Here's my Top 10 links from around the Internet at 10 past 2 pm in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

The WSJ report on growing civil unrest in China is today's must read.

1. 'Euro headed for breakup' - Nouriel Roubini writes here at Economonitor that the Euro zone is headed for breakup.

His analysis is brutal and inexorable.

This is one of the reasons why I'm a perma-bear.

We face a potential European debt meltdown, a US fiscal crisis and doubts about China's growth model.

Either one of them could shut down markets for months on end and slam the global economic and trading systems.

Remember that New Zealand has to roll over bank debt worth 50% of GDP on these markets every 90 days...

Still.

Nothing has been fixed.

Nothing.

All that has happened is that private debt has been shuffled onto public balance sheets and various debts have been extended while governments and banks pretend that growth will make them go away.

Meanwhile, central banks have cut interest rates to virtually nothing in an exercise in financial repression designed to punish savers and inflate away the problem.

All this has done is inflate commodity prices, trigger the North African spring and put emerging economies such as India and China into an inflationary spiral.

Where will it end. I can't imagine this will end with a soft landing and the onwards march of growth forever.

The muddle-through approach to the eurozone crisis has failed to resolve the fundamental problems of economic and competitiveness divergence within the union. If this continues the euro will move towards disorderly debt workouts, and eventually a break-up of the monetary union itself, as some of the weaker members crash out.

The Economic and Monetary Union never fully satisfied the conditions for an optimal currency area. Instead its leaders hoped that their lack of monetary, fiscal and exchange rate policies would in turn see an acceleration of structural reforms. These, it was hoped, would see productivity and growth rates converge.

The reality turned out to be different. Paradoxically the halo effect of early interest rate convergence allowed a greater divergence in fiscal policies. A reckless lack of discipline in countries such as Greece and Portugal was matched only by the build-up of asset bubbles in others like Spain and Ireland. Structural reforms were delayed, while wage growth relative to productivity growth diverged. The result was a loss of competitiveness on the periphery.

2. Welcome to the 2% economy - Time's Rana Foroohar details 5 myths about the US economy to explain it just can't get going again.

There may be $2 trillion sitting on the balance sheets of American corporations globally, but firms show no signs of wanting to spend it in order to hire workers at home, however much Washington might hope they will. Meanwhile, the average American is feeling poorer by the week.

"If one looks at unemployment and housing, it's clear that for all practical purposes, we have yet to fully get out of recession," says Harvard economist Ken Rogoff, summing up what everyone who doesn't live inside the Beltway Bubble is thinking. While the White House's official 2011 growth estimate, locked in before Japan and the oil shock, is still 3.1%, most economic seers are betting on 2.6%.

That's not nearly enough to propel us out of an unemployment crisis that threatens to create a lost generation of workers who can't find good jobs and may never find them. Welcome to the 2% economy.

3. One to watch - The Australian reports Australia's mortgage delinquency rates are rising as the squeeze goes on across the Tasman. This is one to watch. As soon as the Australians and their banks get stressed that will bounce back across the Tasman to us.

A report from credit rating agency Fitch finds that Queensland is the worst-performing state for arrears, with mortgages under pressure from rising interest rates before the floods and cyclones struck in January.

It is estimated that 1.23 per cent of borrowers nationally have missed at least one repayment, and arrears rose in all states.

However, 2 per cent of Queensland mortgages have been in arrears in the six months until the end of March, up sharply from 1.54 per cent previously. The Logan area of southern Brisbane is the worst-performing region nationally for loans in trouble.

4. QBE's profit downgrade - This came through from SMH.com late last night from QBE, which suggests the earthquakes and floods are hitting insurance profits very hard.

The line about reinsurance below was particularly noteworthy.

QBE's bad news came hours after rival ins urer IAG told investors in an investor day update that while it was standing firm on its profit insurance margin forecasts, it had not yet had time to assess the impact or potential costs of the latest earthquake tremors in Christchurch.

Given IAG's track record of profit downgrades - seven in three years and one profit upgrade - the market intepreted this as a possible softening up of investors ahead of possible disappointments in the full-year result.

The gloom followed revelations last month from Suncorp that the two earthquakes in New Zealand had cost it a combined $2.1 billion in gross claims, which is far worse than expected and will cost reinsurers $2 billion and Suncorp a net $NZ120 million.

