Here's my Top 10 links from around the Internet at 6 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

Nassim Taleb at number 4 on the problems of incentives for America's Too Big To Fail banks is brilliant. And Jon Stewart is good at number 10.

1. What the Beijing bubble looks like - Self-styled standup economist Yoram Bauman has produced this curious little video for America's PBS which looks at apartment prices and who owns them in Beijing.

He finds an office worker at a real estate agency who owns a US$400,000 dollar apartment that rents for US$600 a month, but would sell for US$150,000 in America.

I would guess a similar sized and quality apartment would sell for about US$300,000 in Auckland and rent for around NZ$1,600 (US$1,200) a month.

The video also has great shots of huge swathes of empty apartment buildings in Beijing.

There's a problem brewing here.

Well worth a watch.

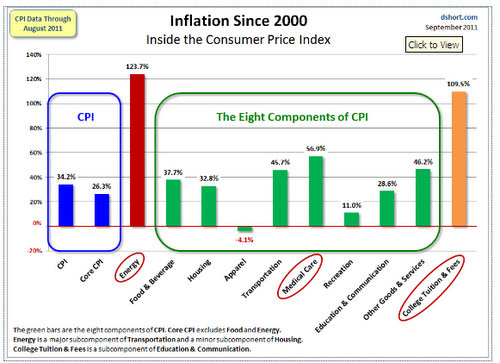

2. American inflation higher than expected - One of the reasons the Fed is reluctant to do a third round of money printing is inflation is creeping up.

Producer price inflation overnight was higher than expected, Bloomberg reported.

Here's a great chart showing American prices since 2000. No wonder the Republicans are banging on about Bernanke's money printing.

3. US military knows the score - America's military is actively planning for peak oil and its F 16s will be able to run on biofuels by 2013, Bloomberg reports.

“Reliance on fossil fuels is simply too much of a vulnerability for a military organization to have,” U.S. Navy Secretary Raymond Mabus said in an interview. “We’ve been certifying aircraft on biofuels. We’re doing solar and wind, geothermal, hydrothermal, wave, things like that on our bases.”

The armed forces say they’ve been successful testing fuels produced from sources as diverse as animal fat, frying oils and camelina, an oil-bearing plant that’s relatively drought- and freeze-resistant.

4. 'I fear class warfare' - Nassim Taleb, the author of the crisis-predicting book The Black Swan, reckons in this Bloomberg interview (that I won't embed because it auto-starts) that Occupy Wall Street will slide into some form of class warfare.

He does not like the uber-banks.

"Last year they were paid record bonuses. This is not rational."

It's compelling viewing. He talks about Hammurabi's Code as a way to change the incentives for bankers.

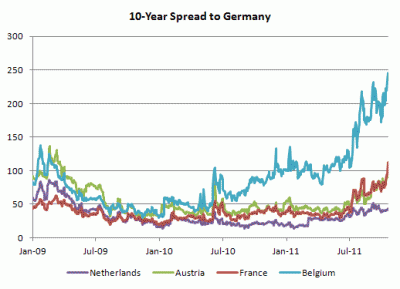

5. The problem in Europe's core - Ed Harrison points out at Naked Capitalism that bond yields in Belgium, France and Austria, have surged.

Belgium is clearly suffering some serious credit revulsion. France and Austria are being carried in tow. That’s where we stand now. The word is that the EFSF will get levered up and banks will be recapped. This may provide some relief but ultimately the euro crisis is more fundamental. Martin Wolf is right when he writes:

The fundamental challenge is not financing, but adjustment. Eurozone policymakers have long insisted that the balance of payments cannot matter inside a currency union. Indeed, it is a quasi-religious belief that only fiscal deficits matter: all other balances within the economy will equilibrate automatically. This is nonsense. By far the best predictor of subsequent difficulties were the pre-crisis external deficits, not the fiscal deficits

Deciding between breakup and deep fiscal integration is the only long-term crisis remedy

6. Is this how private equity works - PrivateEquity hub blogger Luisa Beltran talks to an executive from a chemicals firm who told her why he won't deal with private equity funds again.

