Here's my Top 10 links from around the Internet at 12 midday in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

This will be short and sharp today because all sorts of hell is breaking loose on global markets and elsewhere.

1. 'Just stop the banks lending' - Professors Amar Bhide and Edmund Phelps write at Project Syndicate about how encouraging banks to lend to governments has enabled irresponsible governments and endangered banking systems.

Bhide and Phelps recommend banks be stopped from lending to governments outside of their own country.

That might cause a few problems for New Zealand...and America...and most of Europe if it ever came to pass.

The more grief we see in Europe the more likely this sort of thing is.

The desperation to bail out various European countries is largely about avoiding the sort of haircuts for banks that sovereign debt crises cause.

Lending to states thus involves unfathomable risks that ought to be borne by specialized players who are willing to live with the consequences. Historically, sovereign lending was a job for a few intrepid financiers, who drove shrewd bargains and were adept at statecraft. Lending to governments against the collateral of a port or railroad – or the use of military force to secure repayment – was not unknown.

After the 1970’s, though, sovereign lending became institutionalized. Citibank – whose chief executive, Walter Wriston, famously declared that countries don’t go bust – led the charge, recycling a flood of petrodollars to dubious regimes. It was more lucrative business than traditional lending: a few bankers could lend enormous sums with little due diligence – except for the small detail that governments plied with easy credit do sometimes default.

Later, the Basel accords whetted banks’ appetite for more government bonds by ruling them virtually risk-free. Banks loaded up on the relatively high-yield debt of countries like Greece because they had to set aside very little capital. But, while the debt was highly rated, how could anyone objectively assess unsecured and virtually unenforceable obligations?

Bank lending to sovereign borrowers has been a double disaster, fostering over-indebtedness, especially in countries with irresponsible or corrupt governments. And, because much of the risk is borne by banks (rather than by, say, hedge funds), which play a central role in lubricating the payments system, a sovereign-debt crisis can cause widespread harm. The Greek debacle jeopardized the well-being of all of Europe, not only Greeks.

The solution to breaking the nexus between sovereign-debt crises and banking crises is straightforward: limit banks to lending where evaluation of borrowers’ willingness and ability to repay isn’t a great leap in the dark. This means no cross-border sovereign debt (or esoteric instruments, such as collateralized debt obligations).

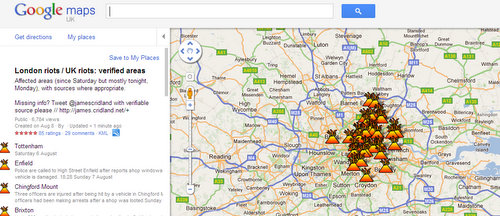

2. Here's a great live Google Map of the riots in London - HT James Saft from Reuters. Click on the image to get to the map.

3. The PPProblem with PPPs - An Financial Times analysis shows Britain would be much better off without Private Finance Initiatives or Public Private Partnerships (PPPs) as we call them.

A Financial Times analysis published today estimates how much the outstanding PFI projects cost the taxpayer to fund, over and above what the state would pay if it borrowed in its own name and built the infrastructure without private finance. The findings are troubling. The extra funding cost amounts to a startling £20bn-£25bn on projects with a capital cost of £53bn and a lifetime of between 20 and 30 years. On top of that, the state has paid perhaps £4bn to consultants to get these projects up and running over the past decade.

Of course, the fact that PFI projects have higher funding costs is a given, and reflects the need to attract private capital. The hope is that these will be offset by fewer budget over-runs and lower lifetime costs. But what the analysis highlights is quite how substantial these savings would have to be for PFI to make sense as a funding option. It stretches credulity to believe that in each and every case this is really the best-value way to deliver the schools, hospitals and roads that Britain needs.

3. What it will cost - Bloomberg reports the European Central Banks' bill for its Italian and Spanish bond buying is likely to top 1.2 trillion euros.

While investors and economists say tighter fiscal ties and increased transfers to the financially weak euro states will be needed to end the financial contagion, purchases of Italian and Spanish debt that Royal Bank of Scotland Group Plc estimates may eventually reach 850 billion euros ($1.2 trillion) threaten fresh political fault lines.

“This huge-risk pooling exercise will not come easily and the risk of political fallout will be large,” Jacques Cailloux, chief European economist at RBS, wrote in a note. “This might be the necessary and painful step required to pave the way for the creation of a common debt instrument, the quid pro quo for this might be the loss of fiscal sovereignty.”

4. Banks are falling over in Nigeria - Bloomberg reports Nigeria plans to inject US$4.5 billion into three banks nationalised by the government three days ago.

Beware of official looking emails asking for your assistance.

5. Money, money everywhere - But not a dollar to invest in job creation. Bloomberg reports investors flooding cash into US bank accounts to avoid carnage in Europe. Welcome to the new hoarding.

Cash held by U.S. banks surged 8.4 percent to a record $981 billion during the week ending July 27, the Federal Reserve said in an Aug. 5 report. That’s more than triple the amount firms had in July 2008, before the collapse of Lehman Brothers Holdings Inc. almost froze bank-to-bank lending.

Even more money may be deposited with U.S. lenders if investors pull away from European banks amid concern the Greek debt crisis may spread to Italy or beyond, said Brian Smedley, a strategist at Bank of America Merrill Lynch in New York. Those funds may not be so welcome: With few opportunities to lend them out profitably, U.S. firms may have to slap fees on depositors to keep returns from eroding.

