Here's my Top 10 links from around the Internet at 10 to 11 am in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

My apologies for no Top 10s on Thursday and Friday. AMI blew us out, I'm afraid. Deadlline missed. Today's Dilbert resonated in a large way.

1. 'We need a new reserve currency' - Bloomberg reports Nobel laureate Joseph Stiglitz has called for a new global reserve currency.

He makes some good points about the subsidy now America has with the US dollar.

The factoid from Fitch about US government debt hitting 100% of GDP next year is startling too.

The debate around America's debt ceiling is well worth watching.

Should we have a debt ceiling here?

A “global system” is needed to replace the dollar as a reserve currency and help avoid a weakening of U.S. credit quality, said Stiglitz, a professor at Columbia University in New York. The dollar fell to an almost 15-month low against the euro last week, and the U.S. trade deficit widened more than forecast in January to the highest level in seven months.

“By taking off the burden of any single country, we don’t have to have trade deficits,” Stiglitz said in an interview in Bretton Woods, New Hampshire. “Things would be much worse if it were not the case that Europe was having even more of a problem, but winning a negative beauty pageant is not the way to create a strong economy.” The ratio of general government debt, including state and local governments, to gross domestic product is projected to climb to 100 percent in 2012, the most of any country with an AAA ranking, Fitch Ratings said last week.

The existing monetary system means “there’s a very good risk of an extended period of low growth, inflationary bias, instability,” Stiglitz said. It’s “a system that’s fundamentally unfair because it means that poor countries are lending to the U.S. at close to zero interest rates.”

2. Risk for NZ banks? - The Sunday Star Times' Rob Stock has an excellent story about the risks New Zealand banks face from damages claims from companies who have lost money to employees who use internet banking to steal. It seems banks' cross checking processes aren't good enough to stop it without a bunch of extra safeguards..

Here's Stock writing about a law suit ASB faces:

The suit against ASB will centre on claims that businesses are not informed by the banks that they do not cross-check the names of payees with account numbers before allowing internet transactions, allowing dishonest employees with internet banking authority to create payment instructions that look like they are legitimate, but instead channel money into accounts they control so they can steal it.

And this one from Rob on a bankers' 'Ye Gods' moment on the issue.

The partners from Daniel Overton & Goulding were, "like most people", totally unaware bank systems did not perform automatic payee name-account number cross-checks, so they sent a small payment between accounts entering false names.

"We did some dummy runs to make small payments between some of the partners by putting in wrong names and we moved money around the system. It demonstrated the flaw straight away," Waugh said.

"When you as a corporate send a payment instruction and you put down the name of the person you want to pay and account number, what do you think is happening? You think that somehow they are cross referencing the name and the account number.

"What they do not tell you is that they are going to disregard the name of the payee on 100% of instructions."

3. The problem with tax havens - Rob Stock also has an excellent piece on tax havens and questions the role of family trusts in New Zealand. I agree with him. They should be restricted at least or banned as a last resort.

People may not even realise they live in a tax haven. Anyone with a bit of nous can reel off a dozen or so island tax havens – Jersey, the Caymans, the Bahamas, Guernsey... but Shaxson is fairly sure they won't name the islands of Manhattan and Great Britain.

He could include New Zealand for that matter, because international "asset planning" firms are making a play of selling New Zealand trusts as safe places to stash wealth discreetly.

This country offers first world stability, and a low-visibility trust system where foreigners can hold assets away from the eyes of their own tax authorities.

New Zealand is mentioned alongside Delaware companies, Barbados trusts, private foundations in Netherlands Antilles and tax-exempt companies in the Cayman Islands. Shaxson said New Zealand was one of the unrecognised tax havens of the world, but that its profile is about to rise.

4. Our budget blowout - Brian Gaynor wrote an excellent column at NZHerald on Saturday on the fiscal crisis now facing New Zealand. He does a great job of showing how revenues have fallen while costs have risen under this National-led government.

The Government is living well beyond its means, as reflected by its negative operating balance before gains and losses (obegal) of $9.2 billion for the first eight months of the June 2011 year.