He explains how they were interested in funding a private equity buyout, but then saw an opportunity to rip off the partners who owned the business by turning them against each other. The partners stood tough and told the private equity guys to go away...

“They’re a–holes.”

“I could never get the shareholders to turn over to private equity because of the experience we had,” says the exec, who is now 63. “I could never do it. We unfortunately saw the worst behavior. They didn’t even respect the agreement they signed. Making a buck was much more important than being honorable business people.”

7. Spain downgraded - The clock is ticking on Europe's timebomb. They had better their act together pronto.

Moody's downgraded Spain's sovereign credit rating by two notches this afternoon, Bloomberg reported.

A double-notch downgrade to Spain's credit ratings has piled more pressure on European leaders to make rapid progress on solving the region's debt crisis or face unbearable borrowing costs.

The fresh blow from Moody's Investors Service came just a day after the agency warned France its triple-A rating could be at risk and overshadowed a report that Germany and France were nearer a deal on leveraging the euro zone's rescue fund.

8. Melbourne's expensive housing - Leith van Onselen at Macrobusiness does a nice job of showing how over-valued Melbourne housing has become and why prices there are now falling.

I'll be sending this to my brother who bought a house for an obscene price in Melbourne's suburbs last year.

With home prices already elevated and illustrating an elevated valuation gap, the lowest rental yields in the nation, and an ongoing boom in supply likely to make the existing glut of unsold homes worse, Melbourne’s housing market arguably offers the worst investment fundamentals out of Australia’s capital cities.

9. Totally irrelevant pictures of the World's most expensive (and ugliest) camper van - Only because I have a thing for camper vans... HT My wife and thanks to The Daily Mail.

It has a pop up roof terrace and has a double tube sport exhaust. And costs 1.3 million pounds.

And even better inside...

10. Totally irrelevant video - Jon Stewart does his thing on Occupy Wall St

24 Comments

This is just awful...who would have predicted the decades of useless UK govt and shoddy BoE regulatory control of greedy banks, could possibly come to this?

"Despite record low interest rates, printing new money and other emergency measures, governments had not yet addressed the underlying problem of overspending that was at the root of the financial crisis, Sir Mervyn King warned. The consequences threatened to “inflict pain on everyone”, he said.( especially the bansters.. but he didn't say that)

In a sobering assessment of the world economy, Sir Mervyn warned that even if world leaders managed to agree on emergency moves to support the banking system and debt-stricken economies such as Greece, they would still not have averted the threat to global stability.

Unless overspending by Western economies was curbed it would bring about an ever-larger debt crisis that would mean much lower long-term growth rates, he said.

Worse, he suggested, some of the measures being deployed to counter the short-term situation could actually exacerbate fundamental economic problems, worsening the debt crisis and leaving taxpayers footing an even larger bill"

I wonder if Wild Bill will take all that in!

yes the world's economy will be rooted for years, whatever response is taken.

the big question is how rooted will it be - mildy (minimal growth on average for a long time) or majorly (depression)

Hopefully the former

I think we'll know by year's end

Whats pretty clear is the property ponzi fuelled "good times" have gone for a long time, if not forever

Never under-estimate the ability to can kick.....its amazing......I thought 18 months ago it was all over.....its still being played out.....

The best plans I see are for this "fund" to hold off the bond vigilanties.....once that's exhausted and the EU voter and their children's children are destitute for life then we might see whole sale nationalisations of banks and a debt jubilee......and the real down turn.....so hey might yet juggle for 12 ~ 18 months.....I think the private investors are gone or going.....that just needs to complete from the countries not yet in the poo.....

