Here's my Top 10 links from around the Internet at 9.30 am in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

I see the French and Germans agreed over the weekend to bail out their banks, but won't give the details til early November. Hmmm.

1, He actually said this - IMF Advisor Robert Shapiro warned in a BBC interview on October 5 of a worldwide banking meltdown within "perhaps 2-3 weeks" unless the Europeans can get their act together pronto.

The G20 meeting in early November is shaping up as crucial.

Unless the Europeans have a 'bazooka' bond buying fund, bank recapitalisations and more ECB money printing all hell could break loose.

We've had US Treasury Secretary Tim Geithner warn of this.

Now the IMF is saying the same thing.

These are not nutters buying baked beans and shotgun shells.

They actually run the show or at least know what's happening in the bowels of the system. They are that worried.

Here's the quote and the video below:

"If they can not address [the financial crisis] in a credible way I believe within perhaps 2 to 3 weeks we will have a meltdown in sovereign debt which will produce a meltdown across the European banking system. We are not just talking about a relatively small Belgian bank, we are talking about the largest banks in the world, the largest banks in Germany, the largest banks in France, that will spread to the United Kingdom, it will spread everywhere because the global financial system is so interconnected. All those banks are counterparties to every significant bank in the United States, and in Britain, and in Japan, and around the world. This would be a crisis that would be in my view more serious than the crisis in 2008.... What we don't know the state of credit default swaps held by banks against sovereign debt and against European banks, nor do we know the state of CDS held by British banks, nor are we certain of how certain the exposure of British banks is to the Ireland sovereign debt problems."

2. Worrying correlations - Here's some sobering charts via Zerohedge of the comparisons between various Japanese and American indicators at similar points at their recessions.

This first one compares the stock markets.

The second one compares money supply contractions.

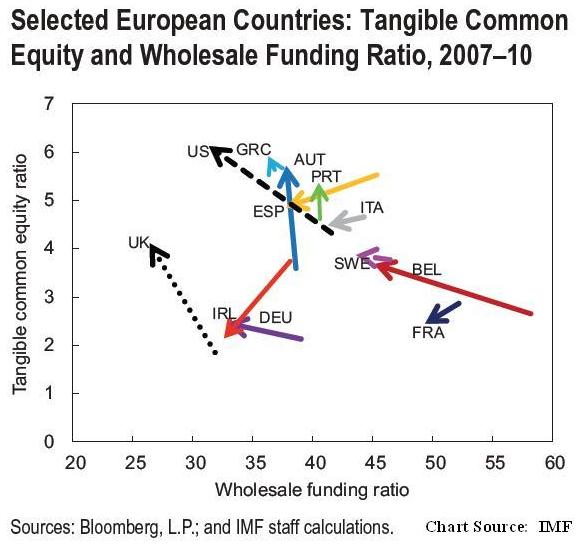

3. Europe's Banking problem - Its banks don't have enough capital and are too reliant on wholesale funding markets. That's the conclusion of this IMF study. HT Ed Harrison at Credit Writedowns

This chart shows the French, Belgians and Italians are still very dependent on 'hot' money that has a tendency to freeze. They have improved their banks much less than the Americans and Brits over the last three years.

4. Depression or not? - Reuters looks at the return of the D word to the economic debate.

But now "depression" is very much back in the mainstream lexicon as the small economic bounce from the deep global recession of 2008/09 fades rapidly after little more than two years and Europe's bank and sovereign debt crisis intensifies.

Economist and doomsayer Nouriel Roubini now says there's a "huge" risk of 1930s-style depression and, on the other side of the political spectrum to Ferguson, advocates further government spending to offset it.

HSBC chief economist Stephen King, who wrote earlier this year of a "new economic permafrost", warned last week that the systemic financial threat of a euro zone collapse and breakup risked another "Great Depression".

5. 'All bankers are capitalists in the good times but socialists in the bad times' - Here's a cracking interview Satyajit Das, author of Extreme Money, gave recently to Max Keiser. Ignore the first 14 minutes of the video. The interview starts at 14 mins 20 seconds. HT Neco in Friday's 90 at 9.

Barack Obama slept through his securities law class at Harvard. That’s the only explanation I can offer for his answer to Jake Tapper’s question at a press conference Thursday. Tapper asked him about the failure of his administration to prosecute a single Wall Street executive. From the transcript.