“It becomes a loser to hold these excess deposits,” said Bert Ely, a bank-industry consultant in Alexandria, Virginia. “At the margin they have to think, ‘What can we do with $50 million of deposits?’ The answer is not much.”

Too many policymakers have relied on the belief that, at the end of the day, this is just a deep recession that can be subdued by a generous helping of conventional policy tools, whether fiscal policy or massive bailouts.

But the real problem is that the global economy is badly overleveraged, and there is no quick escape without a scheme to transfer wealth from creditors to debtors, either through defaults, financial repression, or inflation.

A more accurate, if less reassuring, term for the ongoing crisis is the “Second Great Contraction.” Carmen Reinhart and I proposed this moniker in our 2009 book This Time is Different, based on our diagnosis of the crisis as a typical deep financial crisis, not a typical deep recession. The first “Great Contraction” of course, was the Great Depression, as emphasized by Anna Schwarz and the late Milton Friedman. The contraction applies not only to output and employment, as in a normal recession, but to debt and credit, and the deleveraging that typically takes many years to complete.

7. Here's what the riots look like - This is overnight in Liverpool

8. Australian banks cut fixed rates - AAP reports Commonwealth Bank of Australia and Westpac have cut their fixed mortgage rates in Australia today. Australia's housing market is in trouble.

Steve Keen was right.

9. Clapham Junction looting - Fresh video this morning. 'We're getting our taxes back'

10.Totally a song from The Clash that was slightly prescient.

137 Comments

@5

What I find really annoying is that everyone is ignoring the basic human condition to hoard in bad times. That includes money too. So this idea that if you give wealthy people or banking intuitions more money they will loan it out is absurd. They will simply pile it into bigger and bigger piles and then put those piles into “safe” low interest assets. They are too risk adverse to loan the money out and the general public are too debt weary to spend anything. The US is suffering from the inverse of money velocity; it is suffering from money concentration. They could have made the bailout $14 trillion and it would still be sitting in large pools of cash looking for anythign higher than 0.01% interest. You want to see that money spread out and create jobs then break up the concentration pools.

Do you believe in the "trickle down" theory or the "suction pump" principle (pump it in at the bottom and suck it out at the top).

"To increase wealth systems must be developed to hold and recognise the labour value and resources. Inflation is the enemy of this, as is (social targeted) tax regime (as they both create "leakage" in the "storage tank" of accumulated labour. "" Wellsaid

Trickle down, no...I think we can safely say that was a con.

regards

@iconoclast

Nether...I believe money is pumped in at the top and tends to "stick" there. Some economist will have you believe that the “trickle down” effect happens is you inc4eas confidence. I tend to believe the people are natural hoarders and they will hoard money especially if they are paranoid that they need more of it to retain their wealth they already become accustom too at any cost. And since corporation act like psychopaths that only compounds the problem of large concentrations of wealth stored in large financial institutions. The initial bailout was to relive stress restore confidence and get the credit markets unstuck. But the banks never loaned out the money and still haven’t. They can’t because the general public is too busy paying down existing debt and don’t have the finical capacity to take on more debt. Now there is a death spiral of more money on top with less capacity on the bottom creating an unstable situation. This is the fatal flaw in Keynesian hypothesis of intervention. They will have you believe the bailouts did not work because they didn’t realize how bad the situation was and the bailouts were too small. And I say you could have made them three times as big and it would only exacerbate the situation because the people who need to get the funds and spend them can’t.

They are right it is about confidence but not about banking confidence it’s about the confidence of the general public and economic engine of the middle class. Once the middle class loses confidence you can throw the global GDP at them and they will not bite because they are too paranoid and worried about the smaller things in life like food, clothing, and shelter. The only thing the restores middle class confidence is time. It takes time for all the finical chaos to work itself though the system and there is no way to short-circuit that process. In my estimation we won’t see a rebound in the US till well after 2025. And that means S&P were right to down grade the US.

Doesn't the effectiveness of bailouts depend on where the bailout is directed to? In Australia it was direct to taxpayers, in the US it is to Wall Street. Works better in Australia?

What happened to The Riot Act....In the old days the Act was invoked, a few were shot dead and the riots stopped. How much must burn before the goodygoods wake up.

Massive fire at a Sainsburys distribution centre....its all getting a bit ugly.

Time for the Army ....the Police seem hopelessly outgunned at the moment and they need to stop the momentum.

Too many hanky wringing morons lacking the guts to make the call Kermit. Should have been done 24 hours ago.

You only need to watch the interviews with Clegg & the Police Chief to figure that out Wolly.

Too soft for too long. No consequences........

The problems really start when the crowds shoot back.

Not really. Mobs are inherently cowards. As soon as they figure out they havent got the upper hand then they'll scarper.

If that means shooting a couple then so be it. I would have thought rubber bullets would do the trick.

Then of course there will the claims of Police brutality, inquiries, apologies etc etc which is why they are in this mess in the first place.

Yes ..Kermit ...saw that cowardice in Syria...Libia...yeah lots o places...weak as piss right.

Different kettle of fish.