However you maybe right on this year yet.....

regards

Did MK make any mention about derivatives ? Because until these are frozen/declared illegal like in earlier times, nothing is going to change, Derivative fraud is a major part of why some countries have been loaded up with debt. Being part of the EU is another for those nations, Ireland, Greece etc.

Until the real issues are attacked they can talk all they like, its coming down and its going to be ugly. One could almost argue that this is what is wanted...

Austerity (reduced spending) is not going to make a lick of difference under current conditions.

You cannot externalise risk, you cannot externalise costs. We live on a spherical planet and everthying is connected.

Blame overspending, unfair when our currency is getting debased every day. (It's a slow motion version of hyperinflation)

Canterbury Earthquake inquiry told that GNS scientists held back predictions on the potential severity of further aftershocks after the Boxing Day quake - on the advice of social scientists ...

http://www.odt.co.nz/news/national/183020/experts-held-back-aftershock-prediction

...read 'advice' as being told they were not allowed to tell us.

Extrapolate this type of directive to other issues - such as peak oil, global warming, financial meltdowns and so on and you start to understand why joe public remain ignorant.....

It will be interesting to see how the public, and Cantabrians in particular, respond to this. I think it's potentially dynamite.

On the one hand I can appreciate that the 'experts' didn't want to panic the population, and of course earthquake prediction is notoriously fickle, but this surely comes at the tremendous social cost of a potentially massive erosion of trust and the social contract.

Personally I chose to move my family away from Christchurch, leaving a year after the first quake. One of several reasons was a 'hunch' that we weren't /aren't being given the full story about what is going on down there (which isn't to say that I think another major event is imminent/likely, or anything like that). Not to the extent of being particularly paranoid about it mind; more that we thought our totally quality of life would improve if we moved somewhere else (warmer ;-).

Gosh Kate....you didn't REALLY expect to be told that sort of thing ...did you?..Lately the 'experts' have said the worst is over!.....very similar strategy to that used by English and Key for two years after they got into the Beehive.....say soothing things....hand out the tissues....point to a future of promise....never never tell the peasants bad stuff.

If you want to be able to make a good call on the prospects for a stable chch in the future....all you need to do is look at the premiums demanded by the insurance companies...they don't believe the 'experts'...why should you!

...........nah Wolly..the Insurance Companies do believe the experts..they have access to them.....Joe ignorant is fed the sanitised version that's run past the 'social scientists' (read spin Doctor's) first..

And who is paying the salaries of the social scientists?...how many are there?.....what good do they do?.....

andyh asked the other day, given all the evidence in front of us, why would anyone argue for the status quo? I think Dame Anne Salmond has a pretty interesting take on it;

This, then, is the puzzle. Why do people support policies that are not in their own interests, let alone those of future generations?

Some suggest this is because the middle 40 per cent of income earners aspires to join the top 10 per cent and does not want the bottom 50 per cent to displace them. This may help to explain the rise in consumerism and household debt, but it is only part of the story.

http://www.nzherald.co.nz/nz-government/news/article.cfm?c_id=144&objectid=10759752

A really subtle "divide and conquer"

It's quite an impressive propaganda campaign, isn't it?

Stanford University's newspaper calls for the university to stop sending recruits to Wall St

http://www.stanforddaily.com/2011/10/11/op-ed-stop-the-wall-street-recruitment/

Let us be clear: pursuing a job on Wall Street isn’t evil, and it goes without saying that we need a strong and efficient financial sector. But our generation cannot afford to continue shipping our best and brightest off to Wall Street. The United States and the world face enormous challenges in our lifetimes — from climate change to global poverty — and we need our top talent focused on solving these problems. America’s university system is one of our most prized national assets, benefiting from taxpayer support and providing invaluable public goods in the way of knowledge and human capital. It should stop serving as the vocational training center for reckless banks and hedge funds.

