Here's my Top 10 links from around the Internet at midday in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

1. He actually said this - Prime Minister John Key thinks New Zealand can look for foward to a decade or two of very high commodity prices.

"Whenever we've had very high commodity prices, New Zealand has prospered, and we may well be in for a decade or two of very high prices now so that's good news for New Zealand," Key told reporters at the Field Days at Mystery Creek.

So let's have a look at that.

Firstly, I haven't seen any official forecasts of high commodity prices for 20 years.

Secondly, Treasury's budget forecasts are actually for a 1.7% fall in our terms of trade next year before a steady rise back to where they are now by 2015.

The Reserve Bank does believe there's been a structural shift, but made the point in this April paper we're only going back to levels seen in the 1960s and 1970s.

It all depends on China continuing to grow at 10% into the wild blue yonder.

Key seems remarkably sure of himself. His claim that New Zealand has also done well when commodity prices were high is debateable. They were very high in the early 1970s. Then we had two decades of very high inflation...

The video is here at TVNZ and he made the comments at around 1 minute 29 secs.

2. The problem with low interest rates - Former IMF Chief Economist Raghuram Rajan writes convincingly at Project Syndicate about the danger of artificially low interest rates.

Clearly, someone is paying a price for ultra-low interest rates: the patient and uncomplaining saver. Interestingly, if traditional spenders such as firms and young households are unwilling or unable to take advantage of low interest rates, low rates could even hurt overall spending, because savers like retirees receive lower financial incomes and curtail spending.

This is not a heretical concern. As with any tax and subsidy, the net effect depends on whether those taxed cut back spending less than those subsidized. Economists have sensibly advocated that China raise the interest rates that it pays on bank deposits so that Chinese households earn more and consume more. Some Japanese now wonder whether their ultra-low interest-rate policy could be contractionary.

Equally worrisome are the distortions that easy money creates. Evidence from the recent crisis suggests that ultra-low rates prompted a wide range of portfolio adjustments, whereby Asian and Middle East central banks and funds ended up holding the safest low-interest securities, while the US and European financial sectors went on a risk-taking binge.

3. The extinction of retirement - Michael Pento from Euro Pacific Capital writes here about why many Americans may not be able to retire and when they do their savings won't buy much.

The sad facts are; Americans are have negligible savings, the real estate market is still in secular decline, stock prices are in a decade's long morass, real incomes are falling, public pension plans are insolvent and our entitlement programs are bankrupt. If the pillars that seniors have relied on in the past fail to miraculously regenerate (and there is certainly no reason to believe they will), all that most retirees will have will be freshly printed greenbacks that come from a never ending policy of government deficits and an obliging Federal Reserve.

Unfortunately, the inflation that will result from such policies will sap most of the purchasing power that those notes possess. In other words, for most people retirement is now an illusion, and many Americans will find themselves working far longer, for far less real compensation, then they ever imagined. The quicker we realize this, and plan accordingly, the better off we will be.

4. Debt ceiling chicken - PIMCO CEO Mohamed El Irian has warned via Project Syndicate the US Congress to lift the debt ceiling or risk catastrophe.

Two scenarios for the timing of an interim compromise are possible, depending on whether it is a one- or two-step process. Most observers expect a one-step process for bipartisan agreement before August 2. But politicians may need two steps: an initial failure to agree, and then a quick deal in response to the resulting financial-market convulsions. In the meantime, the Treasury would temporarily re-prioritize and slow outgoing payments.

This two-step process would be similar to what happened in 2008, when Congress was confronted with another cliffhanger: the Bush administration’s request for $700 billion to prevent a financial-market collapse and an economic depression. Congress initially rejected the measure, but a dramatic 770-point drop in the stock market focused politicians’ minds, bringing them back to the table – and to agreement.

But the two-step scenario involves incremental risks to the US economy, and to its standing in the global system. And the longer America’s politicians take to resolve the debt-ceiling issue, the greater the risk of an inadvertent accident.

This brings us to a third, and even more unsettling possibility: a longer and more protracted negotiation, resulting in greater disruptions to government entitlement payments, other contractual obligations, and public services. Creditors would then ask many more questions before adding to their already-considerable holdings of US government debt, generating still more headwinds in a US economy that already faces an unemployment crisis and uneven growth.

5. What Goldman's up to - Jesse Eisinger does his thing at NYTimes' dealbook on Goldman Sachs vs the US Senate.

By shorting C.D.O.’s, Goldman also distorted the pricing of the underlying assets. The bank could have taken the securities it owned and sold them en masse in a fairly negotiated sale, though it likely would have gotten less for them than it was able to make by shorting the C.D.O.’s it created.

Because of Goldman’s actions, the financial system took greater losses than there otherwise would have been. Goldman’s form of shorting prolonged the boom and made the crisis that followed much worse.

Goldman executives surely hope to change the subject from the firm’s specific actions to a more general discussion of how much and when it shorted. We shouldn’t let them.

6. Totally what Airbus thinks the 'new' airplane might look like. These dream sequences always seem to show lots of room between the seats...