It doesn't bode well for negotiations with reinsurers over reinsurance renewals in terms of the price, with premiums in some areas such as catastrophe reinsurance expected to jump by up to 50 per cent, which will be passed on to Australians in higher premiums.

In New Zealand, some brokers are talking about a 500 per cent rise in premiums on the earthquake portion of catastrophe cover. An unintended consequence of these sorts of increases is that people will only build and insure in certain areas.

5. Worse than the Depression - CNBC reports US house prices are now down 33% from the peak.

Prices have fallen some 33 percent since the market began its collapse, greater than the 31 percent fall that began in the late 1920s and culminated in the early 1930s, according to Case-Shiller data. The news comes as the Federal Reserve considers whether the economy has regained enough strength to stand on its own and as unemployment remains at a still-elevated 9.1 percent, throwing into question whether the recovery is real.

"The sharp fall in house prices in the first quarter provided further confirmation that this housing crash has been larger and faster than the one during the Great Depression," Paul Dales, senior economist at Capital Economics in Toronto, wrote in research for clients.

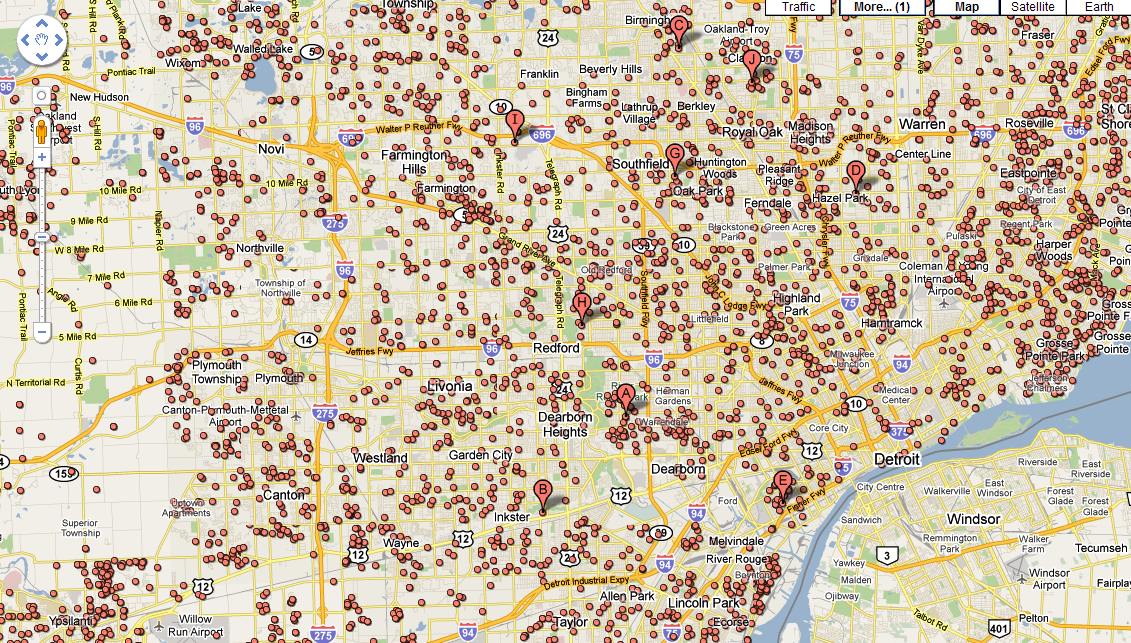

6. Detroit foreclosure map - Ritholz reports the red dots on this Google Map of Detroit are of houses in foreclosure... HT Brian via email.

7. Wave of unrest spreads through China - The WSJ reports a wave of violent unrest has spread across China in the last three weeks.

Remember yesterday's article on the price of pork up 43.5% in the last year?

The North African spring was triggered by the jump in food prices that followed the Fed's QE II. No wonder the Chinese are so keen to slam on the brakes.

A wave of violent unrest in urban areas of China over the past three weeks is testing the Communist Party's efforts to maintain control over an increasingly complex and fractious society, forcing it to repeatedly deploy its massive security forces to contain public anger over economic and political grievances.