One lot are fighting for their basic human rights...the other for the right to nick a few tellys

Now you know as well as I do...if it was happening here the same spin would be on it like shit on a stick...... because it is impossible to be unhappy and disenfranchised in a democracy right..?

Yes that right.......and yet .....there it is.

Andrew there hasn't been any Statesmanship for quite a period of time.

Kermit I wouldn't not be so sure, the NZ Police got their butts kicked during the Sprinkbok Tour. At best it was a stalemate, where both sides simply ran out of steam.

The point that worries me is that when do the Police cease to be independly keeping law and order, and become saviours of those that have caused all the problems. I wish them well, they are going to need plenty of courage going forward.

Having some experience in the field, I hope the troubles England is seeing don't come here. Our Police will be caught with their pants down again. Under trained and resourced. How long ago was it they did away with the height requirement?

Expect to lose some of your housing investment to mobs, or spend other investments on protection.

Well, if N.Z. just carries on it's merry way, following the UK government model of the last decade or so in terms of 'wealth' redistribution to keep on buying votes with welfarism, enabling those to reproduce when they have no work or no way out, then it wouldn't be unfathomable to find us in a similar scenario here. You only need to look back at the Queen St riots and Springbok protests to know there certainly is enough of a feral element in this country.....

Quite an enlightening documentary last Saturday on TV3, Kevin McLeod Slumming It. In an Indian slum right next to Mumbai. 1m people living in 1sq mile. 85% employment. Estimated $1B per annum of business. Hardly any crime. Quite poignant given what is flaring up in London right now..

I expect with all the austerity measures being implemented that we'll see a lot more of this "Anarchy in the UK" , both in the UK and possibly the USA

Well Wolly ...that all got a bit sticky when Gweat Bwitten thought it was a good idea to ostracize other administrations for shooting protesters who may have thought well since I'm here anyway may as well pick up some supplies.

It would appear disenfranchised youth are not happy...no not happy at all..still they should be at home where they can be safe and unhappy.

I think the riots started by police shooting someone, I dont believe police shooting more people will stop it.

"But others said a shot was fired from the cab before police returned fire."

http://www.guardian.co.uk/world/2011/aug/05/man-shot-police-london-arrest

Yeah it's all the fault of the police...sure thing skudiv...how dare they try to arrrest an armed criminal and even worse..they bloody shot back at him!

The riots are nothing but outright criminal violence and given a warning to stop...those who don't should be shot.

Wolly

I suspect the killing was just a trigger that lead to a whole lot of outpouring of anger, anger which has been seething beneath the surface with all the economic woes

Matt - could well be the case. Big q is, could it happen here? See q to Jolly 'Jack-Tar' Wolly. Are we gestating the same? Maybe a slower burning fuse, re. BH's generational wealth transfer and disparity insights? Cheers, Les.

Les - yes I think it could happen here. But things would have to get quite a bit grimmer here for it to happen, I think. Will that happen? Don't know. As you suggest it could well be a slower burning fuse. I feel a degree of empathy with these UK youths. Its easy for white wealthy right wingers to criticise from their ivory towers. This is the kind of social and ultimately economic costs a society "gains" when inequality grows. If Act rose to power I have no doubt that we'd see this here, no matter what he might say about the "Trickle down effect"

God, I'm turning in to a socialist! To be frank, I am taking a turn towards the left, I think the current global failures show right wing policies as being as problematic as the left wing policies that screwed the people of the ex-communist states

Maybe it could happen here Matt, dunno. However, I think it is a concern that we might be allowing the same kind of conditions and influences to develop here. We should learn, sadly it appears UK has forgotten some earlier learning:

http://www.bbc.co.uk/liverpool/content/articles/2006/06/28/toxteth_anniversary_feature.shtml

http://en.wikipedia.org/wiki/1981_Brixton_riot

This is interesting too:

'UK riots: What turns people into looters?'

http://www.bbc.co.uk/news/magazine-14463452

"Prof Pitts says riots are complex events and cannot be explained away as "just thuggery".

They have to be seen against the backdrop of "growing discontents" about youth unemployment, education opportunities and income disparities.

He says most of the rioters are from poor estates who have no "stake in conformity", who have nothing to lose.

"They have no career to think about. They are not 'us'. They live out there on the margins, enraged, disappointed, capable of doing some awful things."

Do we have same in NZ? If so, why? Maybe:

'Susan Guthrie: Rich-poor gulf hard to measure'

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10743832&ref=rss

"They leave considerable amounts of wealth untaxed and redistribute cash on an arbitrary but populist basis.

Current policies arguably exacerbate differences in market incomes and goodness knows what they do to wealth distribution.

A comprehensive, principle-based redesign of policy is long overdue."

Cheers, Les.

At first maybe Matt but the rush to loot burn and smash exposed the animal side of those young people who are encouraged to expect handouts by pollies desperate to park their arse in the UK Parliament.

I have no time for thuggish little shites. Their destructive behaviour cannot be explained away with hanky wringing and cries for "more money more benefits"

The vast bulk of victims of these anti social thugs are those on low incomes trying to make a go of it...people now out of work and homeless thanks to some shite who wanted to burn property.

It will take time but in the end the hanky wringers will realise there are times when force has to be more than a police loudspeaker warning that force may be used if the naughty people don't stop throwing petrol bombs and smashing in windows to loot shops. Shoot them.