I'm 6 foot 5 inches so that seems attractive, until reality hits.

7. Hot particles - It seems 'hot' radioactive particles are getting trapped in the air filters of cars around Fukushima in Japan.

Are they then getting imported into New Zealand? Are we checking them at the ports?

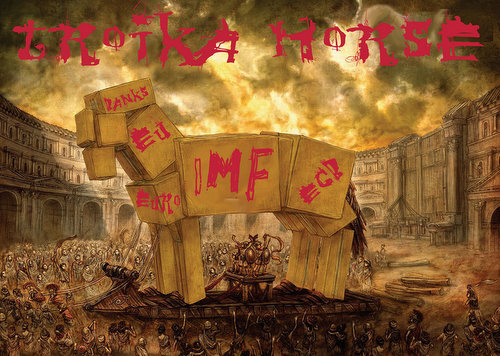

8. Here we go again - Bloomberg reports Ireland's new government has decided to impose a haircut on senior bond holders of Anglo Irish Bank and Irish Nationwide.

Prepare for fallout.

Irish Finance Minister Michael Noonan said senior bondholders should share in the losses of Anglo Irish Bank Corp. and Irish Nationwide Building Society, reversing a policy of protecting owners of senior securities.

“We don’t think the Irish taxpayer should redeem what has become speculative investment -- we don’t believe it should be redeemed at par,” Noonan said. He said the IMF “understood our position fully.”

The government had previously said it wouldn’t seek to impose losses on senior bondholders unless the lenders need additional capital. The central bank said last month neither would need further cash injection.

The European Central Bank has also opposed any moves to force losses onto senior bondholders.

9 A growing angst - Cass Business School Management professor Stefan Stern asks in this Independent column if many young managers within large international corporations are losing the faith in the glory of multi-national corporatism.

All they see is brutal workloads for the highest (and most ludicrously) paid and stagnation for the rest.

Corporate life has always been competitive. And career ladders are narrow. There are bound to be only a few winners and a lot of losers in this game. But something more intense, and more damaging, is happening.

The "delayering" – the removal of tiers of management and flattening of corporate hierarchies – has meant career advances are fewer, yet bigger and less gradual. The career ladder has many fewer rungs on it. But some management jobs have got much bigger, to the point of being almost impossible.

10. Totally a video by Brian Dawe and John Clarke - Pat Pending talks about an invention for dealing with asylum seekers.

108 Comments

I should charge a fee for suggesting months ..years ago that the RBNZ would do better to raise rates and thereby encourage savings and help generate the needed capital for export investment that would create real jobs...but no ...Bolly ignored Wolly and went with the almost zirp policy dictated by Ben the failure at the Fed.

Wolly. As you repeatedly point out (only to be repeatedly ignored), interest rates are the problem. Central Banks determine interest rate settings based on a pre-determined (acceptable) rate of inflation. And that is the problem. Government controlled inflation is theft (as you are wont to say) from savers and a gift to borrowers. The behavioural motivation of "savers" is to try and beat inflation which results in savers chasing blue-sky propositions which offer the opportunity to beat inflation, which after-tax is a losing proposition. And while that continues, savers will either, (a) not save but borrow, or (b) continue to chase blue-sky. The only solution is for governments to make the "inflation" amount of interest received "tax free" or even better still make interest received completely tax-free and interest paid non-tax-deductable. If interest was non-tax-deductible, businesses would seek equity instead of debt.

The question that should be asked of Bollard, Key and English is why, when the tax laws incentivise borrowing and debt and discourage savings, they pay lip service to the creation of capital via internal savings, and remain silent on the simple solutions.

The why is obvious icon....ever tried stopping a container ship moving at just 1.5 knots...you are right about a savings culture and economy being better than the crap we have now...but it will not change until the ship smacks into the rocks.

So sit back and enjoy the show. There are many laughs to come as the moronic pollies and bankers try to hide the Elephant inside a pig.

Wolly. You are right. It's the root cause. It's tiresome reading all the BS as the talking heads tip-toe around the core issue. Would like to see Chaston, Hickey, and Vaughan do a three amigos trick, 3 on 1 with Key and nail him with it. Get some explanations. I mean reasons why they maintain the container ship on its current course. The answers are obvious.

As per the Titanic , it's a helluva hoot to have some ice in your drink ..... not so much fun to be in the drink , with the ice .........

...... meebee Labour's leader , David Cunliffe , oughta be " Hard-Talked " , too .

Dont think we'll have to wait too long. Reading the Hiki articles this week about Greece and France and Germany, the Euro, and ECB one gets the picture of Governments and Government agencies playing high stakes poker (with other peoples money) for the last 3 years without knowing how to play poker. They have got it wrong and their bets have gone sour.

Yes, you were the first and only person to ever think of that.

There was a time when I found your hubris to be mildly amusing, but now you just seem like an arrogant and smug old git who doesn't realise how stupid he seems to everyone else.

Wolly doesn't seem " stupid " to me . ..... I enjoy his comments . And also the fact that he doesn't descend to abusing his fellow bloggers .

