Here's my Top 10 links from around the Internet at 11 pm in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

Here we go. Note to self. Must get these out way, way earlier.

1, A choice rant - Paul Farrell at MarketWatch writes a provocative post on America's problems.

He's as mad as hell and he's not going to take it any more.

Farrell is a well followed commentator on America's biggest stock market commentary site.

Here's a taste.

He's very grumpy.

I've never seen America and its commentariat as febrile as it is now.

The America I believed in when I volunteered for the Marine Corps, went to Korea, that America has been hijacked by an irrational, dark force that’s consuming our political system. We saw this coming a few years ago reviewing Jack Bogle’s warnings in “The Battle for the Soul of Capitalism.” Buffett called that one: “There’s class warfare, all right. But it’s my class, the rich class, that’s making war, and we’re winning.”

My America is out of control, babbling nonsense, acting like a junkie, addict, very bad alcoholic. Been there. Now decades in recovery. Also worked years professionally with hundreds from Betty Ford Center. Today everywhere I see a nation consumed by addictions: self-centered, selfish, greedy, aggressive, power hungry, lost souls with no moral compass, in denial of their suicidal mission, incapable of stopping.

You know exactly what I’m saying: America is way off track. Our great nation is acting like a drunken self-destructive addict. Could use an intervention. But sadly we’ve drifted so far off our moral compass that only hitting bottom, a total collapse, near-death experience, only another meltdown bigger than 2008 and a depression will do the trick.

2. A really ugly open day - The WSJ's Chinarealtime blog reports a group of 400 homeowners in Shanghai rioted over the weekend after the developer of their apartments cut the prices of unsold units.

Home buyers had wanted to speak with the developer to refund or cancel their contracts but were unsuccessful, according to local media. One report said the price cuts exceeded 25% per square meter.

The local media reports said an unspecified number of people were injured. The property developer, a unit of China Overseas Holdings Ltd., didn’t respond to requests for comment. Photos of the event showed broken glass in the sales office, homeowners marching with banners and a phalanx of police watching over.

3. US house prices fall 3.8% - Bloomberg reports US house prices fell 3.8% in the last year.

The fall in household wealth in America because of a 30% fall in house prices is a bigger proportionately than the fall in household net worth in the 1930s.

Recovering the 31 percent plunge in home prices from their 2006 peak will probably be years in the making as foreclosures throw more properties on the market and sales flag. Federal Reserve policy makers like William Dudley are among those that believe bolstering housing is among the “most pressing issues” facing the central bank.

“There is still a big imbalance between demand and supply,” said Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia, who projected a 3.9 percent decline. “Prices will keep declining into 2012.”

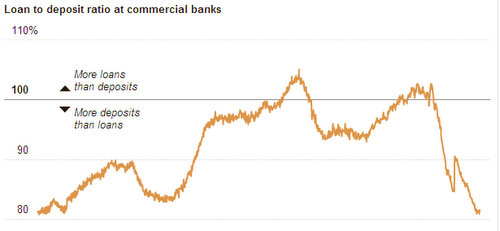

4. US banks swimming in cash - The New York Times reports US banks are swimming in deposits and aren't lending them out.

Banks have built up record levels of deposits, but have not been lending it as quickly as it is coming in. The result, reflected in their loan-to-deposit ratio, is a sharp contrast to just a few years ago, when banks had looser lending standards.

Droves of consumers and businesses unnerved by the lurching markets have been taking their money out of risky investments and socking it away in bank accounts, where it does little to stimulate the economy.

Though financial institutions are not yet turning away customers at the door, they are trying to discourage some depositors from parking that cash with them. With fewer attractive lending and investment options for that money, it is harder for the banks to turn it around for a healthy profit.

In August, Bank of New York Mellon warned that it would impose a 0.13 percentage point fee on the deposits of certain clients who were moving huge piles of cash in and out of their accounts.

5. And on the other hand... - This study reported on VoxEu suggests banks take bigger risks with less capital when interest rates are suppressed.

Do low interest rates encourage excessive risk-taking by banks? This column summarises two studies analysing the impact of short-term interest rates on the risk composition of the supply of credit. They find that lower rates spur greater risk-taking by lower-capitalised banks and greater liquidity risk exposure.

