Here's my Top 10 links from around the Internet at 2.30 pm today in association with NZ Mint.

We welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #8 on alternatives to inflation targeting regimes. New Zealand needs one.

1. Europe needs a Federal Reserve - US economist Aaron Tornell and German economist Frank Westermann have called on Europe in this NY Times Op-Ed to give Federal Reserve-type powers to close banks and print money to the European Central Bank.

That's all very sensible and what is needed.

But to do it properly Germany would have to agree to it (no sure thing at the moment).

Also, there would have to a fiscal and political union.

Germany would also have to agree to those.

I just can't see an easy, fast or painless way out of the euro mess at the moment.

We face years of perma-crisis punctuated by periods of relative calm where zombie banks and governments stagger on thanks to the increasingly grumpy largesse of the Germans.

Meanwhile, Europe's economy will struggle to grow, or worse. Remember, Europe is China's largest export destination.

Here's Tornell and Westermann with one of the best explanations of the problem I've seen in a while.

What ails the euro zone is not a Teutonic allergy to inflation, or a timidity about extending loans, but what economists call the tragedy of the commons. Here’s an example: A group of people go for a drink and agree to split the tab. They tend to drink a bit more than when each goes alone. Each person gets to enjoy 100 percent of the marginal benefit of an additional drink, yet she is responsible only for a portion of that drink’s cost. So she has an incentive to outdrink her friends and exploit the common pool of money that will be used to pay the tab.

The central bank system in Europe is akin to letting the government of California issue bonds, pledge them as collateral at the San Francisco branch of the Fed, and then get fresh dollars to pay for its budget deficit. If this were reality, imagine the strong temptation for California to tap Fed resources to indulge imbalanced spending and borrowing.

If the system isn’t fixed, it will lead to another financial crisis.

2. The chart that scares the 1% the most - Zerohedge has pointed to this paper by a couple of academics about the global financial crisis and the connections between the increasing wealth of the 1% and the increasing proportion of the adult population in prison.

It has a certain Marxist (come the revolution!) tone to it, but interesting none-the-less.

The authors fear that, peering into the future, the '1%' realize that in order to maintain (or further increase) their distributional power (their net profit share of national income - which hovers at record highs) they will have to unleash even greater doses of social 'violence' on the lower classes.

The high level of force already being applied makes them increasingly fearful of the backlash they are about to receive (think Europe to a lesser extent) and nowhere is this relationship between the wealthy capitalists and social upheaval more evident than in the incredible correlation between the Top 10% share of wealth and the percent of the labor force in prison. In order to have reached the peak level of power it currently enjoys, the ruling class has had to inflict growing threats, sabotage and pain on the underlying population.

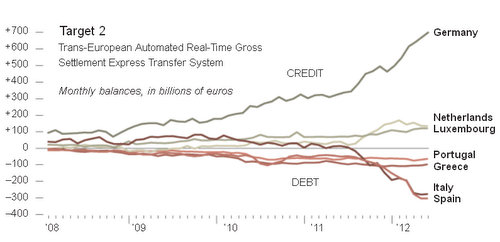

3. Targeting the Target 2 balances - This chart below from an excellent New York Times graphic (HT Dan Bell) essentially shows the extent of the wholesale run on Italian and Spanish banks seen over the last year. The Target 2 balances show how much is owed to the Bundesbank by the Bank of Spain and the Bank of Italy.

The situation in Europe might be worse were it not for a system that was created to clear transactions between central banks. That system is now providing loans to central banks of countries whose banks are suffering withdrawals. The money comes from the central banks of nations with healthier banks, like Germany, the Netherlands and Luxembourg. Germany already has substantial exposure to the weaker economies, which is one reason it has been reluctant to agree to issue pan-European bonds.

4. The real problem is affordability - The Press reports on how landlords in Christchurch are stunned at how difficult it is to rent out houses with higher rents.

There is this remarkably persistent view among landlords that rent increases higher than wage increases will just happen ad infinitum. Affordability matters.

Here's The Press:

Where are all the desperate tenants? That is the question some Christchurch landlords are asking as they struggle to rent their houses.

While a shortage of cheaper homes in the city is attracting attention, mid-priced and dearer houses are sitting empty.

Property manager Agnes White, of Rosevear Wing and Associates, said the rental market was mixed, with shortages of cheaper homes, furnished houses and homes in some school zones. Otherwise, there were "plenty of houses out there."

Some tenants had ruled out the east side of town because of cracked houses and neighbourhoods perceived as damaged. White advised landlords with vacant houses to make sure homes were warm and in good condition.