...... Bernard could organize a " Vote Off " between you and Wolly . The loser being biffed off the site , as dictated by this community's wish .

Do you feel up to it , Rich PI Troll ...... well d'ya , punk ?

Hey GBH I did that...with grassyass the randy pup and ended up with a stalker.....do you really want to get stalked by a Troll...... .......they are there at 3.am just in case you might pop on....

I noticed that you seemed a tadge forlorn at the time , Count .... And I kept thumping the " Report This " button , but Alex didn't notice the bumble-bees swarming inside his head .... Over-doing it at the Hickeynesian Halls of Gloom no doubt !

ha..!.....every new begining comes from some other beginings end....stay happy..!

At first glance I thought you meant a vote off between Bernard and Wolly.

Now that would be interesting :-)

Nah , I'd like to keep Beaker .... ooops , sorry , I mean " Bernard " .... I'd like to keep him around a while longer . ..... He's kinda funny , in a " Sad Sack " sort of way .

Rich PI Troll: Go take a hike you nasty fellow. Abuse happens when intelligence has run out.

Bernard, what happen to "playing the ball and not the person"? This guy needs banning.

Wolly, 100% on the money again my friend

Trolls don't like a bit of Wolly in the morning...hehehe....

At the risk of being seen to support the troll, there is some merit to the sarcasm in the first part of their post.

Wolly is by no means the first person to think of (most) the things he posts, nor is or was he the only one to do so.

But you could be forgiven for thinking otherwise if Wolly's crowing was your only exposure to the rest of the world of economics and finance and other things!

However, as much as I enjoy a good bitchfest, Rich PI Troll was aiming a bit below the belt with his/her other comments.

You mean so ppl who do nothing with their money can but put it in the bank and get a high risk free rate of return? uh no.

You have it wrong, businesses borrow and the OCR has a direct impact on a business, business create jobs but the owner is risking his capital to do so, therefore he should be earning more than the risk free rate of return....or it makes no sense for him/her to borrow at high rates, so that wont create jobs....

regards

Here's The Telegraph on Greece's Lehman moment

Fears about contagion remain acute, with Nout Wellink, a governing council director of the European Central Bank, warning that eurozone members may have to double the size of their European Financial Stability Fund to €1.5 trillion to cover potential risks from Ireland, Portugal and elsewhere.

Holger Schmieding, chief economist at Berenberg Bank, said Greece may still default if the disarrayed government rejects the terms of a new bail-out. While a default alone would be manageable, he said, "Europe would likely switch to contagion control to prevent the turmoil from spreading to Spain and Italy".

It turns out up to half of the corporate jet use in America is for personal use.

http://www.cjr.org/the_audit/an_excellent_wsj_probe_finds_c.php

Meanwhile the debasement policy so dear to the NZ govt, to Treasury and the RBNZ continues apace...purchasing power of the Kiwi$ falling about .25% every month...way to go guys...excellent work....bonuses on the way.

Too right. These sorts of tech export companies generate high paid and interesting jobs that earn foreign exchange.

This is what we should be focused on. Not trying to squeeze hugh amounts of more milk out of a limited supply of land by poisoning the rivers and pumping up balance sheets with foreign debt.

cheers

Bernard

Do we have data on earnings per employee?

Apple for instance earns $2milUS per employee.....so thats pretty high productivity....and farm hands earn what?

regards

Hi ostrich, do you have a link for that? I would be interested to see a breakdown of sector vs. export earnings for those 100 tech companies.

Here's another way to look at it, you could drive from ChCh up to Picton and see copious and obvious evidence of a sector that generates about $1bio export earnings - the wine industy - good on them by the way, every little helps. However, there are a few roads in ChCh where you could drive for a small fraction of the time and distance and pass by the same export earnings outcome - but probably not even realise it.

If only NZ government would implement policy that doesn't work against more of the same.

Why don't they?

Cheers, Les.

Is that it Les.....no suggestions today...!

ssssssssshhhhhhhh ! ....... what've I told you before about poking sticks at 800 lb gorillas !!!

I'm using a seven metre kanuka pole Gummy....works well with wasp nests.

Yep. It's Friday, so off to the pub we go. Have a good weekend, and you Gummy.

Thought you brewed your own Les....avoided the gst like....invited mates round to sink the stuff....

The country's largest private bank, the National Bank of Greece (NBG), has also begun selling off its holdings of Greek bonds, a 180-degree change of course.

http://www.spiegel.de/international/europe/0,1518,768786,00.html

I see the Judge in the Nathans' Finance case is concerned about the stress that the trial has/is placing on the defendants! Poor things....

http://nz.finance.yahoo.com/news/Judge-promises-quick-verdict-yahoofinancenzwp-1949193235.html?x=0

Not a propos of any of the above, but does anybody know why Matt Nolan's TVHE has fallen silent?

We're told Matt's been very busy lately and plans to restart in July.

cheers

Bernard

Dylan Ratigan has a great piece over here on America being for sale

http://www.huffingtonpost.com/dylan-ratigan/america-for-sale-is-goldm_b…

Thought provoking article.

