Aspiring first home buyers are in the best position they have been in to get into a home of their own for the last four years.

However, those on average incomes will likely still struggle in Auckland and Tauranga.

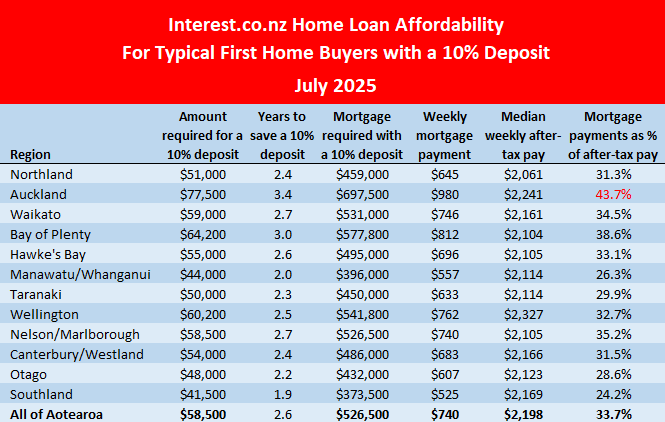

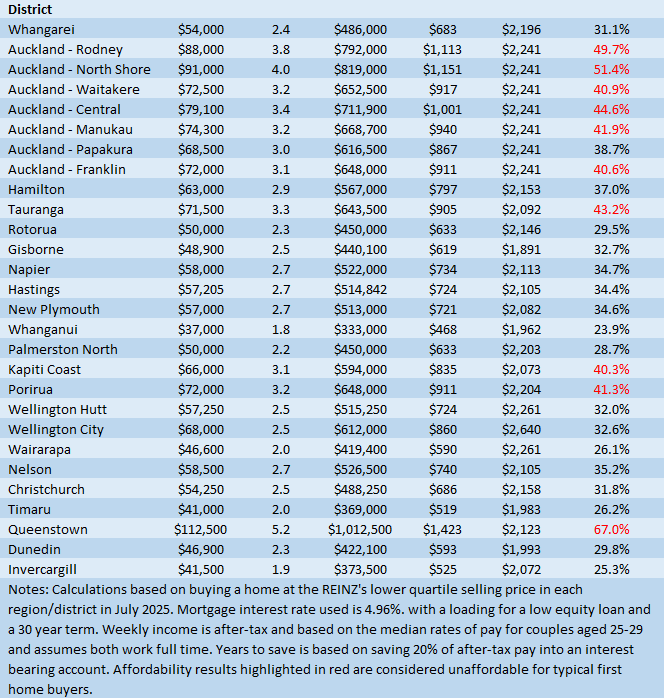

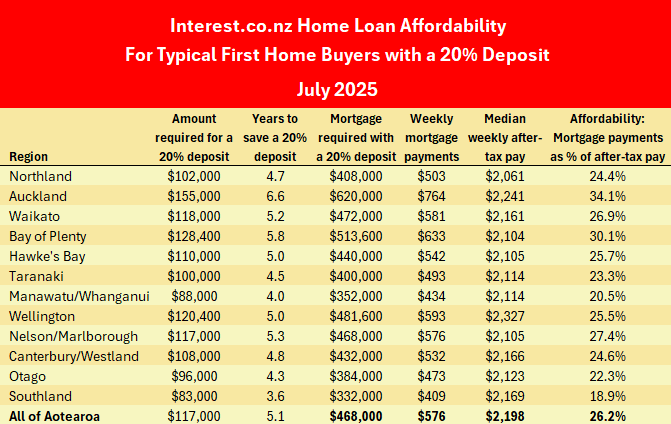

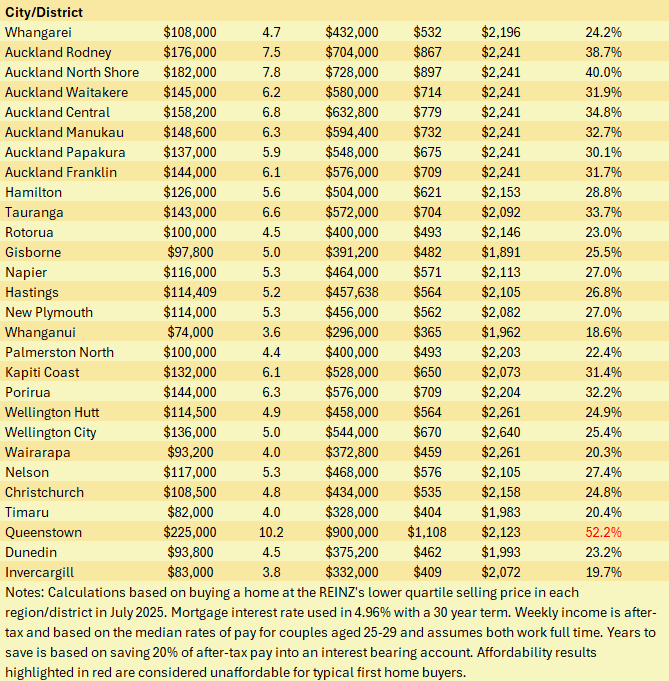

Interest.co.nz measures movements in affordability by tracking changes in the Real Estate Institute of New Zealand's lower quartile selling prices in all major urban areas, along with movements in mortgage interest rates and after tax incomes for aspiring first home buying couples, based on median wage rates for 25-29 year-olds.

All three of these things feed into overall affordability by determining how much of a deposit first home buyers will need to save, and how much of their income is likely to be eaten up by the mortgage payments on a lower-priced home, which is at its lowest level since July 2021.

No change in mortgage interest rates

There was no change in the average two year fixed mortgage rate, which remained on 4.96% for the second month in a row in July.

That follows 19 months of almost continuous monthly declines, with the average two year fixed rate dropping to 4.96% in June and July this year from 7.04% in November 2023.

House prices flat overall

The REINZ's national lower quartile selling price also remained unchanged at $585,000 for the second month in a row in July, although there was some movement both up and down at the regional level.

Compared to June, lower quartile prices declined in Waikato, Bay of Plenty, Nelson/Marlborough and Otago. They were unchanged in Auckland, but increased in Northland, Hawke's Bay, Taranaki, Manawatu/Whanganui, Wellington, Canterbury and Southland.

Overall, the national lower quartile price has declined by 12.7% to $585,000 in June and July this year from its peak of $670,000 in November 2021.

After-tax pay up by $5 a week in July

Based on the median rates of pay for 25-29 year-olds, interest.co.nz estimates a couple working full time would take home $2198 a week in July. That's up $5 a week compared to June, and up $110 a week compared to July last year.