If there was nothing wrong, the only options were to either wait or reduce the rent, she said.

6. Ignore the ratings agencies - Bloomberg reports on how America and Britain's credit ratings were downgraded, yet their bond interest rates fell. Why do we care what the bond vigilantes think anymore?

“I don’t think we should be slaves to the ratings agencies,” Mervyn King, governor of the Bank of England, told lawmakers on Feb. 29. “What we’ve seen is, the action they took recently did actually have no impact on the yield that people in the market were willing to lend to the U.K. government at.”

It’s not just Britain. After Standard & Poor’s stripped France and the U.S. of AAA grades, interest rates paid by the countries to finance their deficits dropped rather than rose. For investors and policy makers, predicting the consequences of a rating change by S&P or Moody’s -- the dominant issuers of debt scores -- may be little different from flipping a coin.

Almost half the time, government bond yields fall when a rating action suggests they should climb, or they increase even as a change signals a decline, according to data compiled by Bloomberg on 314 upgrades, downgrades and outlook changes going back as far as 38 years. The rates moved in the opposite direction 47 percent of the time for Moody’s and for S&P.

7. China's party is about to end - American Enterprise Institute Scholar Michael Auslin has written at the WSJ that China has more than a few problems.

For a while it seemed as if China would never look back. But it's clear now that the easy part is over and that the next 20 years will be harder for the Communist Party to manage. The country's looming problems have never looked as sharp in the past two decades, which spells not only an economic deterioration, but also a possible collapse for the Party.

The problem started late last decade, when President Hu Jintao concertedly changed tack, from privileging the private sector to the public. State-owned enterprises became more dominant than they were, while local governments became emboldened especially after a post-crisis lending spree—these entities together swallowed most of the available credit. The small- and medium-sized companies, the engines of job growth, stalled. This is part of the reason growth is slowing, the government recently revising its estimated growth for the current year down to 7.5%.

The current poor management of the economy comes on top of long-term issues that the Party has ignored. Not only have wages been rising enough to start affecting Chinese companies' competitiveness, there is a shortage of labor in the coastal belt, the heart of economic growth. The shortage is due in part to more opportunities inland, but the biggest problem is the working-age population has peaked.

Fans of Nominal GDP Targeting point out that it would not, like Inflation Targeting, have the problem of excessive tightening in response to adverse supply shocks. Nominal GDP Targeting stabilises demand, which is really all that can be asked of monetary policy. An adverse supply shock is automatically divided between inflation and real GDP, equally, which is pretty much what a central bank with discretion would do anyway.

In the long term, the advantage of a regime that targets nominal GDP is that it is more robust with respect to shocks than the competitors (gold standard, money target, exchange rate target, or CPI target). But why has it suddenly gained popularity at this point in history, after two decades of living in obscurity? Nominal GDP Targeting might also have another advantage in the current unfortunate economic situation that afflicts much of the world: Its proponents see it as a way of achieving a monetary expansion that is much-needed at the current juncture.

36 Comments

Like I said over 4 years ago, at some point the ratings agencies will be marginalized and financial contracts will unwind and will not have a ratings requirement. At that point no one will listen to any rating given by any of the top three ratings agencies, especially since there is nothing that is truly AAA anymore.

Oh and the US isn’t a Plutocracy it’s a Kleptocracy sliding quickly and diligently into Fascism.

Agree....especially the last.....time to spill some blood I guess.

regards

Why QE's & Twists aren't working Thursday, June 21, 2012

The Fed can push as much money out the door as it likes but the only people picking it up are banks who are then giving it back to buy bonds. In other words it's not going into the economy so it's not creating jobs.

http://www.essentialfx.com/market-intelligence/editor's-choice/2012/6/2…

Yes, the Govn has to spend it on worthwhile infrastructure projects that create jobs directly or it wont do a thing....but the Fed cant do that, thats up to Congress and the GOP loons in there wont do it....at least not while Obama is in the Oval office....it would be very funny if they went Keynesian with Romney "in charge"

regards

it's not creating jobs.........In one A.J.....and that is exactly what I have repeated ad nauseum .

The merry go round of Job creation or creating an environment to invigorate industry has found no partnership between Govt....Fed...Enterprise.....to tackle the subject on a united front...... An unwillingness to accept the responsibility to charter a course toward growth in the Job industry rather than pandering to the fears of the Capital Markets.

The injected stimulus goes out and returns to the Fed without achieving anything that has a meaningful impact on recovery.....because it has not been targeted to the job market.