Ratigan asks "will we get better roads when Goldman Sachs determines how much we pay in tolls?". The answer is NO. Goldman Sachs will double or triple the road tolls under the altruistic guise of helping the country reduce its dependence on imported oil. Go GS.

What he does suggest, that has application locally is the natives should start paying attention to the Balance Sheets of their local councils and check to see if infrastructure assets are quietly being sold off to supplement rate increases. Are the councils bankrupt or debt stressed?

Re: 1. If John Key thinks were in for 20 years of sky high commodity prices can we interpret that to mean he thinks that its going to take 20 years of inflationary money printing to deflate away the western worlds debts?

He must be confident that the US wont allow defaults, and would rather print print print than see any correction. If JK is right theres only one way our dollar is moving against the US.

The better explanantion is that John Key doesn't know what he is talking about but thinks it sounds good and goes well with a smile.

At least making it up is a (slight) improvement on the lying he has been known to undertake.

One thing struck me about Resident Witholding Tax a while back. Given that interest rates on term deposits (and other savings vehicles) have practically halved in the last few years presumably the tax income accruing to the government from this source has also dropped dramatically? How important is RWT to the governments books, anyone know?

http://www.treasury.govt.nz/budget/2011/taxpayers/01.htm

RWT is a very small proportion of the overall tax take.

Thanks Kate - interesting, hence they choose to ignore its impact I guess

If they can afford to ignore it, perhaps they could be so good as to do away with it! :P

Re #1. Does Key and big business know something that we the masses do not? Now that New Zealand controls all of Zealandia our 'local' slice of tectonic plate some two thirds the size of Australia. Are we about to become another major mineral extractor but primarily from under our territoreal sea and ocean? There have also been hints that much more oil and gas is out there on our continental shelf to be found and exploted.

What he's predicting I believe is that agricultural commodity prices will remain high for a decade or two - so nothing to do with the wider economy in NZ and mineral exploration.

But it's gotta be the stupidest statement/prediction he's made yet.

Not really, his 100% pure claim was even stupider. But then maybe the 20 year commodity boom is "aspirational" as well.

http://www.nzherald.co.nz/environment/news/article.cfm?c_id=39&objectid=10732698

Its Friday ....yay whoo...er !

here's an FYI emailer and regular reader on this site and how it's working out for him.

A woman's husband had been slipping in and out of a coma for several months, yet she had stayed by his bedside every single day.

One day, when he came to, he motioned for her to come nearer.

As she sat by him, he whispered, eyes full of tears, 'You know what?

You have been with me all through the bad times.

When I got fired, you were there to support me.

When my business failed, you were there.

When we lost the house, you stayed right here.

When my health started failing, you were still by my side...

You know what Martha?'

'What dear?' she gently asked, smiling.

'I'm beginning to think you're bad luck!

" Things Your Taxicab Driver Never Told You " ( Sean Williams ) over at the Motley Fool , takes a looksie at the recent IPO's of hot internet stocks .

....... For those following Pandora Media , the latest darling of the internet IPO circus , it opened at $US 16 per share on Wednesday , and closed trading 9 % up , at $ 17.42 ...... day two , last night , it slumped 24 % , all the way down to $ 13.26 . Well below it's debut .

Oddly enough , it seems that earnings do matter to investors . And Pandora has boxed on for 11 years without yet returning a single annual profit .

But GBH - Surely..........................thers still.................hope..

Yes there is , but not for Pandora Media ...... The new Apple music locker system holds more promise for customers and the company alike . .....

Here's one for anyone still interested in the entrails of the Hanover-Allied Farmers debacle:

"Allied Farmers Limited said today that it has been advised that the ANZ Bank (Fiji) has appointed Receivers and Managers to Vatulele Joint Venture Trustee Limited (VJVT).

Allied Farmers’ wholly owned subsidiary, Allied Farmers Investments Limited (AFIL), is the second secured lender to the Waterfront Fund (managed by Williams Land Limited) behind the ANZ following the purchase of a loan from Hanover Finance Limited in December 2009. The loan is secured by a second mortgage over the Vatulele Island Resort and associated development land. VJVT has provided an all obligations guarantee of the loan.

The loan has been in default since April 2009, an accordingly the carrying value of the loan has already been substantially written down from the amount due under the loan. Allied Farmers advises that at this time it is not possible to fully understand any further impact on the carrying value of the loan arising from the appointment of Receivers and Managers until the completion of the valuation currently underway for the purposes of Allied Farmers’ year end financial reporting, and/ or the completion of any sales process that the Receivers and Managers may chose to pursue.

Allied Farmers will keep the market informed as it receives further information."

Vatulele is a beautiful place. I remember it from the days when the Aussie movie family, the Crawford's, owned it, and hope this mess doen't spoil the retreat.

Allied Farmers stock ( NZX : ALF ) traded 18 % down today , a drop of 0.2 cents , from 1.1 c , to 0.9 cents , on thin volume of just 30 000 shares ...