6. America's rotten system - David Carr writes at NY Times about the rot at the heart of America's corporate system: obscenely high CEO salaries.

He uses a prime example of hypocrisy to illustrate the point.

Here's a thundering editorial at USA Today on CEO pay:

“The bonus system has gone beyond a means of rewarding talent and is now Wall Street’s primary business,” the newspaper editorial stated, adding: “Institutions take huge gambles because the short-term returns are a rationale for their rich payouts. But even when the consequences of their risky behavior come back to haunt them, they still pay huge bonuses.”

Carrr then looks at the history of the CEO pay of USA Today's owner Gannett. The CEO gutted the company and presided over a crash in the share price, yet...

The board gave him far more than undeserved plaudits. Mr. Dubow walked out the door with just under $37.1 million in retirement, health and disability benefits. That comes on top of a combined $16 million in salary and bonuses in the last two years.

7, It's not looking good - The Telegraph reports the European financial crisis summit is starting amid a flurry of disputes and recriminations.

The single currency rescue effort was left hanging in the balance last night as Germany and Italy both challenged aspects of the likely deal.

EU leaders have said a summit tonight will outline plans to cut Greece’s crippling debt burden and expand a bail-out fund meant to support larger EU economies such as Italy and Spain.

Yet leaders last night appeared to be little closer to settling their long-standing differences on those issues.

8. Italy is on the brink - Ambrose Evans Pritchard is in typically blood curdling mode in this piece about how Italy's government is about to collapse.

Italy's coalition was scrambling to head off collapse late on Tuesday after deep rifts on austerity measures dictated by Brussels for a Wednesday deadline, when EU leaders reconvene for yet another crisis summit. "I remain pessimistic," said Umberto Bossi, Northern League leader and key ally of premier Silvio Berlusconi, who had warned earlier in the day that the government was in danger of collapse.

Mr Bossi said his party had offered a compromise on fresh austerity but could not accept EU demands for a rapid rise in the retirement age to 67. "The people would kill us," he said. The pension reform is the EU's tacit condition for intervention to shore up Italy's bond markets.

Silvio Peruzzo from RBS said the Italian government is likely to "implode" before its mandate ends, risking "an ever more severe deterioration of the crisis in Europe". The warning came as French President Nicolas Sarkozy told an Élysée breakfast meeting held behind closed doors that "Europe has never been so close to explosion".

9. Desperation - BusinessInsider reports the head of Europe's EFSF fund is flying to China to beg them to buy the toxic debt Europe is brewing up to insure and leverage up its existing fund...

10. Totally Lewis Black on The Daily Show. He's a great ranter.

9 Comments

And in a jiffy CNBC reports CHina is not interesting in bailing out the Europeans...

The worldwide problems on many fronts are gaining momentum, while societies are paying increasingly for natural and man made disasters also – not a good mix.

I think JK has missed a trick here....he should have arranged for these 'save the piigs and the euro and the EMU and the banks' summits to take place down here in NZ....Merkozy and crowd and media too...all flying Air NZ and landing at AIA...!

US broker John Paulson vs your annual salary – don’t be depressed – but angry, very angry – pure greed - fu?@ing bastards - ruining the world !

Click: http://mahifx.com/

....not even 20 minutes ! ;-))

20 minutes! are you sayin your annual salery is around US$180,000 Walter? It seems you are in the top 10% yourself. I would say most New Zealanders would do well to beat 5 minutes against this guy...

So, Kunst, you salary is over NZ $200,000.00, huh? You rich prick!

Don’t worry David your most appreciated Kaikoura foreigner doesn’t make even 6 minutes here in Kaikoura. We aren’t Queenstown, Rotorua or posh Auckland. Happy is good enough.

When you think the guy, who steals a surf- board makes 50 hours community work and that guy Paulson is still roaming free.

Take a minute folks...make a cuppa and then go read this....fabulous....the sort of treatment that ought to be dished out in our Parliament every time it is deserved.

http://globaleconomicanalysis.blogspot.com/

The leader of Germany...rubbished as a liar in her own Parliament!

To be honest the only way I see this working out is a war of resources, and you baby boomers are bloody lucky you're not at the age where you would/could fight effectively, you would just have you children fight for you. Cheers for that.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.