The Crown has been forced to borrow to finance this deficit and additional capital expenditure. Thus, Crown debt has ballooned from $49.4 billion to $63.4 billion - an increase of $269 million a week, or $38 million a day, in the year ended February 2011. This is not sustainable and our political leaders have to make a number of difficult decisions, particularly as the latest Christchurch earthquake will cost the Government an estimated $5 billion to $10 billion.

Governments have two choices when they experience a huge blowout in the fiscal deficit and gross debt: they can either deal with the situation by making dramatic spending cuts or let the situation drift and leave the country at the mercy of credit rating agencies and foreign lenders.

New Zealand governments, whether National or Labour, find it very difficult to make the tough decisions because well over 50 per cent of the electorate receive some kind of direct or indirect government assistance. In addition there is a huge resistance to asset sales and public-private partnerships because of our experiences two decades ago.

5. Europe's debt problem - The problem with debt anywhere is that it acts as a hand brake on growth. As soon as you get out of recession higher interest rates make it much harder to really get motoring because interest payments rise.

That's exactly the case in Europe. The Observer reports on a consultant's prediction that the European Central Bank's drive to increase interest rates will simply push Ireland and Greece into default. And Spain is vulnerable too...

Here's the report:

Analysis by City consultancy Fathom, obtained exclusively by the Observer, shows that because the interest rates on the bailouts provided to Greece and Ireland track the European Central Bank's lending rate, a series of increases could push these countries – and Portugal – into default.

"If the ECB continues to tighten policy, the impact is clear: default is more or less inevitable," says Fathom director Danny Gabay. "Greece is clearly on an unsustainable path."

Fathom also warns that Spain remains vulnerable, despite Madrid insisting last week that its economy is much healthier than Portugal's and its debts are much more manageable. Spanish banks must roll over debts worth more than 5% of GDP this year, and more than 9% in 2012, in addition to the government's financing needs. A two-point increase in the interest Madrid pays in the bond markets – much of which could come from the ECB, even without a further loss of confidence from bond investors – would, on Fathom's calculations, force Spain into a fiscal crisis.

Much of the debt that has driven the three countries over the brink is owed to banks in the core, and Gabay argues that the insistence on being repaid every penny of that is driving the countries of the single currency apart, instead of holding them together.

"This is a banking crisis, not a sovereign crisis, and the German bankers are in the front line," he says.

6. Crisis at Leighton Holdings - One of Australia's biggest contruction and development firms faces a financial crisis. Leighton Holdings is likely to announce a A$800 million capital raising form its German parent later today after investments in the Middle East imploded.

Any NZ fallout? From what I can see they're not doing much here.

Here's more from Adele Ferguson at BusinessDay:

As of last night the company was planning to raise up to $800 million, at a rough price of about $22.50, or a discount of more than 20 per cent. The method was still not clear and the board was still to approve.

Based on a $1 billion write-down, it would need to change its profit guidance for 2011 from a profit of $480 million to a loss of more than $500 million.

As of last week, the company lost a great deal of credibility when it was forced to go into a trading halt after failing to come to an agreement at last Tuesday's board meeting on the size of the write-downs, the size of a capital-raising, and how to wrap it up as part of a ''wiping the slate clean'' exercise.

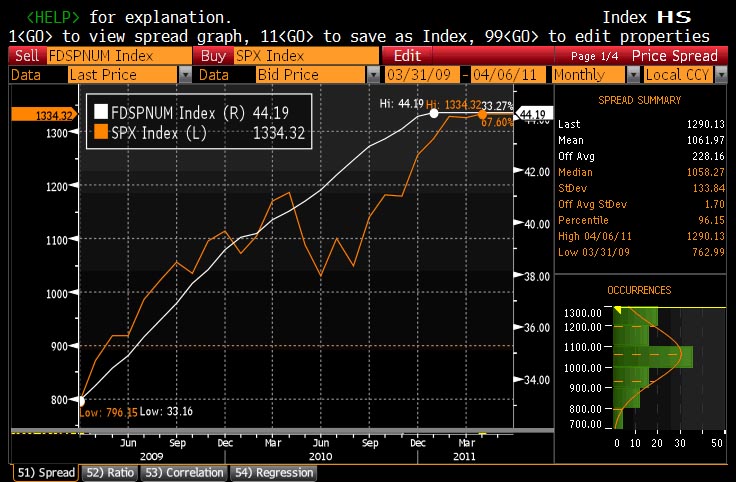

7. How America works now - The S&P 500 is now almost perfectly correlated with food stamp usage in America.

As corporates offshore jobs and sack staff, their profits and share prices grow. Meanwhile the sacked workers have to ask for food stamps. This is just not sustainable. Thanks to Zerohedge for the chart.

