Here's my Top 10 links from around the Internet at 10 to 12pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

My apologies for no Top 10 on Friday. I was travelling and really struggled to get a decent connection.

1. Euro rate hikes are still coming - Bloomberg reports Jean Claude Trichet saying that the European Central Bank still expects to raise its official cash rate next month.

This is despite the Japanese quake and Tsunami and any hit to global growth from higher oil prices.

Higher ECB rates will also add pressure to the European sovereign debt crisis, making it more expensive for many mortgage borrowers in Spain and Portugal.

It also lifts the interest rate 'curve' for many rates, increasing borrowing costs for stretched countries such as Portugal, Ireland, Greece and Spain.

And there is still no solution to the Irish problem.

Meetings are due on that later this month.

The Irish want lower interest rate on their bailout package. The Europeans want Ireland to raise its low corporate tax rate.

There are mumblings about Irish voters and the government talking about allowing their banks to default.

That would freak out the European banking system, which is up to its neck in Irish bank debt.

2. Mortgages without an end - This fits into the category of an industry in a bubble phase. ING announced plans last year for interest only loans that have no fixed term, Leith van Onselen points out at MacroBusiness.

Now Australia's banks are lifting loan to value ratios, the AFR reports.

We've seen some signs of that here too. It's the same banks.

The maximum amounts banks are willing to lend to clients has returned to the levels before the financial crisis, and some lenders are offering specials that waive the requirement for customers who borrow more than 80% of the value of the property to pay mortgage insurance…

Mark Hewitt, general manager of Australia’s largest mortgage broker, AFG said…”LVRs have loosened in the past month and 95% is the benchmark again. There is strong competition on price and product features, and lenders are keen to get money out the door”.

He noted that some niche lenders were probably offering to lend 100% of the value of the property…

Mortgage Choice spokesperson Kristy Sheppard said…banks were offering 97% loans with lenders mortgage insurance capitalised. This means the cost of the insurance cover is included in the loan…

3. Will the Bank of Japan print too? - The Bank of Japan has aggressively pumped cash into Japan's financial system in the last week, but has stopped short of massive purchases of freshly minted government bonds.

This is often referred to as monetising government debt or 'printing money'.

But the drumbeat for more printing is growing, Bloomberg reports.

With Japan’s public debt already at about twice the size of its GDP, Moody’s Investors Service said last week that the disaster may push forward Japan’s “tipping point” for investors to lose confidence in the nation’s credit quality.

“The unsustainable sovereign debt position suggests that the BOJ will have to bear a bigger funding burden,” BNP Paribas SA strategists wrote in a March 18 note.

“The government spent a lot and sold a lot of bonds after the Lehman shock occurred, and Japan greatly stepped back from the fiscal rehabilitation,” said Hiroaki Muto, a senior economist at Sumitomo Mitsui Asset Management Co. “The BOJ is basically reluctant to rush in expanding its balance sheet.”

4. 'Just imagine if' - Michael Lewis, the writer of the must-read The Big Short, writes here at Bloomberg about a magazine article he wrote in 1988 about how a devastating earthquake in Tokyo would cause a US stock market collapse and a 5% rise in interest rates.

He says this quake is different to the one imagined then (or the 1923 earthquake that devastated Tokyo and led to a militiaristic government), but Japan is in a weaker position than it was in 1988.

The ratio of Japan’s government debt to its gross domestic product (more than 225 percent) is the highest in the developed world, almost double that of the next-worst basket case: Greece. The Japanese government still owns about $900 billion of U.S. Treasuries, but less honestly. In effect, the Japanese government has borrowed huge sums from its own, increasingly strapped people and used some of that money to fund U.S. Treasury purchases.

The Japanese population, aging and shrinking, is saving less and less. The historically biggest buyers of Japanese government bonds -- Japanese government pension plans -- have recently become net sellers. The country has run through five finance ministers in the past two years, and in ways that suggest the job has become a lot less appealing. (One left for health reasons, another appears to have committed suicide.)

The Dallas-based hedge fund Hayman Advisors, which has been betting that Japan will eventually need to default or restructure, has estimated that a mere three percentage-point rise in interest rates would leave the government using all of its tax revenue simply to service its debt. Even before the earthquake, Japan, to balance its books, was probably going to need to sell a lot of government bonds to foreigners. And those foreigners probably were going to demand a far higher rate of interest than Japanese government pension plans do to hold them. That rate of interest just went up.