Wolly - such goes on everyday in many big cities around the globe. However, what do you think allowed the touch-paper to develop? I guess your extensive IS training covered this? Did you find that 'Golden Rivet'?

Cheers, Les.

x.

If we are to survive the looming catastrophe, we need to face the truth

The idea that a capitalist economy can support a socialist welfare state is collapsing before our eyes, says Janet Daley.

Try telling Goofy...he wants to borrow more than English....go figure.

The first sentence is absolutely correct.

So is the second, but it's resultant, not causal.

So many, so blind.

PDK my old friend,

I came to Interest.co.nz today specially looking for you and Steven.

I just found out about an obscure sport that is apparently rising in popularity.

I'd love to know what you think of it.

http://www.youtube.com/watch?v=C3eRru7LfMw&feature=related

Knock yourself out.

Love it......

regards

The reason I love it, is that at about 50 litres of fossil fuels per pass, (and goodness knows the CO2 emissions) it is the ultimate middle finger at the resource doomsayers, better even than drag racing.

I would say that's immature of you, par for the course really.

regards

Phil has that data been peer reviewed, and do we know how many polar bear deaths it caused ?

What came to mind was "ah ha" .. PB's automobility on unpaved roads.

European Central Bank must go nuclear to save Europe A chorus of global economists has called on the European Central Bank to go far beyond pin-prick purchases of eurozone debt. http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/86898… drjonathanwilson Ambrose

Dr. King needs to revisit this erroneous claim in order to salvage his reputation:

""At the heart of the problem is the ECB's unwillingness to be seen

'monetizing' government debt.""

The heart of the problem, Dr King, is the on-going insolvency of peripheral EMU arising from differences in productivity. No fiscal union, no Eurobond is going to change that.

But perhaps, Dr. King, the heart of the problem for HSBC is that you have huge off-balance sheet insurance liabilites that will explode in your face if continental European banks call for their payout?

Perhaps Dr. King your call for a German taxpayer backed Eurobond is HSBC's way of avoiding a meltdown of your income statement and balance sheet - self interest on HSBC part - no? Forget the illegality or the democratic deficit or the moral hazard - just avoid the pain for HSBC.

Jonathan

They have nothing to lose.

http://www.youtube.com/watch?v=rCLnzSRnEG4

Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail.

Probably very true, Walter. So is the saying, "those that will not learn from history will be condemned to repeat it," hence:

http://www.bbc.co.uk/liverpool/content/articles/2006/06/28/toxteth_anniversary_feature.shtml

http://en.wikipedia.org/wiki/1981_Brixton_riot What is NZ learning?What is NZ learning, Les? Nothing mate. We're different down here don't you know?! Aren't we? Yeh, nah, yeh, dunno mate.

"The housing boom in Australia is now an escalating bust "(It's) so sad because Australians had every warning in the world. All they had to do was watch the US housing bubble burst. However, you cannot explain anything to anyone with a firm conviction "It's Different Here".

Australian homeowners are now finding out they do not own their home. Instead, their home owns them."

Not to worry NA. The floods didn't warrant an emergency rate cut but this latest market correction will. The Aussie pollies will do what they can (much like ours) to maintain the bubble and protect the banks using the line that they're saving the taxpayer because all their wealth is tied up in property.

I'd guess, meh, that the British, Europeans and the Americans also tried that, and some went damn near to 0%, and look what they got! Still...an unavoidable property market slump.

I'm not saying it's effective (although it seems to have worked in Auckland) but it does delay the inevitable and creates the illusion of confidence in the market.

I dont like using the words "gang rape", but frankly thats what it looks like.

ie yes they do....well we do as tax payers, what we see right now is a transfer of our future earnings/wealth we may not have and cant afford to lose, to see that private investors dont lose paper wealth that was probably not produced by making a good and they wont really miss....and who contributed to this mess the most.

Rioting not justified? Frankly their actions are killing ppl. Hell if this pans out like I think it will, I'll not lose sleep as a few heads of state and bankers get the chop, I might even clap.

regards

How should one prepare for a great depression? Is it better to have some savings in the bank ?

If you can get rid of all your debts. If you are nervous about the banks go fo NZ Govt bonds.

We will almost certainly be heading towrds deflation which means the value of money rises verse assets. Assets will effectively plunge. Cash cash

That hardest Q of all.....based on the last one, Cash.....3 or 4% in a deposit account while everything is falling 10% a year means a great return......or cash like things....

Look up Nicole Foss on youtube.....she has the best advice Ive seen.

http://www.youtube.com/watch?v=BJKZT5TNjYw

probably more the Q and A, here

http://www.youtube.com/results?search_query=nicole+foss&aq=f

regards

Jesus Steven...this must be about the best day youv'e had in an eon.....it's all happening at once ....boom ...crash..opera....I think I can hear the fat lady......clearing her throat and putting on the viking helmut complete with plats....there gonna be some blood.

I dont think I'd say its a best day.....its more like an "oh my god" day....

regards

come on now matey...eh...ol' Nostradamitto hell got nuttin on you n PDK.

I can feel you smiling from here.

No smiles.......to many ppl going to get hurt.....

regards

Glad you realize that......cause it hurts like hell.

Im Sorry for that.....

regards

et tu, Count?

You may have missed it, but oft and long have been my eloquent attempts to sepadifferate the warner from the advocate.