.... the company has 2 billion of these little 0.9 cent beauties sloshing around in investors' portfolios .

And here's Allen Matich

Barry Eichengreen, an economist at the University of California, Berkeley, famously argued that a euro-zone country couldn't leave the single currency because to do so would trigger "the mother of all financial crises." Long before the long political process necessary for any euro-zone country to leave the single currency was concluded, investors would have voted with their wallets. They'd dump the country's sovereign debt and flee its banks.

But this is pretty much what has already happened to Greece. Two-year Greek debt yields 28% while 10-year bonds are trading at less than half of face value. And for months now, depositors have been pulling funds out of Greek banks. Only the lifeline of yet more EU and IMF loans is keeping Greece in the euro. Loans that will have to be paid back.

If Greeks come to think they're already near or have reached the worst-case outcome of a euro exit but are getting none of the upside, they may well start to agitate to leave the single currency.

FYI Apparently the US banks have hedged their Greek CDS risk...Sounds like a Tui billboard to me

http://www.bloomberg.com/news/2011-06-16/u-s-banks-greek-risk-is-whole-…

U.S. banks face “a whole lot less” risk to a Greek debt restructuring or default than implied by the almost $33 billion in “guarantees extended” listed in a recent report by the Bank for International Settlements, according to Glenn Schorr, an analyst at Nomura Holdings Inc.

“We think the U.S. banks and brokers have largely hedged their Greek exposure,” Schorr wrote. “We think more legitimate concerns related to a potential Greek restructuring or default concern the possible drag on economic activity or the potential widening of the risk premium in general.”

And another cracking read from Michael Hudson

After the stock market’s dot.com crash of 2000 and the Federal Reserve flooding the U.S. economy with credit after 9/11, 2001, there was so much “free spending money” that many economists believed that the era of scientific money management had arrived and the financial cycle had ended. Growth could occur smoothly – with no over-optimism as to debt, no inability to pay, no proliferation of over-valuation or fraud. This was the era in which Alan Greenspan was applauded as Maestro for ostensibly creating a risk-free environment by removing government regulators from the financial oversight agencies.

What has made the post-2008 crash most remarkable is not merely the delusion that the way to get rich is by debt leverage (unless you are a banker, that is). Most unique is the crash’s aftermath. This time around the bad debts have not been wiped off the books. There have indeed been the usual bankruptcies – but the bad lenders and speculators are being saved from loss by the government intervening to issue Treasury bonds to pay them off out of future tax revenues or new money creation. The Obama Administration’s Wall Street managers have kept the debt overhead in place – toxic mortgage debt, junk bonds, and most seriously, the novel web of collateralized debt obligations (CDO), credit default swaps (almost monopolized by A.I.G.) and kindred financial derivatives of a basically mathematical character that have developed in the 1990s and early 2000s.

These computerized casino cross-bets among the world’s leading financial institutions are the largest problem. Instead of this network of reciprocal claims being let go, they have been taken onto the government’s own balance sheet. This has occurred not only in the United States but even more disastrously in Ireland, shifting the obligation to pay – on what were basically gambles rather than loans – from the financial institutions that had lost on these bets (or simply held fraudulently inflated loans) onto the government (“taxpayers”). The government took over the mortgage lending guarantors Fannie Mae and Freddie Mac (privatizing the profits, “socializing” the losses) for $5.3 trillion – almost as much as the entire national debt. The Treasury lent $700 billion under the Troubled Asset Relief Plan (TARP) to Wall Street’s largest banks and brokerage houses. The latter re-incorporated themselves as “banks” to get Federal Reserve handouts and access to the Fed’s $2 trillion in “cash for trash” swaps crediting Wall Street with Fed deposits for otherwise “illiquid” loans and securities (the euphemism for toxic, fraudulent or otherwise insolvent and unmarketable debt instruments) – at “cost” based on full mark-to-model fictitious valuations.

Altogether, the post-2008 crash saw some $13 trillion in such obligations transferred onto the government’s balance sheet from high finance, euphemized as “the private sector” as if it were the core economy itself, rather than its calcifying shell. Instead of losing on their bad bets, bad loans, toxic mortgages and outright fraudulent claims, the financial institutions cleaned up, at public expense. They collected enough to create a new century’s power elite to lord it over “taxpayers” in industry, agriculture and commerce who will be charged to pay off this debt.

And the funny thing is, European citizens are far more likely to revolt than Americans. Vive la Revolution, eh?

The French , so I am informed , are particularly revolting ...... or was that meant to be , " particular to revolting " ............ Elley ???

Now that's going to boost my self-esteem :) The French are very grumpy and always keen to go on strike, that's for sure (of course I don't include myself in this generalisation)!

But Elley , credit where it is due , the French do not put up with BS ........ at least they strike & demonstrate , and stir 7 bells of hell out of their politicians ............

...... unlike those long suffering souls in the Land-of-the-Long-White-Sheep !

Be grumpy , be proud , you're a Frenchie... Madamoiselley .

...the French do not put up with BS ........ at least they strike & demonstrate...

Typical pinko socialist commie scum.