Bernake in a release in early in June alluded to this being a change of focus for the Fed stimulation in the months to come.....yet they still have to contend with Republican desires to allow a "bottoming out" to improve Romney's chances of election......

The reality of styfling job market recovery in an election year will be embroiled in political permutations.

But... why would corporates create jobs? Their mandate is maximum bottom line and shareholder's wealth. Where's the first place corporates look to cut costs? With increasing unemployment workers are desperate for a job and have lost any negotiating power for a decent wage. The corporates know that someone will accept employment and have been able to drive down labour costs in most unskilled industries.

I chose the word Enterprise on purpose Meh.....but since we talking Corporates let's assume a bit of we are all in this together for a moment shall we......No growth in the job market....no growth in expendible income....retail markets take a hit and the domino principal follows.....

There is an unrealized co-dependence here Meh....it may even be being styfled in an election year as I posted earlier....nevertheless, there is a co- dependence that needs to be confronted ...accepted....and a "what are (the collective) we gonna ...do.. about it " think tank formed by the Administration in harmony with the Fed and Enterprise......or it's just kicking it back and forth to each other saying ...you fix it ...no you first...and so forth.

In this scenario which I have no doubt was the requirement to previous recoveries, there will be a requirement for Corporate Wall St to take a hair cut in order to grow the.. new do.. as it were.....and nothing surer than that's just what Wall St does not want.....but it should be inescapable.

I agree Christov. I guess it all comes back to society working in harmony though rather than purely self interest. The way I see it is and this is most likely bias to my personal belief systems is that we've (the collective) lost sight/understanding/perception of the value of money/wealth.

How easy will it be for this to alter? Not very unless the big reset comes along. Two options I see - lift the 99% to the same "wealth" as the 1% or vice versa.

You state that Corporate Wall St don't want to take a haircut and I agree. I would also add that the Administration and the Fed (at least the individuals involved) don't want it either.

I would also add that the Administration and the Fed (at least the individuals involved) don't want it either.

Well said Meh....it becomes difficult to distinguish the servants from their masters, but the realization of the impass in forward momentum will at some point bring about a changing of the Guard in both Administration and Federal Reserve......unless civil unrest makes that rational for them first.

#2 There are two things missing from the graph:

1. A correlation (why weren't people in prison last time there was income inequality).

2. CO2 concentration. If you plotted CO2 concentration, you would also notice a correlation over that period. This is the real cause - CO2 is creating inequality and a rise in crime

This is the real cause - CO2 is creating inequality and a rise in crime

LOL - Nice work.We also have to factor in the increase in US postal rates and the obvious connection to CO2

http://joannenova.com.au//globalwarming/graphs/us_post_causes_global_warming_lrg.jpg

;-)

1) probably were, certainly in the UK there was some research showing crime and un-employment were linked.

2) Well if thats the case the fix is obvious then isnt it.

On the other hand maybe you should try looking at such research and data that exists and not picking dogma you like.

regards

If you read the paper from which this graph is taken (linked at #2) you will see that this graph is unusual as most/all of the many other graphs are looking at prices/income shares and similar "economic" data.

#5 There are a number of reasons for the swing from a return on capital to a return on labour and then back again in the post-war period. Greed is a simplistic one, so lets just go with that. Malcolm Gladwell has an interesting talk here: http://fora.tv/2010/10/03/Malcolm_Gladwell_The_Magical_Year_1975#fullprogram where he suggests the tipping point was where high-demand talent began extracting it's actual economic value, which led to a whole new class of rich people. Prior to this actors, professional sports people, M&A lawyers etc. did not earn a lot, but from that period on their wages began increasing towards the level of economic benefit that their labour/talent/brand provided. For example if putting Tom Cruise's name on a movie results in $5m extra ticket sales, he figures he would like to get some of that action. Mr Gladwell presents it in a interesting way, so it's well worth the $4.95 to watch.

"Debt derby" coming to a football pitch soon...

"The battle of the euro zone will be waged on a playing field in Poland on Friday, when Germany meets Greece in soccer's European Championship." So says the Wall Street Journal.

"At least, that is how some soccer fans and media in the two countries see the politically charged quarterfinal match in Gdansk that pairs the euro zone's most cash-strapped nation against its Teutonic task- and paymaster. Some European media have dubbed it the "debt derby."

http://online.wsj.com/article/SB100014240527023044414045774786230214700…

#1 - but isn't the problem that governments are over spending? No amount of fiddling and tweaking the system is going to fix that.