We are the former.

Don't EVER think of us at the latter.

Thank you.

:)

I am to re-title you two.........Warner Bros. in sartorial eloquence.

Did you ever read Groucho's letters to Warner Bros?

They challenged the Marx's about whether they could use the word 'Casablanca' in the title of their upcoming movie. Said they used it themselves....something about copyright.

Groucho suggested the Marx had been using 'Bros' long before movies and Warners came along.

They were funny men.

Christov - here it is; enjoy.

http://www.chillingeffects.org/resource.cgi?ResourceID=31

They don't do funny like that any more.

Thanks PDK really good laugh and still very relevant.... in soooo many ways.

Anti-depressants Billy as many as you can lay hand to.....use all you spare cash to buy em up......wait for the run on Pfizzer to pass ...then sell at a premium.

NZ$ seems to be crashing:

http://www.nationalbank.co.nz/economics/exchange/nzdusd.aspx

Crash away....go you good thing....one mans food n all that ...even if I don't recover personally ...be nice to see some of those smug bastards bank economists faces tomorrow morning.....they will trot out some junior serf for breakfast telly...cause that bald idiot from ASB is looking like a right twat round about now.

Even the $A has slumped to parity with the Greenback ....... and yet it's America that's deep in the pooh pooh , isn't it ...... not Australia ?

.....but when the dust settles , the bargains to be plucked will be in Asia / Oz & even darling NZ .

The imprudent nations ( Europe & the USA ) are getting their comeuppence , and not before time . ......... You were right Bernard , Barry Obama is a useless toss-pot , as too are Timmy Geithner & Hank Paulson ......

In time my sweeties , the disconnect will begin , and the good ship Asia-Pac will sail again . The banks are in good shape . Companies have deleveraged . Profits & dividends are rising ......

..... Keep a watch out for those gems , the pearls are scattered around now , for all to see .

The US gets its rating downgraded, and everyone rushes to buy US dollars, pushing other currencies down. Isn't that ironic?

The reality is that people sell stocks and commodities which are denominated in USD, which means the demand for USD rises. New Zealand and Australia are still in good shape... it's all a game of relativity.

Absolutely ! ........ The panic merchants are having a field day . But in the fullness of time , the re-balancing will occur , and Oz/NZ will be in better shape than many . .....

......We could have done better , but that's just life isn't it , no one gets it 100 % .

Patience will be amply rewarded !

When your done blushing there GBH...you might wanna git on with spreading the joy...I gotta go organise dinner n whatnot...but I'll be checking in on proceedings...big day yesindeedy big day.

Gummy Bear: you really are a hero. Thanks for that optimistic outlook from your far, far away outpost. My burst of maple syrop laced-optimism was starting to fade.

Amanda

actually, he meant: Patients will be euthanased, 100%.

"be nice to see some of those smug bastards bank economists faces tomorrow morning"

Now I might just smile, f*ckwits everyone of them......now if its one bunch of ppl I'd like to see sweeping roads and living in tent cities its this lot.....might be next to them of course.

:/

regards

Yes Ostrich the putrid Irony...the frog dies nobody laughs.

Aha ha de haaaaaa ! ... That's a riot Count ....... " the frog dies nobody laughs " ....... ha ha ha !

.... hang on a tick , does that imply the Gummster is a nobody , or that you're particularly fond of the French ???

Good for you GBH...my inference was to tomorrows disection of todays events....that aside............How can one not love the French....

Louis the XV1 was the King of France in 1789

Wer'e gonna take you and the Queen down to the Guillotine n shorten you a little bit.

You came the wrong way ol King Louis

You disappointed all of France

But then what else could they expect

From a King in silk stockings

and pink satin pants.

Let em eat Cake....got lost in translation ....but did little to alter the outcome.

this time it's

let them get in their es car and go.

Luckily is wasn't an Irish guillotine ....... 'cos you'd look bloody silly in your silk stockings and ornate wig , wandering around with no feet .

I actually got a good laugh outa that...ta mate.

The Frog dies !? Has one of the undeniers organised a hit ?

... you abandoned Miss Piggy at the restaurant , and left her to pay the bill ...

..... that's not what she meant when she asked you to " stiff " her ......

....... now it's pay-back time , Kermie !

There's that word again Kermit.......are you sure you don't mean

trente et un deniers.....More to the point how did I get into the club....I hope not for my response to your comment on the cowardice of mobs above....uh..? I may have been a little sarcastic but to drive a point home I guess......and save keystrokes.

No not you Christov....undenier is code for you know who.

Almost half of young black people, aged between 16 and 24, in Britain are now unemployed, new figures have revealed

http://www.viewlondon.co.uk/news/true-extent-of-youth-unemployment-reve…and the UK Govn says its not justified?

FFS, if not, what is...those with a job will probably be in low paid and insecure ones.....

regards

and the UK Govn says its not justified?

FFS, if not, what is...those with a job will probably be in low paid and insecure ones.....

regards

After being down 634 points today the DOW futures are down 264 more overnight at this point, or approximately 900 points in less than 24 hours.

http://market-ticker.org/Something you should all read on the London Riots from an interesting perspective:

http://pennyred.blogspot.com/2011/08/panic-on-streets-of-london.html

All this while the real looters (bankers and politicians) get to escape justice.

