese."

hindsight...

Let's see which building materials company is first to raise it's prices across all products as a result of the expected 10 billion re insurance money hitting Chch.

And watch carefully as the cost of building a standard 'no frills' 3br box of wood and gib with some glass and paper thin roofing steel, shoots toward $1800 a sqm....more so in Canterbury but a jump to be expected right across the country.

The outcome of this quakeflation if not very carefully controlled by govt and RBNZ, will be to slow down the ... (because why rush the work... right!) rebuilding in Chch at the cost of zero building activity in other regions and a dam sight less in Auckland.

One bloody big mess because the plods in the Beehive and Bollard and Whitehead will fail to see the problem before it's way too late.

So......either the pointy heads very bloody quickly recognise the need to do the job at a pace which will not cause inflation and disrupt what other activity might be going on, or they must accept that chaos and greed will rule.

In a major new report, Global Growth Generators, Buiter nominates 11 countries that are most likely to drive global growth – and generate profitable investment opportunities – over coming decades. These '3G' countries are Bangladesh, China, Egypt, India, Indonesia, Iraq, Mongolia, Nigeria, Philippines, Sri Lanka and Vietnam.

As Buiter notes, all of these countries are currently poor, so their catch-up growth is likely to span decades. A number of them (Nigeria, Mongolia, Iraq and Indonesia) are also well-endowed with natural resources. And all – except China – enjoy favourable demographics. As well, Buiter says that other countries, such as Mexico, Brazil, Turkey and Thailand, will likely enjoy rapid growth. But these countries need to make some economic adjustments, including boosting their domestic savings and investment levels, before they qualify for the 3G list.

Alex - there's a word for that stuff - it's horseshit.

http://www.theoildrum.com/files/campbelldiscoverycurve200903_0.gif

When the area unter the line, equals the area in the bars, she's all over rover.

40how many more airports in China, again?

Of course, silly me, electric 747's. At a certain price, they'll be viable. Why didn't I think of that?

Probably because I'm not stupid enough to be an economist. Or a politicial who worships 'economic growth'.

"Armageddon in the property and banking industries”.

From Monday, under legislation passed by the outgoing Fianna Fáil government, all upwards-only rent review clauses are banned in new lease agreements.

In an attempt to outflank Fianna Fáil, Fine Gael and Labour promised to go further by allowing existing tenants – those with lease agreements up to 30 years old – to have their terms changed and rent cut to reflect the economic decline.

http://www.ft.com/cms/s/0/92c4dbc0-4111-11e0-bf62-00144feabdc0.html#axzz1F0K7UyCq

See what happens when govts meddle in the market....this is the mess this PIIGS economy is in and this is where NZ is heading.

Expect similar rubbish from Goofy...soon as he has picked up on what the socialists in Ireland are promising...expect NZ Labour to promise to do the same in NZ, for all who ask!

Former treasurer of mortgage firm pleads guilty to fraud http://www.washingtonpost.com/wp-dyn/content/article/2011/02/24/AR2011022407520.html?wpisrc=nl_politics

In a parallel civil action announced Thursday, the Securities and Exchange Commission charged Brown with aiding and abetting securities fraud and an attempt to cheat TARP.

The case is one of the largest to emerge from the crisis that brought the nation's financial system to the brink of collapse.

Prosecutors say Taylor Bean acted as a middleman between lenders and investors. The firm borrowed money from Colonial Bank to buy home loans insured by the Federal Housing Administration, the government alleged. Taylor Bean would then pool the loans into securities and sell them to investors. Ginnie Mae would then guarantee them.

Meanwhile the criminals in the banks and at the Fed and in the TOO BIG TO FAIL corporates get off with fat bonuses......harrrrrrrrrrhahaha. Either the American public is too stupid to know their pockets are being picked or ...nope, there is no 'or'!

Not to be outdone...the bureaucrats know a good thing in London when they see it...and no doubt we have this taking place here as well....it's all so secret you see...need to know only....national security matter old bean!

http://www.guardian.co.uk/politics/2011/feb/25/boris-johnson-city-hall-pay

Bernard,

Thanks for posting that up.

Wolly,

I don't think you really understand what is going on in the underbelly of the economy. There is a massive loss of wealth feeding through, deleveraging that just hasn't fed through yet, bank balance sheets which are hanging by a thread and reliant on issuing covered bonds to boost tier 1 capital.

You have no idea how much slack there is in the economy......unemployment near 7% and rising......huge unemployment amongst able bodied men.....if our property assets were revalued you'd see a massive hole in our financial system.

on the money supply: it's been rising at around 10-15% pa for the last 20 years.....we are proposing a 2% injection. as its interest free it has a deflationary effect. it will actually save over $300m in financing costs.

bank credit is toast.....you think banks are going to be lending money at the moment?

in our proposal we will be outlining a number of processes to manage bank credit and the money supply.

i have no concern about the inflationary impact of this proposal. i do have serious concern that without it our economy will collapse.