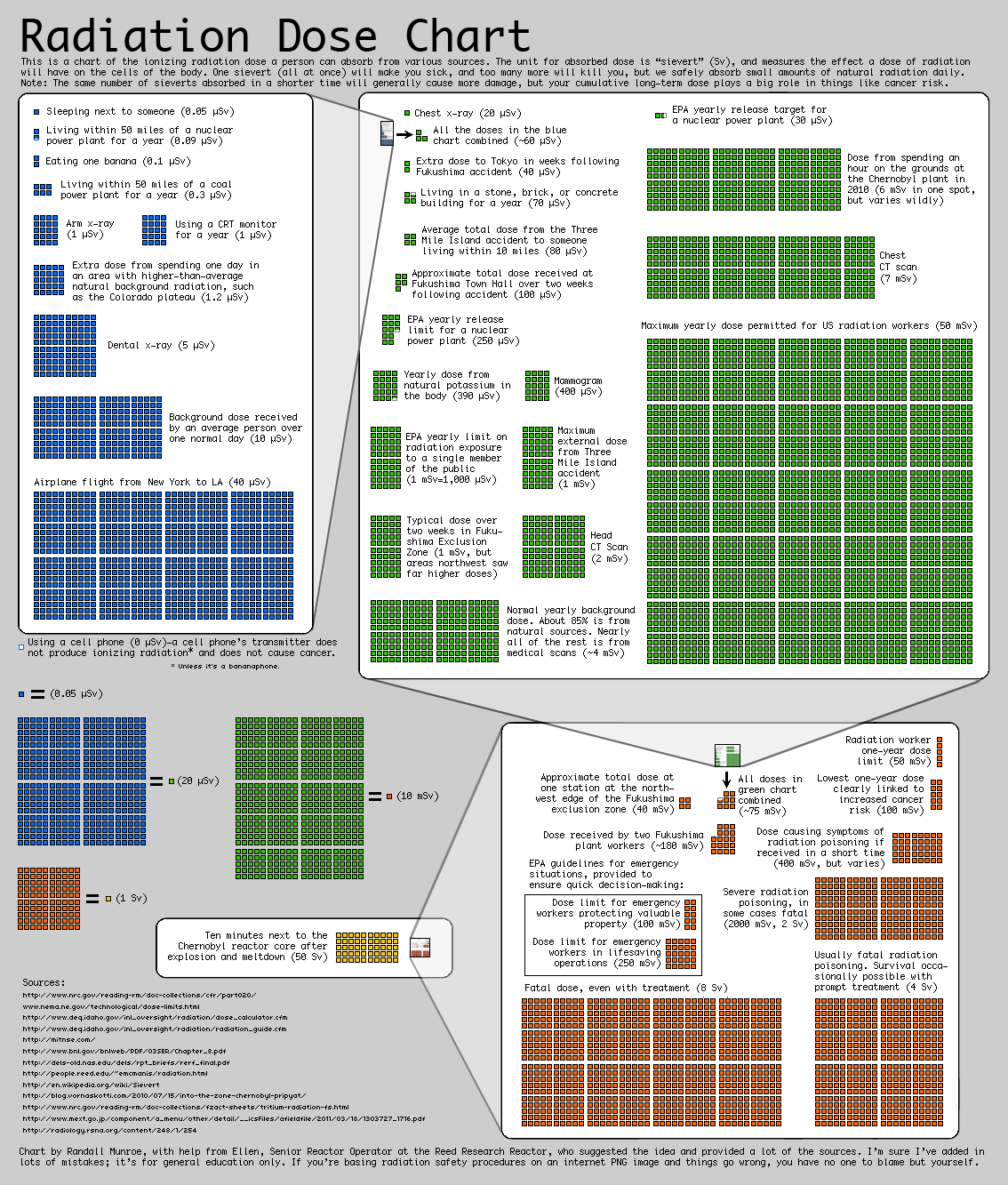

5. Radiation dose chart - This is a great graphical representation of the actual amounts of radiation absorbed in daily life compared with the stuff from Fukushima and elsewhere.