"Well, first on the issue of prosecutions on Wall Street, one of the biggest problems about the collapse of Lehmans and the subsequent financial crisis and the whole subprime lending fiasco is that a lot of that stuff wasn’t necessarily illegal, it was just immoral or inappropriate or reckless…."

By “a lot of stuff”, the President means everything that happened, from fraudulent sales of real estate mortgage-backed securities, to Repo 105, to filing false affidavits in foreclosure proceedings. He knows this even though there have been no criminal investigations, no FBI inquiries, no Grand Jury subpoenas, and apparently no review of independent investigations. For him, this isn’t about law. He just knows that the immoral and inappropriate and reckless behavior that caused the Great Crash and the Lesser Depression wasn’t a crime.

7. And here's why Obama's wrong - Karl Denninger does the work for Obama compiling what the banks did. This is the reason why there are growing numbers of people protesting in America. The 1% got away with it.

Here's Denninger:

- Laundering drug money. Wachovia admitted to doing it in court. They got a "deferred prosecution agreement" and not only did nobody go to jail nobody other than a few bloggers like myself raised hell about it until days before that agreement expired. Then, magically, it got news coverage. This is a clear black-letter felony; where are the handcuffs?

- The former chief risk officer for Citifinancial testified under oath before the FCIC that the company knowingly sold loans on to investors that did not meet their quality guidelines and published claims. In fact, he testified that by 2007 80 percent of those loans were defective. This is functionally identical to selling you a car and rolling back the odometer, peddling tainted medicine or selling melamine-laced baby formula. There is nothing complicated about this and there is under-oath testimony establishing that it was not an accident or an "error in judgment" as it continued for more than a year after it became known and was the subject of internal memos to corporate officers. This is not my conjecture or analysis, it is factual sworn testimony before a government body. Where are the damned handcuffs?

- Perjury is a felony in most circumstances. Banksters admitted to more than 100,000 instances of it by withdrawing perjured ("robosigned") affidavits. Just as with the testimony under oath in the case of Citifinancial, just as in the Wachovia admission of drug money laundering, in this case the violation of the law is clear. Perjury can only be cured at "no penalty" up until it is clear that the defective statement or filing will be discovered; once you're "caught" you cannot avoid liability by withdrawing the filing. Whether someone was paying their mortgage or not is immaterial as to whether filing a false affidavit is a criminal matter -- it is. Again, where are the damned handcuffs?

8. Too much money in the (political) system - Laurence Lessig writes at Huffington Post that the corporate money now embedded in America's political system is one of the major problems behind the economic mess.

Lessig said the ultimate example of Congress's warped priorities is the extraordinary amount of energy members devoted this spring, in the midst of an economic crisis, to the issue of bank swipe fees -- as chronicled by HufPost's Ryan Grim and Zach Carter. "The number one issue they focused on is bank swipe fees," Lessig said.

"That's only because bank swipe fees was the issue that dumped the most money into campaigns."

9. The power to tax - Simon Johnson and James Kwak, the authors of 13 Bankers, write in Vanity Fair that America's revolutionaries actually realised they needed to tax the population to deal with national emergencies, contrary to what the Tea Party thinks.

It's a great history lesson.

As a young artillery captain in the Revolutionary War, Alexander Hamilton learned a crucial lesson: Good credit, based on the power to tax, is essential to a nation’s security. As the first U.S. Treasury secretary, he built America’s fiscal policy on that principle. Will the Tea Party destroy his legacy?

And here's Simon Johnson being interviewed by Andrew Patterson on Radio Live's Sunday Business.

10. Totally Jon Stewart on OccupyWallStreet

30 Comments

Rather than the solution being proposed at #1 to address the crimes detailed in brief at #7 - wouldn't it be better to prosecute the perpetrators and recapitalise the banks via a proceeds of crimes act?

Exactly right. Steve Keen made an interesting comment to Max Keiser over the weekend that the only way to get out of this crisis is to clean out the corrupt bankers by setting up some sort of Pecora commission, and this is indeed what the occupyWallstreet movement should be calling for.

http://rt.com/programs/keiser-report/episode-194-max-keiser/

Steve Keen makes a ton of sense.

Bernard re #1 you're wrong, the people running the show are nutters. Roll the already too big debt into a bigger debt? Intergenerational/sovereign debt slavery?