Saving for a deposit getting easier but still a big ask

The first step aspiring first home buyers need to take is to scrape together a deposit.

For a 10% deposit on a home purchased at the REINZ's national lower quartile price of $585,000, they would need $58,500.

If they saved 20% of their after-tax pay into an interest bearing account each week, it would take them 2.6 years to save the deposit.

In Auckland, where the regional lower quartile price was $775,000 in July, they would need $77,500 for a 10% deposit, which would take 3.6 years to save.

You can double those figures for a 20% deposit. (The tables below show the 10% and 20% deposit figures for all urban centres around the country).

Although the amount needed for a deposit is still substantial, at the national lower quartile price the amount needed for a 10% deposit has declined by $8500 since lower quartile prices peaked in November 2021. The amount needed for a 20% deposit has declined by $17,000 over the same period.

In Auckland a home buyer would need $77,500 for a 10% deposit on a lower quartile-priced home and $155,000 for a 20% deposit.

Mortgage payments in decline

Falling interest rates and lower house prices have combined to bring mortgage payments down considerably over the last two years.

The mortgage payments on a home purchased at the national lower quartile price with a 10% deposit have remained unchanged at $740 a week for the last three months.

That's a decline of $195 a week since they peaked at $935 a week in November 2023.

For this home loan affordability report, mortgage payments are judged to move into unaffordable territory when they take up more than 40% of after-tax pay.

By that measure, Auckland and Tauranga are now the only main centres where mortgage payments would be considered unaffordable for first home buyers.

In the Wellington Region, Kapiti Coast and Porirua remain slightly in unaffordable territory while Queenstown is so unaffordable it's practically off the scale.

Within the Auckland Region, Papakura is the only major district where mortgage payments are still considered affordable.