Click on the chart at XKBD for the full readable version.

6. You've been warned - Bloomberg reports the IMF's Deputy Managing Director John Lipsky has warned that mounting debts in developed economies such as the US, Japan, Europe (and Australasia) are unsustainable and risk creating a future fiscal crisis.

Each 10% increase in debt slows real economic growth by 0.15%.

New Zealand is about to add about 10% to its public debt to GDP ratio in the next couple of years.

The average public debt ratio of advanced countries will exceed 100 percent of their gross domestic product this year for the first time since the war, Lipsky, the IMF’s first deputy managing director, said in a speech at a forum in Beijing today.

“The fiscal fallout of the recent crisis must be addressed before it begins to impede the recovery and create new risks,” said Lipsky. “The central challenge is to avert a potential future fiscal crisis, while at the same time creating jobs and supporting social cohesion.”

Long-term bond yields could climb 100 to 150 basis points, driven by the 25 percentage point rise in sovereign debt ratios since the global financial crisis and projected increases in borrowing in coming years, according to Lipsky.

While interest payments on debt have remained stable at about 2.75 percentage points of GDP over the last three years, “higher deficits and debts together with normalizing economic growth sooner or later will lead to higher interest rates,” Lipsky said. The IMF estimates fiscal deficits for developed nations will average about 7 percent of GDP this year.

The cost of repaying debt would increase by 1.5 percentage points of GDP by 2014 even if interest rates rise only about 100 basis points, Lipsky said. IMF studies show that each 10-percentage-point increase in the debt ratio slows annual real economic growth by around 0.15 percentage point because of the adverse effect on investment and lower productivity growth, according to Lipsky, a former chief economist at JPMorgan Chase & Co.

7. Greenspan was the Godfather - Dylan Ratigan at MSNBC does his thing on the Too Big to Fail banks and Greenspan's Put.

This stuff is starting to go mainstream now. It's unusual to see both Ratigan and Glenn Beck on the same side on anything. They're both haranguing the Federal Reserve, in slightly different way.

Interestingly, Ratigan says the banks have spent US$344 million lobbying against efforts to re-regulate banks...

So much for democracy.

America is a corporate run plutocracy.

8. Less than half sold - At half price. The Southland Times reports that just 8 out of 19 sections being sold at Jacks Point near Queenstown by Allied Farmers.

It seems Dunedin urologists are doing OK in the recession.

Nineteen sections at Jacks Point on land previously associated with failed firm Hanover Finance were up for sale during a silent auction. Overall the lots were worth about $11 million, the expected price tag was less than $5m and the eventual sales amounted to about $1.4m. Most of the lots were bought by overseas bidders.

Urologist Naryan Sampangi, of Dunedin, successfully bid for a lot, where he plans to build an eco-friendly home for business use and holidays. At a reduced price it was a reliable investment, he said.

"You're not going to lose much, I don't think you can get a better place than this, for retirement, for a holiday, for the weekend," he said.

9. Stiassny's racing dramas - I don't often look in the Waikato Times' racing section for news. But this is a cracker. Michael Stiassny is well known in New Zealand's corporate scene as a very influential, and occasionally controversial, character. He chairs the Vector board and is New Zealand's most prominent receiver at Korda Mentha.

He's also the chairman of the New Zealand Racing Board and has pushed a few buttons there it seems. Here's some of the background. The detail is ugly and Stiassny rightly reacted aggressively. The bloodstock agent appears to be one of these 'colourful racing identities' they talk about in Australia.

High-profile bloodstock agent Rob McAnulty is facing up to eight months disqualification as an owner after he yesterday admitted verbally abusing New Zealand Racing Board chairman Michael Stiassny.

Through his lawyer, Simativa Perese, McAnulty pleaded guilty at a Judicial Control Authority hearing at Ellerslie to charges of misconduct relating to his using ''foul, insulting and offensive words'' directed at Stiassny and also chief stipendiary steward Cameron George in voicemail and email messages.

Stiassny has also been aggressive in targeting drug cheats in racing, which seems fair enough. Here's some more at NZHerald.

10. Totally irrelevant video - Here's that video I promoted on Thursday without getting the link right. It had 300 views when I first linked to it. Now it has over 6.8 million.