It's lucky for NZ employers that NZ workers are so apathetic and passive, like all good serfs.

Aha de haaaaaaa ! ..... Best laugh I've had all day . Well done .

Cheers : Gummster

Rogie – I can hear your laugh coming from wealty countryside Loburn is so arrogant aristocratically.

Waltie , you're such a jolly good wheeze ..... bravo old son .

Yoiks , tally-ho , and orf to thrash the peasants ..... nasty oinky little serfs ......

..... where's ma corgis , need one's dawgs !

Haw haw haw ....... Pip pip !

Yeah - such a snooty – “Fox' s Hunting” in Loburn tomorrow starts 9am - departing by the stables - bring your lady friends along.

I can tell you have never had to go somewhere when there was a roadblock in place (truckies' strike), the trains not working (SNCF strike), and the planes not flying (Air France/ air controllers strike)... But yes, you're right, we keep the pollies on their toes and that at least is a good thing.

And yes, a Frenchie but technically also a New Zealander...minus the accent sadly. But an All Blacks supporter :)

Where is the money ?

We are entering a very difficult time in New Zealand. The sooner the people take to the streets, the better. The government need to be forced to make revolutionary changes. As soon as unemployment hits 20%+ it is too late and the situation is escalating. Christchurch is crucial.

Elley, it is not about me. I have a reasonable good standard of living and a happy life. It is about youngsters not having decent jobs. It is about 1/3 of the NZpopulation not being able to pay for daily necessities - struggling – many working hard on low wages, but not to be able to pay for ever increasing food, petrol and power prices etc

Revolutionary changes? peak oil is here, everything we do demands energy and in particular transport energy...and thats fossil fuels and its now scarce and expensive, ASPO etc have been saying this for years, and been ignored. Sure there is drastic alterations to our economy to be done, on the scale of WW2...consumerism exits stage right......30% of the economy if not 50% needs to go on adjustments....no voter will accept 1 or 2% tax increases right now....let alone 10 to 20% and maybe 30%.....yes its going to be difficult, but just looking at Chch I can see the Pollies and the ppl think its business as normal. I see Labour is undertaking "polls" on how hard ppl are finding it...b*llocks frankly, its just Labour's attempt to drive home to ppl that in thier opinion National is doing a terrible job.....when of course Labour were no better for 9 years and show no signs of change...

20% unemployement? easily....the problem is just how do you and what do you do about it.....growth is history its not coming back....3%+ GDP is the minimum needed to decrease unemployment and as I just said there is no more growth....therefore 20% is on the cards....just what do we do with lots of young men many of limited skills and not prepared to work (labour) hard? because labouring is about all we might have a lot of.....

Frankly I dispair because I cant see any answers.....

http://www.youtube.com/watch?v=MhtG85Fu2CA

Unlike the last Great Depression we are energy constrained this time and we dont really need to build huge amounts of infrastructure...most of our rivers already have dams....ones that are worth doing.......we need more electrification, but they will need power supply, things like tidal and wind dont need huge labour gangs.....how we do things has changed drastically...its technology driven and not "simple" effort/force.

What I suspect or hope that will happen is needs will arise and NZers will figure out how to address them....Govn's are shockingly bad at trying to forsee and plan for this sort of thing....JK, or PG for that matter couldnt see their way out of a paper bag...

http://www.youtube.com/watch?v=dcC3QBDMCDc&feature=related

regards

Errrrr, sure. My comment in reply to GBH was rather light-hearted (it's Saturday night)! Striking has been well and truly alive in the French culture for many decades - nothing new or particularly related to the current economic troubles. Not to say that people in NZ shouldn't take action sometimes but my comment was just a general remark about the French attitude towards striking, nothing deeper than that.

Strikes used to be de riguer in NZ too , Elley ... In the bad old days of state ownership .... NZ Rail & the like ...

.... There'd be a strike from the wharfies ( water-siders union ) every school holiday , stopping the trains and the inter-island ferry . And the government's own workers would hold the citizenry to ransom , seeking greater perks / money / freebies yadda yadda ......

.... alot of the team here at www.chicken-little-hickey.com seem to have been too young , or too have short memories , to realise how appalling government run businesses were ........

Kiwis striked not out of principle , but out of greed ........ there , my dear , the French had the moral high ground on us !

First they ignore you, then they laugh at you, then they fight you, then you win.

Steve Kilgallon nailed it... (my emphasis below)

"They don't always say "It's PC gone mad". While incapable of original thought, they are also willing to roll out the other cliches of the bigot: there's "I'm not racist but... (aren't all Pacific Islanders stupid, aren't all Jewish people tight)" or as a general catch-all: "I don't want to offend you but... (you have a bottom the size of small tax haven in the Pacific, have fewer social skills than Paul Henry, smell like Rotorua on a still summer's day)".

Yes, saying "PC gone mad" is the get-out-of-jail card – a free licence to be rude, objectionable and crass. It's like being the old person who feigns dementia to tell young people how lazy, ignorant and stupid they are.