The average mortgage payment for a home bought at the lower quartile price in Auckland is $980 a week. In Papakura it would $867 a week.

Overall, mortgage payments as a percentage of typical first home buyers' after-tax income was 33.7% in July, the lowest it has been since July 2021.

So although aspiring first home buyers still face challenges getting into a home of their own, especially in regards to scraping together a deposit, the odds have moved significantly in their favour over the last four years.

The comment stream on this article is now closed.

13 Comments

Come back when things are actually affordable nationwide, when 4x DTI is the norm, when this epic property crash bottoms in maybe 2027 / 2028.

By then, the dust and bones maybe has settled from the all-consuming property crash bonfire, of specuvestor - uber debt leveraged monkeys, underwater poooperty specportfolioinvests.

Love this Pigeon guy! he gets it.

The Anti-Spruiker:

NZ House Price Insanity! This week - Dannevirke

What makes you so sure prices will return to their affordable level, aka closer in line with wages?

Australia and Canada have been counterexamples of price to income ratios staying irrational for more than a generation, enough to get ingrained in the common psyche

Interest rates are getting lower, capital requirements same, foreign buyers are back on the menu. The political will is there from both sides + more importantly, from RBNZ, to keep the Ponzi going on

I'm not saying it's good or unavoidable. I'm wondering what counterarguments exist, so strong to make you certain they won't pull it off once again?

Good question. The tax free nature of gain is a very strong pull for the property gamblers. I think a lot of the leveraged at 2% er's got a real scare how quickly things turned back to historically average 6-7% cost of debt. Then add in boomers starting to liquidate some assets, as is happening globally, it is really a question of how quickly tax free greed takes over out the scare speculators got.

All the ticket clippers in this sector will have you believe its all pink fluffy unicorns because you taking on the risk of debt is what feeds them.

Spruikerland and Oneroof junkies would all have us believe we are just in an "itsy bitsy gully".....get in quick, NOW, its about to take off!!

More likely, the gully is a mild step down, before the brush covered shear rock face down, crash into the abyss, is next.

Ye olde time spruiker is warned!

The buble in Florida and the mortgage brokers - The Big Short

The current downturn has put a halt to that common psyche ingraining.

As there are more stories of sales challenging the expected clockwork gains (some even confronted with a loss) there is a growing cohort that sees and experiences greater risk in housing "investment".

Loss aversion is a powerful behavioural force and will stick with a population until displaced by a new batch, untainted by the negative experience (see 1987 Crash vs Millennials)

Loss aversion is a powerful behavioural force

Aye, all of our banks are a clear display of this .

So we've gone from impossible to merely severely unaffordable, when the price of basic items continues to increase.

Doesn't feel like much of a win, really.

Young still leaving for Aussie

NZ does not provide hope

A bit late to go to Oz for some, but if you're young, police, nurse or other medical professional then probably still ok - location dependent.

IT Guy,

Indeed, but where are they going? If to Melbourne, Sydney or Adelaide, then the market there is now significantly less affordable than here, as the annual Demographia housing market study makes clear.

IT Guy,

Indeed, but where are they going? If to Melbourne, Sydney or Adelaide, then the market there is now significantly less affordable than here, as the annual Demographia housing market study makes clear.

Agreed. Unless the Govt move the goal posts around endless tax avoiding profit, I just cannot see this changing. Lab were voted in to do something in this space, but they totally failed to deliver anything meaningful. Probably made it worse, as delaying tax free gains just delayed the speculators exit point.

Lab should introduce TOPS land Tax policy, and market themselves to all renters, and overseas voters who want to see meaningful change in this space.

The real question is, if the brightline stayed at 10yr, and tax deductability changes weren't reversed by the current government, would we still have high rents? I'd argue no, as the sheer level of supply and lack of demand would force them lower as we are seeing. Can't charge high rent if there's ample choice and others willing to offer the same for lower to ensure tenancy prevents them from having to pay towards the mortgage.

$3bn transfer for the tax deductibility. Billions into the future for bright line.

Please remember that when government says there's no money for hospitals, new drugs, and operations. And then tells you to stop being a Merchant of Misery.

"Affordability for first home buyers the best it has been for 4 years" - so basically it was more affordable at the peak.

Yep, mortgage rates at 2% are more affordable than 5%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.