Cities, counties and school districts had been sheltered from the full impact of the slump because of the lag between when realty prices fluctuate and values are reset by local tax assessors. That’s changing as property rolls are adjusted to the current market and residents push to have their taxes cut.

Local officials are now facing the consequences. Property- tax revenue dropped in the last three months of 2010 at the fastest pace since home prices slipped from their peak more than four years ago, the Census Bureau said yesterday. The decline may continue as values fall further, adding strains to cash- strapped localities that already fired workers, halted projects and cut spending because of the recession that began in 2007.

9. Rebel forces are gathering - Jon Hilsenrath at the WSJ is a closely watched correspondent on US Federal Reserve policies and politics. Here he interviews St Louis Federal Reserve President and FOMC (rate policy setting committee) member James Bullard.

The Fed governor, one of many, says he wants to pull out of the money printing programme early and will argue for it at the FOMC meeting later this month.

How long before the Fed stops printing and starts putting up rates? And what will that do to the global (and US) economy when it does?

James Bullard, president of the Federal Reserve Bank of St. Louis, said he would push at the Fed’s upcoming two-day policy meeting (April 26 and April 27) to reduce the central bank’s quantitative easing program by $100 billion, but held out little hope of being successful.

“We got a stronger economy and we got higher inflation and higher inflation expectations than we expected at the time,” he said. “The logical thing to do is to pull back.”

But Mr. Bullard isn’t looking to a quick or aggressive shift to tight monetary policy. He said he wants to reduce the asset purchase program, slowly taper it off and then watch to see how the economy performs before taking further steps. “We’d be pulling back just a little bit from where we said we were going to be based on economic developments. Then we would be on pause for a little while,” he said.

10. Totally prescient video (mockumentary actually) of computer gaming from 1970s Britain. Funny in a car crash sort of way.

30 Comments

One cannot stop the thirst of the world in creating more holes in buckets.

Compare debates/ talks you had with friends 10 years ago and now – and one realises - things are moving fast – and mostly in the wrong direction.

Stiglitz also on income inequality in the US:

The more divided a society becomes in terms of wealth, the more reluctant the wealthy become to spend money on common needs. The rich don’t need to rely on government for parks or education or medical care or personal security—they can buy all these things for themselves. In the process, they become more distant from ordinary people, losing whatever empathy they may once have had. They also worry about strong government—one that could use its powers to adjust the balance, take some of their wealth, and invest it for the common good. The top 1 percent may complain about the kind of government we have in America, but in truth they like it just fine: too gridlocked to re-distribute, too divided to do anything but lower taxes...

...The top 1 percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn’t seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late.

http://www.vanityfair.com/society/features/2011/05/top-one-percent-201105?currentPage=1

Re US local taxes. One of the major problems many US states have is capital gains tax. States such as California learned to waste money in truly prodiguous amounts when they had huge sums coming in from capital gain taxes. This is a problem when the gains stop. It also encouraged them to turn a blind eye to the property bubble.

Careful what you wish for Bernard.

Roger wash your mouth out with soap.

Its a well known fact that unless we introduce land tax, stamp duty and CGT and increase the top tax rate as well as making it unlawful to spend ones tax paid income on oneself (ie to buy a nicer house) and abolishing trusts the world is going to end........

A slight of hand it seems, the CGT should be part of the tax take and not most of it....and they havnt wasted money for years if not a decade or two....even before the meltdown California was in dire straights financially. Rates here are based on whast needed then its proportioned and not what houses have gone up by....

Bernard I dont think isnt looking for this sort of "fix"....

regards

Talking of Frogs...what sort of money is there in Frog's legs in France...we could be onto this!

Sorry Wally mine are too skinny....but I do know where you can get some bacon......

We could sell that in the middle east, right Kermit?....call it Mutton Hams and stamp it with the woolboard logo.