Yeah right raf...like I haven't been trying to get that message across for yonks...and you say "in our proposal"....really...and the "our" would be whom raf....the socialists or the pinky greens....

The "underbelly" as you term it, is the activity that was going on pre Sept 2010...it was once hyped up on cheap easy to get credit...that porkfest is over leaving behind the mountains of debt and a return to pre bubble activity at best.

" as its interest free it has a deflationary effect."....utter rubbish

So cut the crap raf. The quake costs are covered by and large by insurance money or EQC funds. There will be costs for all to bare mostly on the insurance premium side. The real damage will come from a 'mark up and be dammed' approach by suppliers and those who get the contracts in Chch.

What you refuse to accept raf is that after several years of debt financed madness blowing bubbles and faking employment...the downside is years of reduced activity as the burden of paying off the debts smashes into the economy....and there is no bloody way to escape that.

Wolly,

Please feel free to rant and rave. I don't think you have much to add to the debate but your point of view is appreciated.

Wolly keep ranting your making more sense than raf.

The Idea that NZ is somehow the US and it can print its way out of this mess is utter rubbish.

Note even the US can't force its toliet paper down the worlds throat forever.

The foreign Bond and FX boys will crush you even before your started up the printing press.

That crushing from overseas will finish every bank in NZ due to them all borrowing short and lending long. Which thanks to the government backing will finish NZ. The Ireland of the pacific has a nice ring to it right.

The foreign Bond and FX boys will crush you even before your started up the printing press.

This of course is the traditional argument of the status quo.

But the earthquake - a human tragedy of such global visibility - perhaps sets NZ outside the status quo, or put another way, the "normal" behaviour of the "markets".

It appears to me that there is around the globe a heightened awareness; a groundswell of action against immorality and injustice. Perhaps society is moving toward a paradigm shift.

I often quote Thomas Kuhn's description of such revolutionary change;

Paradigm change is closely aligned to perceptual change and "novelty emerges with difficulty, manifested by resistance, against a background provided by expectation” .

Raf's way of thinking to me is the "novelty" - Wolly/David C are examples of the manifested resistance and the average citizens of the world grow larger each day in their expectation of change.

So after the dust has settled..I wonder who and what the rebuilding in Christchurch will be for.Will it be a Ghost city like in China...After the aftershocks from the first and second one slow down..It will be many months before much can be done..All those that can get out will have done so...Familys in NZ and Aussie and the UK will be absorbing the Good Citizens of Christchurch..Life goes on.

You are right anon...many months....so why are some screaming for an ocr cut and others calling for Bollard to do a 'Bernanke' with the money supply....seems obvious any rebuilding will be months away at best....the operational business sector not hit in Chch can carry on with what they do...viable entities in need of premises should get the help...families needing a roof also even if that means a roof in Timaru or Rangiora.

david c. maybe you would like to explain to us all how the money creation process works, how the money supply grows and the impact of interest and debt in the financial system.

i'm so open to debate on this but i'm looking for more than the standard pavlovian response.

fwiw, i've got 25 years experience in financial markets and used to be one of those fx/bond boys.

The foreign Bond and FX boys will crush you even before your started up the printing press.

This of course is the traditional argument of the status quo.

But the earthquake - a human tragedy of such global visibility - perhaps sets NZ outside the status quo, or put another way, the "normal" behaviour of the "markets".

It appears to me that there is around the globe a heightened awareness; a groundswell of action against immorality and injustice. Perhaps society is moving toward a paradigm shift.

I often quote Thomas Kuhn's description of such revolutionary change;

Paradigm change is closely aligned to perceptual change and "novelty emerges with difficulty, manifested by resistance, against a background provided by expectation” .

Raf's way of thinking to me is the "novelty" - Wolly/David C are examples of the manifested resistance and the average citizens of the world grow larger each day in their expectation of change.

And for those in wgtn thinking themselves ok because all the pollies said so...have a read of this:

http://www.teara.govt.nz/en/tsunamis/2

It will be a city providing services to the farming and agriculture of wider Canterbury and the large part of the population that has not been materially affected, the north, south & west of the city.

Hopefully the rest if they move in a timely manner and throw enough resources at it.

From Australia, today. Maybe they have started to have the discussion in public (SMH), that we have been having, that they have shyed away from.