27 Comments

FYI from a Telegraph reporter on the ground in Japan. HT Troy via email.

http://www.telegraph.co.uk/news/worldnews/asia/japan/8392549/Japan-cris…

The unshaven man in a tracksuit stops his bicycle on the roadside and glances over his shoulder to check that he is unobserved. Satisfied, he reaches quickly into the sludge-filled gutter, picks up a discarded ready-meal and stuffs it into a plastic carrier bag.

In another time, another place, Kazuhiro Takahashi could be taken for a tramp, out scavenging for food after a long night on the bottle. In fact, he is just another hungry victim of Japan’s tsunami trying to find food for his family.

“I am so ashamed,” says the 43-year-old construction worker after he realises he has been spotted. “But for three days we haven’t had enough food. I have no money because my house was washed away by the tsunami and the cash machine is not working.”

This is fascinating on the issue of stable economies and risilience from a former banker Ashwin Parameswaran. HT Cosmic via email.

http://www.macroresilience.com/2010/10/18/the-resilience-stability-trad…

He refers to a flood protection scheme in India. Well worth a read.

Extended periods of stability reduce system resilience in complex adaptive systems such as ecologies and economies. By extension, policies that focus on stabilisation cause a loss of system resilience

“By building embankments on either side of a river and trying to confine it to its channel, its heavy silt and sand load is made to settle within the embanked area itself, raising the river bed and the flood water level. The embankments too are therefore raised progressively until a limit is reached when it is no longer possible to do so. The population of the surrounding areas is then at the mercy of an unstable river with a dangerous flood water level , which could any day flow over or make a disastrous breach.”

As expected, the eventual breach was catastrophic – the course of the Kosi moved more than 120 kilometres eastwards in a matter of weeks. In the absence of the embankments, such a dramatic shift would have taken decades. With the passage of time, a progressively greater degree of resources were required to maintain system stability and the eventual failure was a catastrophic one rather than a moderate one.

that, Bernard, is a great link.

Worth 10 top 10s.

thx.

complex adaptive, what?

Bernard, what are you talking about? You don't believe in this shite do you?

http://www.mea.org.nz/document.ashx?id=637

Les.

PS - speller on 'risilience'

3. Japan is a fully matured economy now in the early stages of demographic contraction. They have printed money for many years now without any inflationary impact but by continuing to purchase bonds rather than directly spending the money into the economy, they have created an enormous debt burden.

They are boxed in around a strong yen, large overseas assets and a huge public debt.

This offers lessons for many other maturing economies. The US sadly has pursued the same policy by propping up "zombie banks" by buying their unwanted bad assets and by purchasing new government debt.

New Zealand has an opportunity to take a different approach and that is to print new money and directly spend it into the economy. With a huge hole in the economy this is the most sensible option. Bill English said new debt was the only option open to him. He knows that is not true. More debt is not the answer. New Money is.

http://sustento.org.nz/wp-content/uploads/2007/05/A-New-Financial-Deal-…

WOW !! such a simple solution. I will go to warehouse stationery now and buy myself a new bottle of ink and a printer and sent it to Bill English. All our problems solved !!!

Kin, the developed world at the moment is doing just what you suggest in spades. Only they not only print but print the new money as interest bearing debt.

So, what's your real argument against raf's proposal?

Or, I am right to assume that you argree it's okay to print, but only provided a private sector financial institution gets the opportunity to clip the ticket/charge the interest along the way?

kin - Kate beat me to it. Explain, where has Raf got it wrong?

Cheers, Les.

Well, I'm not kin but I'll have a go. As I understand it, in QE as practiced by the US currently and Japan in the past, the central bank buys existing government securities from banks with the view that the cash (that they effectively print to purchase them) will be lent out - although it seems mostly to be used for speculating in commodities.

The Bernank says it's not really printing, because eventually once the economy is growing again and everything is smelling of roses, the FED sells out of it's Government Securities and effectively "destroys" the money that it "printed". Who knows when or if this will ever happen.

Leaving aside the "e-note" aspect which is fairly irrelevant as most cash is already electronic, the above proposal seems to advocate printing new money and giving it directly to the Government to spend. What I would envisage in that scenario would be a total loss of confidence in the NZD and $10 a litre petrol and 20% interest rates in no time.