She wanted to know,' How the hell did this happen', what she been doing walking around with her eyes shut. What a pathetic country, lets see them try this in the good old US of A, wouldn't have the balls and wouldn't be alive or even Australia. They import people while they export jobs and expect the future never to arrive, while the PM is on holiday and Boris complains about the £5000 he gets a week from the Telegraph for an article,as hardly worth the effort.

there was a great track by Gary Clail (On U sound) from the early 90s which had a great lyric, something like:

"the real criminals of this world are not those in prison but those who steal the wealth of the world"

Bring back Gary!

Clash - great band

Just downloaded their classic "London calling" on Youtube, spookily relevant:

"London Calling

To faraway towns..."

It's the school holidays in England at the moment, so plenty of aimless, bored youth out and about, taking the opportunity to make a bit of excitement and mayhem. Wouldn't happen during term time as teachers do a great job of social control

Muza - is this sarcastic or for real

If its for real I wish I had your sense of optimism - or perhaps delusion - around the vast difficulties facing the world in August 2011

Matt, ive been in London for the past decade now, and am here actually the past few days off and on. This is nothing short of the result of decades of failed policy, disenfrachished generations who have nothing to play for so almost nothing to lose.

I am not condoning this behaviour, but it makes me feel very frustrated that here in the news they are not even asking the questions about why this is going on.

Most think that this is isolated and wont happen elsewhere...I feel this is only the start, it is a huge worry, that the conditions, such as massive greed are just going to perculate more & more of this in the next few years.

Lloyd -I'll take a controversial position- I condone it. After all peaceful democracy has not achieved the changes required. Sometimes a bit of violent revolutionary behaviour is what is necessary to wake everyone up from their apathy

Sorry Matt I cant. There were innocent people...kids, families etc who narrowly escaped going up in flames in some of those buidlings. As it is they have lost everything. They didnt deserve this.

The rioters deserve to be strung up, the Police deserve a kick in the bum for not nipping this in the bud earlier and the politicians......well I think the root cause of this is a generation or more of failed policies......they have been setting themselves up for a fall like this for some time.

Fair enough Kermit, but can you not at least understand the position of anger of this vast underclass. I guess you've alluded to some empathy re: the comment about failed policies.

Personally I think the bastards in power need a good wake up call, and thats not going to happen through peaceful democracy, unfortunately. They are all a bunch of deluded bastards, I mean look at that prick Blair who was out here recently, typically deluded, convinced of his own moral superiority, and that the Iraq war etc were justified.

Happen Walter Kunst has been right all along? Perhaps we should build those rail carriages in Dunedin after all......

We are all witnessing extrodinary scenes in London in tandem with markets plungeing and I must admit to a sense of forebodeing. A wave of protectionism is the next logical step which as I understand it is straight out of the great depression play book. Perhaps that wouldnt be all bad for NZ. At least we a producing stuff people need, be it food or timber.

It seems populations have lost faith in their leaders to do whats right for the majority in favour of the rich and powerful, the like of Rupert Murdoch and Sir Fred Goodwin. The peasants really do seem to be revolting..... Interesting times, morbidly facinateing!

Thanks Sheep Shagger for your support.

We cannot, like many do, compare Singapore (model knowledge economy) with New Zealand.

One of governments/ policymakers task is to stimulate it’s economy, accordantly to the social stratification ratio to it’s population. This is simply not the case here in New Zealand. For years we have a very one- sided, unbalanced economy.

Working and middle class people in this country do not have enough decent jobs. The consequences are increasingly visible with many families not able to pay the bills for daily necessities - a poorer nation.

Jeapers, shaggs sheep, you are one of the optimistic ones on this site. Keep your chin up I dont think this is the end maybe a marker on the way. The problems in the UK didn't just happen, they happened years ago due to poor decision making, today is just the result of those actions. I'd be more cautious that the EU lift production caps on agriculture, that would quickly flood markets. I think they will put this fire out, it will break out somewhere else but fire fighting is something Politicians need to get good at fast. We need to ask ourselves where the jobs are going to come from.

At the end of the day the Brits could always send those from other shores back home, just because you have a British passport doesn't mean you cannot be deported,think Australia.

Next problem is going to be the National front, they will be getting a lot of votes out of this, the main stream ploiticians being the prostitutes they are will move to get some of that vote back.

AJ - yes, it's only a marker on the way, agreed. There will be a lot more extend-and-pretend yet, a lot more kicking the can down the road, and at some point, an agreed debt wipe-off. Or an unagreed one!

I suspect we can stagger as far as 2015 maybe, but it could all be over by christmas too - it just depends when the universal belief in the permanence of 'money' implodes. It has to at some point.

It's the young I feel for. We've got enough space for ours to come home, and a few more too, but that doesn't solve the big picture.

In the big picture, we all dead, I wouldn't worry to much. As for money I think we will still be using notes in 2020, its just timing, when the deflationary crash end and hyperinflation kicks in. Ive got your address so my worst case senario is me thw wife and kids move in with you, we only need one room.)think of all the extra compost from your loo)

all those who know the password, may enter :)

I know your heart is soft, you couldn't turn away a hungry family, I can guess the password, normal survivalists it would be 44 magnum, 12 gauge, AR 15 or tactical. In your case Im expecting something better not as simple as Einstein, will have to do better probably, Dorkins ( i know the spelling is wrong but seemed appropriate) I take it you have chenged it since Al Gore fell from grace, (couldn't leave him alone with the wife ;-))

Hubbert .... one for your Kindle AJ - great historical reading.