Yes, of course it is a poor policy and it will be even worse should a capital gains tax be introduced, but exempt owner occupied residences- we'll see more Mc Mansions being developed. Yet just about everyone who touts a capital gains tax, including bloggers on this site, automatically want an exemption for owner occupied properties . Lol!

Yes, of course it is a very poor policy and it will be even worse should a capital gains tax be introduced, but exempt owner occupied residences- we'll see more Mc Mansions being developed. And of course need a horde of extra bureaucrats to monitor the situation and deal with the paper-work. Yet just about everyone who touts a capital gains tax, including bloggers on this site, automatically want an exemption for owner occupied properties. Lol!

That's what these guys are suggesting, muzza. not exepmting any houses; owner occupied or otherwise. CGT on everything. Its stops those tax-free McMansions!

Yes, it's like GST, keep it simple stupid and don't start handing out exemptions for this and that. We got it right when we introduced the GST without offering exemptions. But I can't see that being polically being a starter with any intoduction of a CGT. eg The Greens are big on not including owner-occupied residences, but they are nit-wits anyway when they stray from some good policies on the environment, and unfortunately get into their social engineering mode.

To help my understanding of your posts, Iain. Do you mean 'tier 1' as in a Capital Ratio requirement ie: Basel Accord, or as in 'Top Ranked Banks ie; Tier One banks' ?

Right you are Iain...give the govt complete control over the supply of money...that'll solve the problems...way to go. I can see it now....a Labour govt in control of the money supply....wow what a future we would have.

Well Iain, be grateful that bloggers such as you mention just waste their time venting their spleen claiming they know best, but don't have any say in actually implementing government policy.

Oh ta thanks for the reminder Muzza...I must pay my National Party membership fees.

If you did you might then offer your wisdom and stand for election and be committed to doing rather than just sounding off with your opinions? But the latter is of course the easier option.

{By the way, I don't belong to the National Party}

Decisions are made in the backroom Muzza....my sounding off is no better nor worse than your own sounding off....I'll post you a membership form Muzza....

Can't agree, you are 10 times better at it than everyone, especially with quantity.

IP, "you will discover that EQC takes premium levy it collects"

Would you care to guesstimate the number of uninsured properties that escape the collection net?

Which is why the EQC levy should be attached to the rate demands on all property.

Why is interest.co.nz always full of Social Creditors like Ian and Raf??

Is Bernard really a closet Social Creditor and Interest.co.nz a front site for them. Does anyone see the Irony in interest.co.nz being a closet Social Creditor hang out. Hint (interest)

Ian has been studying banking for around 5000 years and I believe Raf's been working in the Finance sector for at least 3 million years.

Debating a Social Creditor is similar to debating a Young Earth Creationist. The short answer is don't .

But great fun DC...like biffing rocks at wasp's nests!

David C: I said 25 years :-) and I am not a social creditor or any other label you seek to attach. I do believe public money has a place alongside bank credit. this is one of those times.

I have made a proposal and you believe it to be unsound on the basis that creating new money is inflationary. I've asked you to explain how this is any different to current practices. I'm looking forward to your informed response.

Gadarfi looking more like a tribal warlord thug by the hour....soon to be replaced....with what....a democratic open and free society...fat chance....bring on the next dictator....new medals please...

So... Is inflation going to keep driving the dodgy NZX up or will cashing in for the EQC drive it down? Moneys not safe in the bank, property is overvalued. Inflations coming. Gold overvalued. The US is due for a correction.

Aieeeee!

I can't buy fletchers as it's too dear, to get a Return vs. Risk.

I hear lots of gloom, but what are some good ideas? That the average Joe can do, drastic policy change is a waste of breath. What are some solutions for the average punter?

monteiths: yes options not solutions. what to do with your own situation? i've had this conversation with my brother (lives near Perth, ex-credit trader) for 4 years....what do we do when we know the whole system is going to crash apart?

start with the basics: be as self -sufficient as possible...own land, water supply, renewable energy, grow your own food, buy capital equipment, own some gold/silver, plant trees for timer, firewood and fruit. have some animals.

easy eh.

if you can't do that then you're at the mercy of the markets. having money in cash is the next best thing but at some point you have to convert it into hard assets.

the main issue has been of timing.....as land is so overvalued there is a chance that prices could drop heavily as people/banks try to liquidate. but really the 1/4 acre section is about as good as it gets.

Options, not solutions

I talked about a guy I met who works for WINZ. Their office, one of 3 in a provincial town is giving 60-100K a week in food allowances. He said that one day soon the average truckdriver,saleperson and tradesman will work out that if you add this onto the benefit, look at your average after tax earnings, you would be better off on a benefit, with a $200 a week food grant. These people are actually better off once the extra payouts are taken into account and they expect it as a right. He said its getting scary and yet just keeps getting swept under the carpet.

http://theautomaticearth.blogspot.com/

The connection between the Fed, commodity price increases and social turmoil may have entered the mainstream dialogue, but it is exactly when the mainstream recognizes a financial trend that it soon reverses. Investors amassed on one side of a trade will be forced to quickly shift to the other side, and the "inflation" exported by the Fed will be revealed to be just another speculative romp crafted for the benefit of those who made out like bandits during the last one.