But maybe it's worth a try...

FYI Oil up US$2/barrel in first trading after Libyan air strikes

From Chch boy , Paul Nicholls , who gave us the amazing Christchurch quake map .... he has now produced this : www.japanquakemap.com ......... the first few moments show a few smaller earthquakes ....... then KA-BOOOOOM ! ........ all hell breaks loose .

This is a goodie:

http://articles.latimes.com/2011/mar/09/business/la-fi-china-oil-201103…

If anyone has seen Jacks Point recently they will know what's wrong.

Firstly whoever decided that a lake view wasn't a requirement on that side of Queenstown in an upmarket development was clearly mistaken. It's certainly no Millbrook, just open farmland with mountain views, very disappointing. Also the club house facilities (beside not being open) are not comparable to other developments in the area.

I was bewildered by the dozens of Fletchers' built houses sitting vacant.

Obviously the $165k per quarter acre is all you'd want to pay for a site there, and few are even prepared to pay that. At $120k each they might move a few more, but remember it's hard to sell a quarter acre in Kingston for $60k within a whisker of the lake.

'Get squeezing Michael' ('advice' to the Irish Finance Minister Nichael Noonan).

Bernard, you dont seem to like spammers posting here....somehow Interest.co.nz has starting to post articles to my fb account (after I linked just one) without my express permission....its got you tagged as spam

:P

regards

Steven

Are you talking about your facebook news feed? or are you saying it posts to your wall?

Cheers

FYI from Christchurch today

Christchurch earthquake anger eruptshttp://www.stuff.co.nz/national/christchurch-earthquake/4789651/Christchurch-earthquake-anger-erupts

Central Christchurch business owners stormed through a cordon this afternoon as a protest about their treatment by earthquake authorities became heated.

About 100 CBD business owners were at the protest, which began calmly at 2pm.

The protestors marched to the Civil Defence headquarters at the Christchurch Art Gallery, holding signs and shouting for answers about the fate of their businesses.

"Quakes didn't destroy us, council did," one protestor yelled.

Protestors called for Civil Defence national controller John Hamilton, but when he did not appear some stormed through the inner city cordon.

Bernard, I avoided being involved in that protest (I perfer persistent polite badgering). However they have my full support. John Key and Gerry are out of touch and need to stop demolishing ANYTHING until a plan is in place and owners agree.

Just to make it clear they say they are getting buillding owners approval, however all they are doing is ringing owners and telling them that there building is coming down, no discussion, few choices unless you can really kick up a fight.

ChCh CBD is gone. Most buildings are condemned. Exodus is likely without real leadership. We have seen from Key, Brownlee and Parker is a complete disinterest in dealing with the public and the creation of a dictatorial police state.

This will not be the end of protests, ChCh needs everyone throughout the country to make it clear that demolishing property under urgency without the owners having a say is undemocratic and un-New Zealand.

The solutions are simple, yet the Civil Defence has made recovery impossible.

EQC and Fletcher's stalled any chance of an initial Sept 4 recovery now Government meddling is destroying what's left of ChCh.

We need the backing of business leaders in Auckland and Wellington to put on the pressure to get this sorted now!

It's a critical moment in National's re-election campaign and they don't even realise it!

Perhaps we should nickname the "Controller" Hamilton, the "Demolition Czar"?

We moved to Jacks Point three weeks ago, we bought a reserve front house off Fletchers. Although we don't have a lake view the mountain vistas are spectacular, the silence and night skies are also a really special. Less than 10 minutes to Frankton on a traffic free road past the Remarkables ski field access road.

We are very happy with our purchase and the section sale this weekend was a good positive sign that things are moving forward now the market has found a new price level. Considering Lake Hayes estate sections sell about at the same level I would consider Jacks Point to offer outstanding value. There is no contest where we would rather live.

WTF is going on?

WTF is CECC doing about this?

WTF is Peter Townsend doing about this?

WHF the is CDC, Bill Lough doing about this?

WTF is CCC, Bob Parker doing about this?

I got to say, I feel so sorry for these business owners. I know of manufacturers, exporters who have been hit by the eq, but the majority of them have not had to endure this problem.

WTF is happening here? Peter, Bill, Bob, c'mon, for F's sake? These are your people - domestic economy - get the F in behind them, for F's sake.