The simultaneous challenge to social order in several cities from the industrial north to the export-oriented south represents a new threat for China's leaders in the politically sensitive run-up to a once-a-decade leadership change next year, even though for now the violence doesn't appear to be coordinated.

In the latest disturbance, armed police were struggling to restore order in a manufacturing town in southern China Monday after deploying tear gas and armored vehicles against hundreds of migrant workers who overturned police cars, smashed windows and torched government buildings there the night before.

8. Saudi oil reserves depleted - Reuters reports Goldman Sachs saying Saudi Arabia has little ability in the long term to ramp up oil production.

Saudi Arabia's cushion of spare oil capacity would shrink to almost nothing if the kingdom quickly ramps up to 10 million barrels per day (bpd), Goldman Sachs' global head of commodities research said on Monday.

Last week the kingdom said it would unilaterally produce as much oil as the market needed after the Organization of the Petroleum Exporting Countries failed to reach agreement as a whole on output policy.

9. On review - Zerohedge points out Moody's has put French banks Credit Agricole, BNP and SocGen on review for downgrade because of the Greek debt crisis.

The primary focus of all three reviews will be the banks' credit exposures to Greek government debt and the Greek private sector and the potential for inconsistency between the impact of a possible Greek default or restructuring and current rating levels. The review of SocGen will also assess the likelihood of future government support since our systemic support assumption is currently higher than the average for the French banking system.

Moody's also noted that exposures to Greece are to be included within the ongoing review for possible downgrade of Dexia Group's core operating banks.

10. Totally happy story about a Korean street merchant doing a Susan Boyle on Korea's got talent. This is today's feel good story.

46 Comments

Ever thought of cutting your wrists? Seriously.

Nah - BH is an optimist.

He's still a bit mixed up with QE11, energy and food prices.

But we're getting him there.

Just be patient.

QE11 ? .....

.. I must've slept through QE3 through QE10 . ...... . I take it that the first 10 QE's didn't do the trick , then ?

======================================================================

And this mooted suicide attempt by Hickey , is it just 'cos he's narked that JK told him to get a life .... So Bernard thought ," I'll show you , toss-pot , I'll do the ruddy opposite " ???

There is at least good news on oil ex BP's latest publication ...

The worlds known reserves rose by 6.6 Billion bbl during 2010 with global oil production posting it's biggest increase since 2004 of 2.2 %.

How does this fit with the so called " Peak Oil " theory of which you have warned ad infinitum ?

Cue : steven & PDK : Your time hath come , what sayeth yea ?

JD via GBH - what you do, is the math. Oh, and stop thinking linearly.

The planet uses 85ish million barrels per day (mbpd).

So, a billion barrels every 11.7 days.

6.6 times 11.7 = 77 days worth.

Whoopee - that's a game changer, if ever there was one.

2.2%? Off what intermediate base, prithee?

That's the nonsense we get when they talk of economic growth, when only related to the last year, but not a prior peak in real comparative terms.

It's a moot point at the moment, whether we've topped production in volumetric terms:

http://earlywarn.blogspot.com/2011/05/final-crude-and-condensate-stats-…

or not:

http://earlywarn.blogspot.com/2011/05/refuge-for-2008-peakists.html

but in the end, it's the energy delivered that counts, and the EROEI both sides of that equation:

http://earlywarn.blogspot.com/2011/06/global-energy-efficiency-declined…

Then, you have to understand a gaussian graph of a finite resource - push it along the top, the drop-off at the end is quicker (the area under the graph is the resource, thus remains constant.). And, just in case you think a few days worth makes any difference at all, try hypothetically doubling the resource:

http://www.hubbertpeak.com/bartlett/hubbert.htm

I've left out internal consumption (Saudi Arabia is on track to consume ALL it's oil by 2030, for instance) and increasing demand, both per-head, and by increase in heads.

Go well ...............................while you can.

and a little evening learning (it's never too late....) :

Quick Steven mobilise the lynch-mob - theres a denier in our midst !

what? Someone denied he told the Princess he'd turn into a Prince?

Sorry it didn't work, you're obviously uncomfortable being green.

:)

Did you look at the data in detail.? Do you know how to look at the data?

You dont do you.....its almost certianly porkies and more importantly its bait and switch. The small change in total reserves bear no resemblence to the maximum extraction point either in time or quantity..