As The Automatic Earth has repeatedly stressed, however, a deflationary price collapse will make necessary commodities even less affordable for the average person, due to a dramatic reduction in private revenues and public benefits. So while the superficial financial trend may change, the social turmoil will continue on, and next time Egypt's revolution may not be so "peaceful".

We don't and don't worry they will not rebuild it all, the Government had lost interst last time in less than six months, they will all move on again.

Look at the revenue destruction , my father had lunch at a Mega Mitre 10 last week. He was the only customer there, the world is changing, as our standard of living falls.

http://www.stuff.co.nz/business/industries/4706555/NZ-Post-delivers-63p…

The roading costs alone in Christchurch make Joyces decision to blow the budget on wothless projects look a very poor one. Time he left.

http://www.stuff.co.nz/business/industries/4706563/Quake-damage-to-road…

No comment box on "tax breaks for goods as well as cash", Amanda? The experience in the States is that there will be a flood of "goods" donated that are past their use-by date, and/or are otherwise unsaleable. A good way to clear up that sticky inventory!

technical snafu snarly

fixed now.

cheers

Bernard

Ireland's new government on a collision course with EU Ireland's new government is headed for confrontation with Brussels after the country's ruling party was wiped out on Saturday by voters in a huge popular backlash against a European-IMF austerity programme.

http://www.telegraph.co.uk/news/worldnews/europe/ireland/8349497/Irelan…

Thanks for the link AJ, cop this from the Telegraph article:

"the European Commission bluntly declared that the terms of the EU-IMF bailout "must be applied" whatever the will of Ireland's people or regardless of any change of government.

"It's an agreement between the EU and the Republic of Ireland, it's not an agreement between an institution and a particular government," said a Brussels spokesman.

A European diplomat, from a large eurozone country, told The Sunday Telegraph that "the more the Irish make a big deal about renegotiation in public, the more attitudes will harden".

"It is not even take it or leave it. It's done. Ireland's only role in this now is to implement the programme agreed with the EU, IMF and European Central Bank. Irish voters are not a party in this process, whatever they have been told," said the diplomat."

Disgusting arrogance from the EU, just the sort of talk to really get the Irish fired up and say FU to the EU and the IMF. Go for it Ireland.

Ditto.

Where their famous Scotish neighbour, William Wallace's last word was "freedom" - I think the Irish people's will become "sovereignty".

Kate, did you see this article on China ?

http://www.telegraph.co.uk/news/worldnews/asia/china/8349425/The-end-of…

Fascinating. I wonder too whether the government's export subsidies have ceased for many goods. Certainly for years many manufacturers of small goods were selling at or below cost and taking the subsidies as their margin.

Iain, have you read 'Normal Accident Theory' by Charles Perrow?

http://paei.wikidot.com/perrow-charles-normal-accident-theory

it's completely the wrong way to build a productive economy. we should be creating the best design and production teams in the world, creating the best technology to make society more efficient and healthy.

to be fair though to john, that is the world he has grown up in and been a part of for over 25 years. it's a world i came from and so i understand for many (if not all minus a few) there simply isn't any other approach. that's why change is so hard...as kate mentioned above somewhere the belief system is so embedded...this is the only approach that works, whilst ignoring all the evidence around them. also when you spend your life mixing with one class of person you tend to think everyone is like that.

One thing we do know now (as we predicted previously) is that the financialisation of economic activity would bring bubbles, depressions and social unrest. to build an economy around the promotion of complex structured financial products seems to miss the lesson :-)

create a new high functioning and people centered financial system and then we may be talking a different story.

You can whine as much as you like but it won't alter the fact that the Christchurch earthquake has guaranteed that Key and National will romp home in the next election. Sting much?

*smirk*

Interesting comment, but I think there's more brown stuff to fly before November, and not just internally.

I will be - whoever gets it - a poisoned chalice.

The long descent has to be well establisned before the next term expires, and resentment has a habit of targeting those in view.

Winston has some big funding and expensive stategists heading his way then.

We know he can win enough votes to make use of at least one new BMW.

When does Helen Clark's contract run out at the UN? Maybe she is gonna come back and save the Labour Party and us all!

Actually it matters not which main party - National or Labour - gets the most seats, but rather what minor parties they will need to form a government.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.