WyTF aren't you?

Les.

Exactly Les.

Civil Defence and the Government don't know what to do, so they don't think anyone else does either.

Let the bloody building owners, business owners and their contractors get in to sort their own properties out.

As far as the bureaucrats are concerned a house/building with cracked plaster on the ceilings is too dangerous for the public to enter, despite 60% of the houses in the eastern suburbs being in a similar state (and mostly still occupied).

It's a ridiculous situation where buildings sit on the point of collapse in the suburbs, threatening to fall on streets open to the public, yet in the cordoned CBD they are busy demolishing salvagable buildings without the owners' knowledge or full consent.

What's worse is that a large number of deaths on Feb 22 were due to engineers giving clearence to buildings that should have been cordoned. EQC and Fletcher's were also to blame trying to fix things on the cheap (I have proof of this from our dealings with EQC where they tried to say dangerous brick structures didn't need fixed - they all collapsed and could have easily killed had someone been in the wrong place). Now of course the engineers are trying to cover their arses and are killing the whole city at the same time.

It's total government mismanagement and why the hell isn't the rest of the country up in arms!!

Canterbury makes up 20% of NZ's GDP. ChCh is at about half power, if this lasts for the next 12 months (or forever if the demo czar knocks everything down first) then NZ could easily lose 5% GDP over 2011.

NZ is essentially totally stuffed. The government can't afford the rebuild and the economy is too weak to sustain the current mismanagement of the recovery.

Advice to Aucklanders and Wellingtonians is to sell now and move to Australia as quickly as possible.

NZ doesn't have the resources to deal with a quake even remotely close to Wellington or a volcano erupting on Queen St, and don't even for a second think that that is an unlikely event, we are long overdue another 1855, or Rangitoto.

Unless the government can restore confidence in the recovery expect increasing protest and uprising. Politicians trying to name call and dismiss legitimate protesters - we may as well have Gaddafi in charge!

John Key is on track to be a one term Prime Minister.

Coming back to Chch in mid-February , I was amazed at how little had been done after the Sept. 4 'quake . ...... . How the bureaucratic machine took over , stifled individual choice , and allocated big contracts to a chosen few .

NZ has a disaster beyond just the Chch earthquakes ... It is the bureaucratic largesse which both Labour & National have foisted upon the populence , by stealth , over several decades .

....... Home-owners and business people are mightily pissed off with all the shagging around . They want to get their lives back on track .

Lack of vision and urgency create anger – so just a thought for the PM.

Obviously the situation is getting desperate. Businesses have to operate as soon as possible and people need to go back to work.

In Japan the situation is increasingly more dangers, because of radiation.

Why not use these unfortunate circumstances and evacuate as many people out of Japan as New Zealand can accommodate, among them 5’000 construction workers, civil engineers, builders and other trades people. New business complexes/ houses/ shops should be erected urgently, but on safer locations, where people live and don’t have to commute (petrol price)

This would be a fantastic win - win situation for some people of Japan and residents of the wider Christchurch region.

Now - who can deliver the message to the PM ? Bernard ?

Note: Because of radiation (1/3 of Japan could be inhabitable), there is an increasing possibility the international community will be ask to help and evacuate people from Japan. Let's do it now PM.

GBH- it's good to hear that from people from outside. The amount of red tape is holding everythign up. My mother lsot her hosue in Sept...the whole street did just North CHC..and nothing has been done except reconnect water. the government will not make a decision on the land so no one can re build until a decision is made, last they heard they will make a decision by xmas 2011 or early 2012....meanwhile they live in garages and caravans. Now you have whole suburbs in this position.

Thing is FCM...there is no way to change crappy land into stable land without spending hundreds of millions...those areas that turned to porridge will do so again...wrecking whatever is built unless the structures are built to withstand it and that means bloody expensive....The best option is to relocate new suburbs...whole new regions onto stable land to the north or south of Chch....that means some bugger in power making a decision that pisses off vested interests...who stands to gain by staying in those locations...they are the ones delaying the decision....and then you have pollies who have shown themselves to be gutless when it comes to national decisions...so why would they be any different on a matter concerning a suburb in Chch...!

The video of that kid is the best thing on this site apart from Gareth Vaughns articles.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.