Like any good PR man, the kingpins of the "PC gone mad" tribe have subtly built this campaign against a concept that never existed on a fine tissue of outrageous lies, published in in-house journals like Britain's Daily Mail newspaper. The tales of the European Union insisting all bananas must be straight. Schoolteachers changing the lyrics of "Baa Baa Black Sheep" to "Baa Baa Rainbow Sheep", and the blackboard becoming the chalkboard. Travellers beheading ducks and eating them.

They're all rubbish, but 1984 has finally come to pass: we're all stupid enough to believe them.

With this basic fabric established, any slight societal change that they don't like is hooted down with cries of "It's PC gone mad". A quick search this past week discovered the following things that the parrots have lately declaimed in such a fashion: the use of macrons in Maori place names (from a Kapiti Coast councillor), defending Paul Henry's moronic comments on TVNZ (various listeners) and a racist British MP being sacked."

Bernard's also frayed the patience of a bank economist or two as well, drawing out immature (and premature) comments!

Keep up the good work Bernie

banks and politicians have more vested interests that most so its not surprising they get touchy when people like Bernie and his band of merry followers continuously challenge the status quo

Re: Mr Hudson - He's probably not that welcome....

that was better than Jon Stewart

Bernard , that dream sequence of the new AirBus reminded me more of a nightmare . Are you sure that the engineer didn't get his inspiration from the chimaera ?

.. www.who-sucks.com/animals/real-life-sea-monsters-24-bizarre-creatures-of-the-deep

Hey Walter : Click on the link , and scroll down , to get a picture of your new " Chinese " diet ....... want chips or noodles with your deep-fried ghost-fish ......

...... oh , you want the vomit bucket , sir ?

One cannot believe such creature existed before Fuckushima - but then they looks so ugly because they may have eaten/ drunk something else (E.coli sprouts) over many generations. There is so much foreign stuff in the waters and floating on top also. And they (creatures) don't have dentists and beautydoctors like us two, Michael Jackson and many other famous and glamorous people to look stunning.

Those gelatinous " blob-fish " would be a hard act to swallow , even for a seasoned gourmet such as Bear Grylls ........

......... Grills ? ... Hmmmm ! .... bon appetit , Walter

For a laugh check out:

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10732883

NZX chairman Andrew Harmos has called for "intellectual honesty" from opponents of the Government's proposed mixed-ownership model for state-owned enterprises

A more dishonest bunch on nonsense you would be hard pressed to find. - and he is president of the NZX- no wonder they have had to go begging govt for a listing no one else would touch them.

But don't worry the National Party of Socialists will happliy privatise the Commonwealth of New Zealand, the Hydro dams that this lot never built, never had to pay for.

A more one sided immoral article would be hard to find.

Meanwhile the smiling waving former currency speculator grins his way to what exactly. You would seriously have to wonder what is the point of John Key. No vision, no strategy nothing.

Take a look at what Singapore, Demark, finland are doing in the energy sector, The onlty policy we have is to sell off stuff that happened so long ago that the pulic of nZ do not now realise exactly what it cost.

Monocle magazine - lastest- interesting article on Singapore energy sector.

Chart of bank deposit flight from Greek banks (comparison to pre-default Argentina):

http://ftalphaville.ft.com/blog/2011/06/17/598326/the-humble-greek-and-argentine-depositor/

A good time to go long CHF...

The difference between the swiss and the rest- they lie better. Swiss bank that went into tailspin- UBS with exposures many times greater than the Swiss economy. Now talking about Swiss trying to kick UBS out but who would take them?

Who would take UBS , you ask ! ....... JK needs a foundation stone for his brand-spanking new financial hub in New Zealand . And with a 100 % government guarantee ( everyone else in Godzone gets one ) , I'm sure that UBS would be only too pleased to navigate their HQ down to Wellywood , NZ ..... and to become the new mill-stone around the tax-payers' necks .

Has capitalism destroyed democracy ?

Actually, in case the Swiss government doesn’t comply what UBS wants, they are considering shifting their HQ to Singapore.

http://www.business.smu.edu.sg/mwm/documents/news_archive/20100924_BT_S…

Some banks in London are threatening to do the same.....

regards

We already have a financial hub in NZ.

http://www.stuff.co.nz/national/5069771/NZ-firms-linked-to-money-laundering

Absolutely right - CS/ UBS and other international banks are criminal organisations supported by representatives of the government and part of the private sector – a secret society taking hostage 80% of the hard working, honest Swiss population.

Listen....that rumbling sound...hear it...that's not thunder folks...

"The decision whether to trigger swaps lies with representatives from 15 dealers and investors under the International Swaps & Derivatives Association. The committee, which includes Deutsche Bank AG and the world’s biggest money manager BlackRock Inc., rules whether a credit event should be declared after a request is made by a market participant."

Looking forward to see the possible timing of this event, the attempt to pass the new Greek austerity package, the planned national strike and protest at the Greek parliament at the end of the month together with the military placeman spells one thing - July 2011 represents a good a bet as any as the month that Greece goes back to military rule.

That in turn means default, exit and a rapid roll out of bank defaults across EMU that will include Spain and Italy.