Change of plan/leadership, please.

#OccupyFailedEconomicOrthodoxy

I suspect that BH also thinks they are nutters.

"Roll the already too big debt into a bigger debt" except there is only 1 other option,

Default........which will plunge us into a Severe depression immediately....no ifs no buts, really this mess should have been allowed to blow up around 2000 or fixed......but few wanted to curtail the good times.....

regards

Tina-

Geithner says there is no alternative. He has an agenda and bias (like most of us) .

Some important people in Europe and the US disagree with him.

Great reporting by interest.co !!

Thank you for the Daily show clip

So we are now into GFC 2.0....with 2Trillion ? in cost ?? or more ??

Will this be countered by QE3 with 2 Trillion ?? Maybe although they won't admit it...after all "unlimited liquidity" may mean QE in disguised form. Go Gold !!

The world is going bankrupt and the only way out is to print paper (or computer credits) to pay for the losses....Soon everything will double or triple...if wages triple and stuff wages are used to buy them also triple..nobody losses...even banks !!

Way past 2trillion.....

read 10 or more trillion per year.

regards

"These are not nutters buying baked beans and shotgun shells.

They actually run the show or at least know what's happening in the bowels of the system. They are that worried."

Really! If they are so intellegent and knowledgable why did they stand by and do nothing (effective) while the world got it'self into this mess!

Any simpleton now knows what these guys are parroting now.

They haven't got a bloody clue, here is George Friedman explaining why.

More important, such numbers — not only of the status of loans but also about the economic and social status of the debtors — inherently are uncertain........

There is an interesting belief, at least in the advanced industrial countries, that government-issued statistics reflect reality. The idea is that the people who issued these statistics are civil servants, impervious to political pressure and therefore likely providing accurate data. A host of reasons exists for looking at national statistics with a jaundiced eye beyond the risk of politicians pressuring civil servants.......

The center of gravity of our global statistical system, particularly those of advanced industrial countries, is that the selection of statistical models is frequently subject to complex disputes of experts who vehemently disagree with one another. This is also a point where political pressure can be applied. Given the disagreements, the decision on which methodology to use — from sampling to reporting — is subject to political decisions because the experts are divided and as contentious as all human beings are on any subject they care about......

Read more: European Crisis: Precise Solutions in an Imprecise Reality | STRATFOR

re Satyajit Das

He was also on PlanetMoney (on iTunes free) a week or so back making similar valid points, but also that through the growth of financialisation the best and brightest people were drawn to an industry that basically produced only toxic waste.

Nuclear toxic waste....this will hang around for generations....

Funny thing isnt it.....the right wing whinners claim that those working hard and teh brightest pay too much tax.....yet here we are looking at the toxic time bombs they have created at no good to humainity but their own pockets....

About sums up the quality of the rights argument.....expect maybe its regurgitated toxic waste...

regards

worldwide banking meltdown within "perhaps 2-3 weeks" unless the Europeans can get their act together pronto.

Too much at stake. They are not going to let this happen. But printing press would be busy?

#1 lady wants more can kicking...2 or 3 years down the road and by then things should be better....

mad

regards

http://abovethelaw.com/2011/10/occupy-wall-street-needs-to-occupy-a-library/

extract:

Do you know how much planning went into Rosa Parks not giving up her seat on the bus?

I’ll tell you who doesn’t know that: the Occupy Wall Street protesters. They think they can just show up one day, pissed off, and get something done. That’s the heart of this movement. Much has been made of their catchall list of demands, but really you can simplify all of it to “we want things to NOT suck.”

Why do things suck? They have no idea. Who can make things suck less? “Somebody!” Again, this isn’t the preferred response from a group dedicated to making lasting change.

Legitimate concerns at bailouts etc are being hijacked.

http://wattsupwiththat.com/2011/10/09/the-climate-movement-becomes-occupied/

So says the paid off AGW deniers.....

yeah right.

regards

Shouldn't you be at work? You do work, right?

1976 was the year that Steve Jobs , Ronald Wayne & Steve Wozniak founded Apple Computer . Wayne immediately sold his 10 % stake in the company for $US 2300 . But Jobs & Wozniak went on to create their fortunes .

... today , Apple Inc. is a $US 350 billion company . In just 35 years it had grown from a mere idea in the minds of several college drop-outs , to the foremost technology company in the world .