I think the amount of cut-backs required to get spending under control is so large as to be unmanageable (outside perhaps a dictatorship). Sufficient growth seems unlikely at this stage of the game. Some kind of rebalancing (aka crash) seems inevitable.

The problem is that most governments are not spending enough.

Greeks even bigger problem is that it must spend in a foreign currency and therefore has no control over it's deficits.

Governments that create, control & spend in their own currencies only have themselves to blame for their private sector demand collapse, and the voluntary, self imposed austerity measures which exacerbate the problem.

Right..............so what percentage of GDP in your seriously misguided opinion should they go bankrupt at? 200%?

"Governments that create, control & spend in their own currencies only have themselves to blame"

Right...............so who's currency should they be spending without restraint?

Are you for real?

1. Japan's GDP to debt ratio is well over 200% and they are still the world No.2 economy. No one is worried about their governments solvency.

2. My point is that they should be using their power to create, control & spend their own currency to make up for the private sector demand collapse by spending public money back into the private sector to stimulate. Because they CHOOSE not to do this - they only have themselves to blame.

3. Yes. Try reading some of the links BH posted above in the 10@10 to educate yourself to avoid further embarassment.

"Japan's GDP to debt ratio is well over 200% and they are still the world No.2 economy. No one is worried about their governments solvency."

What planet do you get your news from? There have been countless news items concerned about the high debt ratio in Japan. Wait until Japan tries to access funding from external sources rather than it's own people, then the proverbial will hit the fan. A small increase in interest rates and 2/3 of the tax take will go to debt servicing.

It's also well known that much of the Government spending in Japan has been mis-directed, bridges to nowhere etc. Despite massive spending by Government Japan has had deflation for 20 years. Ultimately this level of debt will not end well.

So these PIs struggle to get $450 a week but Big Daddy thought $800 a week was "fair"

If chch isnt an example of a housing shortage not resulting in an increase in rents I dont know what is....

and of course the comment that houses in the $330 week were moving OK....

It would seem affordability is a big factor.....what a shock, not.

regards

The second is what ppl will do....more and more....4 or 5 years of more quakes expected, Its impossible or very expensive to insure down there today? plus no guarantee after a few more shakes of any insurance at any price? you would have to be insane.

Affordable is no longer the big issue I suspect.....having jobs in the area, feeling safe and not losing your equity are big drivers....I bet.

Landlords cant get $450 a week? Well to pay that you would have to be earning a good wage, I'd suggest a household income of $100k, Which I'd assume are the highly skilled ppl and professionals just the ppl who can move easily, and quite possibly have, hence hard to rent out houses. If indeed this is a symptom of enough of them having left then chch simply doesnt matter for a decade or more....

NB Average income in chch is $56k? how can ppl pay $450 a week on $56k???? pay $1800+ a month.....like ouch....

regards

Local knowledge is Such a dangerous thing.

Insurance is just fine for the 85-90% of households who are largely unaffected by the quakes.

They require only cosmetic repairs for the most part (hence the howls of 'all the work is going into houses which need it the least').

And let's spin the broken record once again: the quakes were incredibly patchy in their effects. The MSM has repeated 'the stricken East side' so many times it is an urban cliche, but true only in small patches.

I happen to live in the East: two-storey house, concrete tile roof, a traditional master-builder design from the early 90's before the craze for architects and new materials wiped out Craftsmanship. Total quake damage over the entire sequence of 5 big quakes (many under 8 km away) was a much-loved Agee jar in the pantry, a snowboard scratch on the ski-wagon (sob), and a few hairline cracks in the RockCote which Resene X200 has patched jest fine.

The 1991 Press article which a) predicted the liquefaction and mayhem very accurately and b) showed that Chch has had major quakes rather frequently - alos bears out the notion that Your Mileage May Vary, so it is quite simply impossible to make sweeping statements aboot it all.

The Clueless City Council has of course been shown up as the den of stumblebums with clipboards which it is, and That's a welcome effect of the shakes.

So for 85-90% of the city, life just powers on. We are fed, warm, enjobbed, close to our beaches, skifields, forests and rivers.

But if'n yer want a leetle lesson in ECON101, try a correlation between the prices the insurers will pay, per week, for displaced families to live temporarily, with the sort of prices the landlords are trying for.

Throwing helicopter loads of insurance money around in one area, and dragging their heels in others - now There's a story.

But by simple subtraction, that schemozzle affects only 10-15% of the city, and That on a bell-curve.

See now why uninformed generalisations are rilly silly?

Intersting how those on the right seem to only want to see today and tomorrow and dont seem to want to think on risks.......yeah sure being on the ground imparts valuable info....but then there isnt just you...