The Germans have given up making choices in their own national interest - and that is always the worst of signs as it ushers in the next era of "strongmen". Greece will probably be only the first.

Is this taking it too far? Well the man-in-the-street will be crying out for someone, anyone to restore some semblance of order and that is when dictatorships happen.

Jonathan

Andrew – this is a trend in many countries.

For a variety of reasons, military establishments have gained significant power and achieved considerable autonomy even in those democracies that have long practiced civilian control.

The professional influence of military’s has grown either from circumstances or from necessity.

http://www.unc.edu/depts/diplomat/AD_Issues/amdipl_3/kohn.html

However worldwide military expenditure is growing at its slowest rate in 10 years, according to a leading think-tank, as the effects of the global economic slowdown feed through to the defense sector.

http://www.ft.com/cms/s/0/4f75e682-6427-11e0-b171-00144feab49a.html#axzz1Pb04nKbA

http://www.stuff.co.nz/world/americas/5162457/US-tipped-to-pull-back-from-Aghanistan

What's next after the Euro - a split of the Euro ?

Greece is one of a growing list of poorer European countries whose dream of reaching wealth and stability through integration with their wealthier neighbours is turning into a nightmare. Others include Portugal, Ireland, Italy and Spain, with Iceland, Belgium and Finland perhaps also in trouble.

http://peoplesworld.org/greece-a-nation-with-its-back-to-the-wall/

Tch Tch Tch ! ..... the Gummster is very disappointed in you , Bernard Chicken Little Hickey ...... a story far greater than the Greece / EU crisis , the USA debt ceiling , volcanic dust , peak-oil , .... has gone past you ......

....... was it deliberate , you old muffin-denying curmudgeon , or just the usual ignorance ..... that you didn't remind the crew here that today ( nearly gone ! ) , June 18 , is world international juggling day !

BH on the impact a Greek default will have on NZ

http://www.nzherald.co.nz/markets/news/article.cfm?c_id=62&objectid=10733074

UK banks have pulled billions of pounds of funding from the eurozone as fears grow about the impact of a “Lehman-style” event connected to a Greek default. http://www.telegraph.co.uk/finance/financialcrisis/8584442/UK-banks-abandon-eurozone-over-Greek-default-fears.html

John Key simply said the world needs food, there's an insatiable growing middle class in the world, especially China and India, and they like/want what we produce for export. He also sees that this is a long-term trend, ok over the next 2 decades scenario might be a bit long-term , but basically what he said was no different to what seems obvious except to gloomsters.

John Key is in the same camp as the Think Happy Thoughters; that if you pretend the bad stuff doesn't exist and everything will soon be shiny, it will come true. Meanwhile, the people you refer to as gloomsters refuse to ignore the facts and reality.

Not everyone is a huckster. We don't all think that if we shill and spruik we can make all the badness disappear. Unfortunately, those of us willing and prepared to face unpleasant realities tend to be overshadowed by the high-profile hucksters, shills and spruikers. This sad fact is compounded by the determination of the mass of sheeple to close their eyes and try to will away the bad news.

If more people had the 'nads to step up and openly take the bad with the good we'd be in a much stronger situation right now, instead of perpetually fighting a battle against the mess caused by financial cowards and fools.

Well said and 100% spot on. Denial is neo-classical economics biggest problem right now.

There's a very short expression for it all... Stepford Smiler.

Muzza - I think you've misinterpreted. Bernard wasn't challenging the notion that India and China will keep wanting our food - he was challenging Key's comment that we'll see very high commodity prices for 20 years. Thats fair enough in my view.

OK, there isn't a rapidly developing middle class in the likes of China and India wanting our foodstuffs and there is a large over-supply of foodstuffs so we aren't able to sell much to anyone. Sorry I was taken in by John Key, didn't realise he could get that so wrong. What was I thinking? Have got it right now, so thanks for the help.

As I pointed out to Chicken-Little Hickey , if you're so sure that JK is wrong , are you indicating that you can see more clearly into the future than him . ...... . Meebee Bernard has been yakking with that other gloomster & prognosticator , Ken Ring .

........... BH , you'd do better to tootle off to Punxsutawney ,USA , and get predictions from the Ground-Hog , " Phil " !

The simple question to the PM is:

PM what is more important, to explain the nation about upcoming difficult times and why the nation has to deal with severe restrictions in standards of living or flattering for a re- election – wait and see and smile ?

Or : PM : When are you going to stop bailing out & propping up failures in big business , and start creating a frame-work that fosters start-ups , small business , innovations , entrepreneurship ...... you know , that segment of the economy that actually does create wealth and jobs .

...... we got enough minimum wage people working in the flea infested casinos ...... we need more tech savvy folk , medical researchers , and high-end manufacturers ........

Massive progress Rogie in just one hour - I'm impressed.

.... and another " thumbsy-up " for my buddy Walter .......... oh this is fun ! ....... yup , it surely doesn't get any better than this ...........

Brilliant NeilD, thanks, sent it to my physics professor friends..

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.