The current permanent work-force of Apple Inc. is 49 000 people , a greater number than all the public servants employed by the NZ government .

..... Apple Inc. will have revenue of $US 100 billion this year . At $NZ 130 billion , this one company is nearly equal to the total GDP of New Zealand . And Apple's net profit will fall in the range $US 25 to 30 billion . ...... by contrast , NZ Inc is about $NZ 15 billion in the red .

Steve Jobs created amazing products that have enriched our lives . He created many jobs , productive jobs . Besides himself , many other shareholders got incredibly rich .

... this is the benefit of having a capitalist system . Creation of products and jobs . No government , no bureaucrat , no central planner could ever come within a light-year of the achievements of one excellent capitalist man , such as Mr. Steve Jobs .

"Unlike Jobs and Wozniak, 21 and 25, Wayne,42, had personal assets that potential creditors could seize" It's amazing what having 'something to lose' does to ones risk taking profile! "The best dealers are those who have not yet learned the value of money" (NA; 1983 :)

A present for you Gummy.

http://politics.salon.com/2011/10/08/steve_jobs_and_drug_policy/singlet…

Amanda : Where is the Martin Hawes " interactive " from last Friday ?.... I cannot find it .

...... Gumbo was stuck in a geo-thermal hot-pool over at Negros Occidentalis , when the typhoon struck , and wiped our communications out ...

.. . Life is tough ... But suddenly , unexpectedly , a bus full of Korean teenage girls arrived , and they popped into the waters with me ....

[ God is great ! .. Thankyou , Lawdy lawdy lawdy !! .... Thankyou , Goddy dude ]

An interesting read. One of the most sensible things Don Brash raised recently was the cannabis issue. The 'War on Drugs' is a complete and utter waste of time, money and resources. All it has done is create a market for gangs and criminals. The curent moves banning kronic and other substances the most recent hypocrisy...and at the same time we are all expected to worship the Rugby God propped up by the brewery industry....

No wonder youth get dis-enfranchised.

i think the key thing there gummo is that its a company that is actually producing something..... they're not just buying and selling shares or currency or cdos' without actually adding any value.

Of course it doesn't hurt that their business model (low supply chain costs, great markups etc) is friggin genius....but the fact is that its smart people working hard to make widgets

The key thing for me , VL , is that Jobs created real jobs . They exist because of a marketplace demand for the company's products ....

..... meanwhiles , over at the coal-face of socialism and largesse , Barack Obama is trying to get his job creation bill endorsed ..... and even his own party , the Democrats , don't want a bar of it ......

Government's do not create jobs , nor can they innovate . Central planning is a socialist jerk , it does not work . Never has , never will .

..... and when we get back to an economic system of pure supply & demand , and murder all the finance ministers and central bankers , then we will usher in a new golden age for the citizens of planet Earth .

Central planning in the extreme is a failure, reasonable amounts of it protect us as a nation. Having say a Nationwide power grid takes central planning....having power resiliancy to survive say dry years without businesses having to close or buy and use their own generators saves the country and businesses costs......

Having a centralised public health service, and education....all these examples of centralised planning that can and do work and have a minimal (compared to private offerings) effect on GDP and ppls pockets.

"pure supply & demand , and murder all the finance ministers and central bankers , then we will usher in a new golden age"

Wake up and smell the coffee Gummy.....our economic system has never provided adequately for the over-supply of ppl and never will....we are in huge over-shoot....the population has to decrease as the oil supply decreases....and there you are living in a over-populated counry that has to import a lot of its food? you are stuffed...or will be when they come looking for food and decide little old NZ guy looks tasty.....

regards

More on things turning sour in China (and this from the permabulls at cnbc!!)

I wonder if parky has read this one....sort of blows his pipedream out of the water....govt control over credit for use in infrastructural investment....oh yeah.

" Families living in a $500,000 (Melbourne) home can expect to see $75,000 wiped from its value...By the time the market bottoms at the end of next year", (said) Mr Edwards.. of Residex, a property information firm that collates data on real estate markets throughout Australia, (and) who has monitored the nation's property market for 25 years, "... the pain for Melbourne home owners was far from over."

But Aussie is different....

15% in one year....then allow core inflation or CPI if you want instead...so another 2 to 3.5% gone....

lets be kind and say 17%....or 1/6th of the value.....and why would it stop then?

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.