Re: #4 : Virtually all modern democratic governments are in the same boat i.e. over 50% of the population are either on a Gov't benefit or they don't pay any tax. Therefore any political party has to pander to them. This means that Gov'ts have to run permanent deficits as they cannot raise taxes or reduce spending. However this cannot go on indefinitely and it seems to be reaching a turning point in the near future. Once one goes they will all follow very quickly.

Re #8 - I wonder if councils are smart enuf to watch out for a possible future shortfall in income due to falling or stagnant rateable values? A reason to raise rates now before it's too late? I feel inflation all around me just busting to bubble to the surface and hit me in the pocket! You?

But do council rates feature in the basket of goods and services used to calculate the official inflation figures??

The rateable value doesnt matter, all it says that if you are better off, or worse compared to someone else you pay a slightly bigger or smaller proportion of the bill compared to last year.

So if the council wants to spend 100million then your share is say $1500. Ok if everyone's property drops 50% in the rout of the century it doesnt matter you still pay $1500 next year....

Council rates in CPI? dont know good Q.

regards

In Blenheim they are going up 5.8% and the grab for cash has been ongoing for some time...

Bernard I think you are over sensitive about family trusts. A few family trusts are run by shonky developers with their dodgy advisors pushing the tax and business laws past the reasonable limits. Some will be not keeping the correct records and separation of trust assets. And those ones should be called on it. I would say most are actually run properly and the trusts pay the trustee tax rate of 33% on income. So why should a few eggs who can't or won't run their business affairs properly mean that the rest of us have to be included in reforms?

Because they are also being used as tax dodges....so best they go. Blame the abusers and dodgers for that one.

regards

On that basis why not ban cars because some bad people drive them ?

Its about enforecement Steven, not a one-size fits all solution.

New Zealand has a love affair going with family trusts. Why?

NZ has 400,000 family trust for a population of 4+ million (100,000 per million)

AU has 600,000 family trusts for a population of 22 million (27,000 per million)

What are they doing? Or is it cunning marketing by the Accounting and Legal professions?

Often very little...sweet marketing....the vast majority I have seen have no income producing assets, family home and assigned life policies is about it ...

speckles

And the vast majority did set up a trust just to prevent the painfully slow accumulated savings of a lifetime (investments) going down the drain at a separation or divorce (check the divorce statistics) or to prevent a philanderer in the family, for his own good, squandering hard earned money from the previous generation to keep it for particular purposes like education, cost for children or cost of care for decrepit elderly. Besides if there is an income earning investment, it is taxed by 33%, if some investment of the trust is eventually sold, previous depreciation is living up and 33% tax have to paid again.

So what's wrong? Most people act rather responsible to prepare for the ups and downs of life, to make sure one does not rely on government hand outs.

I agree but it doesn't make a good story :-)

Banks in the uk and in europe told to get stuffed!

"Icelandic voters appeared Sunday to have rejected a government-approved deal to repay Britain and the Netherlands $5 billion for their citizens' deposits in the failed online bank Icesave.

Partial results of a national referendum suggested the "no" side had gained more than half the votes -- a reflection of enduring anger over the economic havoc wrought by Iceland's risk-taking bankers.

Full results were not due until later Sunday. With partial results in from all six of Iceland's constituencies, the no side had almost 57 percent of the votes and the yes camp just over 43 percent.

The dispute has grown acrimonious, with Britain and The Netherlands threatening to block Iceland's bid to join the European Union unless it is resolved"

http://globaleconomicanalysis.blogspot.com/2011/04/icelandic-voters-reject-icesave-again.html

What idiot nation would want to join the eu.......!

Re: It seems banks' cross checking processes aren't good enough

I'm surprised that NZ regulatory bodies allow such nonsense to happen.

http://www.nzherald.co.nz/asb-bank/news/article.cfm?o_id=12&objectid=10703720

Bernard,

The debt ceiling idea is a total fraud. The fiscal appropriations are made first. The same congressmen/woman that approve huge these huge fiscal expenditures and compete over largess, then turn around and feign outrage when treasury has to go about selling bonds to the primary dealers to meet the expenditures. The whole 'debt ceiling' is a complete and utter sideshow that the media falls for everytime, but it does acheive one thing, it allows congress to get away with the perception of being fiscally conservative when they are anything but.