Look at page 8....in 2008 the USA for instance had reserves of 28.4, end 2009 it still had 28.4....so despeite being one of the most drilled countries on the planet and using 8million bpd of its own oil, the sum didnt change....look all down that list, most of the countries numbers have not dropped, they are identical, now ask yourself is that likely?

Can I make it clearer for you,

8million barrels per day x 365 days....how many billion is that? now subtract that from 28.4....

Ask yourself, what do they mean by 6.6Billion do they mean "original oil in place"?

So you know the typical % that's extractable?

going forward in difficult technical circumstances about 37%....

Do you understand the term "peak oil"? you dont do you....

Take indonesia, its annual output is dropping, yet its reserves have climbed slightly, in the meantime its domestic demand has increased, effectively it exports no oil to anywhere else....its a net zero. Who cares if its reserves jump 10% if no one gets the oil........

Do you know what the average domestic increase is for an oil producing country? answer about 5~10% per annum look at page 11......thats 5 to 10% less per year for the likes of us...

So they have increased production by 2.2% but a lot of that has gone internally....net result about 0%

Do you know the relationship between GDP growth and oil consumption?

For every 4% GDP growth 2.5% more energy is used....so even at 2.2% we would have seen 3% more growth, but below that number there is no job growth, so unemployment does not decrease....and that 2.2% as I said isnt NET of domestic growth.....the amount taht makes it to the oil tanker.

Now look at the developed world's reduction in oil use, typically -4%....do you understand now why un-employment is so high? and will stay there?

Good news?

regards

Steven - you did it better than me. We must have a beer one day.

I'll bike up :)

You gotta wonder about these turkeys - do they really believe the can grow (or even go) forever? Don't they see that all the initiatives this last wee wile, have been resource-extraction?

I'm still waitng for anybody - media, scientist, fishing lobby - to point out the energy implications of aquaculture.....what it is that gets displaced, downchain?

Maybe it's just fear. I notice that all the Professor/lecturer types show slides of their grandkids somewhere in their powerpoints - shows they are worried. I wonder if the Frog types are just showing fear in their own way, sometimes.

Go well

The problems with aquaculture are well known, but the industry like to play them down. The real black hole is that for many species it consumes far more fish than it produces. It's a dead end that'll only accelerate fisheries collapse. The only aquaculture that's viable even short-term is stuff like abalone which is herbivorous and can sell for high prices.

PDK what happens to the planet does concern me...however when certain individuals rant and rave that the science is sound (i dont think it is - they are not all on the same page and there remain unanswered questions) and appear almost obsessive about the topic (and at the same time convinced that they are 100% right and all else are wrong) then I cant help having a bit of sport.

A sceptic in Frogs clothing you might say....

i'd just like to ask you steven/pdk - what are you doing about peak oil? i'm not having a go at you i'm just curious as to how you are preparing for it, and what outcome are you expecting. are you thinking that things will just regress backwards until oil is no longer part of our lives (medievil) or are you expecting a 'mad max' scenario or what? or will we (the bulk of people) not be able to handle/ adapt going backwards?

i think i've read you're debt free (or very close to it) - i'd like to be but i'm young-ish (32) and have a family and at the wrong end of a modest mortgage ($200k) - which i could probaly clear in 10 more years - whether that leaves enough time - i don't know - that's the best i can do, and is really my main focus - if i own my own home with some land then that provides some security...

have you got a garden growing? cans in the cupboard? survival gear? any plans? self sufficient?

what do you expect will happen from now on - several more years of oil shocks each one affecting the economy more and more as we slide down the other side of the curve - anytime frames in your best estimates?

lots of questions i know but i find this subject facinating

fff - good questions.

Yep, I think things will descend bumpily, through a series of depressions, attempts to kick-start, and multiple layers (Govt, Local Govt, business, private) of triage.

I suspect we will see across-the-board zero interest rates, but a faster reduction in average incomes. The smart will get where they are in an essential service - food, water, energy, followed by health and infrastructure maintenance.

I also expect a war over resources, within 10 years - probably USA vs China. Watch the jostling for position.

We can't do anything about that, see Poland 1939. Our best effort potential? See Finland 1939-40. Still not good enough. So I don't address that.