Actually never thought of PDK as a 'Survivalist'... much more modern.

Read up a bit on Hubbert a few years back,it started when I read a book called, 'Crude' the story of oil, by Sonia Shah, started me on a bit of a quest, that was back in 2004.

PDK is a modern day survivalist, he has prepared himself for a resouce slim future, however there is a spanner in the works

http://dilbert.com/strips/comic/2011-07-31/

I think he has made the right move, one many will follow me included. Im looking at putting the whole house onto Led lights just a bit expensive at $100 each but in a year I will jump in, they can run on %5 of the energy my current lights use, I will then buy a solar panel and a deep cycle battery just in case, I well into my research into wood fired ovens and water heaters. Ive started planting trees for the job, already paid off the debt and have 250 acres to feed myself. Started buying a few tools that could come into use, maybe a small steam engine to run them.

Chuckle both.

I ran into Hubbert in 1975 - the 'McGraw Hill Encyclopaedia of Energy'. Never took my eye off the ball, but it didn't curtail life, the opposite if anything.

LED's are cheapest bought in bulk. I buy 'super=bright 10mm' by the 500, ex Hong Kong. Four soldered in series (they're 3.2 volts apiece) adds up to 12.8, which is what you get from a charged battery. I use 2 brazing-rods in parallel across the ceiling, and screw-trap the 'gangs of four' across like rungs of a ladder. More light? More rungs. It spreads the light - spottiness is one of the LED failings.You can get 'warm white' nowadays too.

Have you got height difference AJ? Water at height is better than a battery, lower tech and always around. Use wind to pump it uphill to a tank or pond, drop it through a pelton-wheel like mine to another, and recycle it.

Transfer of energy always incurs losses - rather than, say, pedalling a generator to drive an electric grinder, it's better to pedal a grinding-wheel straight.

Ive got a stream with about 30 ft of fall over about 1500 meters, so its fairy slow but flows all year, with fantasic clear water from a big spring up the valley, its full of watercress, eels and such the odd trout, few carp lots of crays, floods unfortunately. All the other streams only flow in winter We dont get much wind here. I am living in a north facing valley its a mcro climate our trees are already starting to bud, and we collect a lot of sunlight during the day. However summer is long and dry with a fire ban for at least 3 months most years,tyhe good news is the stream is classified as a drain so I can get in with a digger and have a bit of a play with out the reg council getting uppy.

The spanner... may take more than a few solar panels to power the electric fence as a solution... 250 acres.... should do it (assuming one has been breeding prolifically and that the sprogs want to come home and breed). I still favour Scarfies 30-60 per acre (I think). Just do it properly. Maybe you should re-zone a bit of it, and build housing for the labour...

Lord of the manor stuff - but it doesn't have to be so...

I still need the the old lightbulbs for heat... :( (not really).

You need to get real Matt. You're sounding like a real champagne socialist.

You can talk about problems with capitalism and there are many, but let's not make Che Guevara's out of a bunch of 14 year olds who couldn't even spell capitalism. Maybe society does have to take some of the blame for the state of an education system that produces such willfully ignorant young people, but they are old enough to take some responsibility for themselves.

Poor and disenfranchised? Give me a break. These "riots" (although that's an insult to what's happening in Syria) have been organised on Blackberrys for f*** sakes. These kids have access to more knowledge and information than most people who have ever lived on this earth. That they would rather smash and set fire to things than try to better themselves is a sad commentary on society, but mostly it's a sad commentary on the individuals involved.

On a brighter note, @RiotCleanup on Twitter already has over 45,000 followers, so it's good to know that the morons that you want to elevate to revolutionary status are still firmly in the minority.

Matt, I hear what you are saying & agree that the peaceful protest was turned into the mess I can see down the road.

People need to get off their butts, this is what many of my posts have alluded to in various ways. Without visible show of dissent, things will only degenerate, and I would expect to see other western countries experience similar, this include NZ.

The rioting in London is not the right way to go about it, and will likely achieve nothing short of further reduction in any freedoms that might still be left...

The question we will ask ourselves in 20 years is, “Where were you when they downgraded the US and the Fed?”

http://www.johnmauldin.com/outsidethebox/?utm_source=newsletter&utm_med…

'We're officially in bear market territory now. TheFTSE 100 index has fallen more than 4pc to 4842.8. This is more than 20pc below its July high of 6054.55' From the torygraphs coverage of the markets in the UK

Ya can't lose with property...

You lose with property if you live in the Ukraine ! ..... That's a pig-ugly real estate market .

"Please note that was not a failed auction. Indeed it was oversubscribed. However, nearly all of that demand is internal.

Internal demand is a double-edged sword. Right now it is still sufficient. However, when (not if), Japan ever needs foreign buyers for its bond market, rates will not be 2.3% on 40-year bonds.

On account of miserable and worsening demographics, bond redemptions have started. However, those redemptions are a still a trickle. That trickle will at some point turn into a torrent."

http://globaleconomicanalysis.blogspot.com/

Ever been in a "torrent"?