Also worth a read.

Re #9 How long before the Fed stops printing and starts putting up rates? And what will that do to the global (and US) economy when it does?

Those are THE questions that matter at the moment - depending on which way Bernanke jumps there will be shock waves sent through many different sectors. Problem is, he's got himself in a complete bind. He has juiced so many markets artificially that he can't stop printing money without them crashing. On the other hand it's becoming more and more apparent if he doesn't stop there is a real risk of hyperinflation in the US and a collapse of the USD. Surging commodity prices are going to be his Waterloo:

From The Wall Street Examiner:

The following chart says it all. The Fed’s aggressive Treasury monetization has been the causa proxima (90-percent correlation) to the peddle-to-the-metal Minsky Meltup in commodities. I suspected this would be the effect but confess I did not believe the Fed and government could be so irrational and stupid as to attempt it, especially with the blowback evident by year end. Though I am one of the most persistent critics of Fed rabble, this exceeded even my worst fears and nightmares. This is what Bernanke refers to as “temporary” inflation. Nor did I anticipate the markets ignoring such clear and present danger either. The transmission of this inflation disease appears to take about six months, which corresponds to the MIT price survey I have been using. It, too, now shows that inflation is in full swing.

http://www.wallstreetexaminer.com/blogs/winter/?p=3833

This also from the Bank of Japan:

Recent Surge in Global Commodity Prices

-- Impact of financialization of commodities and globally accommodative monetary conditions

Global commodity prices have been rising again since 2009, and particularly rapidly since the fall of 2010. While the strong increase in commodity prices has been driven by global economic growth propelled by emerging economies, speculative investment flows into commodity markets have amplified the intensity of the price surge. The dynamics of global commodity prices has been changing as well, in accordance with the growing presence of financial investors in commodity markets. The entry of new financial investors has paved the way for the "financialization of commodities". Consequently, global commodity markets have become more sensitive to portfolio rebalancing by financial investors, which has made commodity markets more correlated with other asset markets, including major equity markets. Furthermore, globally accommodative monetary conditions have played an important role in the surge in commodity prices, both by stimulating physical demand for commodities and driving more investment flows into financialized commodity markets.

https://www.boj.or.jp/en/research/wps_rev/rev_2011/rev11e02.htm/

Contrast that to the RBNZ latest MPS where we get these sort of warm fuzzies:

Global food prices have climbed sharply in recent months, and are now higher than before the global financial crisis. Supply has been restricted by climatic disruptions, and exacerbated by stockpiling in some countries. With demand for food continuing to increase due to the global economic recovery, etc.etc. http://rbnz.govt.nz/monpol/statements/mar11.pdf No recognition of the effects of Bernanke's money printing on commodity prices in little ol' NZ??? If Bernanke does indeed pull the plug on QE our sleepy little undiversified minimal value-added commodity-focussed economy is sure going to get a wake up call.

But we're different!...yeah sure.

"The Centre for Economics and Business Research (CEBR) said soaring inflation coupled with low pay rises means household peacetime disposable income is at its lowest since 1921.

Rising food, clothing and energy prices mean the average British family will have £910 less to spend this year than they did in 2009.

The CEBR calculates that household disposable income will fall by 2pc this year, more than double last year's fall of 0.8pc and the biggest drop since the savage 1919 to 1921 post-First World War recession.

It forecasts inflation will average 3.9pc in 2011, its highest since 1992, as January's increase in VAT from 17.5pc to 20pc and the rising cost of oil and other commodities continue to drive up prices".

Party over folks....batten down the hatches!

"Things are not looking too hot down under. Not only is the Australia housing collapse picking up steam, but Australian retailers are struggling mightily in spite of rising sales numbers"

http://globaleconomicanalysis.blogspot.com/2011/04/australian-home-sales-sink-luxury-units.html

“It's less than encouraging,” he said. “The situation probably is that real estate isn't in vogue at the moment.” “I thought we had enough interest to get them sold, but there w bidders there and they didn't all bid.”

Where you gone OllyN...where are the sprookers now......never goes down in price....always go up...Auckland is next...parasite drive anyone....!