Loss of 10%~15% of the city would seem a pretty decent % to lose....and like I said, lets borrow the right's un-substantiated comments that those leaving for OZ are the "best" ppl that we can least afford to lose. Then those are also the ones who can afford $450 a week and are therefore probably those with spare cash to spend then that 10~15% loss will be noticable for businesses. I know my extended family down there has seen a huge drop off in their lines of work.... One has gone to OZ already...feeling safer especially for the kids and more $ played a part in that decision.....

My house insurance if the quotes are any indication has a 25% minimum rise, that suggest the eq component is x 2....Im waiting with "interest" so see where the existing company pitchs next year's insurance in September......then there is the eq levy......

Sure ignore anything you dont like the look of....

regards

Regarding number two, the US prison population falling so dramatically in the 1930s coincides with the end of Prohibition, while the subsequent rise began at the same time the War On Drugs took off in the 1980s under Reagan.

This is a much more plausible explanation than the one offered by the Marxist "researchers" who ignore the fact that the first half of their graph doesn't correlate at all with their theory of capitalists somehow becoming wealthier by putting lots of people in prison. Well, I suppose the drug lords are probably doing well out of the situation...

What they should look into is the link between monetary expansion and shifts in the share of national income. It is not surprising that when central banks print lots of money it goes first to those who are already wealthy. What would really benefit the proletariat would be a return to sound money, i.e. gold.

Further to #7:

An even more disturbing and convincing take on China's perilous state, with specific mention of consequences for New Zealand and Australia.

http://www.businessinsider.com/4-reasons-why-china-is-headed-for-meltdo…

Re5 -

"We can see from Figure 6 that per capita consumption of oil peaked in the 1970 to 1980 time period, and has since been declining." .

There's no coincidence.

Productivity is a mix of efficiencies, and a reduction of labour renumeration. No more, no less.

Bernard, Thanks as always.

I have pulled the following from the article by the Harvard Economics professor on inflation targetting, as it seems especially relevant to NZ, and our current account problem.

An economy adjusts better if monetary policy responds to an increase in the world prices of its exported commodities by tightening enough to appreciate the currency. But CPI targeting instead tells the central bank to appreciate in response to an increase in the world price of theimported commodities – exactly the opposite of accommodating the adverse shift in the terms of trade

Given we are a small and trade based nation, this paragraph sums up as well as any, the folly of our current Reserve Bank Act and management. The bigger our current account deficit, the higher the exchange rate, and so the bigger again our current account deficit.

No wonder we no longer own anything.

The articled linked to below appears to give an insight into why Dimon was not thoroughly

castigated by the senate hearing (No. 10) and also why the rating agency scores are no longer as relevant to bond interest rates as they once were. (No. 6)

In order to get this depression over and done with we have to have it!

Printing $ is counterfeiting, illegal and madness. I'd go to jail if I did it. Why shouldn't governments?

Indeed it is illegal... And you would go to jail if you got caught doing it. But what would you do if you were 100% sure you wouldn't get caught...?

Rhetorically speaking of course, I am NOT accusing you of being criminally minded...

Well look on the bright side, looks like just about every Govn is determined to make your wish come true....

I guess I consider having to have a depression as like having to have winter, it kills the bugs and parasites....however Im not convinced we have to have a global depression and Im not sure it will have the needed effect....

No govn spending (printing ie it has to be spent) is sound economics in certain situations (liquidity trap) and doing the opposite (austerity) which we are is clearly making things worse.

Govn v you, it isnt the same thing......

regards

#1. Bernard Hickey, "...give Federal Reserve-type powers to close banks and print money to the European Central Bank.

That's all very sensible and what is needed."

Then Bernard, "We face years of perma-crisis punctuated by periods of relative calm where zombie banks and governments stagger on thanks to the increasingly grumpy largesse of the Germans."

It is likely these two scenarios are related Bernard. What you seem to be suggesting Berard prevents capitalism from clearing the excesses of failed institutions by giving those same institutions the power to create money to inject onto their balance sheets...thus prolonging adjustment.

The sooner we understand the importance of diverting resources away from unproductive institutions (instead of to them), the better the world will be for all of us (with the exception, of course, being the unproductive institutions receiving our collective resources).

Try not to buy into the common myth, pedalled by conflicted parties, that failure to divert our collective resources to the unproductive institutions would be catastrophic.

I'm not surprised by Zero Hedge's graph in #2. Here's what Stephen Fry has to say about the link between US prisons and the one percenters:

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.