Simon Jenkins writes well at The Guardian of peace in our time

http://www.guardian.co.uk/commentisfree/2011/oct/18/europe-defunct-idealism-munich?CMP=twt_gu

Europe's financial crisis is acquiring the stench of Munich. No, it is not Nazi Germany. But it is the same ceaseless meetings and pretend deals, the same flying here and there and getting nowhere, the same refusing to acknowledge catastrophe on the horizon, hoping someone else will take a tough decision.

In 2008 the financial spotlight was on Washington. Banks were rescued, but not the American economy. Now the spotlight is on Europe. Again the talk is of saving banks, and none of saving economies. Britain's banks have been given another £75bn, which makes £275bn over two years. No one seems to have a clue where this stupefying sum has gone. Most has allegedly vanished overseas, covering bad debts, fuelling commodity prices, depressing the pound and increasing inflation. Meanwhile, Britain's economy has ground from slow to stop. Quantitative easing is like filling a car with petrol when the tank is disconnected from the engine. It is a dreadful policy.

Here's an article explaining how captured Barack Obama now is by finance industry lobbyists. I said a long time ago he was a liar and a fool. Every day that goes by shows just how much.

Here's a great Vanity Fair article on how Elizabeth Warren was undermined. HT Vanderlei via email

http://www.vanityfair.com/politics/features/2011/11/elizabeth-warren-20…

Millions of Americans hoped President Obama would nominate Elizabeth Warren to head the consumer financial watchdog agency she had created. Instead, she was pushed aside. As Warren kicks off her run for Scott Brown’s Senate seat in Massachusetts, Suzanna Andrews charts the Harvard professor’s emergence as a champion of the beleaguered middle class, and her fight against a powerful alliance of bankers, lobbyists, and politicians.

Yeah BH I don't completely buy your line that Obama is a liar and a fool.

The American political system in its current form is truly awful, and the only way to get elected is to do a ton of fundraising, which by neccessity involves selling your soul. I agree that Obama is waaaaaaay more centre-right than many of his voters believe, and he is quite er, morally flexible. I do think though that IF washington was a more honest place then Obama would be quite different.

I reckon he'll get a second term, and the shit probably will hit the fan before too long so his 2nd term could be more interesting and satisfying for a dirty stinking commie like me.....

Elizabeth Warren though, is a very very impressive woman.

Obama promised significant change, god even I would have voted for him......Foolish, he then squandered that.....honestly IMHO he's in the wrong political party he's governing like a moderate Republican.....

Second term, that's possible only because the Republicans are silly enough to show how stupid they are....however Im not discounting that enough Americans voters are even more stupid. The Texas Governor is the one to watch IMHO......probably the next US President in 2012.....its how I would bet.

Yes, the next term will be very interesting, we had the opportunity with Obama to spend 4 years running for green tech....not enough time....but a start......but with even BH waking up to and commenting on Peak oil and growthless economies the reality is arriving....the yes men's days are numbered.....

Elizabeth Warren, I dont have a clear picture of her yet, but I suspect she should have been the present President.

regards

As usual more Fiat’s roaming the streets of Rome then Pope's.

http://www.reuters.com/article/2011/10/19/italy-factors-idUSL5E7LI4PX20111019

Hiha - why does he not intervene and joins the “Wallstreet Occupy” also - the Pope ?

http://www.ft.com/cms/s/0/e9859fda-fa25-11e0-8e7e-00144feab49a.html#axzz1bDmCcpJw

re #3, more and more large organisations have admitted that they need to get off grid in one form or another and it really says something if the U.S. freakin' Army believe in peak oil...

The kiwi inventor John Fleming is big on the nitrogen-hydrogen model (http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10693646) and I remember him saying a year or so ago in a radio interview here that the US Army had already been working on it for a few years....

its been said that the stone age didn't end cos they ran out of stones. same applies to the oil age

Hydrogen is not positive energy, it can best be described as a battery. You can't get more out then you put in. Same with biofuel, you can only externalise the cost. It takes 1 barrel of oil to make the equivalant of biofuel.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.