In 12 months time NZ will begin the slide into the real recession...the debts cannot be paid off..the talk of a surplus will be put back on the shelf until 2014...by then stupid Kiwi will have forgotten 2011..just as they have forgotten 2008...back then was when national should have started to cut back sharply on the size of govt and the state splurge..instead they went with BS and spin and hope. History has graded that performance a bloody failure. Remember the "6 part strategy".....!

Lately the other foolish claim...about the tradeables sector lifting the economy out of the bog...that BS has died away too. When Bernanke is no longer manipulating commodity prices with mousemoney, expect the export returns to decline. About then the ratings agencies...the ones that lied about AAA quality junk investments and failed utterly to do a proper job...they will downgrade Kiwi.

The truth is this country is living on borrowed money beyond its means and has been for decades. The truth is successive govts lack the guts to make the moves to end the splurge. They simply see protecting their bloated salaries and pig trough positions as more important. This is our Fukushima disaster...a slow grinding failure by govts leading to one awful bloody mess in which far more are hurt than ought to have been the case.

The AMI farce is a classic example...cheap insurance was cheap for a reason...and now taxpayers are bailing out the ones who gambled on cheap cover and the bosses who get to keep bloated salaries even though they formulated the 'cheap' policies.

Oh and not to forget...by 014 the value of your 08 savings will have declined by over 21%....didn't they do well...great govt and brilliant RBNZ management.

Labour Party voters are the luckiest people in the country ! ........ You guys got 9 years of Helen & Michael ramping up taxes and excise duties , 9 years of expansion of the welfare state , 9 years of building up the public service ................ And now , you've had the benefit of 3 years of John & Wild Bill propping up your policies , dutifully honouring your largesse ........

......... And as Brian Gaynor's article shows , look where it has led us . Remeber when Helen implored us , " don't put it all at risk " ....... No risk there , darling , JK & Wild Bill still havn't gotten the kahunas to cross you .

Let's cut to the quick...English should:

- Get rid of the higher salaries and perks commission

- slash all higher state salaries by 5% forthwith.

- Close the departments down that are not core govt functions

- Take the $2m back from Pita

- Get rid of col adjustments on the dole

- Overhaul the dpb to see finite payments regardless of how many babies are popped out.

- Adjust the retirement age to 67 for those under 50

- End the Kiwisaver topup scam

- Freeze WFF handouts at the current rate so that the debasement erases the cost over time.

- Charge interest on student loans on those who are offshore and use every means possible to extract the debt repayments.

- Fire the Governor General and rent out govt house. We only need a GG for the opening of Parliament...for the rest of the time the GG is a waste of space.

"The problem with debt anywhere is that it acts as a hand brake on growth"

Sadly, Bernard has yet to get it.

Let me guess Bernard - there is unlimited land for farming, unlimited land for urban expansion, unlimited everything. It all depends on price, right? And at a certain price, an alternative will always magically appear.

This will happen forever at an exponentially-expanding rate, yes?

Take another look at that Emperor, Bernard. You should be able to see him in detail now.

Note that this Govt - like all others - has only one approach to 'greater wealth'; more natural resources. Oil, coal, lignite, hell, Heatley even upped the Bluefin Tuna take (of a resource down to 20% of original) aquaculture, removal of 'red tape' 'holding up' 'development projects'.

It's all - 100% - based on things physical . So it must peak, and end.

Please don't tout growth as good, or desirable, at the peak point. With respect, it's just not helpful. We need to have a conversation about what the next paradigm will be, and the smart way to go would be to facilitate that. Ask some folk (Minister of Energy, Finance) the hard, clear questions.

Talking of herptiles (look it up, bean-counters) I wonder if GBH has heard the Philippines latest get rich quick scheme? The story goes that a German buyer is wandering the Philippines looking for supplies of Tokay Geckos. Prices supposedly range from P70k (that's about 2k of your fiat NZ funny-munny) for a small one (100g), to P1M for a 450g monster. P1M buys you a very nice car in the Philippines, so all work on the land has stopped and everyone is wandering around looking for Tokays. From my sunny spot on Samal Island, I reckon that every single coconut palm tree has a family of Tokay Geckos living in it...but don't let that get in the way of fool's gold. Photos of Tokays can be found on my website - just google my user name.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.