But everything else, you can, and I (we) do. Given that energy is behind everything, your best move is to be as self-sufficient as possible in that. Easy steps there: heating first (water first, passive solar second. If an existing house, go for North glazing, conservatory, light columns, that king of thing. Not rocket science. Energy will get exponentially more expensive, rapidly.

The rest is food (we are self-sufficient, but still buy 'treats'), and maybe water (it'll be privatised, and screwed - but that will come with the option to not pay (Local A's charge 50% for a service going past, used or not. That doesn't apply in the 'free market') so maybe a tank (watch out, though: the monopoly owners will weasel the fudge, and force you to 'comply' with health regs, which only they can afford!)

Think local, foster a group/community of good-hearted folk - givers not takers - around you.

Debt? Sorry, can't help. No, can suggest: Get a group together, buy a block. Set it up as a business, with shares and clear rules - tenants in common or some such. Buy in-and-out only by majority (75%?) vote.

The housing bit is easy - I could still build, legally, an entirely adequate dwelling for well under 100g, if stuck, perhaps under 50g. If 5 or 10 were built on a block, you'd have economies of scale/expertise.

:)

All good suggestions. Think of it this way - even if Peakoil wasnt such a major looming problem most of those suggestions, if carried out, would benefit you financially anyway...

I would add looking at solar PV. System prices have come down a lot, and the one we recently put in is in the process of practically abolishing our electricity bills (in combination with solar water). Payback (allowing an annual 6% rise in electricity bills) is maybe 12 years.

AH - yeah. I looked into them, after our last discussion - they certainly have come down.

I reckon the best is running water, patricularly with a good head (fall). If I was looking for a block, that'd beat everything in desirability.

We retired the solar, the pelton does it 24/7, and I haven't touched it in months (since I sorted the intake debris-capture).

Our total system (lights, wiring, components and all) cost $4,200, most of it 6 years ago - so we're somewhat past payback.

Good feeling.

"I reckon the best is running water".

Agreed...

regards

Mad max, I hope not, and I dont think so but combined with AGW its not looking good.

I guess there are short term things, medium term and long term....

Short term

First location, I bought a house near good public transport and so use it for work everyday, or walk...saves money, reduces my CO2 footprint and is healthier. End result I use 1 tank of gas in 4 to 6 weeks, so at the moment about $65 a fill, I know ppl who are driving SUVs and its $150 a fill and its at least once a week they are bitching...well duh......

The price is sort of secondary, consider that there will almost certianly be shortages and rationing....so if you cant get petrol at any price what do you do? I have an employer that is pretty open to tele working.....I dont like it but I can if I have to, though push biking to work isnt that far, just a few hills....:/

Debt, Ive paid down as much as I can, based on I dont earn a huge amount....so I still will have a mortgage for at least 10 years probably 15...Im aiming for 10.......

Garden, not really but I can if I need to, food right now is cheaper to buy than grow yourself....also I'd need a considerably bigger plot of land to support my family...I have one rabbit....he eats a hell of a lot.....to eat meat every day thats 1460 rabbits a year...cant be done...

Tools, Im good at DIY and Im an engineer by training....so woodwork, blacksmithing etc...Im buying tools as I can afford, both power and hand....hand tools are actually pretty cheap.....for what they will do for you.....Im trying to train my kids in DIY and using these....

Books, the Internet may not survive that long, books on the other ahnd last centuries....so a good technical library; garden books, woodowrking, engineering, herbal remidies.....often can be picked up cheaply second hand...

If I could afford it I'd buy a small 2 or 3kw deisel powered generator, making your own biodeisel isnt that hard....get the book on that as well....

Look at reducing your energy bills, insulate, plug air gaps.....get used to living with no heating as much as possible, ie spot heat.....turn off all those chargers for the toys at the wall...get into habits like that...wind down your meat use....100g a day....eat seasonal veg.....

Medium Term

Community....villages formed and worked for centuries for very good reasons, community...........

Regress, Our society is so complex because the cheap engineering has allowed us to specialise, but NZ is so small that it isnt unusual for NZers to do lots of different jobs work....also quite DIY capable. Its sure going to change....most fossil fuel is used for transportation so I expect that that is one area that will drastically change mainly because it can....