Yes, why Wolly are running a bot server..! now you know that's illegal...torrents indeed.

I don't own a bot server...what can you cook on a bot server?

I've been reading the posts here, a number pontificating about the riots in England. Matt, I suspect Muzza was probably right yesterday when he noted it was bored youth currently on summer holiday from school and out to make a bit of excitement and mayhem. I've just seen the front page of the NZ Herald and the report which indicates," they looked like bored teenagers on their summer holidays waiting for the 'fun' to begin." Probably bang on too when he said during term time they aren't rioting because under the control of teachers (not always easy to keep the sods controlled, but take your hats off to how well teachers actually do it, they should double their pay, especially at secondary school.)

I wonder if the innocent victims of the riot and looting crimes will be content with the simple analysis that it's only the weather and school holidays to blame? Or might they be asking why this behaviour seems more prone in some locations than others? There is no doubt the individuals who have committed crimes deserve punishment, however the communities deserve more than just simplistic analyses about the causes if they are to avoid sustaining those causes and further repetition of the problem - it's too costly, ask the victims. Maybe it's complex, see:

'UK riots: What turns people into looters?'

http://www.bbc.co.uk/news/magazine-14463452

"Prof Pitts says riots are complex events and cannot be explained away as "just thuggery".

They have to be seen against the backdrop of "growing discontents" about youth unemployment, education opportunities and income disparities.

He says most of the rioters are from poor estates who have no "stake in conformity", who have nothing to lose.

"They have no career to think about. They are not 'us'. They live out there on the margins, enraged, disappointed, capable of doing some awful things."

Les...pack instinct is one of the more removed human conditions...but is ever present... and can be activated even when logic dictates the option is ...wrong...bad...somehow futile.

You have seen this played out on many levels across the globe ...from small street scirmishes...to full blown riots....from all in biffo at the rugby......to the street boys in their crazy cars.

identifiying with their peer group is more instinct than a measured thought of conscience.

The moment the switch goes on...logic departs...enableing pack instinct to govern behavior.

That said I don't condone or excuse the behavior and despite the point I was trying to make yesterday...I agree with Wolly that response should have been swift and forceful...... but that does not deflect the glare away from an underlying problem systemicly social or otherwise.

The willingness of more and more youth with lowered regard for themselves and there own well being appears to be a growing phenomenon and may be a reflection of a very simple human condition response ...too many rats in the cage and sooner or later self importance becomes secondary to survival.....ironically negative behavior ensues from primal frustration.

We had an incident a number of years back with Dave Dobbyn at the Aotea opening...go back have a look at that footage and measure that against the changes that were happening in society at that time ....I recall Heir Banks had a very agressive police policy in cleaning up during a period when there were a lot of disaffected youth about.

You could go on and labor it to death...but ultimately pack instinct is never far from the human consciousness.

Agree with response being swifter and more effective. Maybe more than just the kids are on holiday....

Given Western critisism of Libya and Syria; I'd suggest Britain wanted to avoid a parallel being drawn, by using what could have turned into, a more than firm hand?

Nicholas - "swifter and more effective" need not mean shooting to kill in such circumstances. The UK police, like many in developed countries, are better trained than that and also note, even at this point UK gov. is not using the military, yet. Effectiveness of command and management might need some consideration, especially in the face of mobs coordinating with readily available personal comms. technology.

Having seen some of the footage ( and taking it at face value) I can't see that 'swift or effective' was going to acheive too much. And I doubt that Libya or Syria, initially, started off with the intention of 'shoot to kill', but I could be mistaken. My point is simply that, Britain may be more sensative to 'what if' now, than if Libya/Syria weren't in play. ( This from one who would have been smacked about the face by the local Bobby if I'd given him cheek. So, yes, things have changed...)

That is precisely the point I made yesterday Nicholas...and precisely why the spin machine had to take action before the appropriate reaction could take place.

This is where the PR.PC. world has run amok.....because administrations cannot bear post event scrutiny or justification for fear of being labeled somehow antidemocratic.

Public saftey was the first order of the day that took second place to gaining a PR mandate.

Public Safety...should have been the motivate for rapid response even over kill.....but sadly it reflects the world we live in.

I reckon too, Christov. Some of that in the BBC article I referred to. It's concerning though that it seems area, location specific and seems to be history repeating, re. 1981 riots and a few after that, notably during Thatch's time when austere measures were being taken. One of the accelerants this time seems to be modern personal comms technology. If it is kids gone stupidly wild during the hols, that's bad enough, but if it's deeper than that, as well, that's worse and needs some thought, and I don't mean just throw benefits around to anethetise.

Anyway, it's not our problem, eh.

Yet Les Yet...

Actually, I have ben a bit simplistic with the assumption the rioting youth don't cause problems during school term time because anyone whose taught in the schools they go to will testify they are causing as big as stir as they can get away with when at school, shouting,saundering, abusing,giving teachers grief, lacking self-respect etc . But at least it gets them off the street and it's left to the teachers to cope with and that's why people don't want to be teachers at these schools.

"Or might they be asking why this behaviour seems more prone in some locations than others?"

Certainly...social standards....crowding.....poverty.....a growing number of self raising children...children in mainstream learning schools that just don't get it..! and so on and so forth.

They are the catalyst... yes....but their unification generates an outcome.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.