Our lives will not be awash with oil as it is now before the end of the half century...you can look at home ppl lived in the 1950s and 60s....air travel was for instance a rare luxury only for the mega rich....it will be that way again. Are we any happier today than 50 years ago? I'd say not.

Medium term Im excpecting I will have to move to a piece of land with more uh...land so I can become more self-sufficient...at some stage I might take over my parents place to achieve that.........

"what do you expect will happen from now on - several more years of oil shocks each one affecting the economy more and more as we slide down the other side of the curve - anytime frames in your best estimates?"

Yes, Matt Simmons I think said he expected 3 or 4 oil shocks before Pollies and voters etc cottoned on to the Peak Oil problem....so 5 years....So we are having No2.....of course the 2nd Great Depression could start off this year and really screw things up....I think it probably will happen before end 2012.....so huge devaluations, cash is king....

regards

thanks guys for your very helpful/detailed answers

firstly steven if you have 10+ years left on your mortgage (like me) and are expecting great depression II and looming oil shocks then are you concerned about your amount of debt relative to your income and your ability to pay it off in harsh times

my mortgage is $200k and i earn $60k but have a stay at home wife with two kids under 3 - and i must say the debt is my main concern - oh to add to the problem i'm in christchurch too with a moderately damaged house but in a stable area (north chch) so that limits my options for the next 2/3 years whilst i wait for repairs.

i am acquiring books on all subjects because as you say the internet may not always be there

yes pdk i'd love to move to a 10 acre block and plant it out with apple/ fejoa/ grapes/ nuts/ trees/ vege beds/wheat and i am working towards that and i may be able to convince a couple of faimily members to follow. self sufficiency is my goal but one step at a time - i feel that what i am doing now is okay to build up some equity in my home before making the shift to a rural block - we are saving like mad/ budgeting/ biking to work/ not eating fancy/ no outings - only the odd dvd and walks/ time with kids for entertainment - everything we can to pay down debt - but actually it gets easier and more motivating the more you do it - i think i'm lucky though that my wife thinks like me in this regard.

"then are you concerned about your amount of debt relative to your income and your ability to pay it off in harsh times"

Yes indeed......my debt is actually quite low for a mortgagee, I'd pay far more in rent, but like you I am a single earner.....if my income collapsed I dont know what I would do, sell probably....its a real hard Q to answer.......bear in mind most ppl are far far worse off than me. Statistically, if im forced to that position many more will have gone to the wall before me...and by that stage I dont know what state our economy and society would be in. Really it all hinges on me not losing my job....and not being able to get another, but Ive made sure as best I can my CV is very good and current....again if Im made un-employed a lot will have gone before me.....at that point I would be digging up the road verge to plant potatoes and be damming the stream for Power.....

regards

Well if you don't cut them seriously....your probably just looking for attention.....B.H. seems to be getting that minus the bandage and sob story.

That Korean guy has pretty good teeth and skin for a lifelong street urchin. (Sorry, is that too cynical?)

Yep, and it was a pretty bad interpretation of 'I dreamed a dream' to boot.........

Unrest in China is being given pretty good coverage here in Hong Kong. Authorities can't control cell phone video and people are much more mobile. Recently when coming back late at night across the border our transit bus between the two customs/passport controls for China and HK was stopped unexpectedly and a man came onto the bus and videotaped everyone of us individually.

Migrant workers in the cities despite being treated like dirt don't want to return to their villages. The potential for unrest is a serious threat to the Chinese leadership.

Stratfor.com has been talking about the potential for unrest in China for some time now, I have posted links to thier articles on this.

It is going to be a hard task to hold it all together, blood will be shed either way.

Quantas is feeling the pain:

http://www.cnbc.com/id/43333556

No wonder they (together with their malodorous offspring Jetstar) won't spend a few extra dollars to get their passengers home at the moment...........

Jeez AJ..that was Gross!

Double post

Mish highligting the problems in China:

http://globaleconomicanalysis.blogspot.com/2011/06/wave-of-violent-prot…

Also mentions the potential fraud issue. Looks like they learned damn quickly from the WS Banksters........

good story by bethany maclean in slate.com on goldman sachs and how their clients usuaslly benefit less that gs themselves...

http://www.slate.com/id/2296521/

wonder what role they'll have in privatising our soe's?

Hey BH - if you had a mil in cash to stash somewhere right now, where would you put it for 12 months? Yeah I know you're not giving investment advice and all that blah blah...but seriously where would you put it? If you can't answer this, if I gave you $1mil to mind for a year, where would you put that? Yeah yeah you'd spread it across various low risk yield safe blah blah....no!! Just one place...in the bank, shares, gold, mattress, USD, bonds, charirty, where? Just a theory question noting your state of mind right now...

Probably spread across banks, I think there is a deposit limit the govn will guarantee? 250k?

regards

The govt guarantee has ended for banks Steven.

Put it at kiwibank. At least the govt owns it so must be an implyed guarantee.

Not quite right WAS...a few still have the GG and you can get 5.12% for 3 months GG at Fisher Paykel Finance...so why not take it???

Even that Hawes fellow admitted to a small gold position in case of a crash of the financial system.

But the point is you aren't supposed to know where to put your investments, confusion is the play:)

The prudent course is to diversify the ice cool $ mill. ........ . Might the Gummster suggest a 50 / 50 split to suit Bernard's personality :

$ 500 000 into coffee bean futures , 'cos the big guy loves a latte ...... may as well incentivise yourself to drink towards your own profits ............

... and naturally , the other $ 500 000 goes into a complete re-build of Warren & Tarquains' Salon ........ A man is nothing without a good " boof " on the top of his head . And no one has a bigger head than the Hickster .

...... no need to thank me , Bernard , just give the Gummy Bear bag to the usual shadowy figure in the trench-coat .

Retro link of the day.........10 December, 2008

Risk Management in Australia on the

http://ozrisk.net/2008/12/10/us-money-supply/

.......it should not do too much damage and can be soaked back up by the Fed next year. We’ll see.

Love that graph

Internet IPO of the day is Pandora Media ( NYSE ticker symbol : P ) . The company sold 14.7 shares to investors , at $US 16 apiece , valuing the entire firm at $US 2500 million . Yup , $US 2.5 billion for a year 2000 start-up , which has yet to turn a profit , in 11 years !

.. in the 3 months to 30/04/11 Pandora reported revenues of $US 51 million , and a net loss of $US 6.8 million .

....... in the US Pandora has 90 million subscribers to its online radio business .

Aside from satellite radio operator , Sirius , Pandora has stiff competition from many mainstay internet companies , including Google , Apple , and Amazon , all of whom operate music locker services .

The DFC was actually very successful UNTIL ...

they got indirectly into property speculation which brought about their downfall.

We already have the Science and Technology investments option but given their track record and totally loopy investment choices in non commercial initiatives - you see how teams of civil servants are not the right people to make these sorts of calls.

I'm referring to funding nanotechnology to increase the production of hydrogen in electrolysis.

Martin Jet Pack which is a fun idea going nowhere - just google small one man helicopters and you will see this was solved years ago - but very dangerous and no market exists.

The problem is that without the science and technology background we don't have the people to make these choices.

Look at the graduation lists - Hundreds of Bcom Llb's and other similar soft degrees which have no part in a science / engineering driven export sector vs a handful of Physics / Bio / Eng / Chem / Geo / Maths / Econ / etc etc ie the hard sciences ..

Singapore got the new RR Trent line with 200 engineering Honors & Phd's per annum.

We could start by making the University science fees zero and doubling the rest to fund it !

Not going to happen - but these are the sorts of initiatives we have to make as a precursor to an export renaissance. focused on value driven technologies.

Doomed we are doomed...the sunspots are dying..it's a sign I say...doomed we are...time for a bottle of plonk.

Why do people dismiss things like global warming as trivial or not real and something to laugh at, even as they devote most of their time and lives to wailing in agony about the state of the economy, or the brainless antics of some here today gone tomorrow pollies and business clowns?

Because they are Human.....and it's bloody cold and we need some warmth...

Send you sun spot donation to Wolly c/- BH.....notes only thankyou.

It's fear.

They're just reacting to it in whatever their learned manner.

Any ex-schoolteacher will recognise the symptom.

Hey anyone wanna spare R...I got one left over!

put it back in the bag - it's only woth one point.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.